| Outside food and energy, US prices are picking up again. Disinflation after the epic post-pandemic price shock is over. In other news, the latest nominee for the Federal Reserve’s board of governors is chiding his new colleagues for “tariff derangement syndrome” and the US Treasury secretary says that a jumbo cut of 50 basis points would be in order next month. And the US stock market has surged to an emphatic new record. These things are linked, but not in the way that might first appear. The inflation numbers don’t strengthen the case for a rate cut. All else equal, they should be bad for stocks. But the intense political pressure for a rate cut has little to do with the data. That pressure has moved the dial toward easy money. Rate cuts don’t generally happen when inflation is above target and no recession appears imminent. When they do, the stock market might well melt up. Hence Tuesday’s buying. Last week, the nominee Fed governor, Steven Miran, told Bloomberg there was “zero macroeconomically significant evidence of price pressures from tariffs.” If there were any effect, he said, it would be a “one-time price shift,” as happens when governments raise sales taxes, and not an enduring regime change. If the administration’s message wasn’t clear enough, Treasury’s Scott Bessent piled on to say that the Fed should consider cutting by 50 basis points next month.

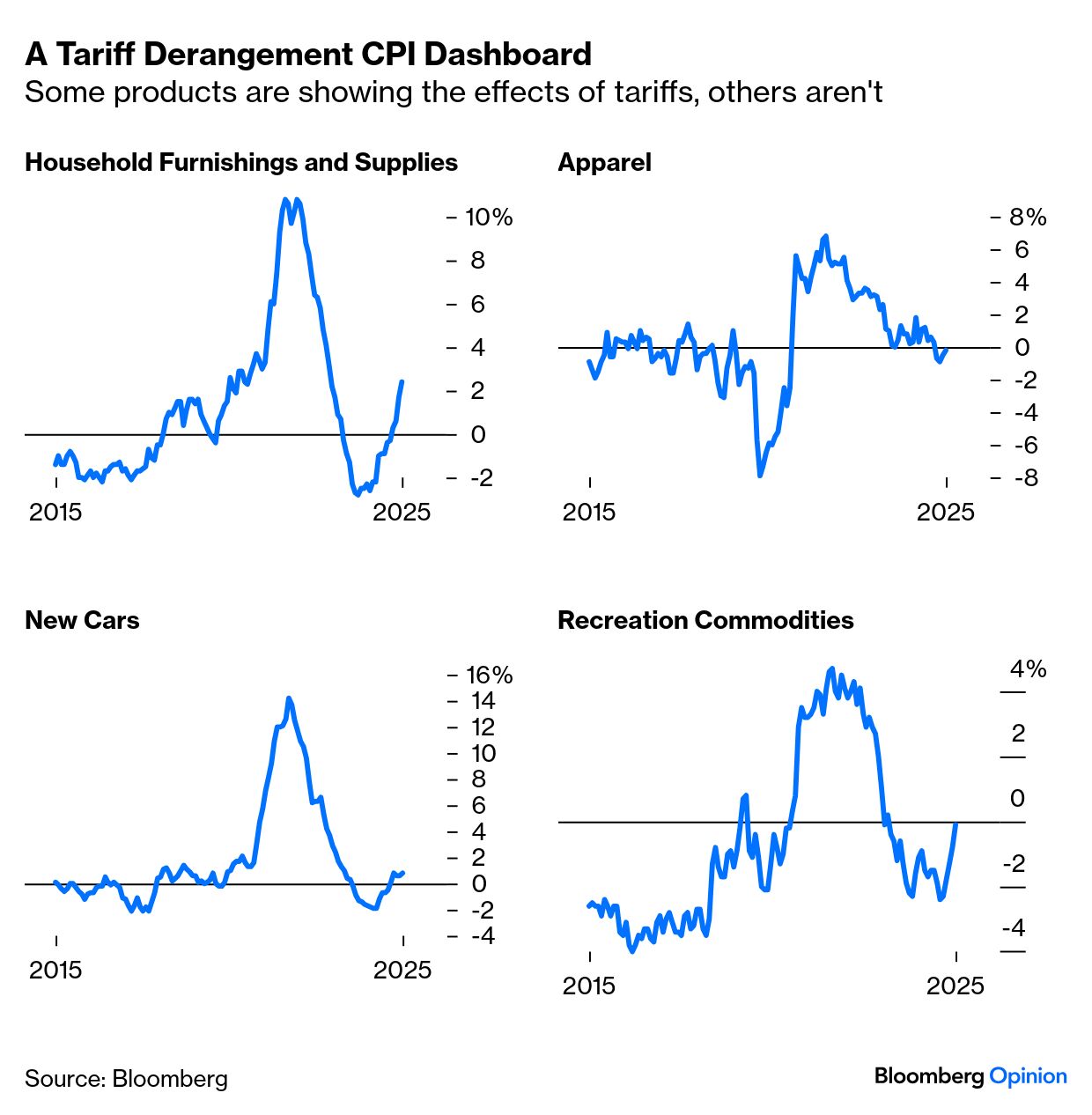

It’s hard to reconcile such rhetoric with the actual numbers. This is our standard beautiful chart, dividing inflation into its four core elements: Tariffs have their most evident effect on core goods, which are scarcely visible in the big chart. Here is the sector’s contribution to CPI in isolation: Two points are clear. First, core goods aren’t contributing much to the overall price burden. Second, their prices usually have a tendency to go down, so even if they add only two-tenths of a percentage point to bring core CPI to 3.1%, a trend has turned. It’s not terrifying, but is concerning. Some tariffed products (like home furnishings) are already showing signs that the levies are being passed through, and others (notably new cars) aren’t:  Tiffany Wilding of Pimco offers reasons why companies are prepared to “eat” tariffs so far: Their margins are healthy, giving them space to do this; consumers are price-sensitive, so businesses selling to them will hold off on price rises as long as they can; and corporate tax cuts in the One Big Beautiful Bill Act offset the pain. Can this continue? Omair Sharif of Inflation Insights LLC warns that of 75 items within core goods, 65.3% rose in July, up from 57.3% in June and the highest in 30 months. He suggests that a wider swathe of core goods is steadily being impacted by higher tariffs. Services, not goods, have been leading inflation and continue to do so. Chair Jerome Powell started to look at “supercore” (core services minus shelter) as a priority, which is unfortunate as it has unambiguously turned upward, rising to 3.2% from 2.7% in April: This might be because of concern over tariffs, a belief that the Fed will make a dovish error, or any number of things; the key is that the trend is no longer in the right direction. The same is true if we look at inflation of sticky prices, for products whose prices take a while to change and are very difficult to cut. Again, this inflation is rising again, and it never got down to the Fed’s upper bound of 3%: The Cleveland Fed produces a median CPI, and also a trimmed mean, which excludes outliers. Both these purists’ measures of core inflation have stopped falling and started to rise, without ever getting within target range. Outside the post-pandemic spike, the median hasn’t been this high in more than three decades: The overall numbers look good because one of the Trump 2.0 priorities, a lower oil price, is coming through in spades. Cheaper gasoline will make people much happier and brings the headline rate down to 2.7%. Exclude energy, and everything else is at 3%. It’s not at a level that would normally encourage central bankers, who generally ignore oil prices as they have no control over them, to ease rates: The markets most closely tied to rates don’t see this inflation report as moving the needle much. A September cut is seen as a racing certainty — but that’s been the case ever since last week’s employment revision: A rate cut is likely, and defensible, because of unemployment. This month’s huge revisions showed the labor market was much weaker than thought. But payrolls are still growing. The official unemployment rate, less susceptible to revision than the payroll figure and compiled with a different survey, rose menacingly ahead of last September’s “jumbo cut.” That seems to have halted the deterioration: Wage inflation is falling, but not as fast as the Fed would like. These are the wage-tracker numbers produced by the Atlanta Fed from census data. Wages are rising, for both full- and part-time employees, faster than at any time in the 20 years before Covid: Jim Bianco of Bianco Research makes the devastating point that in the last 40 years, the Fed has only once cut rates when the core was above 3% and the three-month change was greater than 0.3%. That was between October 1990 and March 1991 when there was war in the Persian Gulf and the economy slid into recession. The Fed might now give up on its 2% target. There’s an argument for that, but the electorate seemed to feel differently last November, after the battering from inflation during Joe Biden’s presidency. As for stocks, everyone understands the potential of artificial intelligence. But the S&P 500 is trading at a record multiple of sales, so a lot is riding on keeping margins high: Share prices shouldn’t be viewed in isolation. Lower interest rates justify higher valuations. But if we compare the S&P’s earnings yield (the inverse of the price/earnings ratio) with the 10-year Treasury yield, or its dividend yield with the three-month Treasury bill, stocks look terrible value. Those rate cuts really need to happen: Tariffs’ pass-through to prices to date has been weaker than many had feared. But it’s not deranged to monitor the risks, which are clear and obvious. Whether it’s deranged to pile into stocks is another matter. With a dovish error apparently in the pipeline, maybe it makes sense. |