| | Prominent US conservative activist Charlie Kirk is killed, Oracle shares surge, and investors eye Ch͏ ͏ ͏ ͏ ͏ ͏ |

| |   COPENHAGEN COPENHAGEN |   WARSAW WARSAW |   HANGZHOU HANGZHOU |

| Flagship |  |

| |

|

The World Today |  - Trump ally killed

- Russia crosses a line

- Israel’s aggressive posture

- US wholesale inflation drops

- Oracle shares soar

- Klarna’s IPO pops

- China’s robotic goals

- AI’s environmental impact

- Ozempic maker cuts jobs

- Rocks signal life on Mars

How medieval Islam and Europe collaborated to advance astronomy. |

|

Conservative activist Charlie Kirk killed |

Trent Nelson/The Salt Lake Tribune via Reuters Trent Nelson/The Salt Lake Tribune via ReutersCharlie Kirk, an influential conservative activist and close ally of US President Donald Trump, died Wednesday after being shot in the neck at a university event in Utah. Kirk was a transformative figure on the American right as the founder and executive director of Turning Point USA, a conservative youth organization that became a national juggernaut and helped propel Trump to victory last year. A search was ongoing for a suspect and the shooting’s motive was unknown, but it underscored the heightened frequency of political violence in the US. “We all must reflect on how we can tone down the anger & hate that has poisoned our politics,” a Democratic lawmaker said. |

|

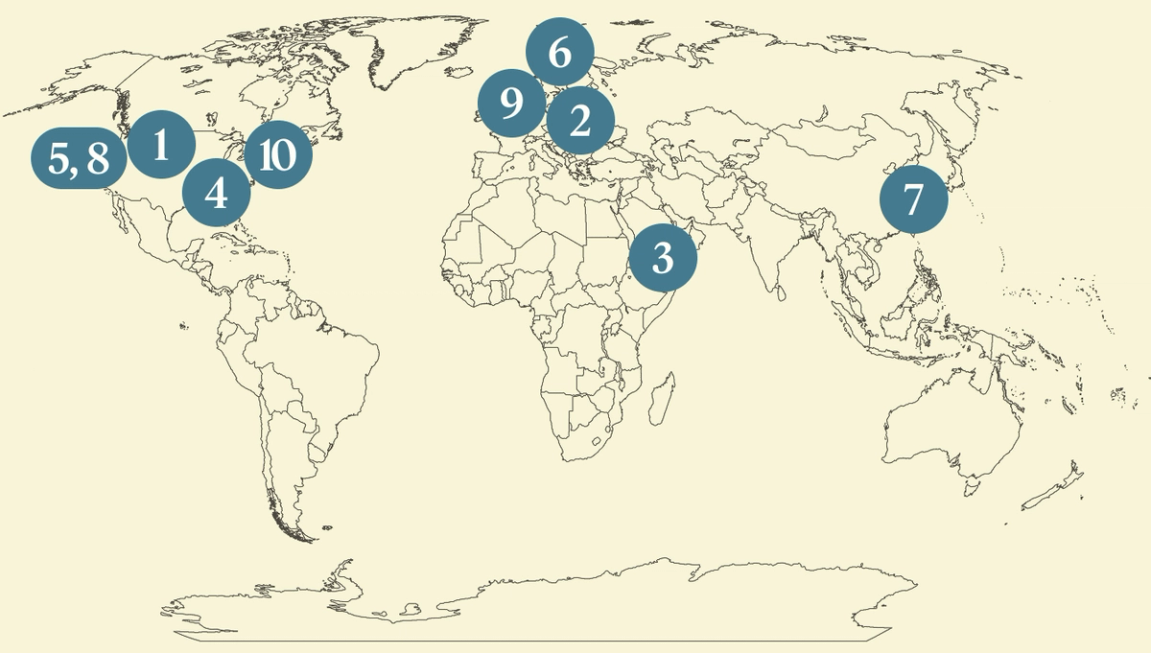

Poland says Russia crossed line |

Kacper Pempel/Reuters Kacper Pempel/ReutersPoland’s leader said the country is “the closest we have been to open conflict since World War II,” a day after NATO fighter jets shot down Russian drones in Warsaw’s airspace. “A line has been crossed,” Prime Minister Donald Tusk said; his government is reportedly seeking more air defense systems to deter Russian aggression. The incident marked the most serious incursion into NATO territory since the alliance was formed, The Economist wrote, as Russia tests “the willingness of Poland’s NATO allies to react collectively to a vivid provocation.” Any coordinated response would require the backing of US President Donald Trump, who merely commented “here we go” after the incident. Republican senators are urging Trump to put new sanctions on Moscow. |

|

Israel attacks Houthi targets in Yemen |

Khaled Abdullah/Reuters Khaled Abdullah/ReutersIsrael attacked sites across Yemen on Wednesday, targeting the Iran-backed Houthi militia a day after launching an airstrike against Hamas officials on Qatari soil. Israel’s defense minister vowed to press on with attacks on “enemies everywhere,” reflecting the country’s new, aggressive security posture, which favors military action over diplomacy across the region. The US’ condemnation of the strike in Qatar showed Israel intends to act unilaterally, and for Gulf leaders, it underscored the limits of their American security agreements to deter foreign aggression within their borders, Semafor’s Mohammed Sergie wrote. While the Gulf shares Israel’s hostility for Hamas, “where they diverge is over what comes next: how to end the Gaza war… and stabilize the region.” |

|

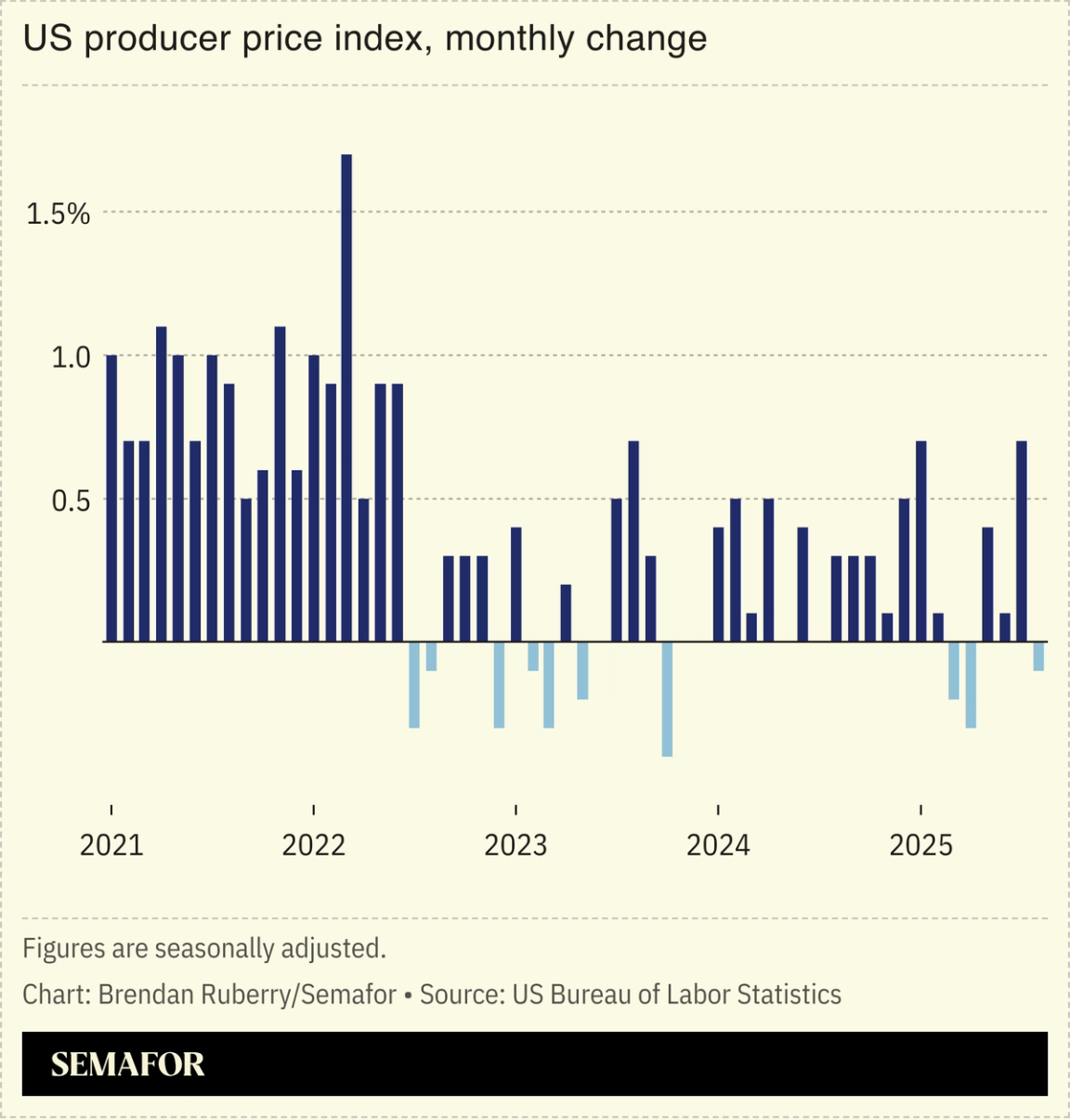

Surprise fall in US wholesale inflation |

US wholesale inflation unexpectedly fell in August, signaling inflationary pressures may be easing as the Federal Reserve prepares to cut interest rates. The decrease was partly driven by falling service-sector margins, suggesting companies absorbed some of the higher costs from US President Donald Trump’s tariffs rather than passing them on to consumers. “The worst-case scenario on inflation isn’t playing out,” one analyst said, noting that Thursday’s consumer inflation data — which tracks prices paid by shoppers — will carry more weight. The S&P 500 hit a record high as the inflation drop reinforced bets the Fed will cut rates next week. Despite other economic warning signs, US stocks have kept rising; Barclays and Deutsche Bank raised their year-end target for the index. |

|

Oracle shares soar on AI contracts |

Oracle shares soared Wednesday after the company promised Wall Street hundreds of billions of dollars in AI-related cloud revenue. The US software maker said it expected to get $144 billion per year by the end of this decade from AI companies using its cloud computing capabilities, much of it from OpenAI, which The Wall Street Journal reported will buy 4.5 gigawatts’ worth of data center capacity from Oracle — enough energy to power millions of homes. Oracle’s stock had its best day since 1992, a 36% increase that catapulted co-founder Larry Ellison over Elon Musk to become the world’s richest person. |

|

Klarna market debut marks IPO resurgence |

Brendan McDermid/Reuters Brendan McDermid/ReutersShares in buy-now-pay-later firm Klarna popped 30% in the company’s trading debut Wednesday, the latest sign of a US IPO revival. Other tech companies, including stablecoin issuer Circle and design platform Figma, have also held splashy listings this summer, and crypto exchange Gemini is expected to go public this week. For the Sweden-based Klarna, the IPO reflected its push to expand into a full-fledged bank; it recently rolled out a debit card in the US. Making purchases using buy-now-pay-later loans is increasingly common, though Klarna faces some regulatory headwinds globally: The UK has proposed imposing further oversight over the loans to address affordability concerns. |

|

Investors eye China’s robots |

Tingshu Wang/Reuters Tingshu Wang/ReutersA Chinese humanoid robot-maker is eyeing a $7 billion valuation for its upcoming IPO, in what would be one of the country’s largest tech listings in recent years. The figure, Reuters reported, reflects China’s widening interest in humanoids: Tech giant Alibaba said this week it is investing $100 million in another Chinese robot startup as the country vies for global supremacy in the sector. China has hosted a series of flashy events showcasing local companies’ advances, but they have also demonstrated the tech’s shortcomings. At an Olympics-style event in Beijing last month, many robots failed to complete basic tasks, and experts have raised questions about their ability to operate outside of controlled environments. |

|

Rethinking AI’s energy use |

Manuel Orbegozo/Reuters Manuel Orbegozo/ReutersArtificial intelligence’s environmental impact is overstated in public discourse, a tech writer argued. Latest figures for AI models suggest that a single query uses a comparable amount of energy and water to doing a Google search 15 years ago, or running a microwave for one second, James Ball wrote in Transformer: 1,000 ChatGPT queries would represent less than 1% of a family’s daily use of either resource. AI’s energy demand is growing, but analysis suggests air conditioning and electric vehicles are expected to drive much more electricity usage by 2030 than AI. The question, Ball said, is whether the public can be convinced that AI is as vital a use of resources as cars and AC. |

|

Novo Nordisk cuts 9,000 jobs |

Tom Little/Reuters Tom Little/ReutersNovo Nordisk, the maker of Wegovy and Ozempic, will cut 9,000 jobs as pressure grows from rival weight-loss drugs. In 2023, Novo became the most valuable firm in Europe on the back of Wegovy’s explosive growth, and the firm nearly doubled headcount in a hiring spree. At one stage its market capitalization exceeded the entire Danish GDP. But sales growth has stalled, notably thanks to new drugs such as Eli Lilly’s Mounjaro and to legally dubious copycats. The cutbacks — including 5,000 in Denmark, the largest layoff in the country’s history — are intended to reduce costs and reassure investors. “Novo expanded organisational complexity too quickly,” one analyst told RTÉ. |

|

Martian rocks are ‘clearest sign’ of life |

NASA/Jet Propulsion Laboratory NASA/Jet Propulsion LaboratoryNASA said some spotted rocks on Mars were the strongest indication yet that life might once have existed on the planet. The markings, nicknamed “leopard spots” and “poppy seeds,” may have a geological explanation, but they are strange enough that NASA considers them potential signs of life. The Perseverance rover spotted the rocks last year, in what was once an ancient lake; researchers said that they were evidence of chemical reactions in the mud at the lake bottom. Scientists cannot rule out non-biological sources for the marks, and one told the BBC that the only way to be sure is to return samples from Mars — but a planned mission to do so faces cancellation after NASA budget cuts. |

|

|