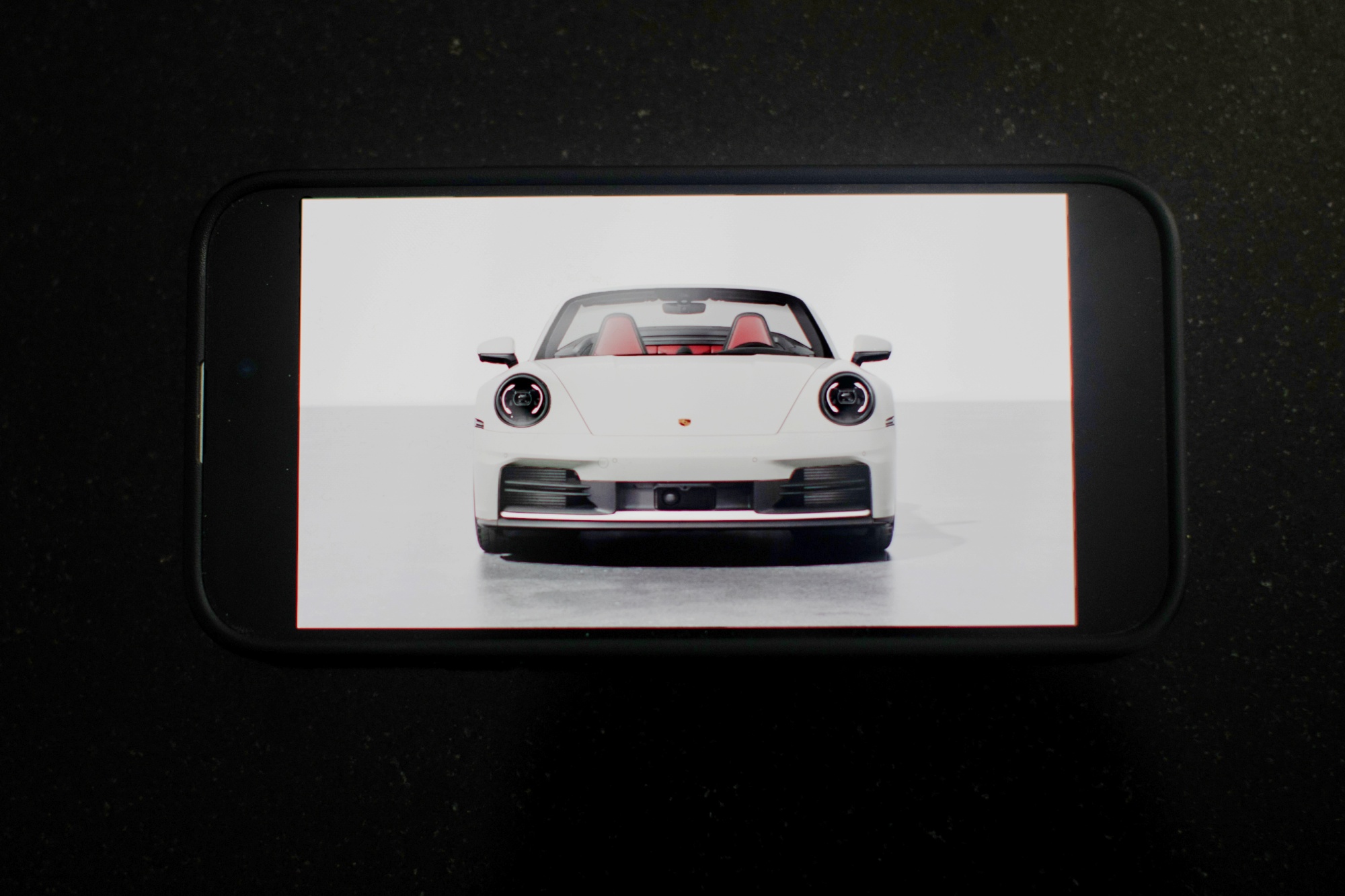

| Thanks for reading Hyperdrive, Bloomberg’s newsletter on the future of the auto world. Read today’s featured story in full online here. The springtime car-buying surge to get ahead of President Donald Trump’s auto tariffs is rapidly depleting the supply of duty-free vehicles, setting up a summertime slump for the industry and a severe case of sticker shock for shoppers. The run on showrooms has slashed new-vehicle inventories by 24% compared with this time last year, which is “one of the largest drops we’ve seen in several years,” said Jonathan Smoke, chief economist for market researcher Cox Automotive. Dealerships have 61 days’ worth of cars on hand, the lowest level in nearly two years and down from a 98-day supply in January, according to the market researcher. Once that pre-tariff stockpile runs dry, “you’ll see a demonstrative slowing in sales,” Smoke said.  Kia vehicles at a dealership in Richmond, California, on April 16. Photographer: David Paul Morris/Bloomberg Fallout from Trump’s tariffs is coming into relief even as the president gave the industry a partial reprieve last week. General Motors expects as much as a $5 billion hit this year from Trump’s duties, while Ford is bracing for a $1.5 billion blow. Stellantis and Mercedes-Benz scrapped their forecasts for the year. Automakers are rapidly preparing for the next chapter of Trump’s tariff turmoil. GM and Volkswagen have signaled they plan to absorb much of the tariffs while working to offset them. Some carmakers are dialing back incentives to preserve inventory. Cut-rate financing deals — a critical come-on in this age of high interest rates — are also disappearing. The number of 0% loan deals in the US market has fallen to the lowest level since 2019, Smoke said. Read More: Car-Buying Frenzy Leaves Americans With a Big Debt Problem The result? Fewer deals and less inventory giving way to higher prices, slowing the rush of buyers. “I’m a little shocked,” Smoke said. “I really thought it would be the end of May before we would go through this roller coaster ride.” The seesaw is being fueled by car buyers like David Avetisyan. The southern California banker spent the last two years planning out what he calls his “mid-life crisis car.”  The customized Porsche 911 Cabriolet that the Avetisyans originally planned to purchase. Photographer: Alex Welsh His wife Ester helped configure a brand new Porsche 911 Cabriolet in chalk white paint and a deep red “Bordeaux” interior. As they received photos and assembly updates from the Porsche factory in Stuttgart, Germany, they envisioned future date nights in their drop-top dream car. Then came Trump’s 25% tariff on imported vehicles. The Avetisyans feared the steep duty would drive up the sports car’s already expensive $160,000 price to more than $200,000, and ultimately kill their deal. Instead, they bought a jet black 911 that their Porsche dealer in Santa Clarita already had in stock for the same price. Although it was still possible that the white-on-red convertible would arrive in time to avoid the 25% levy, they didn’t want to risk it. They took the bird in hand and accepted the black 911 from their dealer’s inventory. “We were freaking out about the tariffs because we had our hearts set on that car, but I wasn’t going to pay an additional $40,000,” David, 50, said in an interview. “So we got a little scared.”  David Avetisyan and his wife Ester in front of their new Porsche 911. Photographer: Alex Welsh Similar decisions helped push up US vehicle deliveries 11% in March. The annualized sales pace slowed slightly in April to 17.3 million vehicles, from 17.8 million in March. That’s still well above the roughly 16 million cars and trucks Americans purchased last year. Stoking the inventory drawdown are some highly advertised discount programs from Ford and Stellantis – two automakers that were sitting on inventory levels considered to be too high. Both companies last week extended employee-discount pricing promotions. The discounts are fueling sales — including a 16% jump for Ford last month — and draining dealer lots. JD Power estimates tariffs will reduce US auto sales by about 1.1 million units on an annual basis, or roughly 8%. Surging car sales are expected to slow down in the second half of the year and lose even more steam in the fourth quarter as prices rise due to tariffs, according to the researcher. At a raucous celebration for the redesigned Ford Expedition SUV at its Kentucky factory last week, CEO Jim Farley pledged to hold the line on pricing — unless his rivals jack up their sticker prices. “We have to watch what our competitors do,” Farley said, standing near a row of jumbo SUVs priced above $80,000. “They have $5,000 to $10,000” in additional costs per car from tariffs. “Will they absorb those? Will they pass them on to consumers?”  Jim Farley speaks at Ford’s Kentucky Truck Plant in Louisville on April 30. Photographer: Carolyn Kaster/AP For now, Ford dealer Beau Boeckmann is focused on moving the metal. The president of Galpin Motors in Los Angeles is advertising his roughly 3,000 “tariff-free” new vehicles in stock, encouraging shoppers to get them while they last. He wasn’t sold on Ford’s employee pricing discounts initially, thinking it would deplete his finite supply of pre-tariff cars and cut into profit margins. But he ultimately came around. He said Ford’s “From America, For America” promotion draws attention to the fact that the carmaker domestically produces about 80% of the vehicles it sells in the US, more than any carmaker other than Tesla. He even dipped into that inventory to buy his 20-year-old daughter a new Ford Mustang before price increases hit. Boeckmann concedes it’s unclear what the car market will look like when prices rise after pre-tariff inventory sells out. For now, automakers aren’t providing many answers, he said. “I don’t have any clear direction on what’s going to happen tomorrow,” Boeckmann said. “We have inventory now that’s not affected by tariffs — and we’re going to promote that fact — and then we’ll deal with whatever comes next.”  European Union flags in Brussels Photographer: Hatim Kaghat/AFP The European Union plans to hit about €100 billion ($113 billion) in US goods with additional tariffs in the event ongoing trade talks fail to yield a satisfactory result for the bloc, according to people familiar with the matter. The proposed retaliatory measures will be shared with member states as early as Wednesday and consultations will last for a month before the list is finalized, said the people, who spoke on the condition of anonymity because the plans are private. Negotiations between the EU and US, which began in earnest last month, have made scant progress and the expectation is that the bulk of the American tariffs will remain in place. See Also: Tesla sales kept sliding across Europe’s biggest electric-car markets in April, despite the company rolling out an updated version of its most popular vehicle. The carmaker registered only 512 new vehicles last month in the UK, the Society of Motor Manufacturers and Traders said Tuesday, down 62% from a year earlier. Tesla’s plunge was even more pronounced in Denmark, the Netherlands and Sweden, with sales dropping by at least two-thirds in each country. |