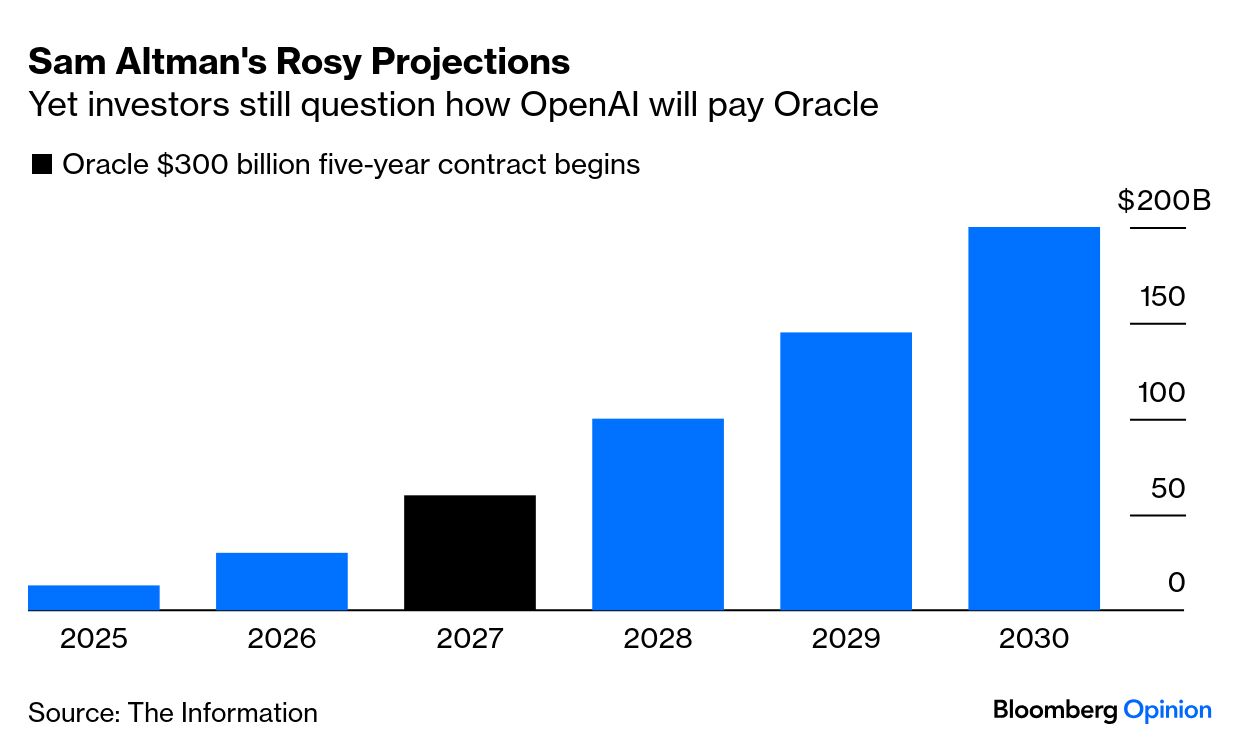

| This is Bloomberg Opinion Today, a percolating perambulation through Bloomberg Opinion’s opinions. Sign up here. Disney Beware! The Princesses Are Gen Z Now | To help inspire the drawings I attach at the end of these newsletters, I have a small shelf of picture books by the great Japanese artists Katsushika Hokusai and Kawanabe Kyosai. My sketches have nothing close to the deep whimsy and magical simplicity of their intricately conceived work. Still, if you’re familiar with either or both, you’ll notice lots of stolen tropes in Drawdown. The world of big-budget Hollywood animation may want to at least borrow ideas from Japan’s anime studios. Last weekend, a movie with a mouthful of a title, Demon Slayer — Kimetsu no Yaiba: Infinity Castle, topped the North American box office with $70.6 million. As Gearoid Reidy says, “It’s the sort of figure you’d expect to see from a mainstream Hollywood hit — a James Bond, say, or Fast & Furious.” On Japanese movie screens, this iteration of Demon Slayer is on course to be the country’s biggest movie ever, dethroning the first Demon Slayer theatrical release in 2020. The previous top-notcher was Studio Ghibli’s 2001 Spirited Away, itself a beloved global classic. The world has grown weary of the Disney-Pixar consortium and its business model of animate-first, live-action sequel next. This corporate approach to creativity is missing the generational shift. Anime was a “niche within a niche” in the last century. But, as Gearoid notes, “With the growth of the internet, fans began pirating series not officially released overseas, adding their own subtitles and growing franchises by word of mouth. At the same time, Gen Z attitudes have shifted toward things that were once considered the realm of geeks. Now, anime is given cred by the perennial gatekeepers of cool — athletes (from Ibrahima Konaté to Jamaal Williams) and celebrities (Billie Eilish, Michael B. Jordan).” (The anime-Gen Z connection also reared its head in Nepal, where Gen Z protesters who helped bring down the government used a pirate flag from the popular manga series One Piece.) Disney’s competition isn’t just coming from Japan and its anime culture. Korea contributed its culture and ethos to Netflix’s box office surprise, KPop Demon Hunters — which had a lucrative though limited sing-along release in August. The biggest global box office for any theatrical release this year has been China’s Ne Zha 2. That animated epic bombed in the US, despite an English-dub featuring Michelle Yeoh, but made the huge bulk of its $2.2 billion in the People’s Republic — the second largest movie market in the world. That’s where Infinity Castle may be headed next to pile on its earnings. Can You Have Too Many Drones in Your Army? | The war in Ukraine, as well as the recent bouts of hostility between Israel and Iran, have convinced most of us of the tactical and strategic value of drone technology. And the sprawling defense industry has jumped on it for potential profits. But could all those unmanned aerial vehicles just be a bubble? Chris Bryant notes that the head of Europe’s most valuable military contractor is saying just that. Rheinmetall AG Chief Executive Officer Armin Papperger told the Wall Street Journal at the Defence and Security Equipment International fair in London this month that he’s “personally not convinced that the UAV business is as big as a lot of people think.” If he’s right, huge amounts of money and enterprise time are going to waste. Summing up the Rheinmetall argument, Chris says: “Governments don’t need hundreds of thousands of UAVs, and their prices are falling rapidly, he said, referring to relatively low-tech, commoditized short- and long-range drones that now cost around €1,000 and €2,500 respectively – the type Ukraine and China excel in making.” That could be the Excel sheet point-of-view. Chis thinks there’s so much going on with drone and counter-drone development that UAVs will continue to command the military market place. “If drones are a bubble,” he says, “it still has plenty of time to inflate further.” “When Masayoshi Son bets big, it either marks the dawn of an era, or the dusk of a tech cycle. … So how should we read the tea leaves now that Son is ‘all in’ on Sam Altman’s OpenAI Inc.? In April, SoftBank led a funding round that valued the unicorn at $300 billion, promising to invest as much as $30 billion by the end of the year. … There are nagging concerns about OpenAI’s cash flow, with the company projecting that it will churn through $115 billion through 2029. How it plans to pay the $300 billion cloud contract it has signed with Oracle Corp. is anyone’s guess.” — Shuli Ren in “Masayoshi Son Is Going Big on OpenAI. Time to Worry.”  “The sticker on the windshield of a parked Tesla in the center of Paris says it all: ‘I bought this before Elon went nuts.’ A similar geopolitical logic is sweeping through Europe when it comes to space, where a humiliating dependence on Elon Musk’s dominant technology helps defend vital territory in Ukraine but also allows the billionaire to troll Kyiv’s allies and empower Trumpian bullying. Yet successful alternatives will need more than a bumper sticker. … Satellite firm Eutelsat Communications SACA has been recapitalized and awarded new space contracts with the French military. The European Union is unlocking €6 billion ($7.1 billion) to fund a “sovereign” satellite network, Iris2. ...” — Lionel Laurent in “Break Starlink’s Dominance by Getting Even, Not Mad.” Conspiracy theories and China’s stockpile of oil. — Javier Blas The prospective TikTok deal looks bad. — Dave Lee A history lesson for Britain’s battery panic.— Lara Williams Hong Kong’s great leap into crypto. — Andy Mukherjee China’s Lukin is looking into the US. — Juliana Liu Britain must keep its promise to Hong Kongers — Matthew Brooker Sam Altman visited the UK too. — Parmy Olson The Trump nominee who could make the dollar weaker. — Shuli Ren Walk of the Town: A Thorn in the Treasure House | The British Museum has many treasures it will not part with, despite their provenance as war loot. The Parthenon Marbles and the Asante royal regalia are among the most recent in the news. But there is one glittering relic of established ownership that isn’t allowed to travel at all: the Holy Thorn Reliquary. A beautiful example of late medieval enamel work, it is almost convulsive with its filigree frothing around a shockingly plain splinter, maybe twice as thick as a toothpick. A French monarch acquired what was believed to be the original crown of thorns from Christ’s crucifixion in the 13th century. He and succeeding kings would pluck single thorns from the circular wreaths, encase each piece in an elaborate objets as a gift or sign of favor to royal allies and relatives. The British Museum’s reliquary is probably the most stunning and valuable surviving example of that largesse. It would have been even more valuable if the fire that engulfed Notre Dame in Paris a few years ago had incinerated the entire crown of thorns, which was kept in a chapel there. Firefighters rescued it. The crown of thorns was kept in the Louvre until the church was restored.  The thorn in the British Museum’s treasury. Photograph by Howard Chua-Eoan/Bloomberg The British Museum’s thorn was owned by the English branch of the Rothschild dynasty, which inherited it from their Austrian relations. I mentioned the clan in my column about migrants. The Viennese Rothschilds won possession of the reliquary after it moved from France to the Holy Roman Empire with a Habsburg. The ornate, transnational religious trophy was long thought to be a counterfeit until experts — comparing a host of copies — declared in 1959 that it was a genuine 14th-century example of the French Valois dynasty’s munificence. One of the knock-offs is displayed on the other side of the space devoted to the Rothschilds’ own glittering bequests to the museum. But does it quack like a duck?  ”Mom, it’s so cute. Let’s eat it!” Illustration by Howard Chua-Eoan/Bloomberg Notes: Please send squeaky-clean feedback to Howard Chua-Eoan at hchuaeoan@bloomberg.net. Sign up here and find us on Bluesky, TikTok, Instagram, LinkedIn and Threads. |