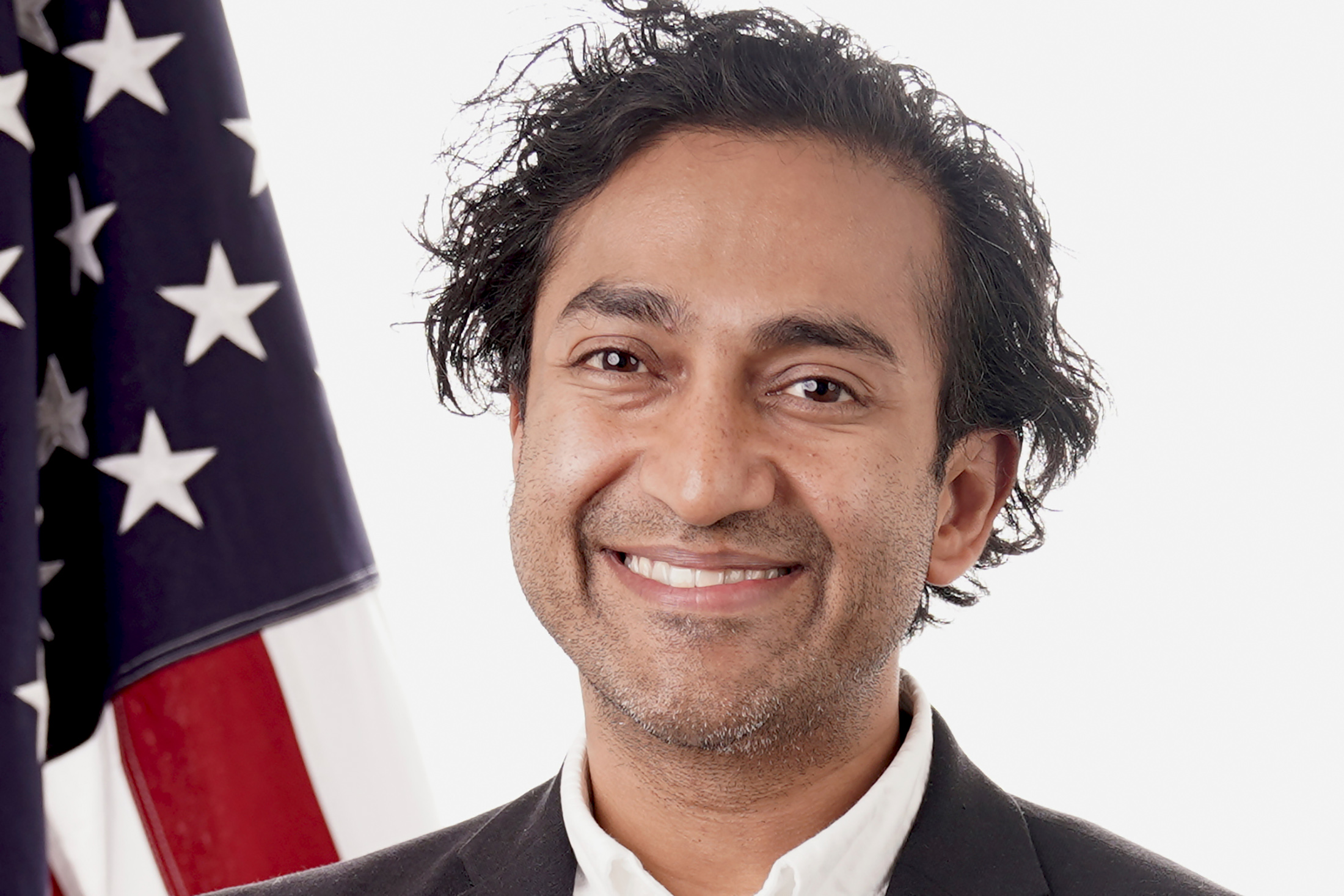

| The Food and Drug Administration isn’t typically this dramatic. But the controversial appointment, whipsaw resignation, and surprise return of a drug industry provocateur is turning President Donald Trump’s FDA into an unknowable quantity in American public health. And that uncertainty has reverberated onto Wall Street, where unpredictability isn’t warmly received. It all centers on Vinay Prasad, a firebrand academic who made his name challenging medical orthodoxy and excoriating FDA decisions in a series of academic papers, social media threads, and podcast rants. That endeared him to Marty Makary, Trump’s pick to lead the FDA. Makary put Prasad in charge of the division that regulates vaccines and gene therapies, and later promoted him to be the agency’s top scientist and chief medical officer. Biotech stocks promptly swooned as investors revisited Prasad’s hard-nosed takes on the drug industry and prepared for the worst.  Vinay Prasad Source: FDA Then it all came unglued. In July, the FDA demanded that Sarepta Therapeutics stop selling its gene therapy for a rare form of muscular dystrophy after the deaths of two patients. The move put a spotlight on Prasad, who had railed against the FDA’s decision to approve Sarepta’s treatment, called Elevidys, before joining the agency. Patient groups protested; conservative commentators called it a regulatory overreach; and Laura Loomer, the right-wing media personality with the ear of the president, branded Prasad a “leftist saboteur” who needed to be fired. Within days, the FDA walked back its decision on Sarepta, and Prasad resigned from all three of his jobs. Now, after two weeks away from the FDA, he’s back, presiding once again over the Center for Biologics Evaluation and Research, the department that regulates vaccines and gene therapies. The sudden reversal has left agency watchers wondering which Prasad they’re going to get: the fiery critic from social media, or the more measured regulator described by Makary. Steven Grossman, a regulatory consultant who follows the FDA, says he’s “guardedly optimistic” that Prasad has learned from his experience in the public eye. But there’s no guarantee Prasad has taken the right lessons from his whirlwind summer, Grossman says. “It is possible that Makary and Prasad somehow see his return as a form of vindication,” he says. “That would be a mistake, since the forces that created the pressure – apart from Laura Loomer – have not gone away.” News of Prasad’s return came as a shock to Wall Street, where biotech investors were hoping for prolonged calm at the FDA. “Many of us thought that with him gone, maybe things would be a little bit quieter,” says Eric Schmidt, a biotech analyst at Cantor Fitzgerald. “Not necessarily better, but at least quieter.” Instead, the Prasad saga marks the latest upheaval at the Department of Health and Human Services, one that makes it that much more difficult to predict what’s going to happen next. And it might not be the last: Loomer posted over the weekend that she’s preparing “more exposés of officials within HHS and FDA.” In the meantime, biotech stocks remain volatile, and the persistent leadership changes at FDA “may just prove too tumultuous for some investors’ tastes,” RBC analyst Brian Abrahams wrote in a note to clients. — Damian Garde |