|

Should we worry about AI's circular deals?

AI companies are borrowing more money to invest more in AI.

A week ago, I wrote a post about the possibility of a bust in the AI sector:

One aspect of the story I didn’t talk about was the web of “circular” deals between AI model makers, compute providers, and chipmakers. Almost every news story or blog post that worries about the threat of an AI bust mentions these. Here are some excerpts from a good overview of the situation by Emily Forgash and Agnee Ghosh in Bloomberg:

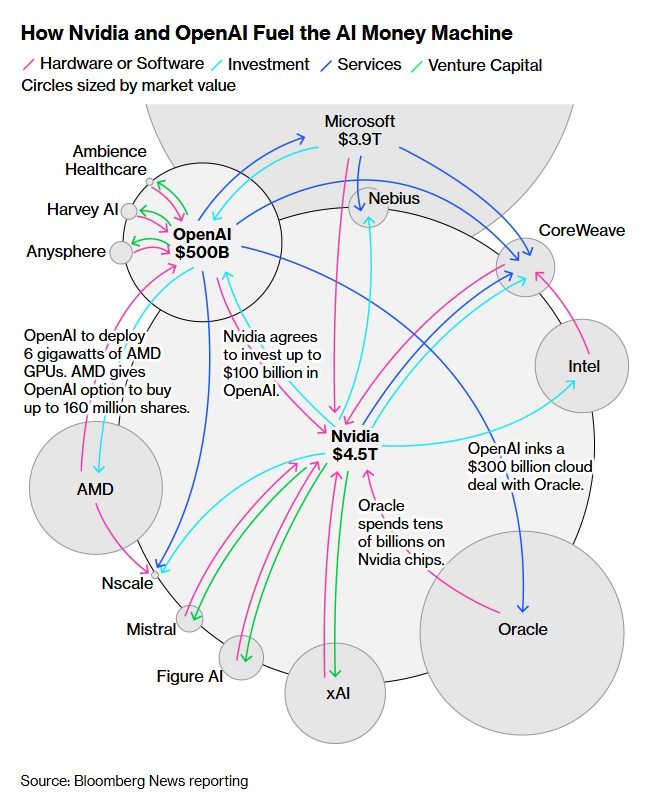

Two weeks ago, Nvidia Corp. agreed to invest as much as $100 billion in OpenAI to help the leading AI startup fund a data-center buildout…OpenAI in turn committed to filling those sites with millions of Nvidia chips. The arrangement was promptly criticized for its “circular” nature…This week…OpenAI…inked a partnership with Nvidia rival Advanced Micro Devices Inc. to deploy tens of billions of dollars’ worth of its chips. As part of the tie-up, OpenAI is poised to become one of AMD’s largest shareholders…

OpenAI confirmed it had struck a separate $300 billion deal with Oracle to build out data centers in the US. Oracle, in turn, is spending billions on Nvidia chips for those facilities, sending money back to Nvidia, a company that is emerging as one of OpenAI’s most prominent backers…Nvidia plans to invest up to $2 billion in equity in Elon Musk’s xAI in a financing round tied to Nvidia’s chips…

[Nvidia] agreed to buy $6.3 billion worth of cloud services from CoreWeave, which rents out access to Nvidia chips. OpenAI, meanwhile, received $350 million in equity from CoreWeave ahead of the IPO and recently expanded its cloud deals with the company to as much as $22.4 billion.

And here’s their schematic diagram of the deals:

|

Here’s a similar article in the Financial Times.

Some people worry that this web of relationships either A) could exacerbate a bust, or B) is a sign that a bust is coming. Here’s an example of the former, from that same Bloomberg article:

[S]ome analysts and academics who’ve tracked the tech industry long enough see uncomfortable similarities to the dot-com bubble. “In the late 1990s, circular deals were often centered on advertising and cross-selling between startups, where companies bought each other’s services to inflate perceived growth,” said Paulo Carvao, a senior fellow at the Harvard Kennedy School who researches AI policy and who worked in tech in the late 1990s. “Today’s AI firms have tangible products and customers, but their spending is still outpacing monetization.”

Paul Krugman, meanwhile, thinks circular deals could be the canary in the coal mine:

Third, there is what Azeem Azhar calls a “financial ouroboros” now taking place in AI: what looks like revenue generated by sales is, in some cases, really just the same stock of money going in circles between the various AI companies…[G]iven the pace at which capacity is expanding, one can’t dismiss concerns that circular flows of money are a warning sign.

So let’s think about why these circular deals could be a problem.

Basically, the supply chain for AI looks like this:

chipmakers —> cloud providers —> AI companies

Chipmakers like Nvidia make chips and sell them to the cloud providers like Microsoft, who operate the data centers that train and