| On the face of it, news doesn’t come much bigger than Operation Spider Web. You can read all about it here — Ukraine somehow managed to get drones deep into Russia in trucks and used them to destroy bombers. I’m already looking forward to the movie. The incident challenges assumptions about the inevitability of Russian victory. Ian Bremmer, head of the Eurasia Group political risk consultancy, summed up the implications: The biggest impact of Ukraine’s battlefield coup may be to challenge the core strategic presumption that has guided Vladimir Putin’s thinking for over three years: that time is on his side. Since the invasion began, Putin has bet on outlasting Ukraine – grinding down its defenses, draining Western support, and waiting for the political winds in Washington and Europe to shift. That assumption has underpinned his refusal to negotiate seriously.

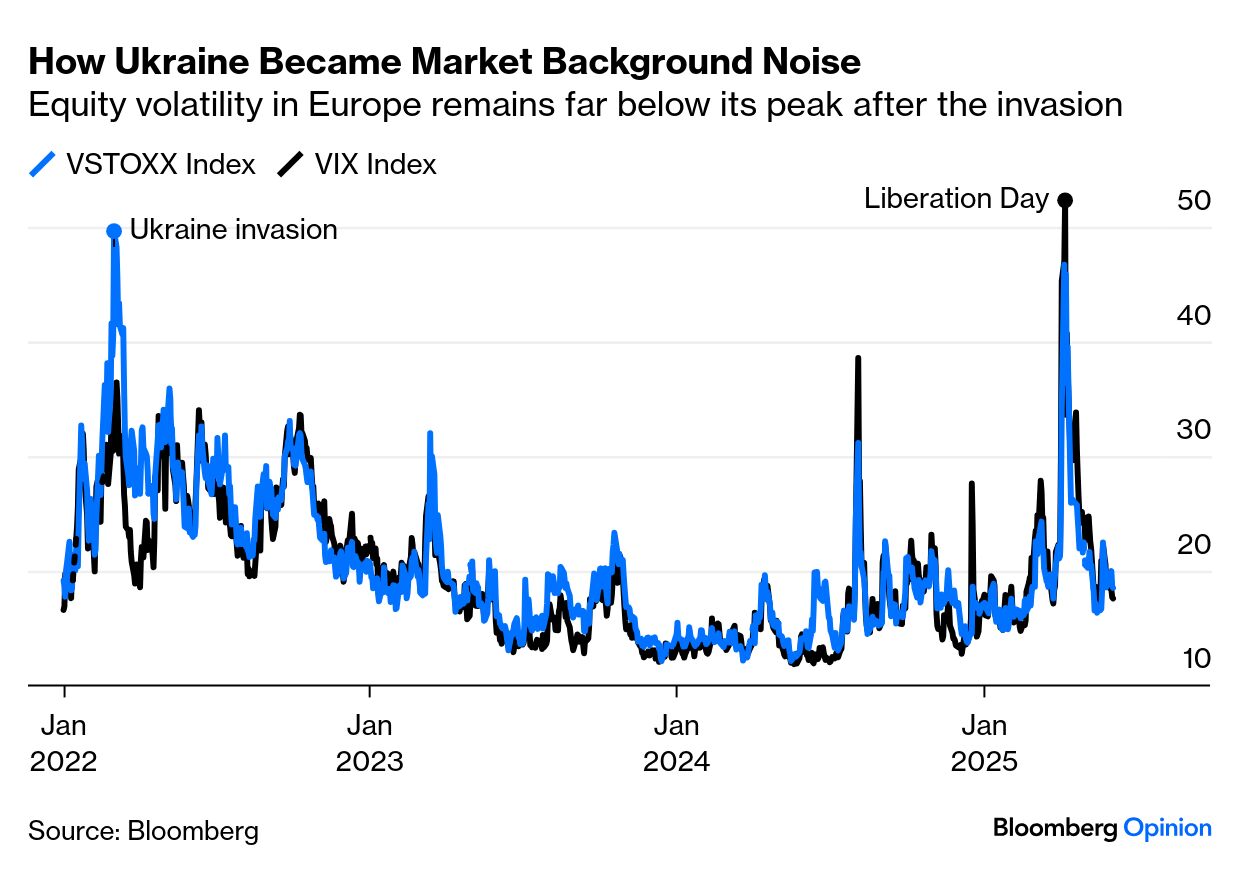

Like the North Vietnamese Tet Offensive of 1968, which resulted in a serious defeat but nevertheless inflicted a massive psychological toll on the US, the mere fact that this can happen is hugely significant. But it hasn’t generated all that much interest, at least in the financial community. This is a Bloomberg News Trends of the weekly numbers of stories mentioning Ukraine from all sources on the terminal: Since the initial excitement over Putin’s invasion died down, the only spike in interest came when Ukraine President Volodymyr Zelenskiy was berated in the Oval Office. There is a similar pattern in markets. The invasion drove an immense spike in equity volatility in Europe (and to a much lesser extent in the US). That soon declined. “Liberation Day” sparked an even bigger spike three years later, which swiftly subsided, but the pattern is that markets on both sides of the Atlantic decided some years ago that the Ukraine conflict could safely be ignored — just as the more limited one in the Donbas had grumbled on in the background for years without generating any market angst:  The simple explanation for this is, to paraphrase Marko Papic of BCA Research, “what happens in Donbas stays in Donbas,” as far as markets are concerned. This isn’t because traders are heartless, but because the conflict matters financially only to the extent that it threatens the supply and price of oil. Similar logic has allowed the Gaza clash to rage on for 20 months without having great impact on global markets. The greatest risk the Ukraine hostility posed was to European natural gas supply. That briefly paralyzed the continent’s economy, but the main benchmark shows that the problem has long since been dealt with. Renewed concern no longer has much effect: Crude oil seems irremediably weak at present, driven by poor sentiment around demand. For now, it looks like it’s closely tied to the dollar. When it spikes, so does the dollar (because it is a safe haven). And of late, they have been falling together. This terminal chart compares the rate of euros to the dollar to the West Texas Intermediate crude price: This is a strange inversion of the more common relationship between the two. What follows is the same chart for the five years from 2004 to 2009, but with the critical difference that it shows dollars per euro. The inverse relationship between the dollar and oil used to be as strong as the current apparent positive correlation. That at least suggests that it would be unwise to bank on it enduring: The loss of interest in the dollar as a safe haven in part reflects the steady desensitization to conflict risks in the years since the invasion. This chart from TS Lombard’s Christopher Granville demonstrates that each fresh outbreak has had progressively less of an impact on the oil price: The uptick in response to the latest news is barely visible. Efforts by Saudi Arabia to engineer a supply increase from the OPEC+ cartel have outbalanced the news about Ukrainian drone attacks. However, Granville adds: It does, however, offer a useful prompt to recall the real-world source of a new energy supply shock. This would be a no-holds-barred move by the US to throttle Russian oil exports.

Enter Lindsey Graham. The Republican senator has been a reliable supporter of President Trump, and is now pushing for a 500% tariff on imports from countries that buy Russian oil products and uranium. In Congress, he has 82 co-signatories, from both parties, for this effort and he has also been discussing it with European allies. Unlike the tariffs that have dominated conversation for months, these would not be designed to obtain any economic advantage for the US. They would have the sole aim of throttling Russia by cutting off buyers for its resources, such as China and India. And the oil market would, to use a technical term, freak out. It’s little remembered now, but US stocks gained in the day after the invasion, because the initial signs were that Europe would balk at the most severe sanctions. (You can read Points of Return’s account here.) It’s hard therefore to call such Russian sanctions a black swan. They’ve been under discussion for years, and they are a logical response to Russian aggression. Might the president, whose attitude to Putin appears to be changing, allow these sanctions to happen? If he does, in the current context, those sanctions would have the same impact as the darkest of swans. |