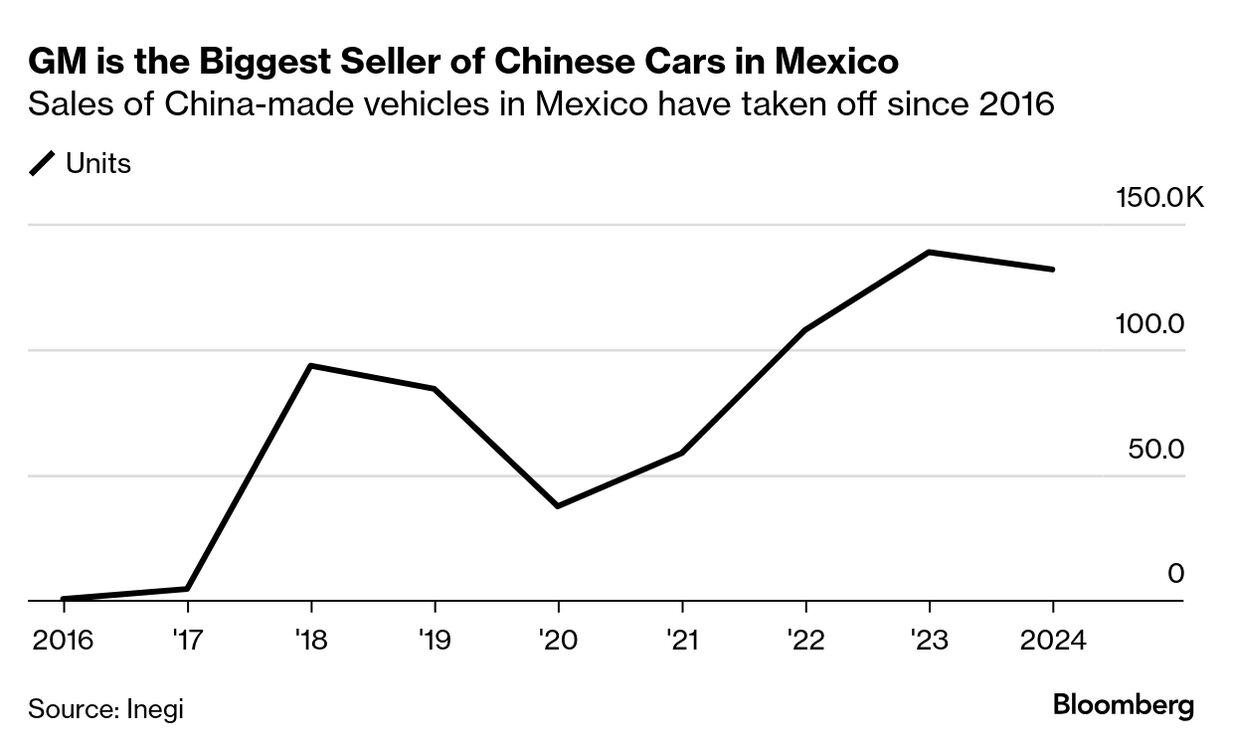

| Would you believe me if I told you that you could buy a brand spanking new Chevrolet that gets 48 miles per gallon for only about $17,000? It sounds too good to be true, but that’s the actual price tag for the Aveo. There’s just one catch, if you’re from the states: In North America, the model is sold in only Mexico. Oh, and this “Heartbeat of America” Chevy? It’s actually made in China. In a new feature, Bloomberg News’ Amy Stillman and David Welch report that Chinese-made cars are infiltrating Mexico because “cheaper labor and component costs allow companies to churn out less expensive cars.” In the US, the average price for a new car is almost $49,000, and GM’s least expensive model in the states — the Chevy Trax — costs thousands more than the Aveo. “Washington has promised to shield American automakers from Chinese imports with tariffs,” Amy and David write, “but that hasn’t stopped GM, Ford Motor Co. and Stellantis NV — which owns the Chrysler, Jeep and Ram brands — from shipping their own China-made cars to Mexico. They’re part of a wave of Chinese car exports in recent years.”  It’s the start of a troubling trend, writes Shannon O’Neil. “While Mexico’s overall trading ties with China pale in comparison [to ties with America], they have been growing at double-digit rates,” she writes. “Most worrisome for Mexico, the surge is mostly one way. Chinese imports nearly doubled over the last decade to some $130 billion, while Mexican exports back total less than $10 billion, leaving a $120 billion bilateral trade deficit outstripping that between the US and China in relative size and share.” What’s worse, Shannon says there’s a precedent for it: “In 2000 Mexico exported more computers, telecommunication equipment, clothes and auto parts to the US than any other country. Just over a decade later, it had lost its lead to China in all but auto parts.” That early aughts “China Shock” could very well repeat itself with the latest surge of vehicle imports. “Last year one out of every five cars bought in Mexico were made in China, despite Mexico’s own prowess as the world’s fifth largest automaker,” she writes. Just anecdotally speaking, when I was in Mexico City last week, not one but two of our Ubers were BYD Dolphins — both of them the cute millennial pink color. “The solution is not just to raise tariffs to appease Trump,” Shannon writes. “Mexico should push again for fuller North American integration. Its best path forward is not diversifying away from, but tying itself closer to, the United States.” Bonus Car Reading: Competition between Uber, Tesla and Waymo is heating up in the robotaxi space, and it’s not clear who will prevail. — Liam Denning While “CEOs are warning that AI could make their employees’ jobs obsolete,” as Beth Kowitt notes today, I have a related question: What if AI outs an AI CEO having an affair — will his job become obsolete? Sorry, I had to. This clip of a CEO embracing his Chief People Officer on the kiss cam at a Coldplay concert, both of whom were who were identified using facial recognition, is making everyone on social media very nosy today. But back to Beth’s point: In part because of AI, “employers are abandoning the tools of corporate diplomacy as a way to motivate employees and instead shifting to strongman tactics.” At JPMorgan, junior bankers have been told they’ll be fired if they get caught accepting a job offer from somewhere else before their 1.5 years are up. At Goldman Sachs, they’re doing three-month check-ins to ensure nobody’s lined up an outside gig. Beth says these “companies may end up with employees who are afraid to leave — but that’s not going to result in the same benefits that come with a truly dedicated workforce.” How do you get a truly dedicated workforce, then? In China, Shuli Ren says the traditional way to recruit a hard-working cohort is to look at educational pedigree. But as the country’s “engineer dividend” takes hold, she says a lot of companies are looking past elite diplomas. “Beyond those working on deep tech, soft skills, such as teamwork and the ability to deepen client relations, matter more to on-the-job success than academic excellence,” she explains. In the US, too, straight A’s from a prestigious university are no longer a golden ticket for Gen Z to get into the job market. “The prospect of rising college costs — and a shrinking earnings premium for degree-holders — has many high school students rejecting the traditional four-year pathways,” writes Mary Ellen Klas. “But rather than strengthen four-year schools to target these shortcomings and boost trade schools to meet rising demand, the tax-cuts-and-spending law slashed $300 billion from the higher education system and made college less accessible for anyone who receives a scholarship or a loan to cover the cost — which is to say, most people.” Bonus Corporate Talent Reading: Big Tech's “acquihiring” trend may sound uncomfortable, but could it spawn something better? — Parmy Olson |