| | In this edition: An interview with Absa’s new boss, the ‘misallocation’ of resources, and why Madaga͏ ͏ ͏ ͏ ͏ ͏ |

| |   Dar es Salaam Dar es Salaam |   Johannesburg Johannesburg |   Khartoum Khartoum |

| Africa |  |

| |

|

- Absa’s policy push

- Tanzania’s top bank expands

- Enko Capital raises new fund

- Africa’s misallocated funds

- Madagascar credit drops

- BNP Paribas’ Sudan damages

A pioneering sign-language app wins a top engineering prize. |

|

Hello! Welcome to Semafor Africa where we celebrated our third anniversary this past weekend. When we launched Semafor on Oct. 18, 2022, the idea of a US-based publication with an Africa-focused edition was unusual — it still is. But Africa has been central to Semafor from the start, in the form of this newsletter, and in the convening that is the heart of our mission: Our first major event was the Semafor Africa Summit in December 2022. Three years later, we’ve featured stories from over 50 African countries including scoops and deep dives on how the great power rivalry plays out on the continent, key White House Africa appointments, and the rising influence of global tech’s big players. None of this would have been possible without Semafor’s excellent journalists, both in-house and the many contributors we work with across the continent. Semafor Africa has been a success by nearly every measure, including subscribers, daily readers, and partners. It joins the wider achievements of Semafor alongside our sister verticals in Business, Energy, Technology, Washington, Gulf, and our soon-to-launch China edition. It’s been humbling for me, Alexis, and the team to meet some of you in person at the World Economy Summit last week in Washington and in New York last month at The Next 3 Billion, and to hear how meaningful this work is to you. Now we’re going to be bringing our events to the continent and beyond: We’ll be in Abuja on Wednesday, Johannesburg next month, and Abu Dhabi in December, returning to East Africa in the first quarter. We’re looking forward to meeting many more of you. Thank you! |

|

Absa steps up government relations |

Mike Hutchings/Reuters Mike Hutchings/ReutersAbsa, one of South Africa’s largest banks, is stepping up its regulatory push with the government as it sees a “massive opportunity” in the restructuring of Africa’s largest economy, its chief executive told Semafor. Kenny Fihla, who joined Absa from rival Standard Bank in June, said the bank would focus on working more closely with the government to influence policy with the aim of benefitting the private sector overall. “It’s not our responsibility to formulate policies, but it is in our interest for the right policies to be formulated,” he said. The bank sees opportunities to boost a sluggish economy — forecast to grow by just 1.6% this year — by accelerating reforms in the logistics, transport, and energy sectors. He also called for changes to South Africa’s immigration policy to allow it to recruit more top global talent. Absa is widely seen as having lost its way in recent years following a series of senior executive changes. Fihla has been clear the bank needs an overhaul to improve customer experience with increased digitization and simpler branch formats “not hidden in malls behind bulletproof glass.” Fihla said Absa could buy a fintech startup in an acqui-hire strategy to bolster its technology capabilities as part of its digital transformation but also to influence Absa’s “culture and orientation.” — Yinka |

|

Tanzania’s top bank to expand regionally |

Dar es Salaam. Dong Jianghui/Xinhua via Getty Images. Dar es Salaam. Dong Jianghui/Xinhua via Getty Images.Tanzania’s biggest bank by assets and loans, CRDB, is actively exploring new markets in its landlocked neighbors and beyond the continent as it seeks to establish itself as a regional leader, its chair told Semafor. The four-decade old banking group — which established its first international footprint in Burundi in 2012, followed by DR Congo 18 months ago — is now looking to Malawi, Rwanda, Uganda, and Zambia, said Neema Munisi Mori, speaking on the sidelines of the World Bank and IMF annual meetings in Washington, DC, last week. She said the bank had also established a representative office in Dubai and set up a China desk as part of its wider ambitions to expand its access to funding and partners. CRDB, which had assets of around $6.5 billion at the end of 2024, is open to working with equity and debt investment partners, especially those that can support its cross-border expansion, as it did in DR Congo with Norway’s sovereign fund. — Yinka |

|

Enko Capital raises $100M |

Alain Nkontchou, co-founder of Enko Capital (center right). Courtesy of Enko Capital. Alain Nkontchou, co-founder of Enko Capital (center right). Courtesy of Enko Capital.Asset manager Enko Capital raised $100 million in the first close of an expected $150 million fund that aims to provide US dollar-denominated private credit to companies across sub-Saharan Africa. The Africa-focused firm manages $1.3 billion in assets. The focus of its new fund is on “cash-generating businesses” in agriculture, telecommunications, manufacturing, renewable energy, and financial services, it said in a statement. The UK’s development finance body, British International Investment, was the anchor investor for the first close, with Mauritius-headquartered SICOM Global Fund also investing. The fund is capped at $200 million, Enko said. Founded in 2008, Enko is co-owned by Cameroonian businessman Alain Nkontchou and his brother Cyrille. In August, Alain’s private investment vehicle Bosquet Investments acquired a 21% stake in pan-African banking group Ecobank from South Africa’s Nedbank for $100 million. Enko also acquired the Mauritanian unit of Société Générale bank in the same month. |

|

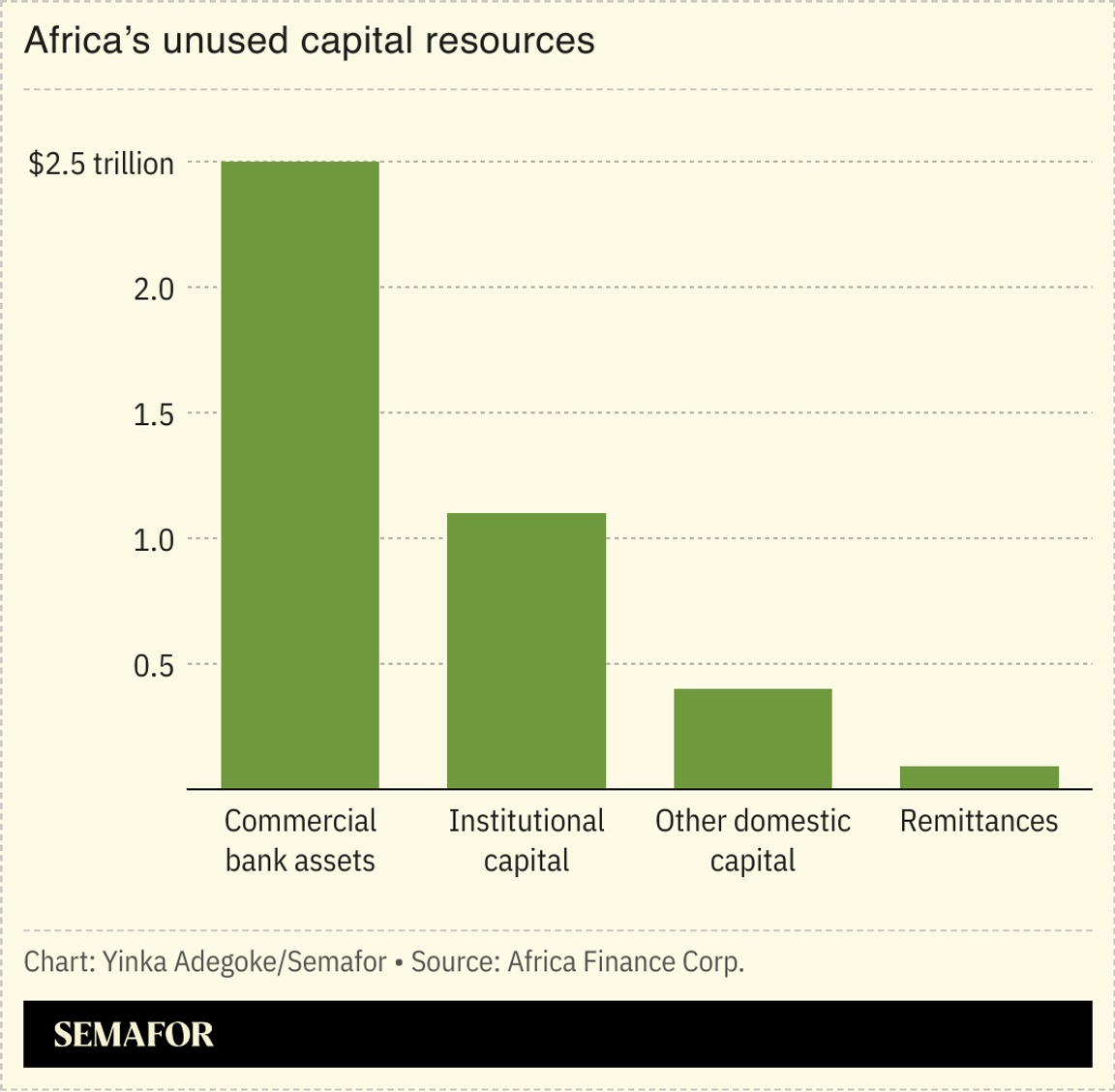

Africa’s fund ‘misallocation’ |

Africa is sitting on around $4 trillion in untapped capital resources yet the continent’s most transformative opportunities remain underfunded because of a “systematic misallocation” of funds, according to a new report from Nigeria’s United Bank for Africa. Some 85% of the continent’s domestic financial assets are being absorbed by sovereign borrowing and flowing into so-called safe assets like short-term government securities, wrote UBA. The resources — made up of a mix of commercial bank assets, pension and insurance funds, national reserves, and remittances — could be more efficiently deployed to invest in key areas to support small and medium enterprises and back climate finance, and importantly in funding infrastructure to enable intra-African trade, the bank argued. Lagos-based infrastructure financier Africa Finance Corporation first pointed to the $4 trillion opportunity back in June. “The real opportunity isn’t just building roads to the sea, but railways and digital networks that connect Africans to each other,” said Harvard professor Marlous van Waijenburg, at a launch event for the report, which makes the case for accelerating the implementation of the African Continental Free Trade Area agreement. — Yinka |

|

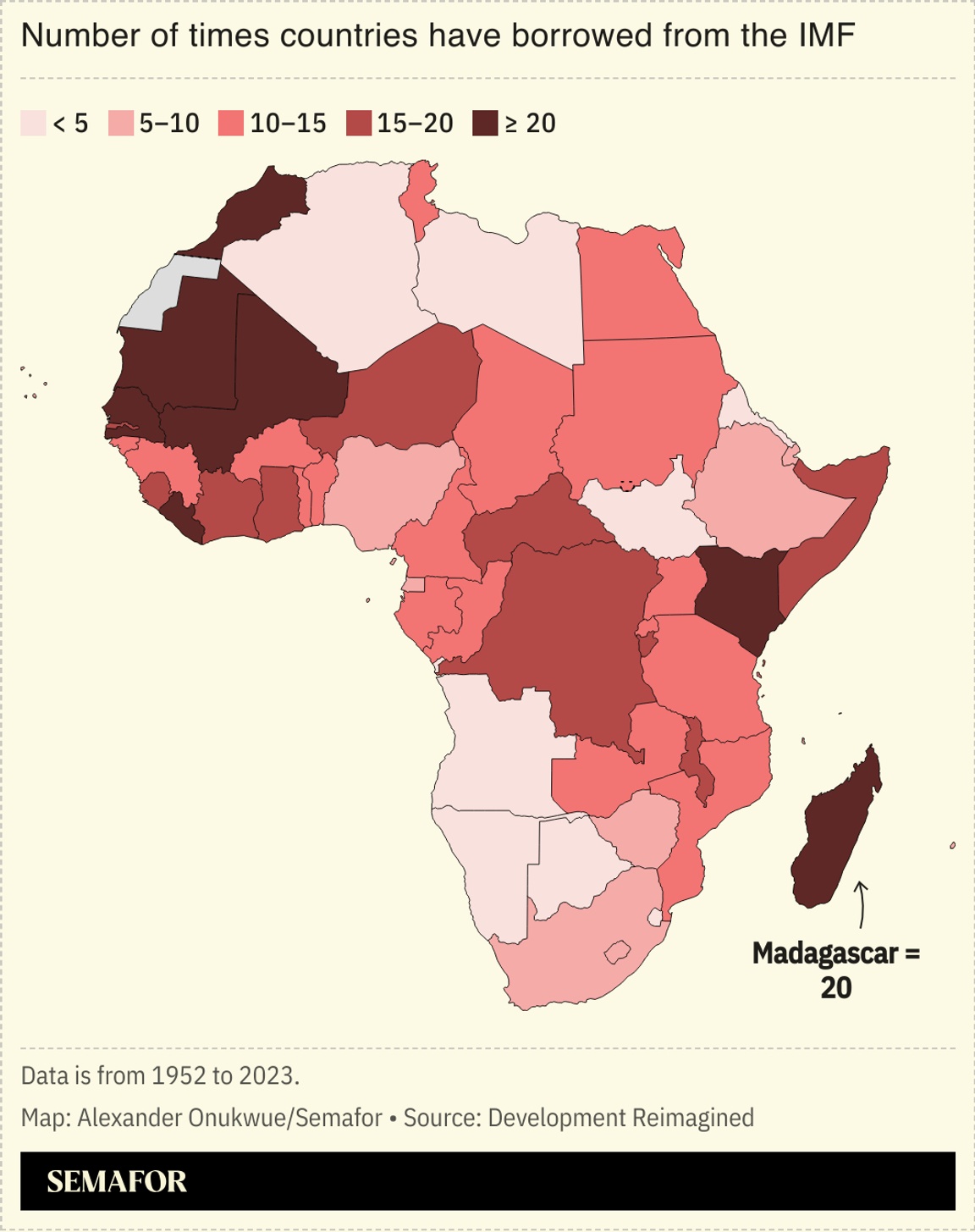

Madagascar put on credit watch |

Ratings agency S&P Global placed Madagascar on ‘CreditWatch’ with negative implications as coup leader Michael Randrianirina was sworn in as president following weeks of anti-government protests. “We think the political uncertainty will hinder policymaking and reform implementation in the near term, consequently weighing on investment, growth, and fiscal consolidation and possibly on debt service,” the agency said. S&P also revised its GDP growth forecasts for Madagascar down to 3.0% for 2025 to 2026, from 4.1%. Youth-led demonstrations against power and water outages in Madagascar quickly swelled into broader discontent and calls for the resignation of former President Andry Rajoelina, who fled the country last week. In 2024, about 80% of Madagascar’s 32 million inhabitants lived below the World Bank’s daily poverty line of $2.15. |

|

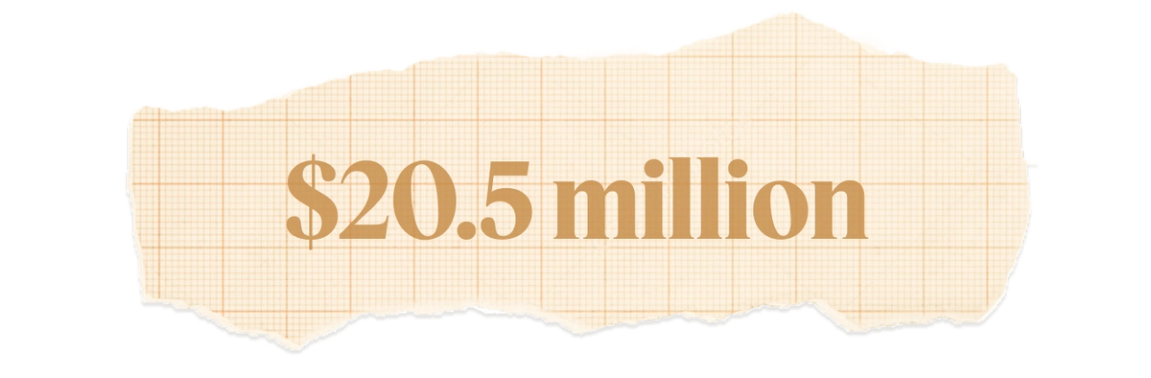

BNP Paribas damages over Sudan |

The amount BNP Paribas must pay three Sudanese refugees after a US jury found France’s largest bank helped Sudan’s former government commit genocide by providing its leaders with banking services. Lawyers for the plaintiffs, who are now American citizens, said the verdict opens the door for more than 20,000 refugees in the US to seek billions of dollars in damages from the bank, Reuters reported. The case relates to the regime of deposed leader Omar al-Bashir, who led Sudan for three decades before he was ousted and detained in April 2019. BNP Paribas said the verdict should be overturned on appeal. Shares in the bank, which operated in Sudan from the late 1990s until 2009, fell by more than 10% on Monday. |

|

On the first stop of The Next 3 Billion Tour, Semafor will bring the conversation to Abuja, spotlighting Nigeria — one of Africa’s most influential innovation hubs. With its fast-growing economy, vibrant tech sector, and young, connected population, Nigeria is at the heart of the continent’s digital transformation. Join Lasbery Chioma Oludimu, Vice President of Global Operations and Managing Director, Yellow Card; Uche Amaonwu, Country Director for Nigeria, Gates Foundation; Serah Makka, Executive Director for Africa, ONE; and Raliat Sunmonu, Vice President, Middle East and Africa, Accion, as they discuss how Nigeria’s fintech innovation, evolving regulations, and entrepreneurial energy can drive financial inclusion and open new pathways for equitable growth. Oct. 22 | Abuja, Nigeria | Request Invitation |

|

|