|

Want Safer, Stronger Dividends? Skip the Top Yielders

The highest yielders are often traps - here’s why the second tier delivers safer, stronger dividends and market-beating results.

👋 Howdy partner!

Back in May I shared a simple strategy that beat the pants off the S&P 500.

Here’s the idea:

Take the Russell 1000, rank all the stocks by dividend yield, and split them into five groups.

Instead of chasing the very highest yielders, buy the second tier.

The Magic of the Second Quintile

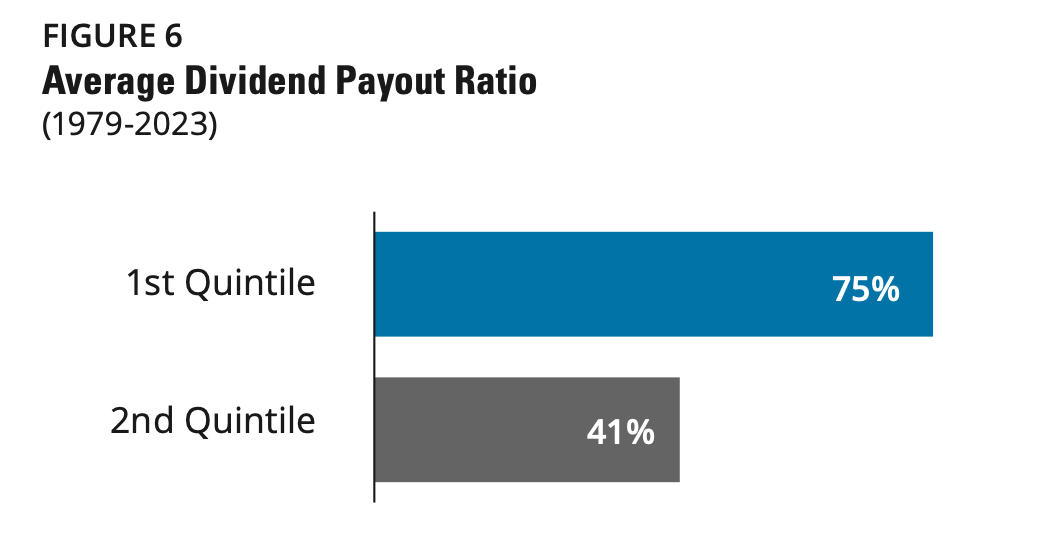

Why do we avoid the top dividend payers?

Because the top group is usually filled with companies in trouble.

Their yields are high because their stock prices are falling, and they tend to have high payout ratios.

The second tier, on the other hand, tends to hold solid businesses with healthy payout ratios.

Backtests Show it Works

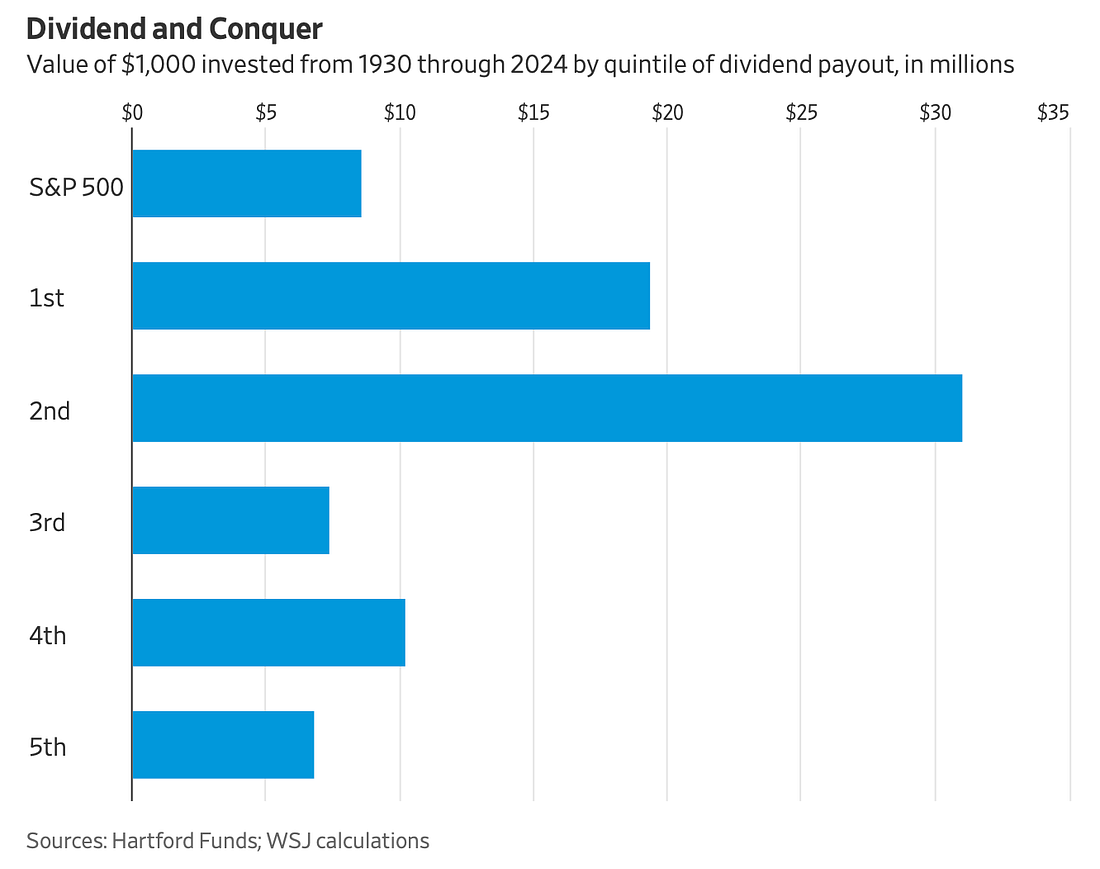

The strategy was tested going back nearly a century. The results were stunning.

A $1,000 investment in the S&P 500 in 1930 grew to $8.6 million by 2023.

That same $1,000 invested in the second-quintile dividend stocks? $31 million.

That’s almost 4x more wealth.

And it wasn’t just about bigger returns. The second tier also had the fewest down years of any group.

That matters.

The key to compounding isn’t finding the next moonshot - it’s avoiding the blowups, keeping losses small, and letting dividends pile up.

It’s an elegant, no-nonsense strategy - and now it’s time to run the numbers again.

Today’s Second Quintile: 201 Stocks. $10,600. 3.35% Yield.

I ranked the Russell 1000 by dividend yield.

There are 201 companies in the second quintile.

The average yield of the group is 2.62%.

Equal weighting the companies with $100,000 would get you $2,620 each year in dividends.

And here’s what you get in return:

A diversified basket of businesses

No “high-yield” landmines

Reliable, growing income streams

A strategy that’s quietly beaten the market for 90+ years

We’ve put the full list of 201 companies into a spreadsheet.

Click the button below to access it:

Out of those 201 names, I’ve picked six companies that stand out.

Each one is a dividend compounding machine that passes the Chowder Rule.

Ready to find out what they are?...