| | In today’s edition, how a fickle CPI makes it harder for the Fed to Fedspeak, and Apple’s best tech ͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Business |  |

| |

|

People mostly yawned through Apple’s new product lineup unveiled this week. It’s hard to get jazzed about the two millimeters of pocket space reclaimed by the thinner model. But live-translating AirPods are one of the more exciting and tangible uses of AI I’ve seen so far. They foreshadow AI that doesn’t just make things cheaper, but makes entirely new things possible. The new AirPods are a concrete example of something I’ve had trouble envisioning, 18 months into this hype cycle. It’s easy enough to see the cost savings from AI as technology replaces humans. But by PWC’s estimate, two-thirds of AI’s contributions to global economic growth will come not from gains in productivity but from gains in consumption. In this vision, AI will spark the creation of more goods that people want to buy, and make them available to more people. Railroads didn’t just reduce the cost of shipping goods; they opened the West. Fiber-optic cables didn’t simply make communication easier, but birthed the internet. Transformative technologies create bigger pies, not just cheaper ones. Language barriers act as invisible tariffs on the global economy. They add friction to financial markets, artificially constrain talent pools, and leave money stranded on the wrong side of comprehension. Flip that switch, and suddenly every market becomes accessible, and good ideas trapped behind a language wall get unleashed. Goldman Sachs can deploy its sharpest minds in Brazil without Portuguese fluency. My failed hunt for custom blazers in Hong Kong last year can become a completed transaction. (Also: tips for next time, please.) Netflix’s “localization” model becomes possible for new industries. There’s something dystopian about a world where everyone is sporting AirPods all the time, but I suspect the future is heavy on wearables anyway. The question is whether that hardware expands or merely entertains. Technology that opens up new avenues meets the hype in a way that AI replacing baby investment bankers or advertising studios just doesn’t. |

|

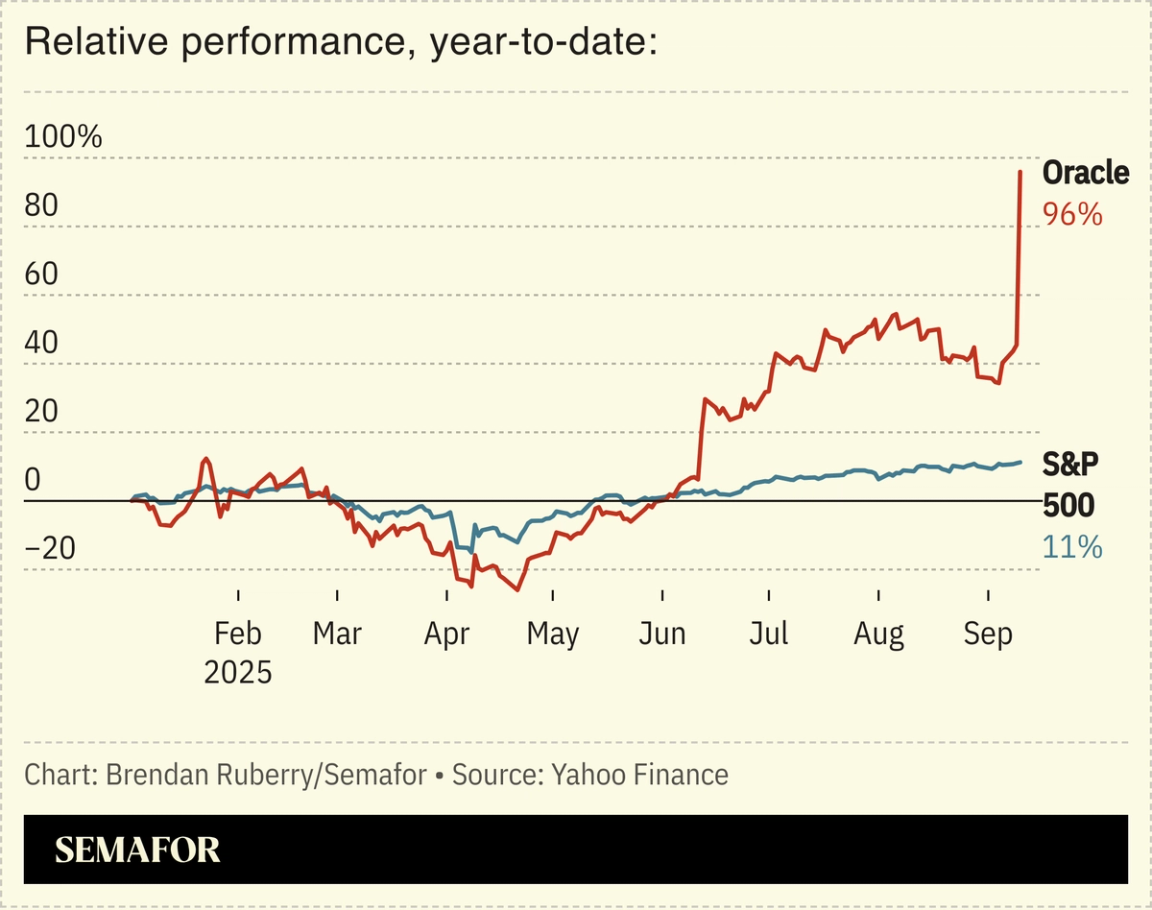

AI revenue forecasts sent Oracle’s stock soaring yesterday, a remarkable turn for a company that went public in 1986 and lacks the consumer cache of its Silicon Valley rivals in the AI race. The company announced more than $450 billion of AI-related revenue under contract, much of it coming from a megadeal signed with OpenAI to use Oracle’s cloud computing services, Semafor confirms. Oracle is not without its skeptics — short-seller Jim Chanos has some questions. But its surge has put it in spitting distance of a $1 trillion market value and briefly made its co-founder, Larry Ellison, the world’s richest person. Amid a debate about whether internet natives like Google and Amazon will be leapfrogged by AI natives like Anthropic and Perplexity, don’t count out a dinosaur. |

|

Inflation rises as Fed eyes jobs |

Consumer inflation rose in August for a fifth straight month to its highest level since January. The 2.9% annual pace of price increases may complicate what has looked like a simple decision for the Federal Reserve to cut interest rates starting next week. The central bank’s focus has notably shifted over the past year from one part of its job (keeping prices stable) to the other (keeping unemployment low). That “dual mandate” has been increasingly in tension, and solving one problem tends to exacerbate the other. The Fed is still likely to reduce interest rates at its meeting next week, even though doing so risks more inflation. Here’s how Fed Chair Jerome Powell’s language has evolved as the risks to the economy have changed.  |

|

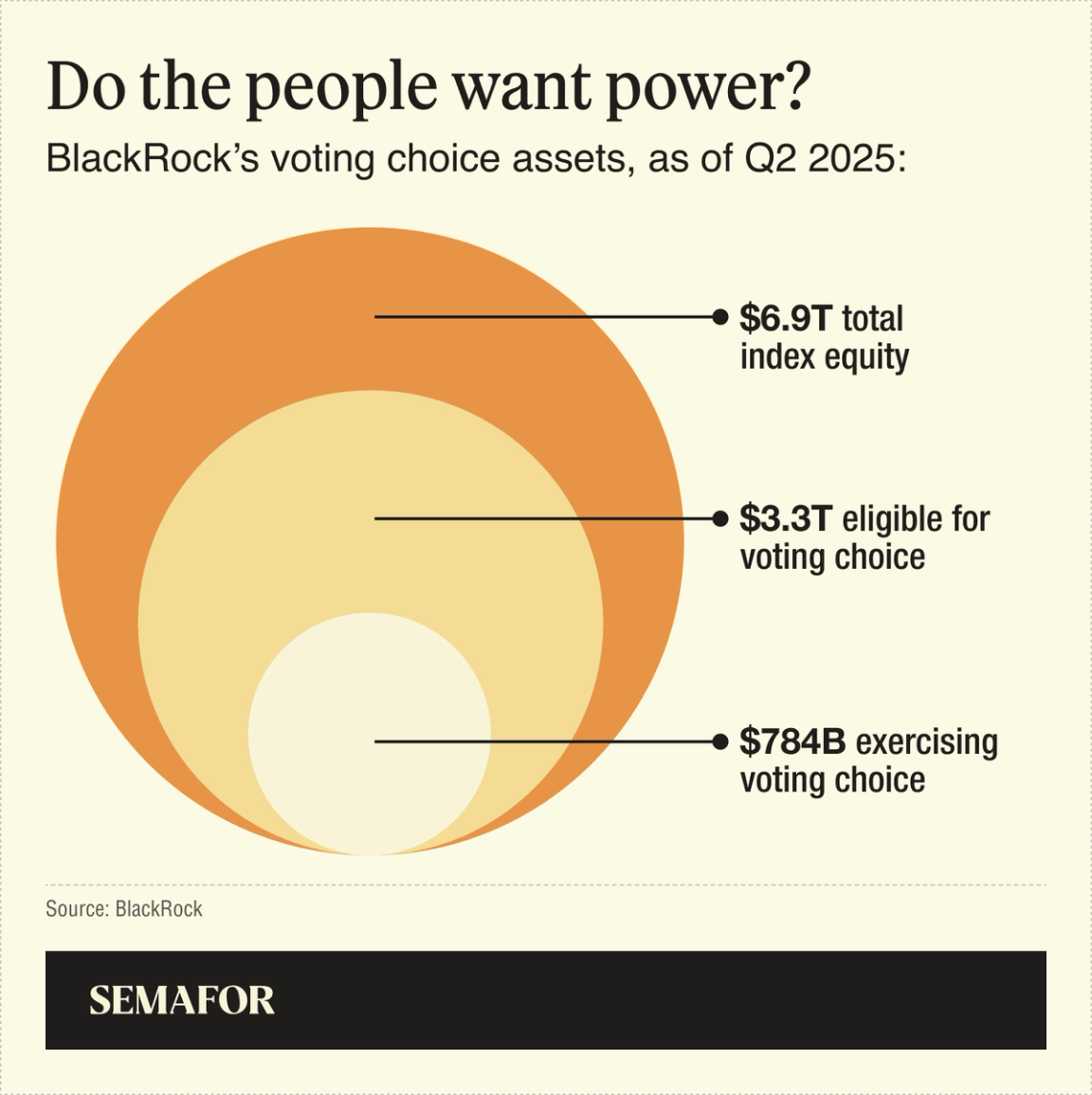

Shareholder democracy enters its BuzzFeed-quiz era |

The trillions of dollars managed by BlackRock, State Street, and Vanguard gave them huge power over corporate America. Retreating from political criticism, they’re trying to give it up to everyday investors. The Big Three investment firms have rolled out programs over the past three years that let individual investors vote their own shares in corporate elections, rather than governance experts at HQ. BuzzFeed-Disney-princess-style quizzes could one day help clients distill their preferences into “archetypes” — pro-environment, deferential to management, socially-minded — and automatically vote accordingly on ballot measures.  Vanguard on Wednesday said that the number of investors opting into their program had more than doubled from 2023 to 2024, though it remains a small fraction — just 82,000 of the firm’s 10 million eligible clients. “It’s giving voice to investors that have a perspective,” John Galloway, global head of investment stewardship at Vanguard, told Semafor. A side benefit is reducing the power of these firms, which is both real — BlackRock, Vanguard, and State Street together control around 20% of the average S&P 500 company — and magnified by conservatives who see a vast left-wing conspiracy in corporate boardrooms. |

|

Trump’s anti-ESG push hits Brussels |

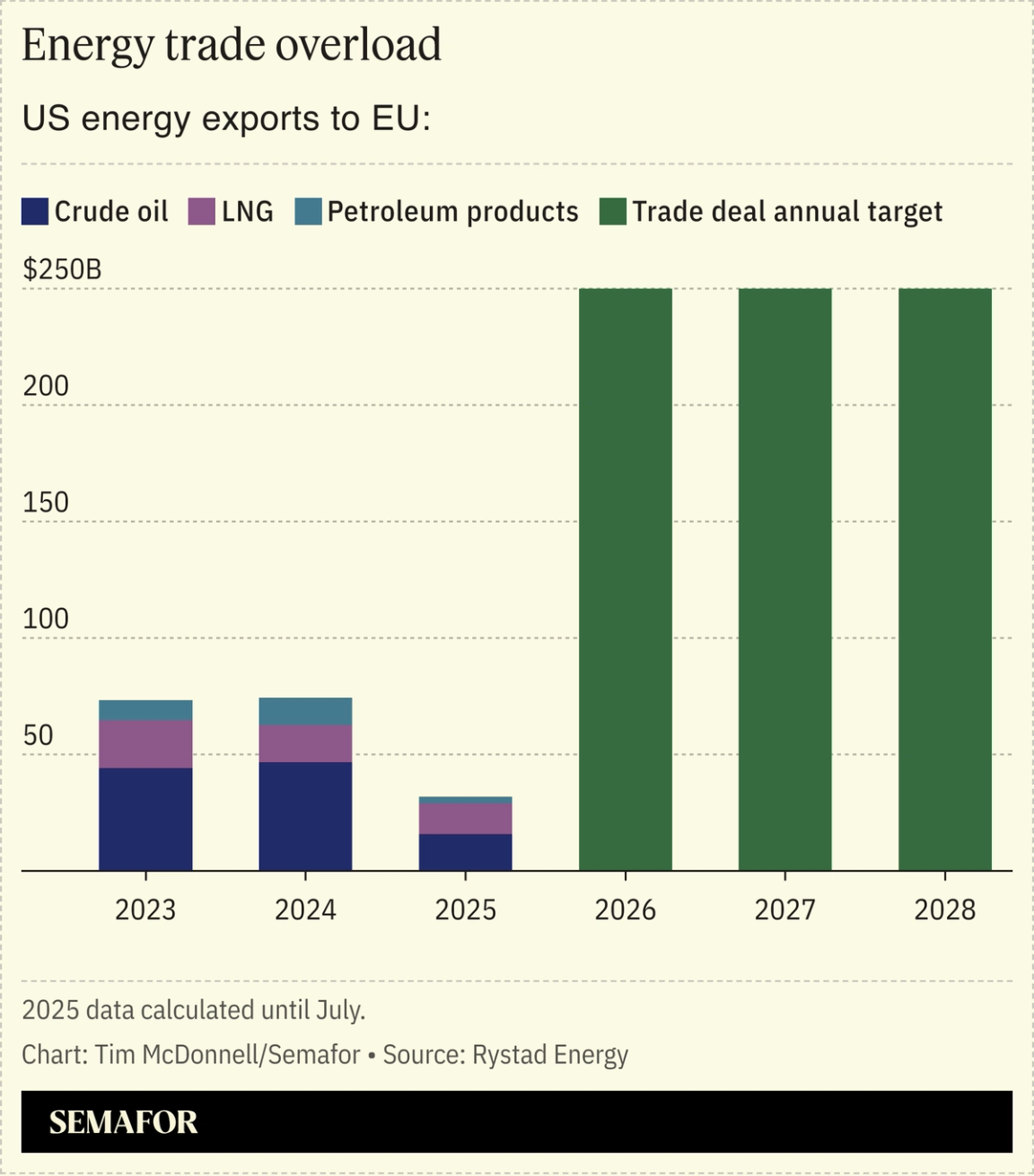

US Energy Secretary Chris Wright chided European leaders in Brussels today over the continent’s continued embrace of climate regulations. Previewing his plan to reporters including Semafor’s Tim McDonnell, Wright said Europe’s “march to net zero was wrong” and risks undermining a $750 billion energy-import deal agreed in July that helped ratchet down tensions between the US and its largest trading partner.  Wright added that US gas producers are concerned about the legal exposure and cost of compliance with ESG-related reporting requirements, as well as regulations that target methane emissions. “We’re here to work on removing non-tariff barriers that are getting needlessly in the way of bringing more energy into Europe,” he said. The Trump administration has been exerting pressure on foreign regulators. The president blasted last week’s EU antitrust fine against Google, and Capitol Forum reported that the criticism cowed Europe’s antitrust chief into canceling a press conference announcing the penalty. |

|

SKorean chief warns Trump after ICE raid |

Korean workers being detained by ICE. ICE/Handout via Reuters. Korean workers being detained by ICE. ICE/Handout via Reuters.South Korea’s president issued his strongest rebuke yet in the wake of the Trump administration’s immigration raid on a Hyundai plant in Georgia, warning that tough visa requirements could make it difficult for the country to keep investing in the US. The images of Hyundai technicians taken out in ankle bracelets — just days after Hyundai pledged $26 billion in new investments in the US — “flummoxed” the South Korean business community, President Lee Jae Myung said at a news conference Thursday. Trump’s immigration crackdown is at odds with his efforts to bring foreign money into the US and could unsettle trade talks with South Korea, which in July pledged $350 billion in investments in exchange for being spared steep tariffs. |

|

Companies & Deals- Canary in the gold mine: With the cement barely dry on its new New York City headquarters, JPMorgan has hired architects to build what could be London’s largest office tower, in Canary Wharf, Bloomberg reports.

- Crackle, pop: Goldman Sachs is expecting the busiest week for IPOs in more than four years, David Solomon told CNBC shortly after Klarna surged 30% in its debut Wednesday.

Watchdogs- Friends like these: Trump’s nominee to run the Commodity Futures Trading Commission accused the Winklevoss twins of meddling in his nomination as they continue to fight the agency’s previous enforcement case against their crypto company, Gemini, which is set to go public this week.

- Conduct unbecoming: The UK government removed Peter Mandelson as ambassador to the US after revelations of his ties to Jeffrey Epstein, whom Mandelson called his “best pal” and commiserated with over email.

- A labor of love: The Labor Department’s internal watchdog is probing how the Bureau of Labor Statistics collects data.

- Two can play: Mexico said it would impose a 50% tariff on Chinese car imports, acquiescing to US pressure, as well as introduce a broader range of levies aimed at reducing imports from Asia and propping up the local economy.

Markets- Depreciating asset: The failure of a Texas subprime auto lender has left banks nursing big losses and cast a regulatory spotlight on stretched borrowers. The DOJ is investigating allegations of fraud at the company, the Financial Times reports.

|

|

|