| | In this edition: MTN’s South Africa faces US probe, calls for a new African business council, the im͏ ͏ ͏ ͏ ͏ ͏ |

| |   Kampala Kampala |   Kigali Kigali |   Johannesburg Johannesburg |

| Africa |  |

| |

|

- MTN faces US probe

- US-Uganda migrant deal

- Calls for business council

- DRC’s new bank governor

- Stablecoins grow in Africa

- A new bitcoin institute

- Cash transfers impact

A Lesotho artist wins a top prize. |

|

South Africa’s MTN faces US probe |

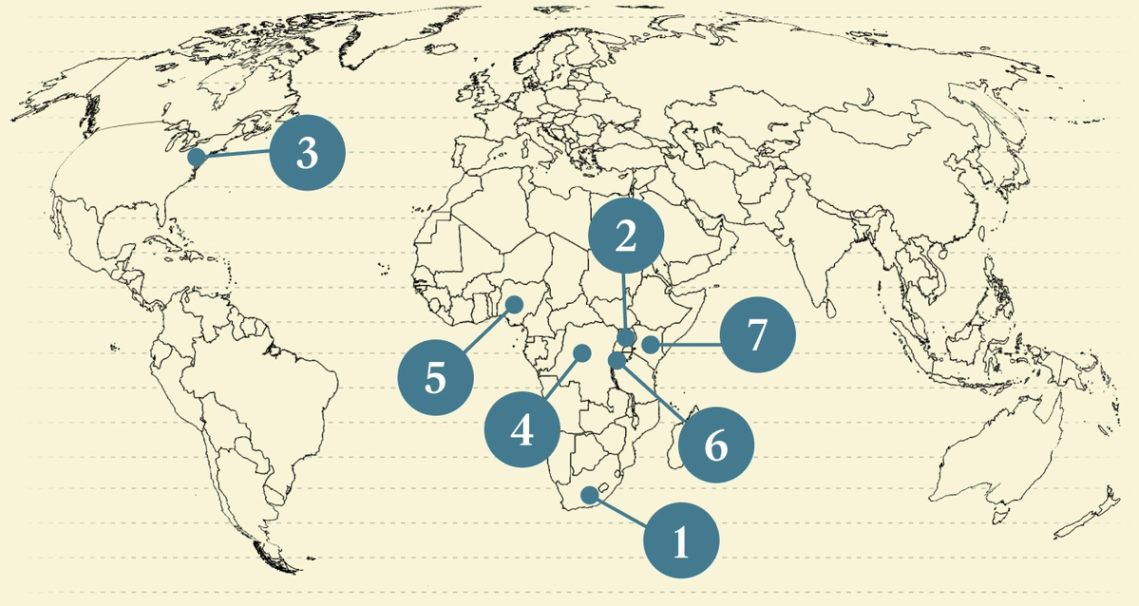

Siphiwe Sibeko/Reuters Siphiwe Sibeko/ReutersAfrica’s largest telecommunications group MTN said it was under investigation by the US Department of Justice over its operations in Afghanistan and Iran. The South African company, which has nearly 300 million subscribers, said it is “voluntarily responding to requests for information.” The probe could lead to an indictment and charges against the company. MTN operated a subsidiary in Afghanistan from 2007 until April of this year, when it completed a $56 million sale of the unit. It still owns a 49% stake in Iran’s state-run Irancell. MTN had been involved in a 2022 lawsuit by American military service members and civilians injured or killed in Afghanistan and Iraq between 2005-2010 and who allege that MTN — through its affiliation with Irancell — supported anti-American militias in both countries. That case precedes and appears to be related to the DOJ probe. MTN also announced changes to its leadership, appointing Group Chief Risk Officer Ferdi Moolman as CEO for MTN South Africa, while MTN Nigeria CEO Karl Toriola takes on an additional role as vice president for Francophone Africa. |

|

US-Uganda deportation deal? |

US Army Sgt. 1st Class Nicholas J. De La Pena/US Department of Defense via Getty Images US Army Sgt. 1st Class Nicholas J. De La Pena/US Department of Defense via Getty ImagesUganda’s state minister for foreign affairs said the country had not struck a deportation deal with the US following reports in Washington of an apparent agreement, as the White House steps up its immigration offensive. CBS News said that it had obtained internal government documents showing that Uganda had agreed to accept an unclear number of asylum seekers in the US who come from other countries, as long as they don’t have criminal histories. The documents also showed that Honduras had agreed to accept deportees, the outlet reported, saying it would take several hundred over two years from other Spanish-speaking countries. “To the best of my knowledge we have not reached such an agreement,” a junior Ugandan foreign minister told Reuters, saying the country did “not have the facilities and infrastructure to accommodate” US asylum seekers. The Trump administration has been targeting African nations under its “safe third country” move to reroute deportees to countries that are not their own as it ramps up deportations. This month, Rwanda said it would accept up to 250 migrants from the US, while both South Sudan and Eswatini have accepted small numbers of deportees. |

|

US Dems push for Obama-era council |

| |  | Yinka Adegoke |

| |

Kevin Carter/Getty Image Kevin Carter/Getty ImageDemocrats in the US Congress are pushing for the reestablishment of an Obama-era business council in Africa to counter what they say is rising Chinese influence on the continent. In a letter seen by Semafor, Raja Krishnamoorthi, the top Democrat on a hawkish House of Representatives subcommittee focused on China, called on the US Commerce department to reconvene the President’s Advisory Council on Doing Business in Africa and host high-level trade missions “to counter the efforts” of China to expand its influence in the region and make further “inroads to the detriment of American interests.” While Republicans on the committee did not sign the letter, it captured sentiments they have aired. China’s bilateral trade with Africa reached $280 billion last year, and is now around four times that of the US. Meanwhile the Trump administration has effectively killed the African Growth and Opportunities Act (AGOA), a favorable trade pact, with the introduction of new tariffs on African exports. |

|

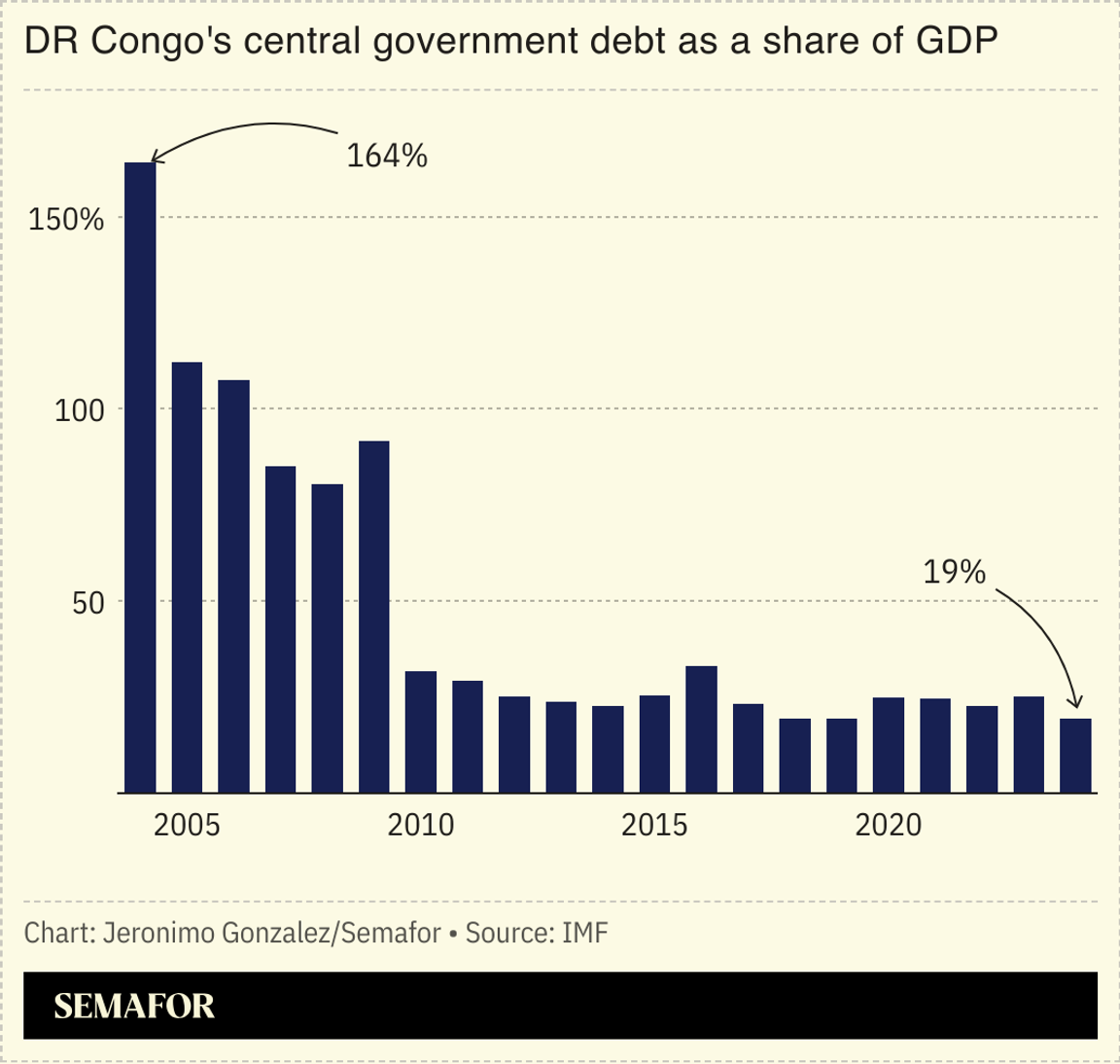

New DRC central bank governor |

The appointment of a DR Congo presidential insider as the country’s central bank governor is raising questions about how its financial sector will retain independence from the authorities. Last month DR Congo President Félix Tshisekedi named his deputy chief of staff for economic affairs, André Wameso, to lead Banque Centrale du Congo (BCC). Wameso’s 2021 bid for a BCC board seat was blocked after the International Monetary Fund raised objections over his close ties to the presidency. Kinshasa was then negotiating with the fund for a $1.5 billion investment in a three-year development program — the country’s first in nearly a decade — as it struggled with critically low foreign reserves. The franc was under pressure and the government was eager to restore access to concessional finance. Wameso, a 50-year-old former corporate banker, replaces Malangu Kabedi Mbuyi, a former IMF official who led the bank since July 2021. Under her tenure, DR Congo’s foreign reserves rose more than fivefold, inflation slowed, and the BCC’s credibility improved among investors and lenders. — Joël Té-Léssia Assoko |

|

The next wave of global growth starts here. Against the backdrop of the UN General Assembly, Semafor will host a landmark gathering on one of the greatest social and economic opportunities of our time: connecting the unconnected. The Next 3 Billion will explore the forces accelerating economic and societal growth across the world’s most ascendant regions. Join world leaders, top executives from the world’s most powerful companies, and leading investors for a full day of dialogue on connecting the next three billion people to the digital economy. September 24, 2025 | New York City | Delegate Application |

|

Stablecoins expand in Africa |

Stablecoin use is rising in Africa, with people using cryptocurrencies beyond cross-border trade in areas such as remittances, savings, and payroll systems, cryptocurrency company Yellow Card said in a report. The growing adoption in Africa mirrors a wave of rising stablecoin use across the globe, reflected in the growth of the market capitalization of the cryptocurrencies from $5 billion in early 2020 to $230 billion in May 2025. Yellow Card said its operations in 20 African countries — particularly Kenya, Nigeria, and South Africa — as well as other emerging markets have seen it process $6 billion in transactions, mostly in Tether and USD coin. The company said 70% of its stablecoin customers use cryptocurrencies for remittances and savings. But the report noted they’ve also been used in other ways such as for crop insurance in Kenya, as a store of value for tech startups against inflation, and to enable cost-effective payroll systems across multiple jurisdictions with different currencies. — Alexander Onukwue |

|

New bitcoin institute to focus on Africa |

Dado Ruvic/Illustration/File Photo/Reuters Dado Ruvic/Illustration/File Photo/ReutersHuman rights activists and technology leaders in Africa are working on developing original research into rising bitcoin usage on the continent as they seek ways to both boost financial inclusion and counter digital restrictions by authoritarian leaders. Anaïse Kanimba, the daughter of Paul Rusesabagina, the political activist whose story inspired the film Hotel Rwanda, is leading the new Africa Bitcoin Institute, which will be based in Kigali, Rwanda, and is being supported by organizations including the Human Rights Foundation and the Massachusetts Institute of Technology. Bitcoin use has grown on the continent in response to unstable local currencies, difficult and high-cost cross-border transactions, and as a store of value in the face of rising inflation. But as much of the research on bitcoin has come from outside the continent, Kanimba told Semafor she is building a team to address a gap in the global bitcoin and digital currency narrative with African voices, data, and leadership: “We have a problematic cycle where African policymakers rely on global precedents rather than African realities when crafting digital currency policies,” she said. |

|

Cash transfers reduce infant mortality |

The amount of cash given to households with pregnant women in rural Kenya, which researchers found helped reduce infant mortality in the area by 48%. The study, led by the University of California-Berkeley and Oxford University, tracked more than 100,000 births and found there was a 45% increase in hospital deliveries after the one-time mobile money transfer from the nonprofit GiveDirectly. It also found that women worked 51% fewer hours in their third trimester and in the months after giving birth, following the intervention. With USAID cuts in Kenya estimated at around $225 million — 46% of its former budget in the country — there is a significant risk going forward to infant and perinatal health. The study determined that cash interventions should be more widely used in aid efforts, as “a scalable, cost-effective strategy to maximize the impact of limited aid dollars, rapidly save lives, and help achieve these ambitious global health goals without costly delivery infrastructure.” |

|

Business & Macro |

|

|