|

| By The Free Press |

It’s Monday, May 5. This is The Front Page, your daily window into the world of The Free Press—and our take on the world at large.

Today: The strange politics of Harvey Weinstein’s retrial; Harvard is spraying perfume on a sewer, says Rabbi David Wolpe; another study finds weak evidence to support “gender-affirming care”; 60 Minutes gets an Emmy nod for its controversial Kamala interview; and more.

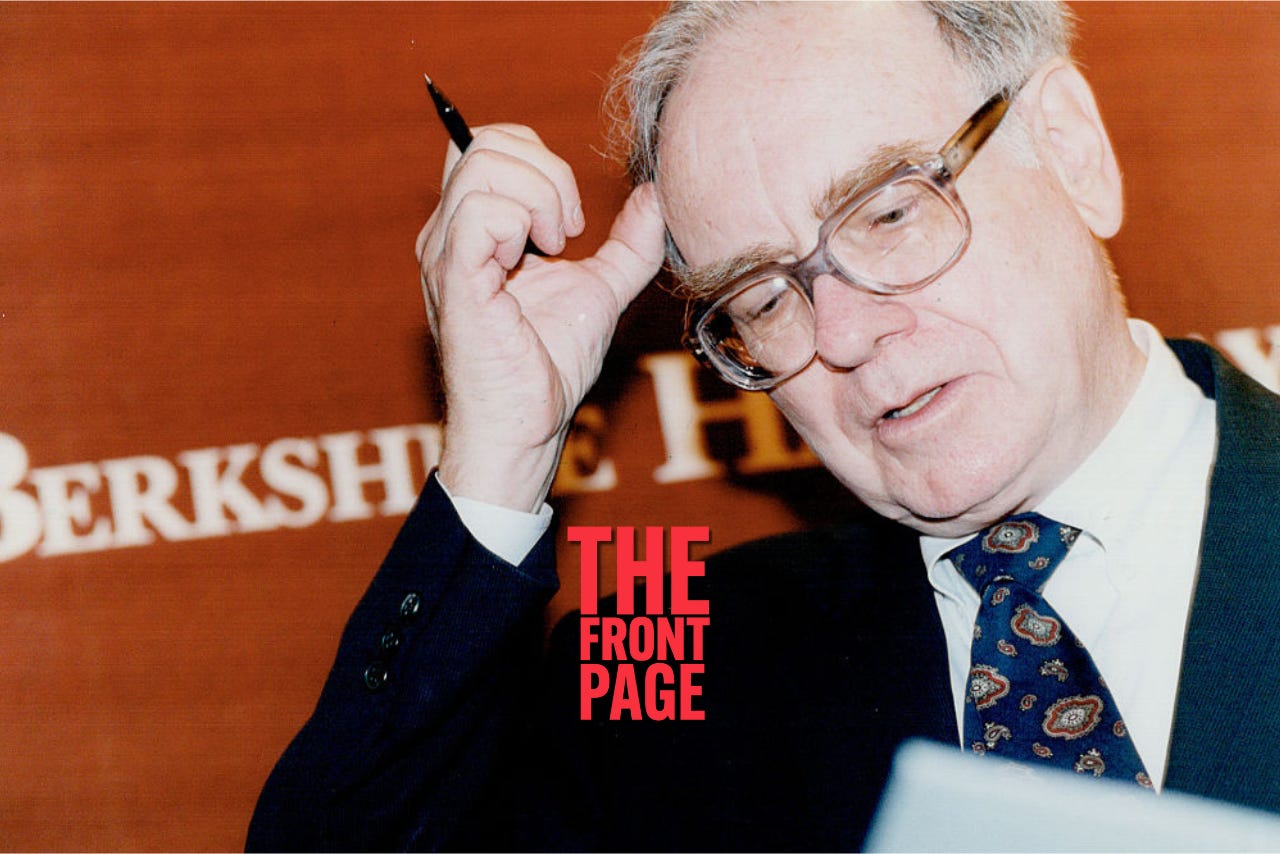

But first: Warren Buffett’s amazing run.

Whenever I’ve attended a Berkshire Hathaway annual meeting or read the letter to shareholders its CEO and chairman Warren Buffett writes every year, I’ve always been struck by how sensible he sounds. On the stage of the Omaha arena where the annual meeting is held, he and his partner Charlie Munger (who died in 2023 at the age of 99) crack plenty of jokes, but they also offer the kind of practical investing advice you’d think everyone would follow.

Buy undervalued companies. Focus on long-term growth, not short-term stock fluctuations. (“Our favorite holding period is forever,” he likes to say.) Be patient and disciplined. You get the idea.

At Saturday’s annual meeting, the 94-year-old Buffett dropped a bombshell, announcing that he will step down as CEO at the end of the year. Maxwell Meyer reports on the announcement in his story for The Free Press today, and offers a smart appreciation of what Buffett has wrought during the 60 years he transformed Berkshire Hathaway from a declining Massachusetts textile business into one of the greatest conglomerates—and greatest investment vehicles—the world has ever seen.

What’s always struck me about American investors is how few of us follow that sensible advice Buffett doles out, even though it has made him a billionaire many times over. Are we patient? No. Disciplined? No. Do we focus on the long term? Hell no—we’re always chasing hot stocks. Buffett, bless him, has been telling us how to do it right for 60 years. Maybe it’s time we finally listen. Read Maxwell’s story and you’ll see what I mean.

—Joe Nocera