| Bloomberg Evening Briefing Asia |

| |

| The trade deal that US President Donald Trump celebrated as the largest in history becomes the more puzzling the more layers are peeled back. The centerpiece is Tokyo’s pledge to set up a $550 billion US investment fund and the lack of detail is raising questions about the viability of an agreement that’s been floated as a potential template for other major trading partners. The deal imposes 15% tariffs on Japanese cars and other goods, one of the more favorable rates. While the start date and other basic elements are still unknown, Treasury Secretary Scott Bessent warned this week that the US would monitor implementation and bump the rate up to 25% if Trump isn’t satisfied. The two countries’ leaders seem at times to be talking at cross purposes. The White House said over $550 billion will be invested under the direction of the US, and Trump said on social media that 90% of the profits will be given to America. Prime Minister Shigeru Ishiba, on the other hand, said Japan would offer a mixture of investment, loans and loan guarantees up to a maximum of $550 billion. Who exactly will be funding the bulk of the amount and over what time period remains unknown. —Balázs Penz | |

What You Need to Know Today | |

| Thailand warned that the military conflict with Cambodia could “potentially develop into a war” as troops used rockets and artillery to shell targets along their contested border for a second day. Acting Prime Minister Phumtham Wechayachai told reporters on Friday that the severity of the clashes was escalating, endangering civilian lives. The crisis is inflaming nationalist tensions in Thailand, threatening embattled leader Paetongtarn Shinawatra and boosting support for the military.  A Cambodian military vehicle in Oddar Meanchey province on July 25. Photographer: Heng Sinith/AP Photo | |

|

| Federal Reserve Chair Jerome Powell is in the middle of Trump’s strategy of “flooding the zone” to attack an adversary. As the president pushes the Fed to hew more closely to his agenda, he also personally attacked Powell, questioned spending on the renovation of the Fed’s Washington headquarters, discussed the job with at least one possible replacement and appointed three political officials to a planning commission that is reviewing the Fed’s project. On Thursday, Trump ramped up the pressure even further when he visited the Fed headquarters to see its renovations in person, turning it into a televised political event. | |

|

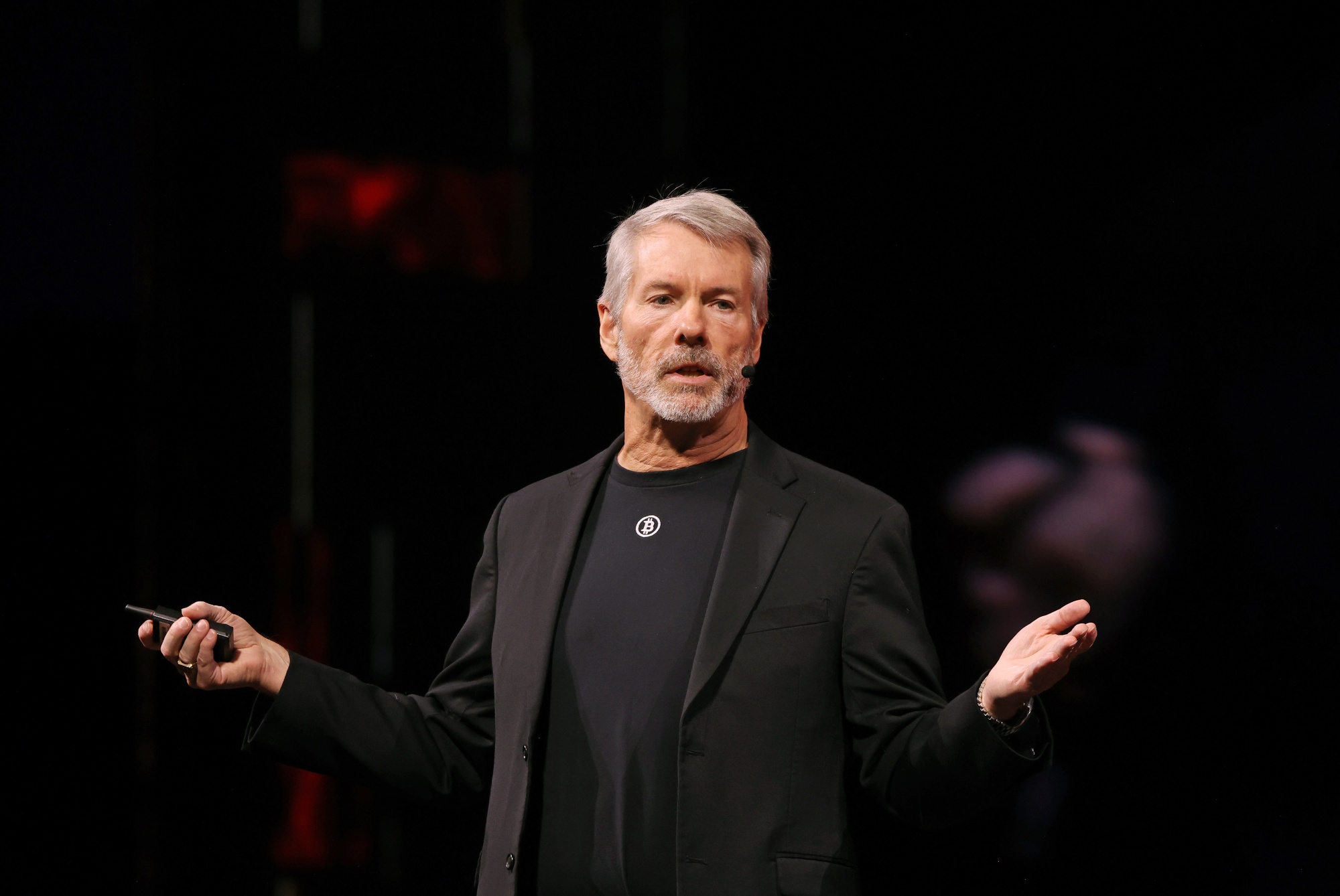

| As crypto prices continue to boom, Michael Saylor’s Bitcoin holding company Strategy launched a new kind of preferred stock, and then promptly upsized the deal from $500 million to $2.8 billion, according to a person familiar with the transaction. The security that priced on Thursday, which the company is calling Stretch, promises buyers a hefty 9% annual payout, with no end date attached — unusual in the arcane world of preferred stock offerings.  Saylor during the Bitcoin 2025 conference in Las Vegas in May. Photographer: Ronda Churchill/Bloomberg | |

|

| Citigroup pushed a trading desk head to delete a social-media post that was critical of Israel’s actions in Gaza and drew attention to widespread starvation in the region. Akshay Singal, the London-based global head of short-term interest rate trading, published the note with photos of malnourished children on Thursday. Before the end of the day, the bank asked for it to be removed and is conducting a review, according to people with knowledge of the matter. | |

|

| Singapore’s sovereign wealth fund, GIC, unveiled its newest platform to highlight how AI is changing the way it does deals. About an hour after uploading data and background materials on a proposed investment, the bot spits out a detailed summary of the key issues and examples of questions an investment committee member might ask before giving it a green light. GIC also revealed that it ramped up investments in the Americas while its Asia-Pacific holdings declined, as the giant fund wagers that the US will benefit most from the artificial intelligence boom. | |

|

| Volkswagen lowered its financial outlook for the year, with the escalating cost of Trump’s tariffs weighing on earnings at the Audi and Porsche brands. Volkswagen also cited internal restructuring expenses and greater sales of lower-margin electric vehicles for the forecast change. Europe’s largest carmaker is under pressure to cut costs and improve its products to deal with crises in three key markets.  New Porsches for sale in Los Angeles. Photographer: Eric Thayer/Bloomberg | |

|

| Country Garden has agreed to some key restructuring terms a group of bank creditors had demanded, according to people familiar with the matter, potentially easing the path for an overall debt deal. The company, once China’s biggest developer, has sent a document to a group of banks known as the co-ordination committee addressing their concerns. The document details a deal in which the key term is $178 million in compensation that Country Garden will pay the banks for the return of seized collateral, the people said. | |

What You’ll Need to Know Tomorrow | |

| |

| |

| A financial analyst typically starts the day scouring earnings reports and macro trends. Jay Patel does that too, but he also studies planetary charts and moon cycle trackers. Astrology has long been stitched into the fabric of Indian life, shaping decisions around marriage, money and even baby names. But fueled by apps and a younger generation seeking guidance, the once-intimate practice of consulting trusted diviners is taking root more widely — from stock trading to therapy and career planning. India’s total astrology market is estimated to be worth more than $7 billion, and the digital segment alone is expected to grow tenfold by March 2030. | |

| Enjoying Evening Briefing? Check out these newsletters: - Markets Daily for what’s moving in stocks, bonds, FX and commodities

- Breaking News Alerts for the biggest stories from around the world, delivered to your inbox as they happen

- Balance of Power for the latest political news and analysis from around the globe

- India Edition for an insider’s guide to the emerging economic powerhouse

| |