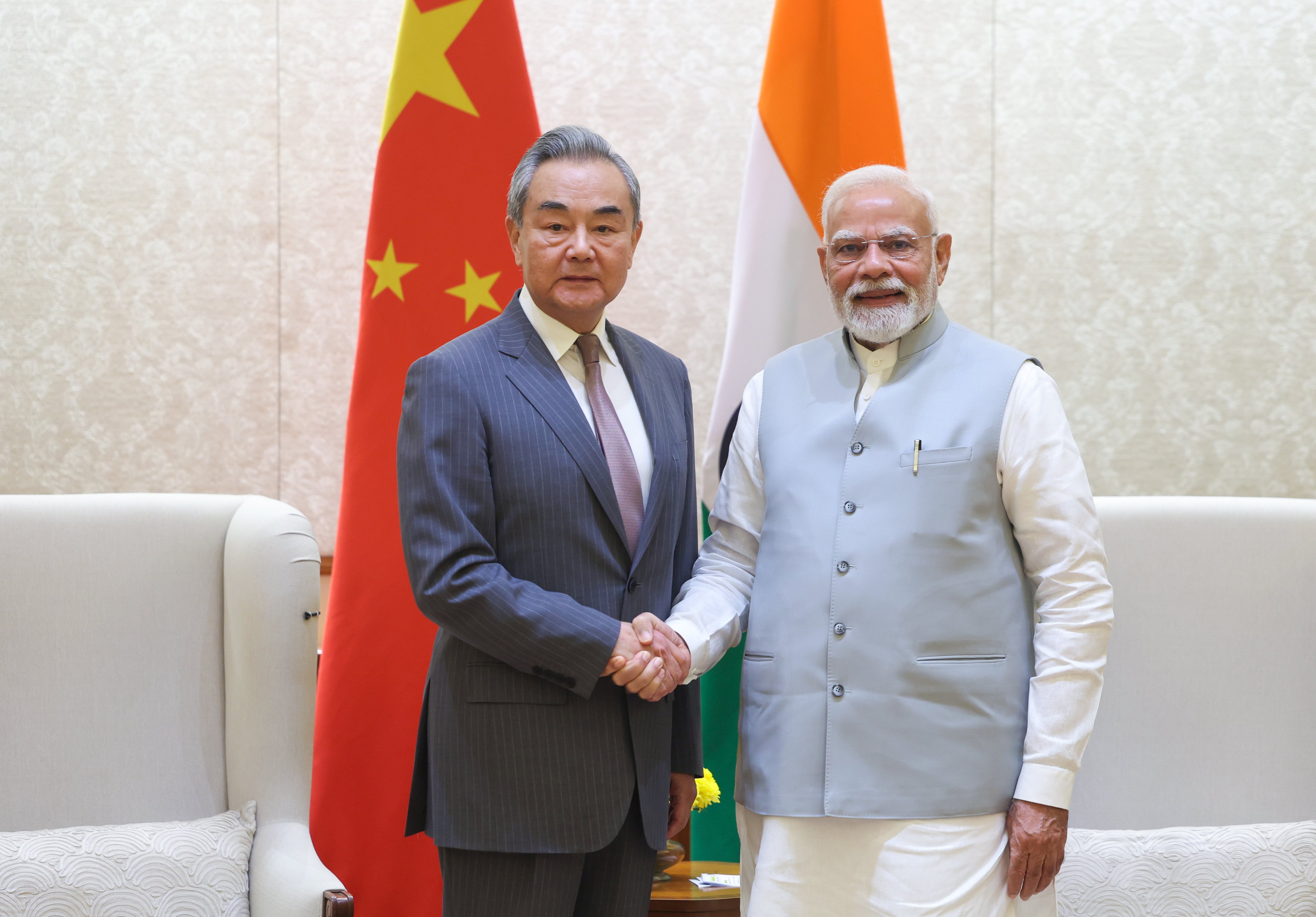

| In most breakups it is common for the jilted party to splurge on a makeover and look for new partners while dissing the ex. India’s Prime Minister Narendra Modi seems to be doing just that after being spurned by US President Donald Trump. This week Modi revived domestic economic reforms, warmed to the other superpower China and responded with recalcitrance to US warnings on India’s purchases of Russian oil. Many in India are viewing these developments as a sign of India’s strength even as stock markets remain cautious.  Chinese Foreign Minister Wang Yi met Indian Prime Minister Narendra Modi in New Delhi on Aug. 18. Source: Narendra Modi on X The India–China thaw Modi, who after the 2020 border clash was urging Indians to junk their made-in-China goods, this week warmly welcomed Chinese Foreign Minister Wang Yi on his first visit to New Delhi in three years. The two countries agreed to revive travel and trade ties, especially Chinese supplies of rare earth minerals, fertilizer and tunnel-boring machines. They also agreed to explore border demarcation, notably with no mention of India’s earlier demands for the restoration of pre-2020 territorial status. Later this month, Modi will meet President Xi Jinping on his first visit to China in seven years. Expect more chummy headlines then and maybe even a selective relaxation of Indian restrictions on Chinese investments. After all, Modi also has an Apple economy to protect. Trump’s actions against India may have added urgency to these reconciliatory moves but they should be viewed as part of a longer process that includes last year’s Modi-Xi meeting in Kazan, Russia, Tanvi Madan, senior fellow at Brookings Institution’s Center for Asia Policy Studies, said to me over phone and email. India has been seeking to stabilize ties to create more strategic and economic space for itself and to prevent another border crisis. The question is whether China will follow through on the commitments. “We’ve seen previous such dialogue phases get cut short by border crises, for instance, in 2017 and 2020 — and, if Beijing perceives New Delhi as vulnerable, there could be another,” Madan said. As if to underscore that fragility, right after his India visit, Wang travelled to Pakistan, a country China has deep economic and defense ties with. Make no mistake, the India-China patch-up will also be impacted by how Trump views this new coziness between the two BRICS members, and finalization of the US-China trade deal. Modi’s reform revival With Indian corporate chieftains suggesting the Trump tariff crisis is an opportunity to reform, Modi, after a dull first year of his third term, is making moves to boost slowing economic growth. On Aug. 15, he announced a long-pending rejig of the country’s goods and services tax. The proposed rationalization of over five tax rates to about two will lower prices and help lift consumption. But it’s also expected to cut tax revenue, especially for states, raise borrowing costs in the short term and curtail government expenditure — a key driver of growth for India in recent years. And until the rates for different goods and services are finalized, consumers may postpone purchases of high-value discretionary goods like air conditioners, refrigerators and automobiles. To say this could have been better planned may be viewed as nit-picking, so let’s just take the win. There will be more, said Modi in a social media post that promised a “roadmap for next-generation reforms” but offered no details. Business leaders like Anand Mahindra and Uday Kotak are calling for more fiscal support to small businesses, export incentives to counter Trump’s tariffs and large-scale deregulation. A government commission set up earlier this year has yet to suggest measures to cut red tape for big and small firms. Economists I speak to are hoping for new ideas on spurring manufacturing hubs, incentives to super-size the boom in offshoring services via global capability centers, faster trade deals with the EU and others, implementation of new labor codes, improved market access for agricultural goods, improved efficiency in the judicial system and speedier monetization of government assets to fund all these. Many of these have been pending for years. Besides, the government’s view of reform can often mean cosmetic changes to a law, like with the criminal and income tax codes. Or the outlawing of an industry overnight, as India did with online money gaming this week.

Modi’s reforms need to go beyond incrementalism, Madan said. A robust economy creates space for India with its rivals and its partners, adding to negotiating heft. Starting next week, Trump’s 50% tariff will impact over $48 billion in Indian exports, according to a government estimate. No relief seems to be in sight yet, with US negotiators reportedly deferring talks and senior Trump administration officials slamming Indian billionaires for profiteering off Russian oil. Modi’s response has been to buy even more oil while making small concessions to the US, such as lower duties on cotton imports. Picking defiance over diplomacy could cost India its biggest trading partner and access to the world’s largest consumer market. China camaraderie or reform intensity are good moves, but even they won’t make up for that. |