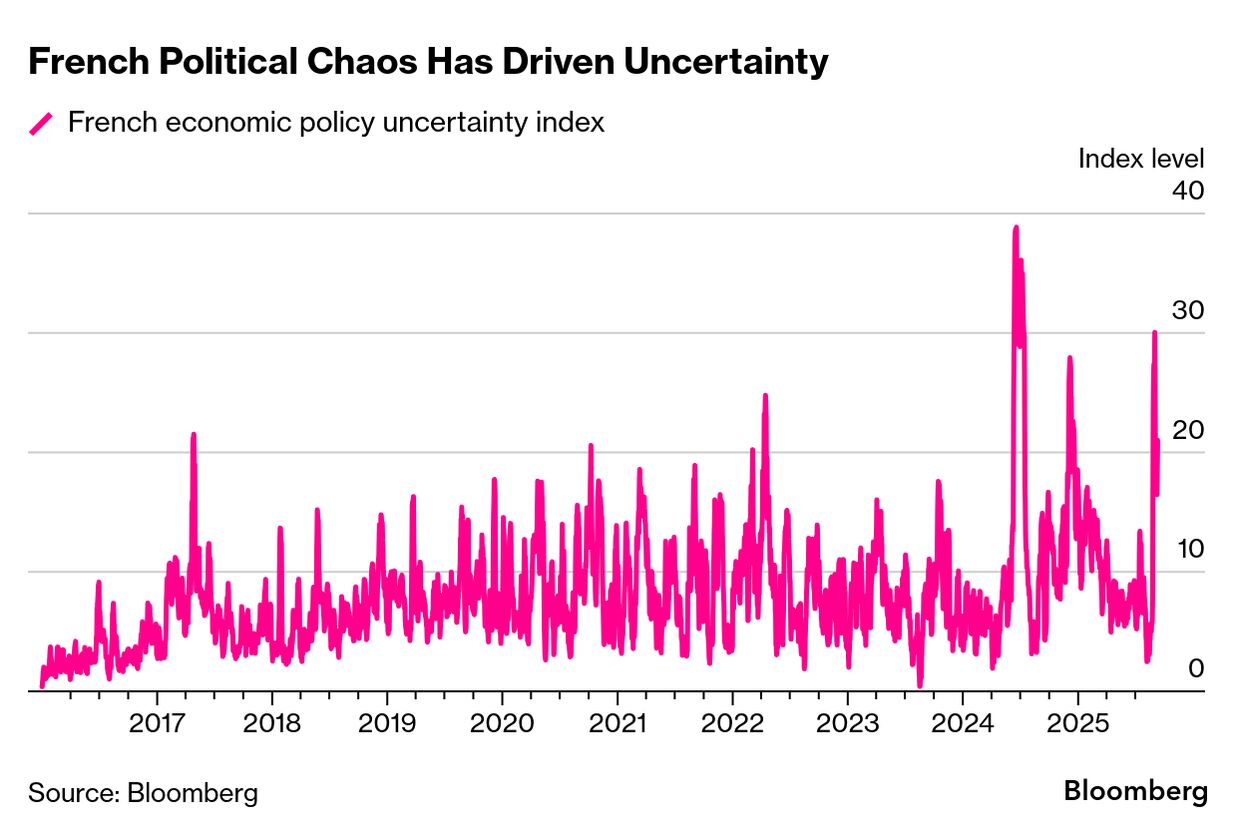

| France is becoming a byword for political dysfunction. At a time when the European Union is desperately in need of strong leadership and robust growth to meet new geopolitical realities head-on, it’s worrying to see one of its biggest members cycle through governments at a frenetic pace while support for the far-right grows. New Prime Minister Sebastien Lecornu will have his work cut out shaking off the “new Italy” tag.  But arguably the bigger surprise this week is that French political chaos is not deterring big investments in the world of artificial intelligence. Shortly after the ouster of Francois Bayrou’s government at the start of the week, startup Mistral AI announced a €1.7 billion fundraising led by Dutch chip-machine champion ASML, valuing the Parisian tech darling at €11.7 billion — France’s first $10 billion-plus “decacorn,” as the lingo dictates.

This is a big boost for Mistral and the wider European tech story, which has had its fair share of brutal disappointments in an industry dominated by the US and China. It gives Arthur Mensch and his co-founders a leg-up in the spending race for precious compute power and talented engineers. It offers up a unique test-bed of precision hardware for Mistral’s AI applications. And it brings the long-term vision of a strategic anchor investor.  Arthur Mensch, founder of Mistral AI. Photographer: Nathan Laine/Bloomberg Mistral can’t change the global picture alone. It is a relative market-share minnow in an ocean of whales like OpenAI or Anthropic, and the EU lacks an ecosystem of cutting-edge tech companies and investors to call its own. It’s also an open question as to how much speculative Fear Of Missing Out is driving this deal – and raising the risk of disappointment down the line. Still, for the time being, Macron and Lecornu can at least take comfort in the fact that French tech is getting better even as its politics gets worse. With yet another budget stand-off looming and credit rating agencies circling, this state of affairs may not last. France’s new premier pledged big changes as he tries to engage opposition parties in the herculean task of reining in the country’s debt amid hostility to budget cuts. Mistral has received a valuable dose of capital and credibility from ASML Holdings NV’s investment, but still has to prove it can survive in an industry dominated by the US and China. Bank of France Governor Francois Villeroy de Galhau says that another reduction in borrowing costs by the European Central Bank can’t be ruled out. Euronext NV will replace Teleperformance SE on France’s blue-chip CAC 40 index. Giorgio Armani’s will outlines plans to sell a stake in his closely held fashion house to a major luxury firm including LVMH, EssilorLuxottica or L’Oreal, setting in motion a process to eventually fold the Italian brand into a larger group.  Giorgio Armani during Fashion Week in Paris, on Jan. 28. Photographer: JULIEN DE ROSA/AFP French wine production is expected to drop below the five-year average in 2025 after heat waves, drought and wildfires damaged vineyards. Monday: World Space Business Week 2025 conference begins; Bank of France economic forecasts Wednesday: Hydrogen conference at Finance Ministry Thursday: Unions call day of strikes Friday: French September business and manufacturing confidence; 2Q wages In an increasingly frustrating and stingy market for airline loyalty programs, Air France-KLM’s “Flying Blue” has soared to the top for the second year in a row.  An Air France-KLM aircraft taking off at the Paris Charles de Gaulle Airport in Paris, on July 18, 2025. Photographer: Nathan Laine/Bloomberg |