|

Today is Dividend Day.

The series where I teach you 5 things about dividend investing in less than 5 minutes.

1️⃣ Dividend Growth Matters

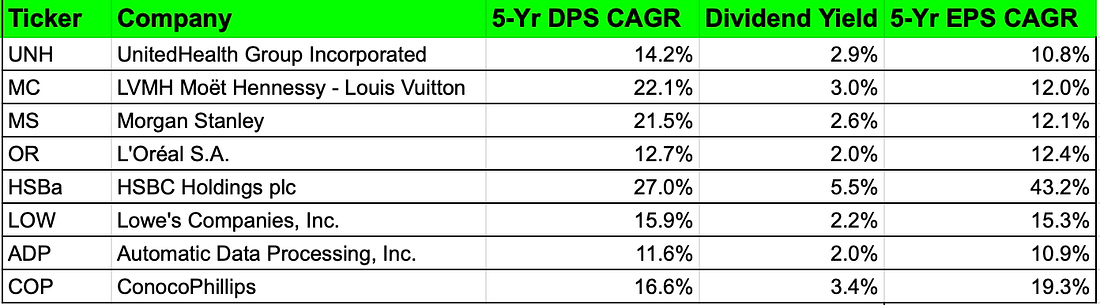

Here are 8 companies that didn’t just pay dividends – they grew them by 10% or more per year for 5 straight years.

Dividend growth is powerful.

Let’s say you earn $1,000 in dividends this year. If it grows by 10% annually, here’s what happens:

Year 1: $1,000

Year 5: $1,610

Year 10: $2,590

Year 20: $6,730

That’s the magic of compounding - not just from reinvested dividends, but from dividends that grow faster than inflation.

The lesson: Don’t just chase yield. Look for growth too. It adds up in a big way.

2️⃣ Compound Your Dividends

This chart shows why growing dividends matter.

Since 1992, the S&P 500 went up 781% on price alone.

But with dividends reinvested, it grew 1,481%.

That extra return came from dividends that got bigger every year.

It’s not just about getting paid - it’s about getting paid more over time.

3️⃣ An Investing Quote

Warren Buffett says that you don’t need to be brilliant.

You just need to start early, stay consistent - and let growth do the hard work.

Compounding can generate amazing results from average efforts.

"My life has been a product of compound interest. Nothing more. Nothing less. And nothing brilliant. " - Warren Buffett

4️⃣ Buffett Compounds His Dividends

Warren Buffett owns a lot of dividend-paying stocks - and it’s no accident.

He looks for businesses that generate steady, growing cash flow.

Dividends give Berkshire income without ever having to sell.

Top holdings like Apple, Coca-Cola, and Chevron all pay - and grow - their dividends.

That cash gives him flexibility: to reinvest, wait, or buy when the time is right.

It’s a strategy built for long-term compounding - just like dividend growth investing.

In my free e-book, I’ve pulled together my top takeaways from the 2025 Berkshire AGM—including what Buffett said about dividends, cash flow, and building wealth slowly.

Click the image to download it.