| | In today’s edition: Abu Dhabi’s global stablecoin play, OPEC’s comeback moment, and Semafor columnis͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Gulf |  |

| |

|

- Tahnoon’s stablecoin…

- …and Indian banking plays

- Saudi tweaks market rules

- OPEC’s comeback moment

- Saudi music’s a hit in Brazil

- Gulf women take the stage

The science and mystery of cloud seeding, and other weekend reads. |

|

Ambitions of Abu Dhabi stablecoin revealed |

Abdulla Al Bedwawi/UAE Presidential Court/Handout via Reuters Abdulla Al Bedwawi/UAE Presidential Court/Handout via ReutersThe ambition of a blockchain and stablecoin project directed by Sheikh Tahnoon bin Zayed, brother of the UAE’s president, is massive: international payments, digital identity, and energy trading in emerging markets, with an initial focus on Africa, an executive involved in the effort told Semafor. Subsidiaries of International Holding Co., the $240 billion conglomerate chaired by Sheikh Tahnoon — who is also deputy ruler of Abu Dhabi and UAE national security adviser — will integrate the ADI Chain and stablecoin into their operations, potentially reaching millions of users outside traditional financial systems. Meanwhile, a “major payments provider” in Africa is signed on to be the first partner, ADI Foundation CEO Andrey Lazorenko, who is overseeing the project, told Semafor. — Kelsey Warner |

|

IHC lands Indian mortgage lender |

The amount International Holding Co., Abu Dhabi’s largest listed company, spent on a slice of Indian mortgage lender Sammaan Capital. The 43.5% stake is a big bet on the future of the housing market in the world’s most populous country, which has seen better affordability and rapid urbanization in recent years. The deal with the Mumbai-listed firm, pending regulatory approvals, follows others by the sprawling conglomerate helmed by Sheikh Tahnoon into India. These include investments in conglomerate Adani and snack food company Haldiram’s. |

|

Saudi may lift foreign investor restrictions |

Faisal Al Nasser/Reuters Faisal Al Nasser/ReutersSaudi Arabia is preparing to lift restrictions on foreign investors buying local stocks, in the latest step by regulators to boost trading on the Tadawul exchange. The Capital Market Authority launched a 30-day consultation on rules that, if approved, would scrap the so-called Qualified Foreign Investor program, which forces international investors to meet certain criteria before they can trade. The proposal would also eliminate a swap program used by foreigners to access the market indirectly. Once the latest amendments are finalized, anyone around the world will be able to start investing in the Saudi market. Regulators said the move was part of a “gradual approach to opening the market” designed to attract “greater flows of foreign capital.” The kingdom has a big pipeline of companies planning to list: digesting this new supply of shares will need as many investors as possible, which would also help boost liquidity, a common bugbear for foreign investors looking at investing in Tadawul. — Matthew Martin |

|

OPEC’s moment to squeeze US shale |

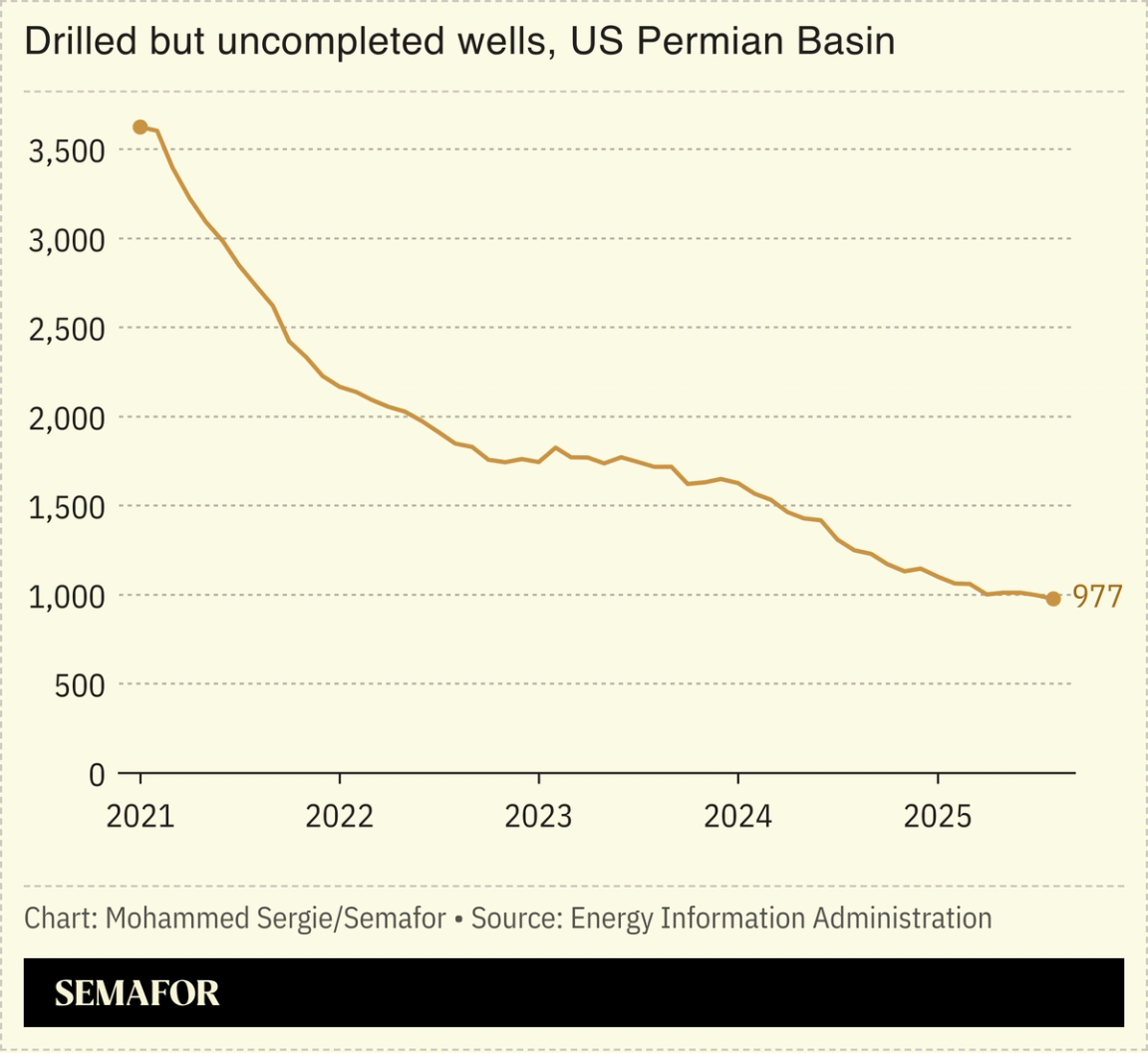

Oil market dynamics have opened a window for OPEC+ to reclaim market share lost to US shale, with expectations building that the group will raise output despite short-term price pressures, investors and experts said at a Gulf energy conference. US oil production is forecast to decline slightly next year, according to the Energy Information Administration, as drilling slows in prime acreage in the Permian basin. The number of drilled-but-uncompleted wells in the patch — used by operators to raise debt or hold for higher prices — has dropped below 1,000. That suggests the most productive “Tier 1” assets have been tapped. “OPEC+ wants to bring barrels back to the market, but they don’t want to start a price war,” Toby Iles, chief economist at Riyadh-based Jadwa Investment, said in an interview at Gulf Intelligence Energy Markets Forum in Fujairah. “We are in a moment where they can do calibrated increases, reassessing every month, as US shale struggles to boost output.” — Mohammed Sergie |

|

Courtesy of Spotify Courtesy of SpotifySaudi Arabia’s music scene has gone global, new data from Spotify shows. Household names like Abdulmajeed Abdullah (essentially Saudi Arabia’s Taylor Swift) and Abadi Al Johar now draw 200,000-300,000 monthly listeners on the platform. Their popularity doesn’t come as a surprise, but what does is that most of the income for Saudi artists comes from abroad: More than 90% of Saudi artist royalties were generated outside the kingdom, led by fans in the US, Brazil, India, and Europe. The country’s musicians earned more than 13 million riyals ($3.5 million) in royalties last year, double 2022’s total. Local consumption of Saudi music on Spotify is also booming, nearly tripling since 2020. |

|

View / Gulf women get a music break |

| |  | Camilla Wright |

| |

Semafor SemaforWomen in the Gulf have risen to prominent roles across sectors in recent years, including fashion, film, and the arts. But the most visible performers are still forced to navigate a complex, conservative society, Camilla Wright, a media commentator, writes in a Semafor column. Saudi Arabia sent Zena Emad, the Gen Z rising star of Arabic music, to a music competition in Moscow. “Backed by a male band; beautiful in full make-up and long black and gold dress, some hair showing from under her headscarf,” Zena found the balance on “her path to fame,” Wright wrote. Other performers haven’t, and while “their sound can go global… they are still invisible at home.” |

|

Beijing and Washington are now so evenly matched that the Trump administration may have no other choice than to collaborate with China rather than risk confrontation, Semafor’s new Managing Editor for Live Journalism Andy Browne writes in his inaugural column for Semafor. “In certain technologies, China has not just caught up but pulled so far ahead the US may never be able to compete,” Browne, a veteran China watcher who was part of a Pulitzer Prize-winning team for his coverage of the country, writes. “So, despite the bellicose rhetoric often emanating from the White House and Capitol Hill, don’t be surprised if the two sides reach a pragmatic deal.” |

|

On Nov. 12 at Cipriani South Street in New York, the Dubai Business Forum will convene CEOs, senior executives, and policymakers for a day of high-level conversations on global growth, AI disruption, and cross-border collaboration — examining the strategic opportunity Dubai provides for adaptive, forward-thinking companies. Featured speakers include H.E. Sultan bin Saeed Al Mansoori (Chairman, Dubai Chambers), Jose Minaya (Global Head, BNY Investments and Wealth), Jared Cohen (President of Global Affairs and Co-Head of the Goldman Sachs Global Institute, Goldman Sachs), and Ola Doudin (CEO, BitOasis). Request your delegate invitation here. The Dubai Business Forum USA, powered by Dubai Chambers, is produced in partnership with Semafor’s events and marketing teams, with select editorial sessions independently developed and led by Semafor’s newsroom. |

|

Archaeology- A major archaeological find in northern Saudi Arabia is rewriting art history in the Arabian Peninsula, with the unearthing of engravings and tools revealing previously unknown settlements from 12,000 years ago. — The New York Times

Crypto- Abu Dhabi’s agriculture regulator has banned crypto mining on farms. Violators face fines of up to 100,000 dirhams ($27,000), loss of subsidies, and power cuts as authorities crack down on misuse of agricultural land.

Deals- Abu Dhabi Investment Authority is taking a stake in Haagen-Dazs ice cream maker Froneri. Alongside French private equity firm PAI Partners and Goldman Sachs’ Vintage Strategies, the €3.6 billion ($4.23 billion) deal will create a new ownership structure for PAI’s stake in the UK consumer company. — The National

- MGX joined investors in a $6.6 billion OpenAI share buyback that values the generative AI leader at $500 billion, vaulting it to the world’s most valuable private company. — Bloomberg

|

|

|