| | An AWS outage takes down much of the internet, the Argentine peso falls to a new low despite a US ba͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Flagship |  |

| |

|

The World Today |  - Far-reaching AWS outage

- China rare earth leverage

- Xi’s purges escalate

- Argentine peso weakens

- Betting against Trump pays

- NASA frustrated by SpaceX

- CATL’s Europe push

- Global data center pushback

- Japan nuclear backlash

- Implant restores sight

A rare view of Renoir’s drawings, and why nothing said online sticks anymore. |

|

AWS outage takes websites, apps offline |

Anushree Fadnavis/Reuters Anushree Fadnavis/ReutersA major outage at Amazon Web Services, the world’s largest cloud provider, brought down much of the internet on Monday, including — as observant Flagship readers will have noticed — the company that sends Semafor’s emails. The problem appears to have been in the DNS, the internet’s “phone book” that tells devices where to find particular websites; airlines, social media sites, banks, and even a smart mattress favored by tech billionaires were affected. The collapse raises questions over the wisdom of so many institutions relying on one vendor for critical services, creating a “single point of failure” problem, FXStreet said. Amazon said the hours-long outage was easing, as evidenced by Flagship’s US morning edition arriving, albeit two hours late, in your inbox. |

|

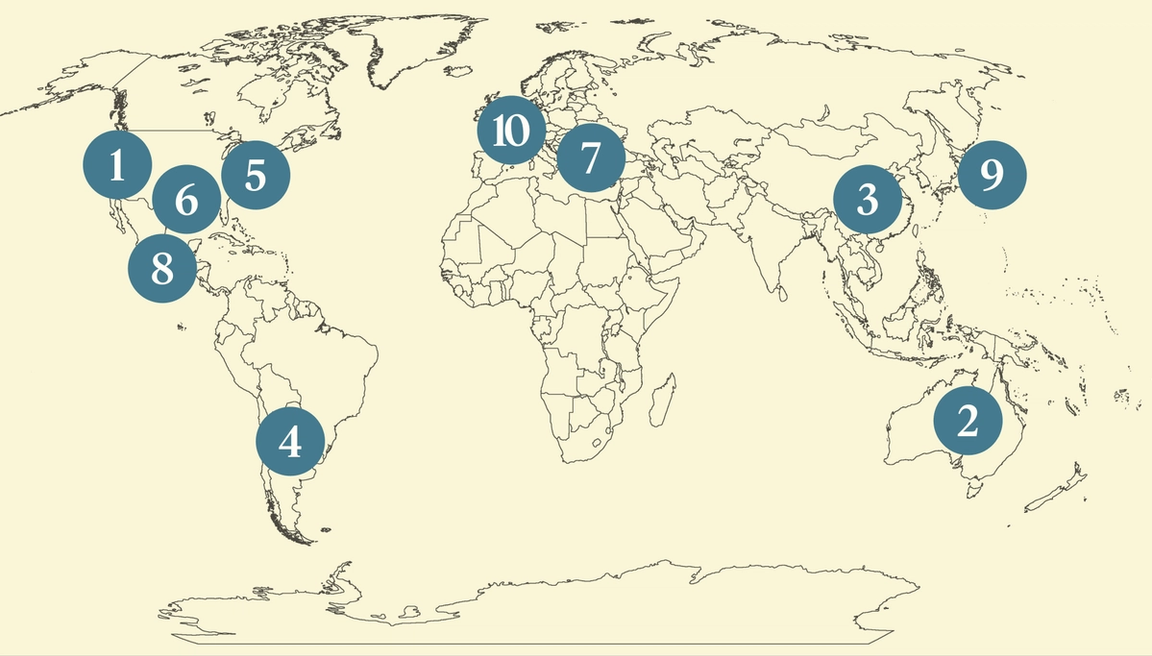

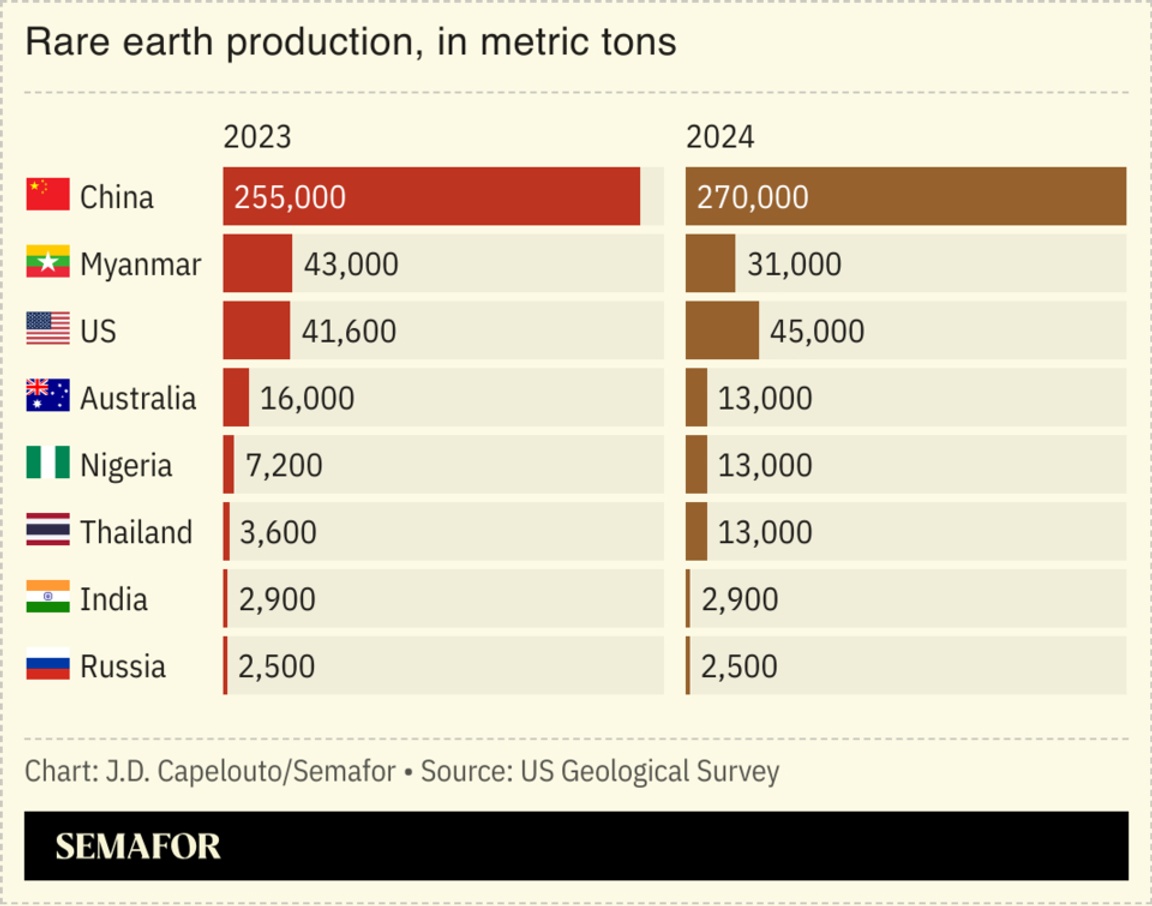

China rare earth exports fall |

China’s rare earth shipments to the US fell nearly 30% in September — even before Beijing announced its latest export restrictions. China “knows it holds a key card” in trade talks and shows no sign of backing down, one analyst said, while US President Donald Trump’s eagerness to strike a deal signals that Washington knows how much leverage China has in the critical sector, the Financial Times’ Gideon Rachman argued. The US is turning to Australia for help: On Monday, the countries struck an agreement to boost rare earth production and counter China’s dominance. The pact fits a broader pattern of Canberra’s efforts to thwart Beijing’s diplomatic and security-related influence, The Economist wrote. |

|

Xi’s purges loom over CCP plenum |

Florence Lo/Reuters Florence Lo/ReutersA meeting of China’s top officials this week will not only preview the superpower’s economic blueprint, but also reveal the extent of leader Xi Jinping’s escalating political and military purges. The Chinese Communist Party on Friday expelled nine officials, including the army’s No. 2 general and its top political representative. Analysts are closely monitoring attendance at the party’s “Fourth Plenum,” which began Monday, to see who might be formally removed from the government’s powerful Central Committee. Xi has widened an anti-corruption campaign in recent years, but the latest purges suggest he is more focused on “controlling dissent and reinforcing [his] dominance” than cleaning up graft, an East Asia scholar said. |

|

Argentine peso falls despite US bailout |

Jonathan Ernst/Reuters Jonathan Ernst/ReutersThe Argentine peso fell to a new low on Monday, even as officials signed a $20 billion currency swap agreement with the US. The rout suggests President Donald Trump’s rare intervention to stem Buenos Aires’ market turmoil has so far faltered: Trump made further support contingent on Argentine President Javier Milei’s performance in midterm elections on Sunday, heightening anxiety, El País wrote: Investors are hedging against the possibility of a bad outcome for Milei’s party, which would curb his ambitious cost-cutting agenda. Traders “won’t rest easy until they see the election result,” an economist told La Nacion. Trump is also facing bipartisan opposition at home for bailing out an overseas ideological ally. |

|

Betting against Trump on Polymarket |

Ken Cedeno/Reuters Ken Cedeno/ReutersAmateur traders cashed out this year by betting that US President Donald Trump wouldn’t follow through on his threats. Bloomberg analyzed 300 questions on prediction platform Polymarket that focused on Trump’s potential actions — for example, whether the president would deploy Marines to Los Angeles, or impose more sanctions on Russia — and found that more often than not, “no” won out. Consistently betting against Trump following through would net a 12% return, similar to the S&P 500’s gain this year; wagers on tariffs yielded the strongest returns. The findings mirror Wall Street’s “TACO trade,” short for “Trump Always Chickens Out,” and show that crowds “systematically overestimate the likelihood of many political events,” Bloomberg wrote. |

|

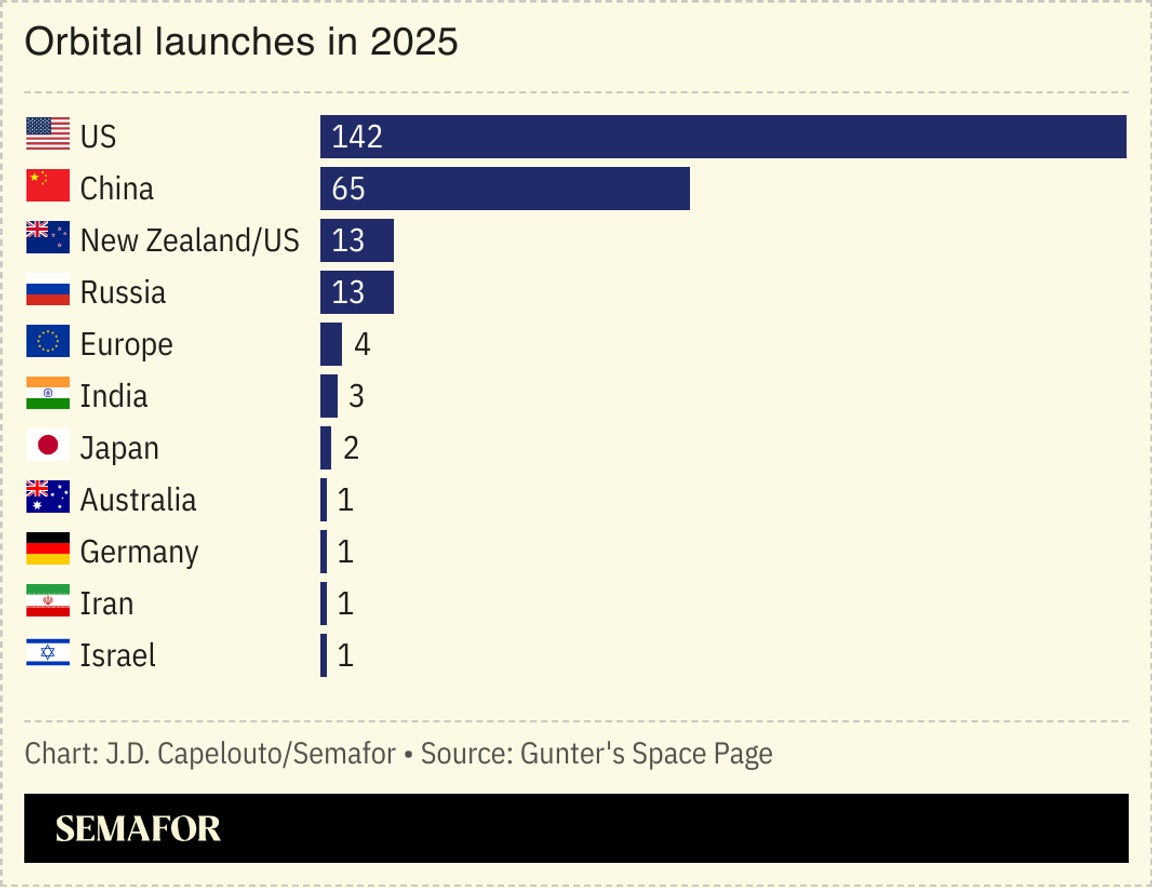

NASA frustrated with SpaceX delays |

The US is looking to other companies to help it return to the Moon after delays at SpaceX, the current contractor, have put the mission behind schedule. Acting NASA administrator Sean Duffy said Monday that the government would “open up the contracts” and let firms like Jeff Bezos’ Blue Origin compete with Elon Musk’s SpaceX. “We’re not going to wait for one company,” Duffy said, casting the effort to send astronauts to the Moon as a race against China. The move to reopen contracts comes months after the White House abruptly pulled its nomination for Jared Isaacman, a billionaire commercial astronaut with close ties to Musk, to lead NASA. |

|

CATL could face EU headwinds |

Florence Lo/Reuters Florence Lo/ReutersChinese battery giant CATL reported a surge in revenue on Monday as it furthered its overseas push, but it could face headwinds abroad amid a slowdown in electric vehicle adoption. The world’s largest EV battery maker used a blockbuster public listing in Hong Kong to fund an expansion into Europe, with plants in Germany and Hungary. But on top of geopolitical fault lines, there are signs of dampened demand: Automakers in the US and Europe are scaling back ambitious EV targets and lobbying against Brussels’ plan to phase out combustion-engine cars. CATL is rethinking the size of its Hungary plant, the Financial Times reported, reflecting “wider forecasts of slowing Chinese investment” in the EU as global tech tensions escalate. |

|

Regulation is evolving faster than ever, redefining how companies innovate and how consumers engage. From pharmaceuticals to food and beyond, shifting policies are reshaping markets, competition, and access to essential products and care. For patients and consumers alike, these changes determine everything from treatment availability to everyday safety. Join Semafor as we explore how businesses can stay resilient amid regulatory flux, what policy approaches best encourage responsible innovation, and how industry and government can work together to ensure accountability while unlocking progress. Oct. 28 | Washington, DC | RSVP → |

|

|

Global data center pushback rises |

Jonathan Ernst/Reuters Jonathan Ernst/ReutersLocal pushback to data centers is growing around the world. An explosion in AI adoption has triggered a building boom for facilities that power the tech, but The New York Times found the sites have fueled or exacerbated electrical disruptions in more than a dozen countries. From Mexico to Ireland to South Korea, activists and residents have banded together to oppose the data centers, saying they strain grids and contribute to water shortages — some analysts argue fears of AI causing a global electricity shortage are overblown. Banning data centers is also proving to be a salient political stance in the US, Semafor reported earlier this month, as candidates in both parties blame the buildings for higher energy costs. |

|

Backlash over Japanese nuclear plant |

Kim Kyung-Hoon/Reuters Kim Kyung-Hoon/ReutersJapan’s efforts to restart one of the world’s largest nuclear power stations have been met by a backlash. The Kashiwazaki-Kariwa plant has been offline since the 2011 Fukushima accident prompted Japan to shut down almost all nuclear power. Tokyo is keen to restart its fleet to meet growing power demands and reduce carbon emissions, and aims to supply 20% of electricity via nuclear power by 2040. Several plants are back online, but nuclear remains unpopular: Some polling suggests 70% of residents near Kashiwazaki-Kariwa have safety concerns. Activists have also been angered by the power company offering a $650 million payout to local community projects in exchange for restarting the plant, which one citizens’ group called “bribery.” |

|

|