| Read in browser | ||||||||||||

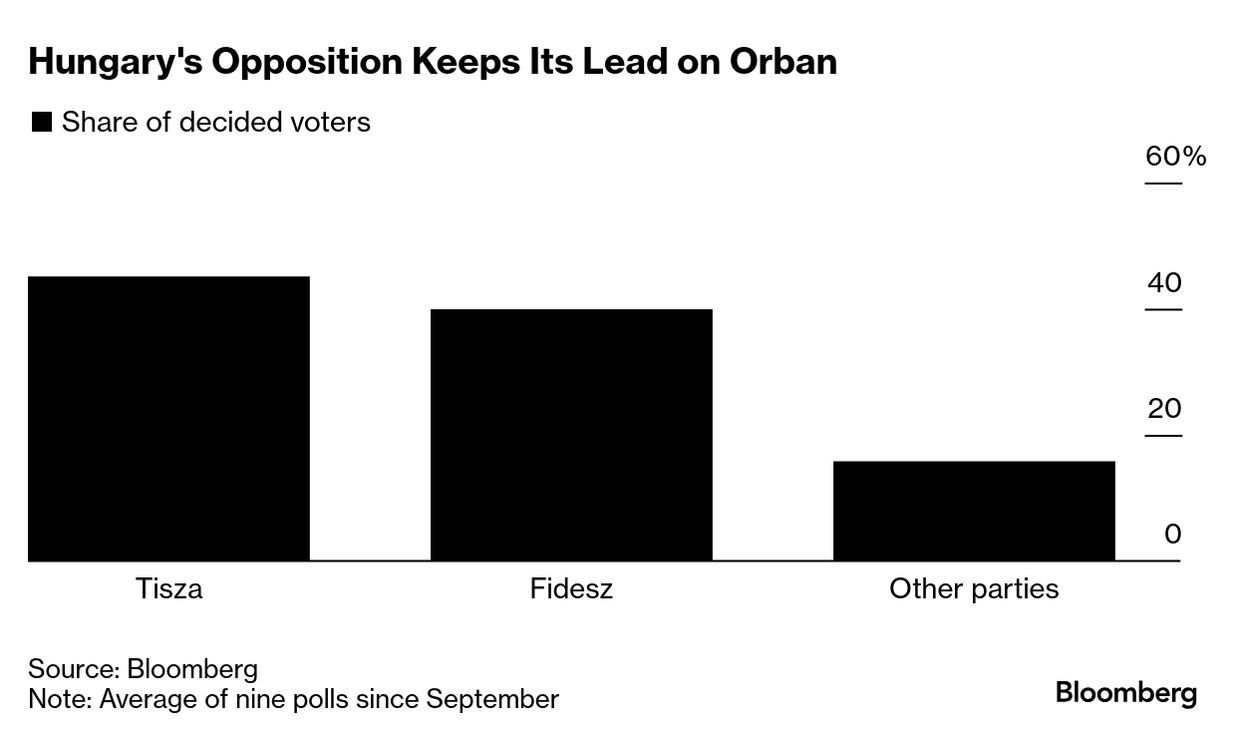

Hi, this is Andrea Dudik in Prague. Welcome to our weekly newsletter on what’s shaping economics and investments from the Baltic Sea to the Balkans. You can subscribe here. Market RenaissanceMore than three decades after ditching communism for capitalism, the Warsaw Stock Exchange says the time is approaching to move on from being an emerging market. Tomasz Bardzilowski, the bourse’s chief executive officer, said in an interview that an upgrade to developed market status by MSCI could take place within three to five years, as my colleague Konrad Krasuski reported. Should it happen, Warsaw would become the first stock exchange in the region to achieve that milestone, and Poland’s metrics indeed are looking strong. The economy topped $1 trillion this year, the benchmark stock index rose 50% in dollar terms, and more companies are looking at listings as the government uses tax incentives to rekindle an “equities culture.” Smyk Holding is the latest. The retailer of toys and children’s apparel is planning an initial public offering. It would become the third market debut in Warsaw of 2025, but critically the first in two years when a company is aiming to raise new money. Another is book, music and school supplies retailer Empik, which is eying an IPO next year. Poland isn’t the only stock market having a bit of a renaissance. In Romania, family-owned cold cuts producer Cris-Tim’s IPO is underway while the government is due to dust off its plans to sell stakes in state-run companies. Prague, meanwhile, is abuzz with talk of a possible IPO by armored vehicle and munitions maker Czechoslovak Group. The company, whose sales have soared because of the war in Ukraine, may go public in early 2026 and list in both Amsterdam and its home capital. The sale could raise north of $3.5 billion, boosting a market that once looked all but dead.  The Warsaw Stock Exchange. Photographer: Sergei Gapon/AFP/Getty Images Around the RegionUkraine: Donald Trump said he didn’t want to have “a wasted meeting” with Vladimir Putin. Volodymyr Zelenskiy, meanwhile, said earlier that Budapest wasn’t the best venue for talks to end the war. Poland: The government in Warsaw wants to discuss ArcelorMittal’s plans for operations in Europe amid growing concerns over the country’s ailing steel industry. Hungary: Energy company Mol restarted parts of its refinery near Budapest after putting out a fire following an explosion overnight. The incident had sent Mol’s shares tumbling at one point. Lithuania: Defense Minister Dovile Sakaliene resigned following public clashes with the prime minister, escalating a crisis within the Baltic nation’s fragile ruling coalition. Latvia and Estonia: The largest IKEA franchisee is buying €720 million ($840 million) of forest land in the Baltic countries to ensure a well-managed source of sustainable raw material for its furniture. Chart of the Week As Hungarians commemorated their 1956 revolt against communist rule, the national holiday was the usual chance for the country’s opposing political groups to lock horns and stage competing rallies. This year, though, there was more at stake with polls showing a consistent lead for the opposition Tisza party against Prime Minister Viktor Orban’s Fidesz six months before elections. By the Numbers

Things to Watch

Final ThoughtBuilding bridges is normally about bringing sides together. Not in deeply divided Kosovo, where a push to span the Ibar River in Mitrovica has caused an uproar among the Serb community in the city and upset allies who keep the Balkan nation afloat. One of the two new bridges is for cars and opened in August. The other is for pedestrians and due to open by year’s end. The aim, the government in Pristina says, is to foster integration, and it’s not backing down. As Foreign Minister Donika Gervalla-Schwarz put it: “We are building bridges. We are not building prisons and walls for Serbs.”  The Ibar River divides ethnic Serb and Albanian communities in Mitrovica. Photographer: Ben Kilb/Bloomberg Thanks for reading our newsletter. Please send any feedback to eeedition@bloomberg.net. We’re improving your newsletter experience and we’d love your feedback. If something looks off, help us fine-tune your experience by reporting it here. Follow us You received this message because you are subscribed to Bloomberg’s Eastern Europe Edition newsletter. If a friend forwarded you this message, sign up here to get it in your inbox.

|