| | In this edition, a vibe check between those who paint a rosy economic picture and the numbers that s͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Business |  |

| |

|

- Murdoch saga ends

- David Sacks

survives thrives - Musk takes on telco oligopoly

- His Excellency goes to DC

- PNC goes coastal

- Ken Griffin’s lonely fight

|

|

The Biden vibe-cession has turned into the Trump vibe-spansion. The previous administration was felled by the emotional gap between the actual economy (pretty good) and how people felt about it (pretty bad). President Donald Trump is enjoying the opposite: Companies and consumers are behaving like everything is fine, despite plenty of warning signs that it isn’t. The labor market is weakening; today’s revisions were bleak. Inflation is stuck above the Federal Reserve’s target of 2%. More US companies went bankrupt in July than in any month since 2020. One of every $8 in outstanding US credit card debt was severely delinquent at the end of June, the highest level since 2010. AI has wallpapered over cracks: As Matthew Klein pointed out recently, spending on data centers has just barely offset declining warehouse construction, raising questions about whether we’re experiencing a “but-for-AI recession.” If AI turns out to be as economically miraculous as it is technologically marvelous, no harm done. If not, those cracks will have been deepened by neglect. But economic actors are whistling past the graveyard. Real consumer spending grew at a solid 2% annual rate in August, global M&A volumes are up 30% from last year, and the corporate bond market is on fire. Investors haven’t been this sanguine about blue-chip debt since 1997. “The markets are saying, ‘nothing to worry about,’” Jonny Fine, who oversees high-grade debt underwriting at Goldman Sachs, tells me. Vlad Barbalat, who manages more than $100 billion as chief investment officer of insurer Liberty Mutual, cited “a feeling of goodwill” between executives and the Trump administration — also heavy on vibes, not outcomes. “The business community felt like they didn’t have an audience” under Biden, he said. “This administration seems to be open to the business community articulating its needs and challenges. The policies don’t necessarily result, but it’s translating into the way people do business.” Psychology can trump data in today’s attention economy, especially if nobody trusts the data anyway. Reality may catch up — consumer sentiment legged down in August after two months of improvement — but the vibes have a head start. Just ask Biden. One more thing: Next week I’ll be moderating The Business of Luxury, a conversation with leaders from Art Basel, Sotheby’s, FlyHouse, Genesis, and others on how consumers are rewriting the rules of heritage and innovation in the luxury world. Request an invitation here. |

|

Murdoch feud ends with whimper |

Reuters TV Reuters TVThe Murdoch family drama ends with a whimper — and a heavily discounted sale that will reshape ownership of a powerful voice in conservative media. Lachlan Murdoch, the son who shares Rupert’s politics, will assume de facto control of News Corp. and Fox News, which remains a powerful perch in Republican circles. In the end, family harmony and money defeated a long-running insurgency that James, the former heir apparent (and model for Succession’s Kendall Roy), framed as a battle in the anti-Trump resistance. James, Elisabeth, and Prudence will be bought out for $1.1 billion each, 79% of the value of their shares — a steep haircut, but one that keeps control in ideologically friendly hands vetted by the company’s bankers at Morgan Stanley. |

|

David Sacks has done more than outlast Elon |

Al Lucca/Semafor Al Lucca/SemaforIn the days after Elon Musk’s and Trump’s public split, David Sacks’ days seemed numbered. The Silicon Valley investor-turned-White House crypto czar was close to Musk, and White House grandees come and go. (“All hail the Asian carp czar,” went a 2010 Atlantic headline.) But Sacks “has emerged as perhaps the most effective representative of America’s business community in Trump’s new Washington,” Semafor Editor-in-Chief Ben Smith writes. His All-In podcast commands attention and he’s comfortable with semi-public shows of loyalty, like storming out of group chats that turn against the president. He was publicly attached to Trump’s second-biggest legislative win, the pro-crypto GENIUS Act, which has left banks in a losing battle with crypto for White House support, wishing they had a czar of their own. |

|

Musk’s $19B satellite gamble |

Kevin Lamarque/Reuters Kevin Lamarque/ReutersElon Musk’s Starlink struck a $19 billion deal Monday for EchoStar’s spectrum licenses, edging out T-Mobile and positioning it as a potential competitor to the big three wireless carriers. Spectrum is a finite asset and licenses for big blocks, like those Charlie Ergen had been sitting on, don’t come up for sale that often. AT&T agreed last month to buy $23 billion worth of EchoStar’s spectrum, and Starlink is buying much of the remainder. Musk’s deal came as a surprise to some observers, even after Semafor reported Starlink’s and T-Mobile’s interest. As recently as last week, telecom executives were privately dismissive that the billionaire was serious about building a competitor. |

|

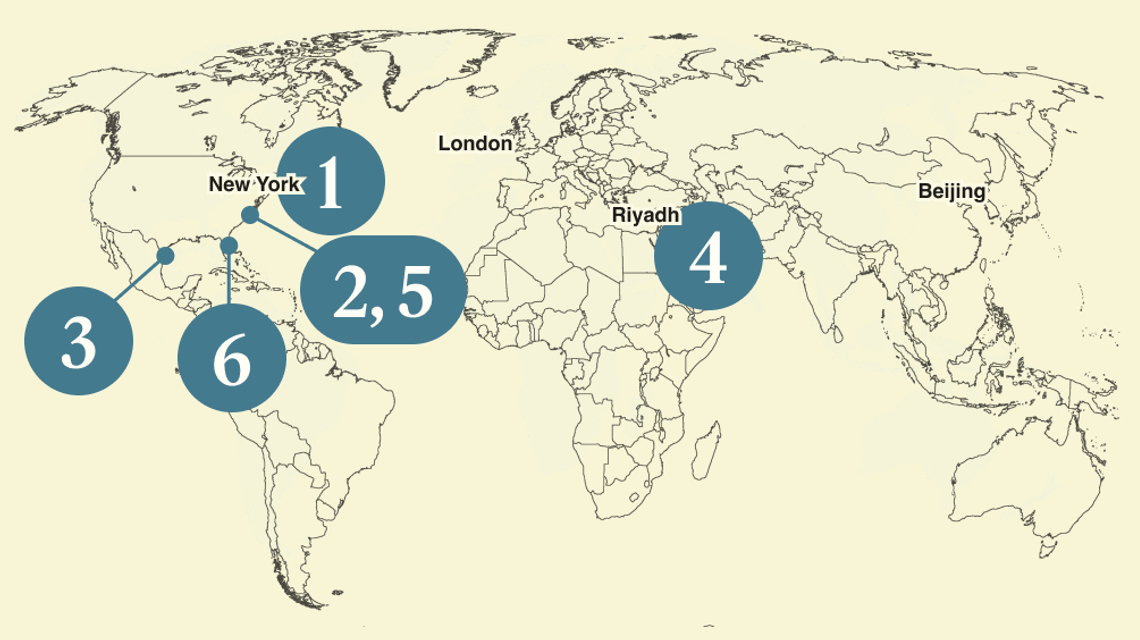

PIF boss still hopeful on golf megamerger |

Yasir Al Rumayyan golfing. Paul Childs/Action Images via Reuters. Yasir Al Rumayyan golfing. Paul Childs/Action Images via Reuters.The head of Saudi Arabia’s sovereign wealth fund is still hopeful for a deal to combine the upstart LIV golf tournament with the PGA, after more than two years of fruitless talks. “Hopefully, in the future we will be able to bring the game of golf together,” Yasir Al Rumayyan, governor of the Public Investment Fund and chairman of LIV, said at The Economic Club of Washington DC Monday. He gave no further details on the deal, first floated in 2023 and seen as the pinnacle of Saudi Arabia’s bid for global cultural sway. Talks have gone quiet since a February White House meeting, Adam Scott of the PGA Tour’s player advisory board said in July. Al Rumayyan’s talk was notable more for its venue than its message, which mostly reiterated the need for Saudi Arabia to kick its “oil disease” and diversify its economy. He rarely does unscripted events, so even a friendly conversation with Economic Club president David Rubenstein signals the kingdom’s desire for closer ties with Washington. |

|

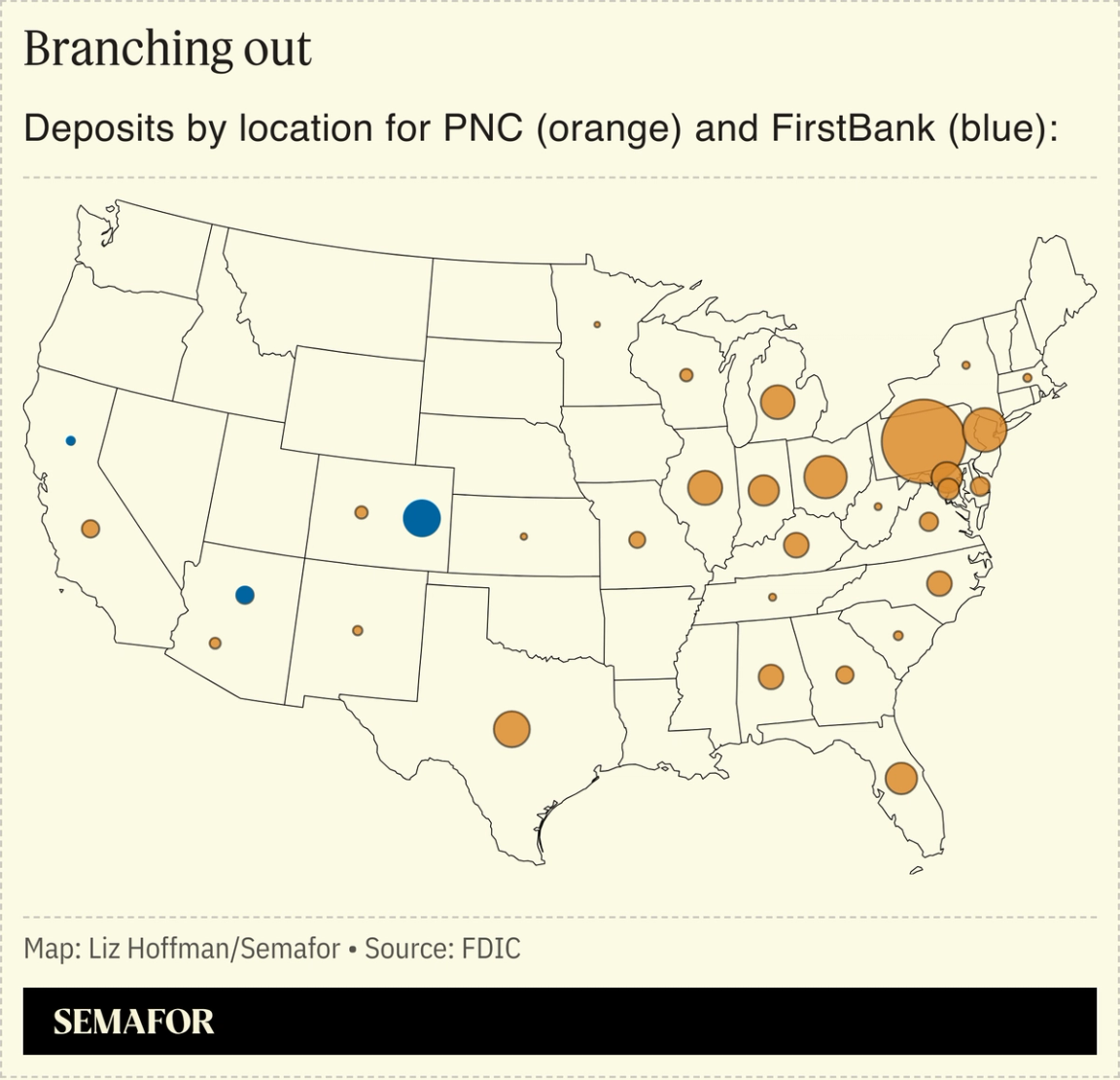

In the era of fintech and neobanks, an old-school financial playbook is being dusted off: Pittsburgh-based PNC is trying to build the first new coast-to-coast US bank in 30 years. Its $4.1 billion deal this week for Colorado’s FirstBank is the first step in a plan to challenge the likes of Bank of America, built via acquisitions in the 1990s, for national relevance. After being shut out of the bidding for First Republic in 2023 — a wound that CEO Bill Demchak has nursed for two years — he’s back with a deal that puts the industry on notice.  “Our first priority is organic growth,” Demchak’s No. 2, Mark Wiedman, told Semafor, “and yes, M&A is an essential part of the toolkit.” (A copy of BankTown, which chronicles Bank of America’s consolidation, sat on his desk.) PNC is forecasting a 25% return on the deal, figuring it can turn FirstBank’s customers into private-bank clients and commercial borrowers. “An acquirer that knows what it’s doing, and even pays a rich price, can actually make a lot of money,” Wiedman said. “That’s going to be a signal to the marketplace both with our strategy, but I’m sure others will observe as well.” With $560 billion in assets, PNC is the eighth-largest US bank, and Demchak is an M&A-minded operator who trained under Jamie Dimon. PNC bought BBVA’s American branches in 2021, then paused during the Biden administration’s antipathy toward mergers. |

|

Ken Griffin sits on an island of one |

Shannon Finney/Getty Images for Semafor Shannon Finney/Getty Images for SemaforCitadel’s billionaire CEO Ken Griffin continues his lonely critique of Trump. Writing in The Wall Street Journal — and bringing a University of Chicago economist Anil Kashyap along for cover — he warned that “Trump’s interventions and his dismissal of the head of the Bureau of Labor Statistics have damaged the credibility of official economic data.” Griffin, who helped bankroll Nikki Haley’s presidential bid before reluctantly voting for Trump, is a rare billionaire to give voice to private concerns. At Semafor’s World Economy Summit in April, he warned that Trump’s tariff moves were putting the American “brand at risk.” The president hasn’t publicly responded to his Palm Beach neighbor, but the huge role of Citadel’s securities-trading arm in US stock markets provide an opening for the kind of pressure the administration has exerted on perceived enemies. |

|

Luxury is being reshaped by a new generation of consumers. Once defined by scarcity, craftsmanship, and status, rapid technological advancements and shifting global markets have transformed how the industry balances heritage and innovation. Join Semafor on Wednesday, September 17 as we examine how the business of luxury is evolving, the leaders shaping its transformation, and what these changes mean for the industry’s future. September 17, 2025 | New York City | Request Invitation |

|

➚ BUY: Receipts. House Democrats released the birthday letter Trump reportedly sent to Jeffrey Epstein, which the president denied existed. ➘ SELL: Recounts. The jobs market continues to look worse in hindsight, with revised numbers today showing the US added 911,000 fewer jobs than previously thought between March 2024 and 2025. |

|

|