Points of Return

| To get John Authers’ newsletter delivered directly to your inbox, sign up here. Trump-Fed conflict amps up, with mortgage fraud claim agains | | | | | | To get John Authers’ newsletter delivered directly to your inbox, sign up here. | | | | | | The Battle of the Federal Reserve | | | There’s no rest in the battle over monetary policy. It’s now being fought both on familiar territory — with carefully chosen words in the Federal Open Market Committee’s minutes — and in startling new terrain, as the federal housing regulator digs up alleged evidence of mortgage fraud by a Biden-appointed governor and calls for her resignation. First, the mundane. The minutes don’t name names or offer precise numbers, but give rough indications of how many committee members (in bold below) adhered to different points of view at last month’s meeting, which held steady on rates despite two votes to cut them. Most are plainly still more worried about tariffs and their potential impact on inflation than about anything else. All agree that there are risks of both rising unemployment and accelerating price rises. The key is that a majority “judged the upside risk to inflation as the greater of these two risks,” while several viewed them as roughly balanced, and a couple (presumably the two who voted to cut) thought employment the “more salient risk.”  The Fed’s Michelle Bowman, Jerome Powell, Lisa Cook and Adriana Kugler in June. Photographer: Al Drago/Bloomberg Many said: - Overall inflation remained somewhat above the committee’s two percent longer-run goal.

- It could take some time for the full effects of higher tariffs to be felt.

Some: - Mentioned indicators that could suggest a softening in labor demand.

- Emphasized that a great deal could be learned in coming months from incoming data.

- Noted that it would not be feasible or appropriate to wait for complete clarity on the tariffs’ effects before adjusting monetary policy.

- Stressed that the issue of the persistence of tariff effects on inflation would depend importantly on the stance of monetary policy.

A few: - Emphasized that they expected higher tariffs to lead only to a one-time increase in the price level that would be realized over a reasonably contained period.

- Remarked that tariff-related factors could lead to stubbornly elevated inflation.

A couple: - Suggested that tariff effects were masking the underlying trend of inflation and, setting aside the tariff effects, inflation was close to target.

This was a reasonable conversation during unprecedented times among a group of economists who need more data before they’re comfortable cutting rates. Meanwhile, the administration wants to cut, aggressively. Governor Adriana Kugler, who didn’t vote at the meeting, has since resigned. President Donald Trump’s economic adviser Stephen Miran has been nominated to replace her; he would shift the balance at least to 9-3. Any more vacancies would be filled to tip the tally further toward cutting.  Cook in the crosshairs. Photographer: Al Drago/Bloomberg The spotlight now turns to Lisa Cook, the governor whose mortgages are now under scrutiny. Trump has demanded her resignation over the fraud allegations; she has said she will gather information to respond to any legitimate questions. Cook was not one of the “couple” who dissented on rates. If she were to resign and be replaced as expected, that would bring the balance to 8-4. It wouldn’t flip the committee in itself, but afterward it might not take much change in the data to shift members a long way. As Cook’s term has more than a decade left to run, replacing her would be a big deal. Two points seem clear. First, what Cook is alleged to have done would be hugely inappropriate behavior for a Fed governor. According to the Federal Housing Finance Agency, she bought two different houses within a few months and said on both mortgage applications that they would be her primary residence for 12 months. Second, the alleged offense is widespread and pursuing her on this reflects an astonishing ranking of priorities by the FHFA, whose chief responsibility is to oversee the federal housing agencies Fannie Mae and Freddie Mac. In coming months, the Trump-appointed director, Bill Pulte, will probably have to oversee Fannie and Freddie’s reprivatization, by far the biggest move in the world of US housing finance since the Global Financial Crisis. And yet he is devoting time and energy to looking at what Cook put on mortgage application forms. This looks like vindictiveness and a misallocation of regulatory resources. (Cook says she won’t be bullied into resigning.) It’s also a clear message of intent. This White House is thinking a long way out of the box to exert control over public institutions that it sees as having gone astray. It’s going to make Cook’s life very unpleasant. Other Fed governors inclined to disagree with the administration know the same fate awaits if they’re not careful. This is a new way for the government to do business with the Fed, and the market isn’t trying to deal with it. Ahead of the Cook news, fed funds futures put the odds of a cut next month at 84.5%. After the accusations, and the Fed minutes, it was 82.5%. Now, off to the annual central bankers’ symposium in Jackson Hole, Wyoming. | | | | | US indexes sold off a lot earlier on Wednesday, and then pulled back their losses significantly by the close. This isn’t as yet a bear market, or even a correction of the overall market. It looks more like a rotation, or a correction of particular anomalies, which probably should have longer to go. For one spectacular example, Palantir Technologies Inc. has enjoyed the kind of year that companies of its size almost never get. At one point, it was down 23% from last week’s all-time high. By the close, this was down to 16.8%. But its outperformance of the overall market has been so phenomenal that the pullback seems only reasonable. It’s outpaced everyone else in a way that dwarfs even Cisco Systems Inc.’s extraordinary run in the year that led up to its brief reign as the biggest US stock by market cap: There’s no particular reason why outperformance can’t carry on for any given day, but the higher a stock rallies, the more it is likely to fall at some point. Similarly, stocks can always grow more overvalued, so extremes don’t help with timing. But on any worthwhile metric, be it multiples of sales, earnings, book value, or dividend yield, the difference between the market cap-weighted and equal-weighted versions of the S&P 500 entered this selloff at unprecedented levels. A reversal was a matter of time: It’s also noticeable that the turnaround of the last few days hasn’t boosted smaller stocks, but merely knocked froth off the sectors that were most overvalued. The Russell 2000 index is down for the week, and the gap that has opened up with the mega caps of the Russell Top 50 is not closing: The catalyst for the latest rotation, judging by the market chatter, is a report from MIT that can be ordered here and suggested that AI adoption in most cases failed to deliver improved profits. Still, it took people a while to work out how to make money from the internet, too. More such fragments will be needed to force a more significant correction. When it comes, it could well be significant, because markets remain priced for perfection. According to Nicholas Colas of DataTrek Research, the S&P 500 entered the week trading at 21 times consensus earnings for next year. The average over the last decade has been 18.5. By his math, earnings would need to beat consensus by 10% for the current price to look attractive (it would deliver 14% upside). If the forecasts are accurate, then a gain like that can only happen if the forward multiple expands to 24 or more — and that is 1990s dot-com territory. | | All Quiet on the Ukrainian Front | | | The epoch-making summitry over Ukraine has had minimal impact on markets. The events — Russia’s leader, an accused war criminal, walking the red carpet on US soil, and then eight European leaders rushing to Washington to plead their case — were nothing if not dramatic. The longer-term consequences will be profound. But in themselves they change little, and the Ukrainian conflict itself is no longer particularly salient to the market.  The market noticed, but wasn’t moved. Source: Bloomberg After the round of summitry, the conclusions seem to be: - Putin still says peace can only be obtained by Ukraine ceding territory in the Donbas that Russia has failed to control militarily.

- The US demand for a ceasefire seems to have been abandoned, along with attempts to impose tougher secondary sanctions.

- Trump is, however, evidently trying hard to achieve some kind of peace settlement, and the “vibes” around his meetings with European leaders, particularly Volodymyr Zelenskiy of Ukraine, are orders of magnitude better than earlier this year.

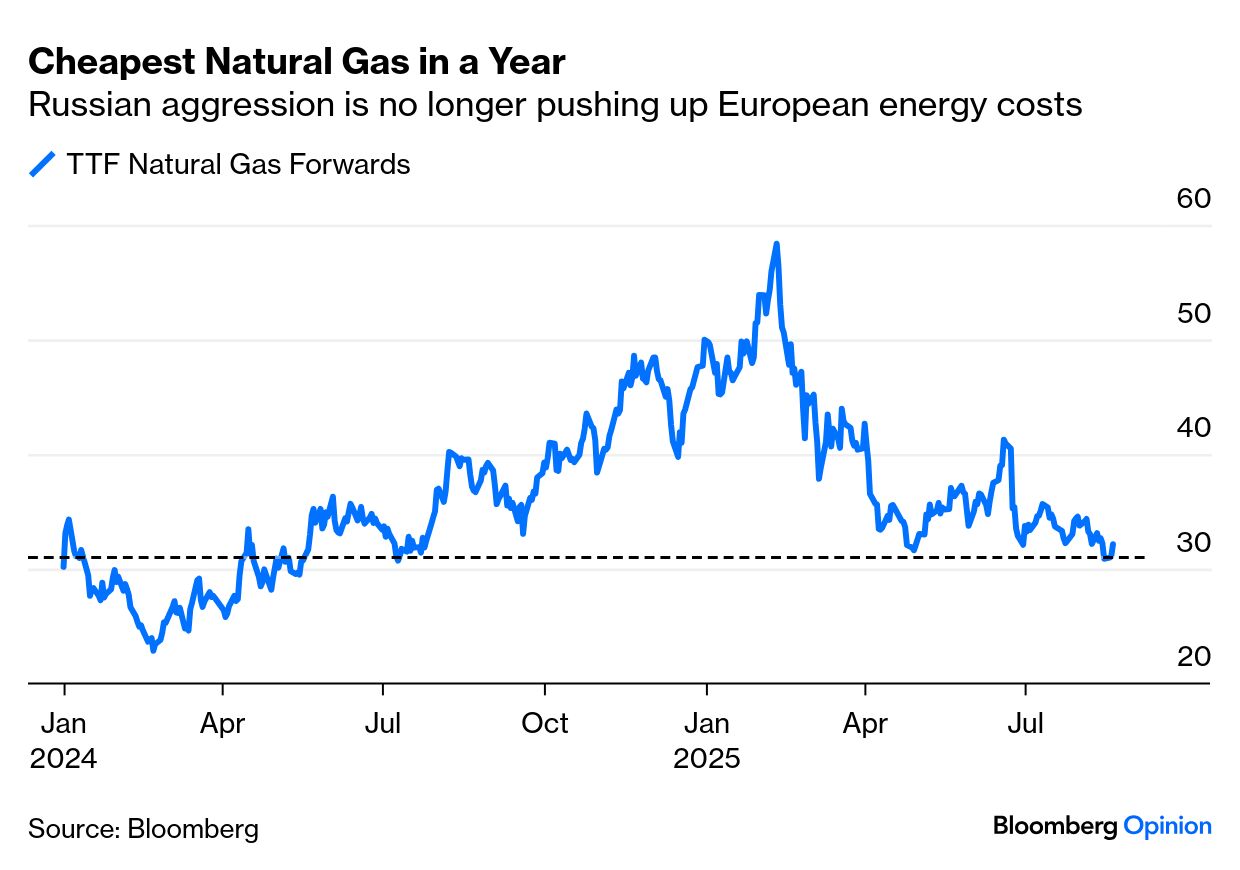

None of this shifts the base case, which is that the war probably drags on for a while longer, and that the stalemate remains. The market has already gotten used to this, as it grew accustomed to Russia taking the Crimea and making incursions into Donbas in 2014. So it’s hard to find much evidence of all the diplomatic activity in markets. European defense groups are still feasting on Germany’s historic return to big arms spending. They’ve given up a few gains in the last few days, but it’s nothing profound: The natural gas price, which skyrocketed in 2022 to bring the continent to a crisis, dropped to its lowest in a year on the news. But it’s been stable for a while. There’s little sign that summitry has shifted a status quo that Europe can live with, in either direction:  That price arguably does more to force Putin into a compromise than any of the threats from America and Europe. “Russia has an interest in quitting while it is ahead,” says Matthew Gertken of BCA Research. “The oil price is falling, depriving Russia of the means to escalate its military campaign significantly.”

His overall odds are the same now as before Putin set off for Alaska, with a 60% chance of a ceasefire, a 35% chance of continuing conflict along the current lines, and an outside 5% chance of a war that involves NATO by year-end. That latter option would, to use some understatement, be market-negative. The odds are 95% that the conflict will not get in the way of making profits on the market, just as has been the case for three years now. | | | | | | | Want more Bloomberg Opinion? OPIN. Or you can subscribe to our daily newsletter. Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters like | | |