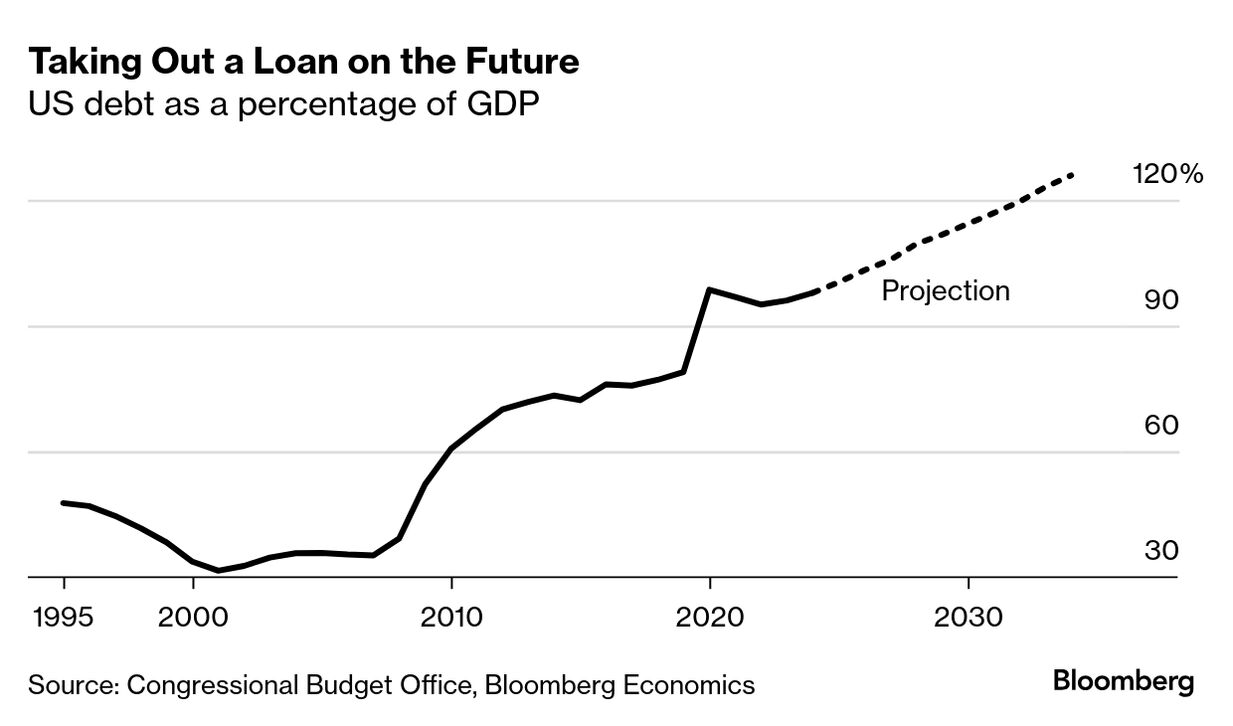

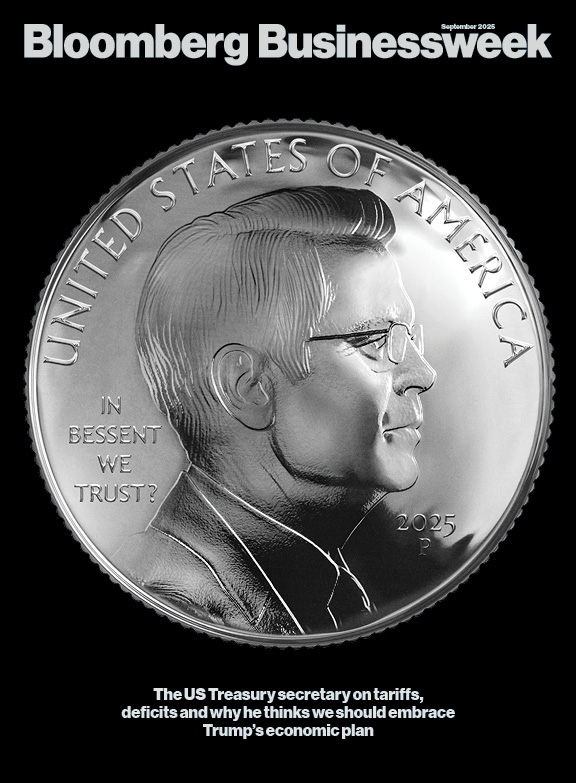

| The September issue cover story about Treasury Secretary Scott Bessent is live, and Bloomberg Businessweek Editor Brad Stone is here in the newsletter today with Remarks about the fiscal legacy the Trump administration is creating. Plus: Two stories about unusual housing construction in old New York City offices and on new islands in Dubai. If this email was forwarded to you, click here to sign up. Donald Trump couldn’t ask for a better pitchman for his unorthodox stewardship of the US economy than Scott Bessent. Deregulation and cuts to government spending, along with punishing tariffs on friends and foes alike, will lead to a bonanza of growth and higher wages, the US Treasury secretary predicts in an interview with Bloomberg Businessweek for September’s cover story. He even forecasts, improbably, a lower deficit. “The deficit-to-GDP [ratio] is going to be lower this year than it was last year, mark my words,” he says. “If you constrain spending, which we’re doing, and grow 3%, then the debt-to-GDP will drop.” Independent experts aren’t as confident about the longer-term picture. The bipartisan Congressional Budget Office, which uses a baseline gross domestic product growth rate of 1.9% in its projections, estimates the recently passed budget bill will add $3.4 trillion to the deficit over the next 10 years. If the temporary provisions in the One Big Beautiful Bill Act are extended—and as we’ve witnessed, it’s politically unpalatable to ever let a tax break lapse—that number would climb even higher. Bessent argues that faster growth and resurgent domestic manufacturing will boost tax revenue, which together with rising income from tariffs will make up for the shortfall. We should all hope he’s right—if he isn’t, one perennially quiet constituency will pay an awfully high price for all that gathering debt: future generations of Americans.  Photo illustration by 731; Photos: Getty Images (4) The deficit is not the creation or fault of any single party or politician. Recent presidents always seemed to have good reasons to kick the balanced-budget can down the road. Ronald Reagan was fighting communism, George W. Bush terrorism. Barack Obama had to defibrillate the economy during the Great Recession, Joe Biden during the great pandemic. In these cases, the choice to spill red ink was politically easy to justify. President Trump never once mentioned the deficit in a State of the Union during his first term and seems to have a peculiar rationale for running up debt now: putting more capital in private hands and restoring blue-collar industries to the US and tucking them safely behind protectionist walls. It’s a cliché to wail, “Who will think of the children?” But honestly: Will anyone? The CBO projects the debt could be almost double the size of the GDP by 2050, with a third of every tax dollar going to paying interest. Such massive debt payments would seriously constrain future legislators, hamstringing their ability to respond to a crisis. It could also crowd out private borrowing, propel interest rates higher and push homeownership further out of reach for young people who’ve already weathered a financial crisis and pandemic and will have to load up on debt to pay for college. “Deficits don’t seem to matter until all of a sudden they do, and then they are going to matter a whole lot” as investors get nervous and capital flees, says Elizabeth Popp Berman, a professor of organizational studies at the University of Michigan and author of Thinking Like an Economist.  The recently approved Big Beautiful Bill is symptomatic of a policy direction that seems to favor older people and to push all kinds of liabilities onto future generations. There’s the unquantifiable expense of forcing an estimated 10 million people off Medicaid by 2035, as the CBO predicts of the law, which could require emergency rooms to provide care for many more people with no insurance. There’s also the reputational debt of America’s sinking stature abroad because of Trump’s combative tariff policy. Young Americans will now have to navigate a world where their country is as distrusted as it was valorized for much of the last century. Now add to that the grave environmental debts we’re handing to our grandkids. Scientists warn of the catastrophic impact of a 3C rise in global temperatures and say we’re on track to hit that mark by the turn of the century unless we change our ways. The consequences could be profound: swamped coastal cities, severe droughts, falling crop yields and heat waves that kill millions. Trump’s way of addressing this problem is to simply deny that it exists. In addition to discarding the established climate science as fraudulent, his Environmental Protection Agency recently revoked the finding that global warming endangers human health, which had given the agency the regulatory authority to combat pollution and protect the environment. Young people will have to methodically reverse every one of these actions and find new ways to accelerate the shift from fossil fuels. “Debt is really too mild a word,” says Nicholas Stern, chair of the Grantham Research Institute at the London School of Economics. “It’s a brutality against our children and grandchildren of huge proportions. This is not alarmism, it is simply describing what the science is telling us.” In his interview, Bessent told us that “if we don’t make capitalism work for everybody, people are going to revolt against it.” He had a storied 40-year career on Wall Street and taught economic history at his alma mater, Yale University. Bessent’s words carry significant weight, so in this context, they’re chilling. It’s difficult to imagine, on the current path, how the system is going to work for the generations that will have to pay our accumulated bills when they finally come due. Read September’s cover story: Bessent on Tariffs, Deficits and Embracing Trump’s Economic Plan, or listen to it here.  Photo illustration: Danielle Del Plato; Photos: Getty Images (1); U.S. Mint (1) |