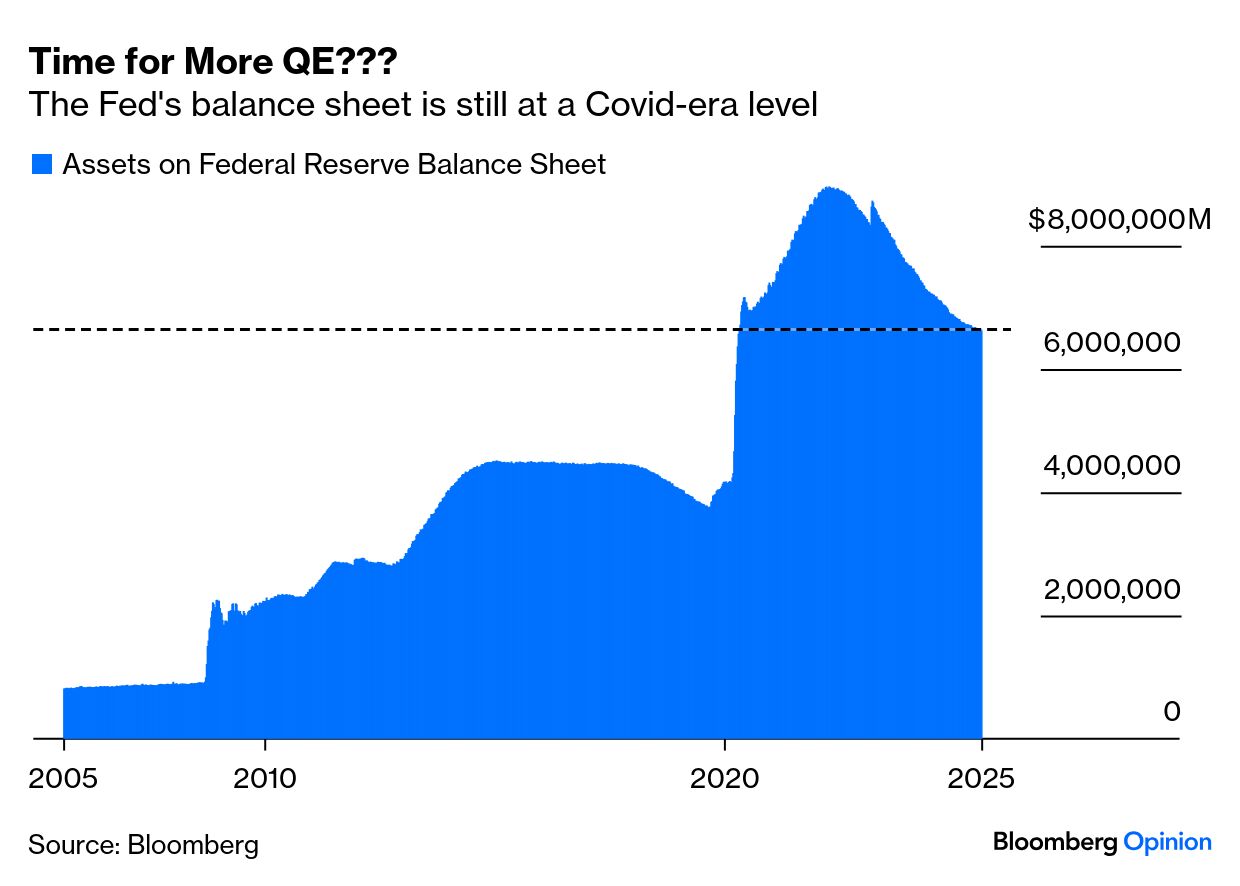

| National capitalism is here. Nvidia Corp. and AMD Inc. will be permitted to sell H20 chips to China in return for a 15% cut to the US government. Such crude intervention doesn’t, arguably, count as capitalism. And yet US stocks were largely flat for the day. Chipmakers themselves have surged ever since the administration’s 90-day tariff delay back in April. They’re unscathed: For now, investors think they can put up with such interference. This even extends to the currency market, where backlash to US trade policy had been strongest. Trump 2.0 transactionalism damaged the dollar as foreigners questioned whether the US had the strong institutions needed to be a reliable counterparty. But the downward trend seems to be over, and the currency is in the beginnings of a recovery: This is all the more remarkable as institutions believe US equities are overvalued. The share of global fund managers surveyed by Bank of America Securities who think so has risen to a record 91%: And yet, the flow of money from US to European equities has stopped. Fund managers are stepping back into the US, and exiting the euro zone: This is partly because economic optimism is back. Worries about a potential hard landing have been soothed by the global economy’s successful avoidance of any severe impact from tariffs to date. The odds of such an outright downturn are as low as they have ever been since BofA started asking this question more than two years ago: The natural corollary is that the risk of overheating should rise. But in a bizarre conjunction, fund managers think both that inflation will rise, and that rates will fall: Further — and this is extraordinary — most of BofA’s respondents believe the next Fed chair will resort to quantitative easing or yield curve control, desperate expedients that are hard to justify outside the hardest of landings: QE is a desperation tactic of buying bonds and putting them on a central bank balance sheet that was pioneered during Japan’s deflationary morass. The Fed used it to inject liquidity, or effectively print money, after the Global Financial Crisis and during Covid-19. It continued — in hindsight unwisely — into 2022, allowing inflation to take hold. Years of unwinding the Fed’s balance sheet have only brought it back to its 2020 level. If there is a risk of inflation (of which we will learn much more in the July CPI report shortly after you receive this), then there’s no possible justification for QE — but most fund managers expect exactly that:  How to square this circle? Investors are grasping that fiscal dominance, or financial repression, is the order of the day. The US debt burden takes priority, taxes won’t be hiked to fix it, and so people will be forced to lend to the government for cheap (as happens with QE). Shareholders have to put up with the government muscling in on their share of the action, as with the cut of China sales that chipmakers are paying. Guardrails against such behavior have all failed in the last seven months — neither Congress, nor the courts, nor (mostly non-existent) retaliation by other countries, nor the financial markets have thwarted the imposition of the highest tariffs in a century. The assumption is that the rest of the America First agenda will go through, too. Markets are taking this with equanimity because they can live with it. To quote Ian Harnett of Absolute Strategy: “85% of something is better than 100% of nothing.” Markets are inherently transactional. Others might have a problem with a government behaving this way, but traders can treat it as business as usual. Monday brought news that the White House has widened the field of candidates for the Fed chairmanship to include several current governors. Rather than firing the incumbent, Jerome Powell, which is legally and constitutionally dubious, this move maximizes leverage over the entire committee. Each knows that their chance of landing the big job will rise if they vote for a cut. Thus government control over the Fed is perceived to increase.  Team of rivals? Photographer: Al Drago/Bloomberg Financial repression isn’t great. The QE era from 2009 to 2016 was marred by sluggish growth and deepening inequality. But it was good for asset prices. There are still problems with the market’s equanimity. Russell Napier of Orlock Advisors argues that QE is directly inflationary. If prices continue to rise, as many expect, then the government will have to force savings institutions to buy government debt. They’ll need to sell stock to do so, so this QE might not help the stock market. Second, national capitalism like this involves repatriation of capital. That would be a potential disaster for the US as foreign holdings of American stocks far exceed US stakes in foreign securities. Germany and Japan might be surprising beneficiaries. The story isn’t over. But for now, the US gets what it wants, and the stock market can rally on. |