| Welcome to Next Africa, a twice-weekly newsletter on where the continent stands now — and where it’s headed. Sign up here to have it delivered to your email. The outcome of Ivory Coast’s presidential elections on Saturday won’t be much of a surprise. Yet doubts about the credibility of the contest may linger for years to come. Alassane Ouattara, who’s held power since a civil war ended in 2011, is seen as shoo-in for a fourth term. While the West African nation’s constitution limits presidents to two terms, the courts upheld his argument that a 2016 amendment reset the clock. The 83-year-old will square off against four contenders, but none has a realistic chance of winning.  A campaign billboard for Ouattara in Abidjan on Oct. 18. Photographer: Issouf Sanogo/AFP/Getty Images The main rivals — former Credit Suisse CEO Tidjane Thiam and ex-President Laurent Gbagbo — were disqualified from running and their attempts to mobilize protests against their exclusion have largely fallen flat. Granted, Ouattara may well have won re-election even if the contest wasn’t so heavily stacked in his favor. The economy has been one of Africa’s fastest growing since he took office, bolstered by large infrastructure investments and the discovery of oil. “People want to see Ivory Coast prosper and if that means accepting a fourth term” for Ouattara, they may be prepared to accept it, said Tiffany Wognaih, an Ivorian national and senior associate at New York-based J.S. Held.  A rally in Abidjan on Aug. 9 to protest against the exclusion of opposition candidates. Photographer: Issouf Sanogo/AFP/Getty Images Investors don’t appear to be overly concerned about any backsliding in the nation’s democracy, with foreign bonds continuing their rally. Samir Gadio, head of Africa strategy at Standard Chartered, sees scope for more gains if the election goes ahead without major disruptions. Ouattara has promised more economic gains, pledging to fire up manufacturing and mining and to get Ivory Coast admitted to the ranks of upper middle-income countries by 2030. If he succeeds, many people may forget this weekend’s skewed playing field. — Kamailoudini Tagba and Moses Mozart Dzawu Key stories and opinion:

Ivory Coast Democracy Strained by Leader’s Bid for Fourth Term

Ivorian Soldier Shot Dead During Patrol Ahead of Elections

Hundreds Detained in Protest Ahead of Ivorian Presidential Vote

Ex-Credit Suisse Boss Tidjane Thiam: ‘I Don’t Do Regrets’

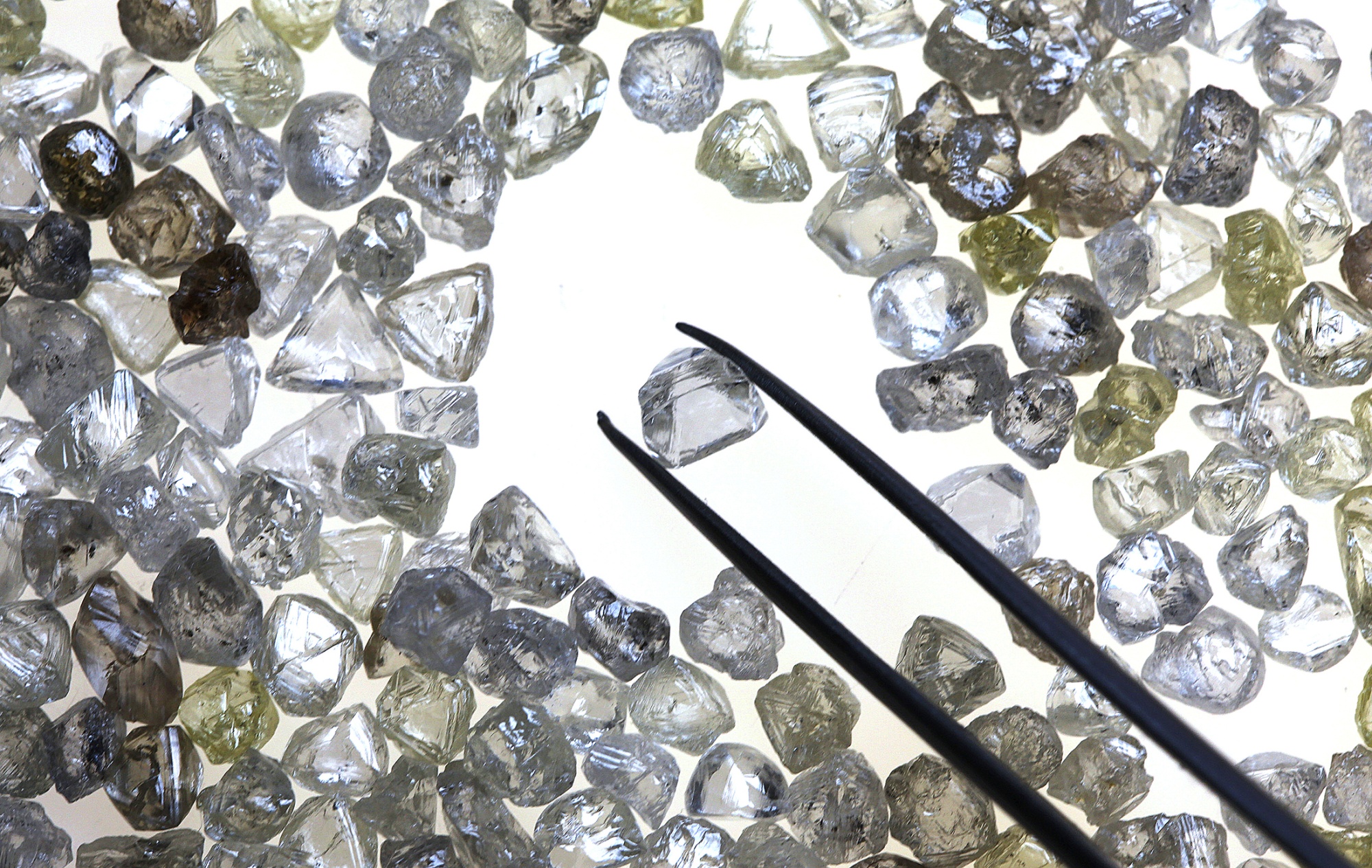

Gen Z Protests Will Spread as Leaders Fail Youth: Justice Malala  WATCH: Beverly Ochieng, Control Risks’ senior analyst for Francophone Africa, speaks about the election on Bloomberg TV. Angola has offered to buy Anglo American’s entire 85% stake in De Beers, setting up a clash with other potential suitors including neighboring Botswana. State-owned gem producer Endiama presented “a concrete and well-defined proposal” to Anglo, CEO José Manuel Ganga Júnior said in an interview. Botswana — where De Beers mines most of its diamonds — is also seeking to boost its 15% to a controlling share, with President Duma Boko calling ownership a “matter of economic sovereignty.”  Uncut diamonds on a sorting table in Gaborone, Botswana. Photographer: Chris Ratcliffe/Bloomberg China is leveraging its position as the world’s largest creditor to help broaden use of the yuan, offering overseas borrowers the chance to benefit from economically-depressed interest rates at home by ditching the dollar. Ethiopia became the latest this week in looking to convert at least part of the $5.38 billion owed to Beijing into yuan-denominated loans. Kenya is seeking to save $215 million in annual costs, while the plan has also piqued the interest of Zambia’s finance minister. Huawei is promoting DeepSeek, a Chinese AI chatbot, to African startups and innovation hubs as a far-cheaper alternative to Western equivalents like ChatGPT. To critics, though, the strategy carries ominous echoes of Belt and Road programs that helped some poor countries build critical infrastructure, but left them heavily indebted and financially dependent on Chinese suppliers. Separately, a dearth of African-language content is delaying the rapid uptake of AI on the continent, according to mobile industry body GSMA.  In this episode of Bloomberg’s Next Africa and Big Take podcasts, reporters Loni Prinsloo and Helen Nyambura join hosts Sarah Holder and Jennifer Zabasajja to discuss the AI landscape. Beninese Finance Minister Romuald Wadagni and the leader of a small opposition party were the only two candidates accepted by the West African nation’s electoral commission to run in next year’s presidential race. Wadagni, widely credited with steering Benin’s strong economic performance is widely viewed as the frontrunner to succeed President Patrice Talon in the April vote. South Africa’s $25 billion transmission grid-expansion program has attracted interest from international developers, including a company owned by Indian billionaire Gautam Adani and Chinese firms. The government started up the Independent Transmission Projects program in December to bring in private partners to help install 14,000 kilometers of new power lines.  Electricity pylons in eastern South Africa. Photographer: Waldo Swiegers/Bloomberg Operations restarted at Barrick’s massive gold mine in Mali for the first time in more than nine months, after a state administrator took over the asset in June, sources say. Production activity resumed at the site late last week following a deal to restart payments to contractors, which had been suspended when Barrick halted work. The Canadian company shuttered the Loulo-Gounkoto complex in January after the West African nation blocked exports, seized gold and detained senior employees. Next Africa Quiz — Which country’s economy is the least risky according to the Bloomberg Africa risk-o-meter study released this week? Send your answers to gbell16@bloomberg.net. Data Watch - Senegal’s debt-service bill is expected to be 12% higher than previously forecast next year, after the authorities uncovered billions of dollars in unreported liabilities.

- South Africa, Nigeria and Burkina Faso are among countries expected to be removed from the global dirty-money list later on Friday. See our previous reporting on the gray list.

- Ethiopia’s currency looks set to gain in coming months, supported by surging gold exports that have surpassed coffee shipments for the first time, central bank Governor Eyob Tekalign said in an interview.

A sign in Addis Ababa in December 2023. Photographer: Michele Spatari/Bloomberg Coming Up - Oct. 27 Possible release of official results from Cameroon’s election and Ivory Coast

- Oct. 29 South Africa money supply & private-credit data for September

- Oct. 30 Interest-rate decisions for Botswana and Malawi, South Africa budget balance and producer inflation for September, Zambia inflation data for October & trade balance for September

- Oct. 31 Kenya and Uganda October inflation, South Africa trade balance for September, Namibia money supply, Impala Platinum first-quarter production report

|