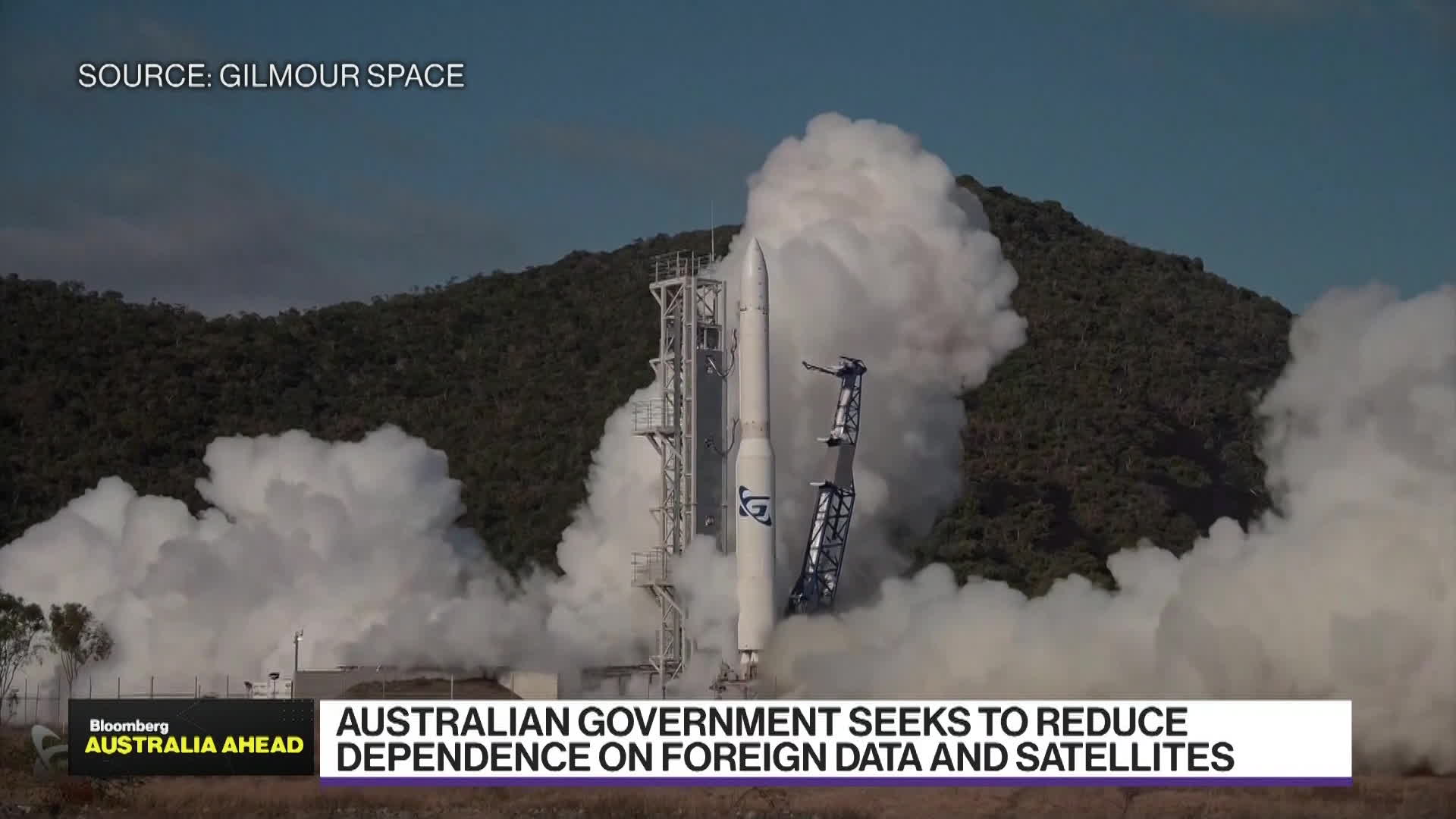

Australia is marking a new chapter in its space ambitions with the launch of the Australasian Space Innovation Institute. ASII CEO Andy Koronios says Australia is not far behind other developed nations, but it can do better. He discusses the institute's potential impact across agriculture, defense, disaster resilience, and beyond on Bloomberg TV's Australia Ahead.