| | In this edition: A new mining coalition, borrowing costs soar, S. Africa’s retail boost, and how sna͏ ͏ ͏ ͏ ͏ ͏ |

| |   Addis Ababa Addis Ababa |   Accra Accra |   Johannesburg Johannesburg |

| Africa |  |

| |

|

- AU plans mining coalition

- Borrowing cost woes

- New World Bank loan

- Fintech targets migrants

- Ghana’s infrastructure push

- S. Africa’s retail boost

- Chatbot stereotypes

How snakes could help tackle pollution. |

|

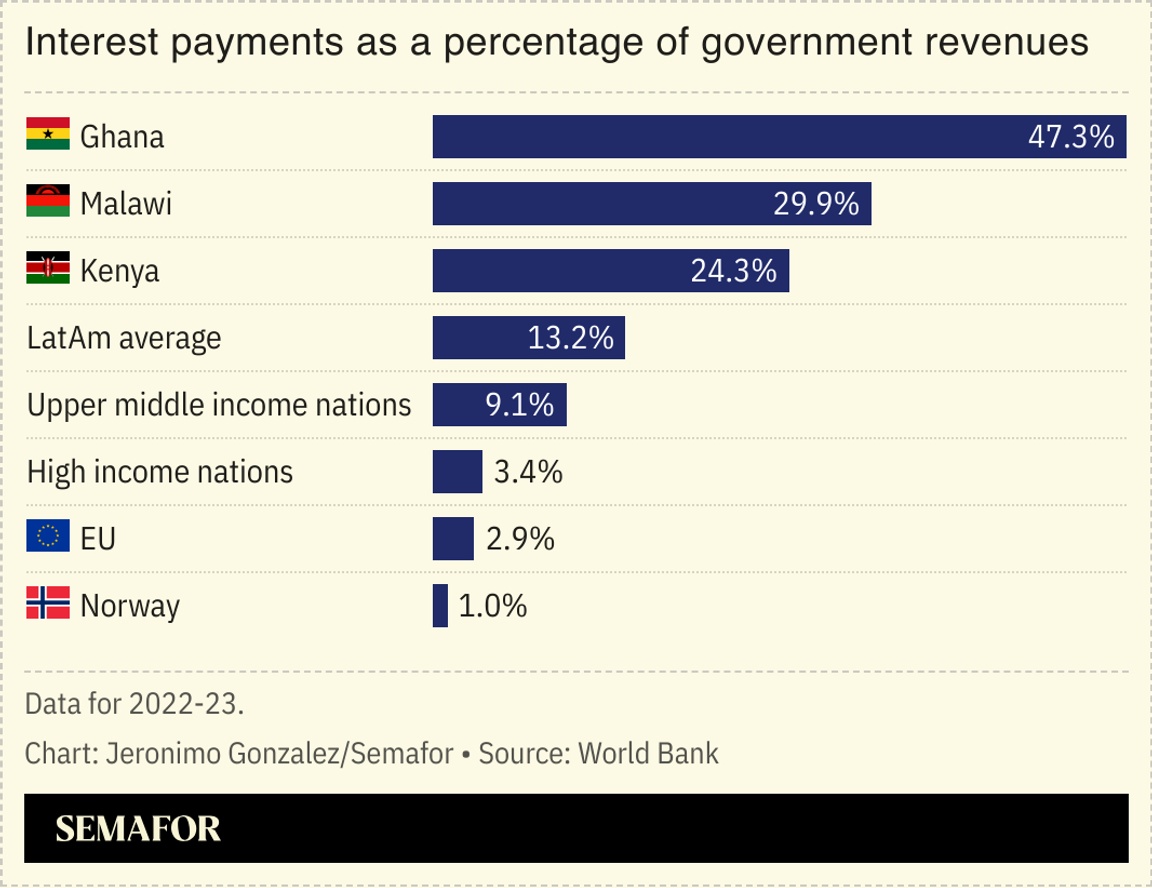

Borrowing cost surge hurts economies |

Borrowing costs have surged for businesses and governments in Kenya, Nigeria, and South Africa in the last five years, according to a new report by Moody’s. The credit rating agency put the rise down to policy weaknesses, market constraints, and inflation, Reuters noted. High borrowing costs, a problem across much of the continent, leave less room for investment in education, health, and social services, while eroding funds required to build infrastructure needed to stimulate economic growth. Last month Bloomberg reported that Nigerian companies were increasingly opting to issue short-term debt to avoid locking in high borrowing costs. In a June blog post for the Institute of Economic Affairs, a Kenyan think tank, a researcher wrote that “aggressive tightening of monetary policy” in recent months was limiting access to credit and capital in the private sector, in turn reducing investment into key sectors such as manufacturing. |

|

AU proposes a mining coalition |

A copper-cobalt mine in DR Congo. Arlette Bashizi/For The Washington Post via Getty Images. A copper-cobalt mine in DR Congo. Arlette Bashizi/For The Washington Post via Getty Images.The African Union plans to form a coalition of mineral-producing nations in an attempt to shore up regional alliances at a time when countries across the world are trying to capitalize on the continent’s natural resources. The move was announced off the back of the second Africa Climate Summit, with the AU saying the coalition would be a “vehicle for harnessing Africa’s vast mineral wealth for climate-resilient development.” China has already heavily invested in the continent’s mineral resources and the US is trying to catch up: US President Donald Trump’s administration has centered ongoing peace negotiations that it is helping to broker between DR Congo and Rwanda on access to minerals for American companies. The two African countries have committed to revamping their mineral supply chains, according to a draft economic framework seen by Reuters. |

|

World Bank’s new Africa loan |

The World Bank’s Axel van Trotsenburg. Dado Ruvic/Reuters. The World Bank’s Axel van Trotsenburg. Dado Ruvic/Reuters.Africa is set to receive 70% of a new $100 billion financing package mobilized by an arm of the World Bank to support the world’s poorest nations. It comes as traditional aid to the continent declines. “We have been very clear that the bank remains strongly committed to Africa,” Axel van Trotsenburg, the bank’s senior managing director, told Bloomberg. Foreign aid to Africa by nations that make up its aid committee fell 1% to $42 billion last year, according to preliminary data released by the Organization for Economic Cooperation and Development. Aid flows are expected to shrink further as the US reduces funding under President Donald Trump and European nations divert resources to defense. |

|

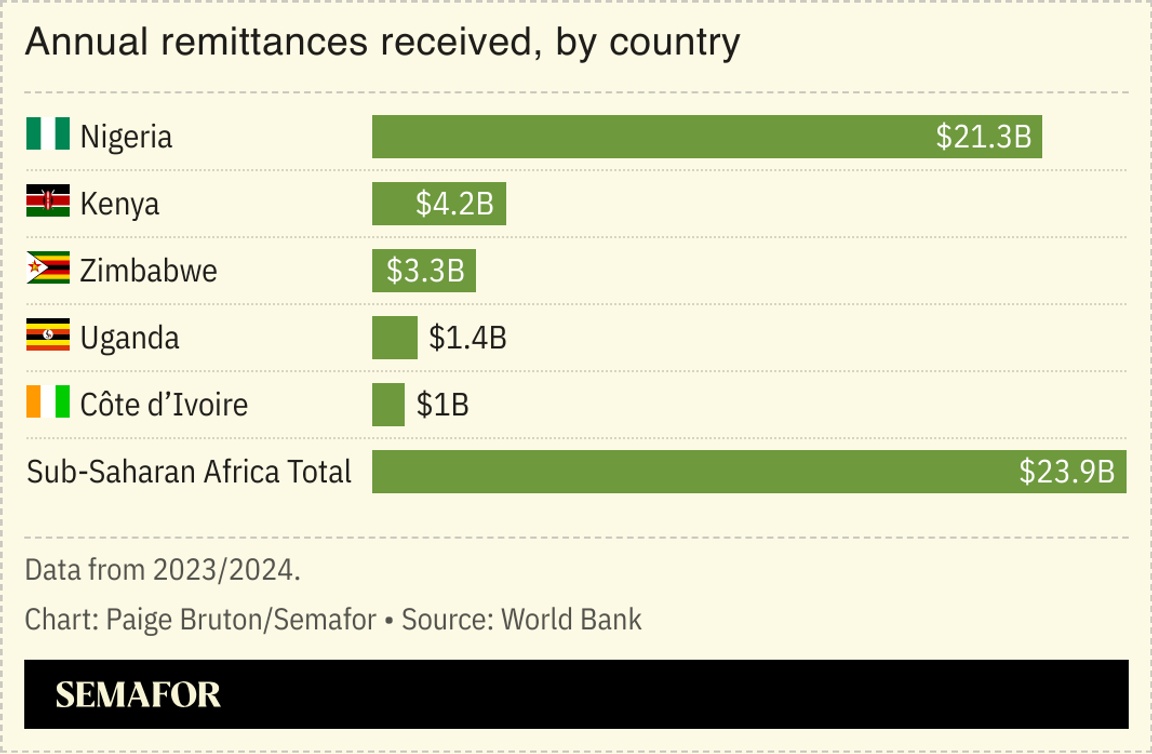

US fintech for African migrants raises $22M |

A US startup that enables African immigrants to build credit profiles through their remittance transactions has raised $22 million to roll out its service in Europe and Canada. New York-headquartered Kredete, which was founded by Nigerian entrepreneur Adeola Adedewe in 2023, is one of a rising crop of startups serving Africans in the diaspora whose international money transfers are a sizable source of financial flows to Africa. In the US, Kredete enables users to build their credit history in the process of sending money to more than 30 African countries, thus allowing them to access other financial products which Kredete is rolling out. Other Africa-founded cross-border remittance providers, such as LemFi, are increasingly tapping into the market for providing credit access to migrants. Like LemFi, Kredete is rolling out user bank accounts denominated in euros and dollars. It also plans to introduce a stablecoin credit card for users in 41 African countries. |

|

Ghana on infrastructure drive |

Matt Cardy/Getty Images Matt Cardy/Getty ImagesGhana will invest up to $1.2 billion in infrastructure projects this year in a bid to boost growth, the country’s deputy finance minister said. The proposed spending is aimed at engineering an “an economic reset,” Thomas Nyarko Ampem told a conference in Accra on Saturday, citing better transportation, dependable energy, and modern irrigation among Ghana’s most pressing needs. The government aims to secure funds for the projects from oil revenues and mineral royalties, and the spending could rise by half a billion dollars by 2028. The cocoa and gold producer is recovering from its worst economic crisis in a generation, which led to a 2022 debt default that prompted a $3 billion loan from the IMF. Ghana’s economy grew 5.7% last year, according to the World Bank, and is this year expected to expand 4.3%. President John Mahama, who took office in January, made a $10 billion infrastructure program a key pillar of his campaign manifesto. |

|

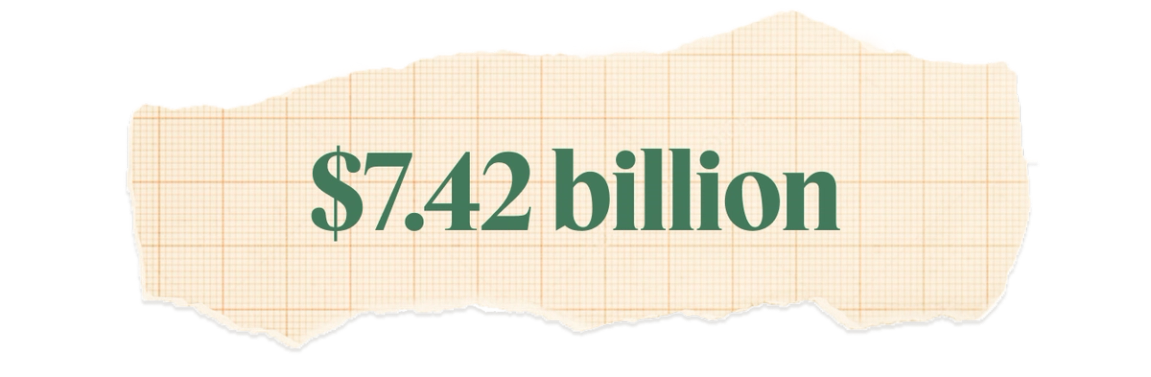

South Africa’s retail surge |

South Africa’s expected online retail turnover this year, according to a new study, up from $5.54 billion in 2024. Research firm World Wide Worx, in collaboration with Mastercard, Peach Payments, and Ask Afrika, found online purchases are likely to account for 10% of all retail sales, compared with 8% last year. Grocery shopping has driven a surge in online sales because leading retailers Shoprite, Pick n Pay, and Woolworths have adopted on-demand shopping apps. Researchers found online fashion sales have also grown, following investment by retailers in digital platforms. The arrival of global players in Africa’s most advanced economy has spurred sales, too: Amazon launched in the country last year, as did low-cost Chinese online retailers Shein and Temu. |

|

What chatbots get wrong about Africa |

Biased and limited datasets about Africa are leading AI chatbots to misinform people about the continent, argues a writer in a column for Semafor. Moky Makura, the executive director of media advocacy organization Africa No Filter, asked her team to see what the most widely used AI chatbots “thought” about Africa with questions such as, “What news about Africa do you ‘remember’ most?” They found that while chatbots rejected the most extreme stereotypes, the bots still fell back on a familiar script. On the news, for instance, their “memories” were largely about war, coups, and famine. There was little about innovation or progress or opportunities. “If AI is now the arbiter of knowledge, it has opened up a whole new front on which we must fight stereotypes,” Makura writes. The challenge, she says, is to increase visibility through more digitization that captures more of the continent, “so that the world’s most powerful technologies don’t get to define who we are as a continent.” |

|

Business & Macro

|

|

|