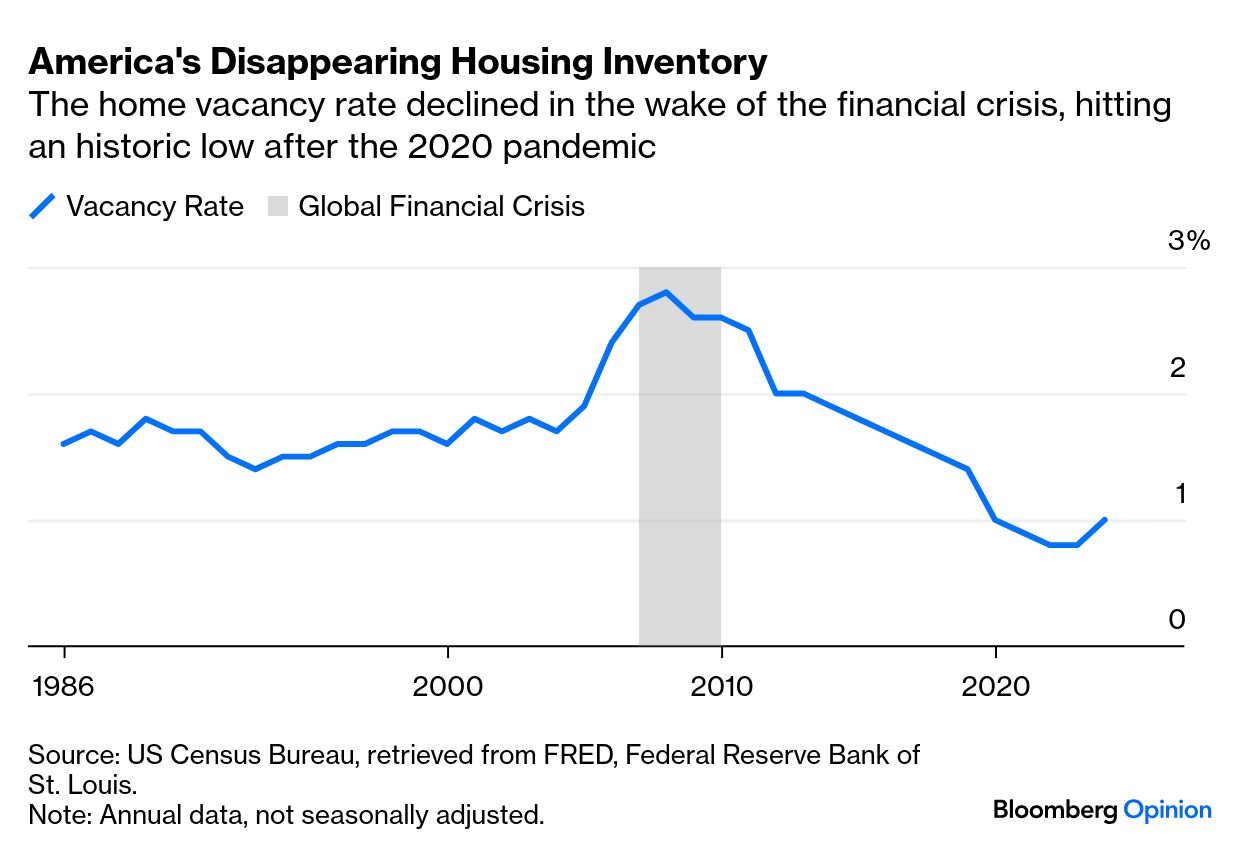

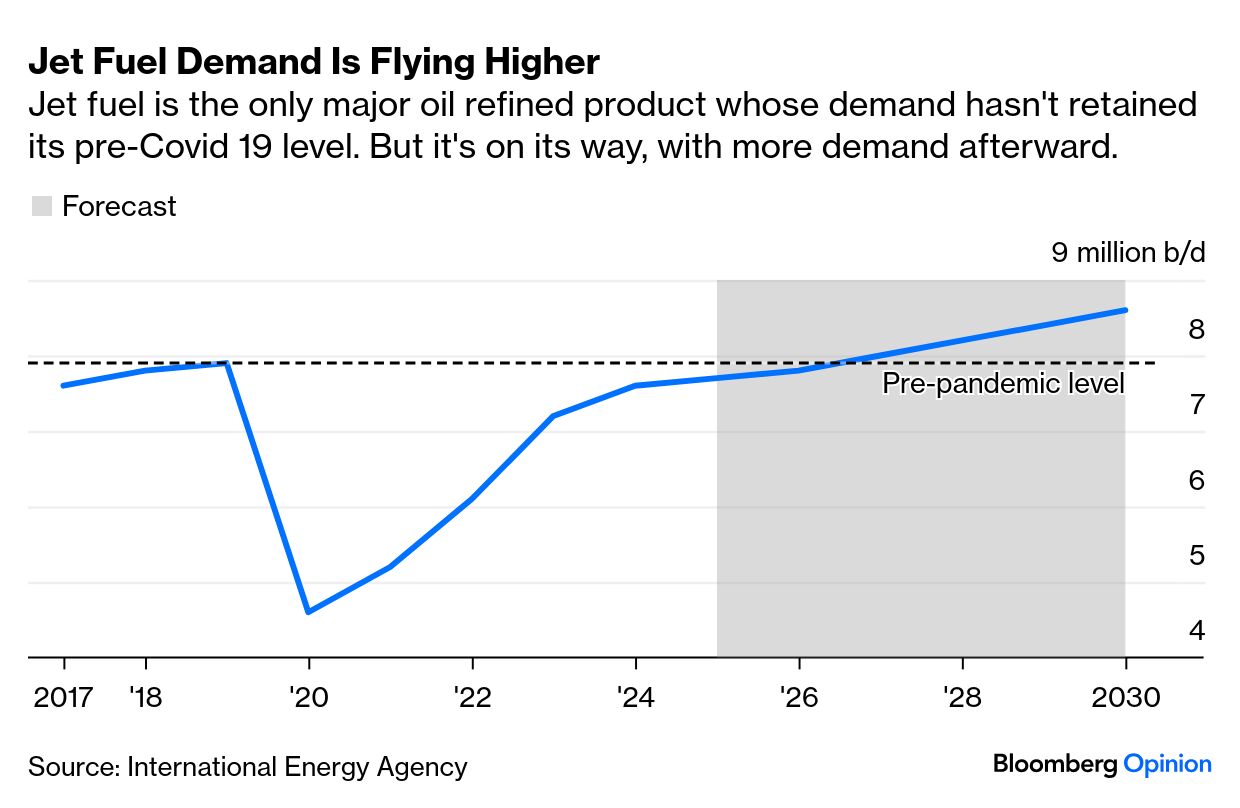

| Here’s a Bloomberg News story about how Apollo Global Management is taking “financial wizardry” to a new level by engineering a trade for Athene, its insurance arm. “The deal, named Fox Hedge LP, has repackaged $5 billion of loans and other debts that were already owned by Apollo’s funds and, through clever financial origami, turned them into bonds mainly for Athene to own,” writes Paul J. Davies. Now, normally I’d leave the task of explaining a highly complex financial machination to Matt Levine, but he’s on vacation (hopefully) until the end of this week. So you’re stuck with me, a person who majored in English in college and didn’t know what a synthetic risk transfer was until five hours ago. So I’ll start with what I do know: wizardry. When someone calls you a “wizard” or a “magician” at your job — something that happened quite frequently back when I helped manage Bloomberg Opinion’s social channels for five (!) years — it almost always means that while this person may admire your work ethic and dedication, they really have absolutely zero clue what it is you actually do, or how you do it. And that kinda tracks with what’s going on with Apollo! While Paul is impressed by such “a fascinating trade” — his words — he says nobody really knows how Apollo did it: “Apollo is very reluctant to discuss its details, which may be because the asset manager doesn’t want competitors to easily copy it, although imitators are very likely to sprout quickly. Regardless, the lack of disclosure makes it hard to assess the risks involved. The obvious worry is that this trade could be too clever by half.” If Matt were here, he’d probably end this with some equally-clever-yet-painfully-obvious (in hindsight) observation, but I’m no financial wizard. And honestly? I’m totally fine with that. In President Donald Trump’s eyes, the housing crisis has a simple solution: lower interest rates. But the country’s lack of supply can’t be solved by taking a tour of the Federal Reserve. If Trump really wanted to put his hard hat to good use, he could be out there building homes, Jimmy Carter-style! Or at the very least, he could “be pressing Republicans in Congress to pass a new piece of bipartisan legislation that would do more to address the problem,” writes the Bloomberg Editorial Board. “A slowdown in housing construction after the 2008 global financial crisis produced a shortfall of nearly four million homes, according to one estimate, which has only recently started to improve.” Only Congress has the power to truly fix it.  Serious question: Was Javier Blas possessed by Nathan Fielder, or merely separated from him at birth? Because they share a rather strange hobby: “Tracking flights and reading crash-investigation reports are some of my guilty pleasures,” he writes. For those familiar with Fielder’s HBO show, The Rehearsal, that’s pretty much a dead ringer for the origin story of the second season. “Perhaps because of my enthusiasm for planes, perhaps because I fly a fair bit for work, I’m typically upbeat about the future of aviation. No matter how much I hear about staycations, heat waves or anti-tourist protests, I’m convinced people will continue to take to the air for holidays.” His theory is backed up by the data on jet fuel: “From 2026 onward, demand should be setting new all-time highs every year,” he writes. “Until when? We have good visibility at least until 2030, when the need is likely to top 8.5 million barrels a day.”  Gavin Newsom is taking a page from Bill Clinton’s 1992 centrist playbook. — Ronald Brownstein Trump's summitry makes for great visuals, but it’s done little to change the on-the-ground reality. — Andreas Kluth With India, the White House expects the same level of trade loyalty as it got from the Germans in 1967. — Andy Mukherjee The new political battle over data centers is not split along partisan lines, it’s between locals and Big Tech. — Mary Ellen Klas Don’t be fooled by Beijing’s icy reception to the return of Nvidia's H20 chips; China is merely buying time. — Catherine Thorbecke The Trump administration seems determined to dismantle the crown jewel of US scientific research. — Lisa Jarvis Bolivia has a shot at change after the general election — even if it’s a long one. — Juan Pablo Spinetto The risks are skewed toward a hawkish surprise from Jerome Powell’s last stand at Jackson Hole. — John Authers The White House’s new TikTok account is getting dragged. SpaceX’s Starship explosions are starting to add up. Oracle is betting big on the cloud computing boom. The MAGA meat craze has a deportation problem. French dips are taking over New York City. Dog survives harrowing cheese ball catastrophe. Watch out for Listeria in the Pepper Jack. Researchers discovered a new class of origami. |