|

|

How Tiktok inspired New York Times video strategy

Plus: interview with Newsweek editor Jennifer H Cunningham about how she is making the magazine "more reflective of the modern era"

Welcome to this week’s Press Gazette Future of Media US newsletter on Friday, 7 November.

💲 This week we’ve had quarterly financial updates from some of the biggest news businesses in the US (and, therefore, the world).

News Corp revenue continued to grow, up 2% in its last quarter to $2.14bn. Subscriptions-powered Dow Jones continued to do more than its fair share in terms of contributing growth, up 6% to $586m.

However the rest of News Corp’s news media business, which includes the New York Post, The Sun, The Times and News Corp Australia, saw a “strong improvement in profitability” driven by cost saving initiatives and lower costs at Talk in the UK (formerly TalkTV) which is now focused on radio and Youtube.

Revenue in that division was up 1%, having seen a hit to advertising of 4% but subscription price rises on the likes of The Times in the UK. Notably, no progress is being made on growing digital as an overall percentage, staying at 38% of all revenue.

Another subscriptions superpower is of course The New York Times, where it saw the biggest net addition to digital subscribers in a quarter since it started reporting on the number of subscribers (rather than individual subscriptions) in 2022.

The net growth by 460,000 digital subscribers (taking it to 11.8 million or 12.3 million total subscribers) will have been helped by the addition of family subscriptions which come at a higher price point for up to four people. They are counted in the data as two subscribers and the additional family subscribers now make up 2% of all digital-only subscribers.

Unsurprisingly digital subscription revenues were up 14% with digital-only average revenue per subscriber increasing 3.6% to $9.79 thanks to price rises. But digital advertising is still strong for the NYT too, growing by 20.3% “due mainly to strong marketer demand and new advertising supply”.

Not all publishers are having such luck with advertising though: People Inc has seen a 3% drop as Google's AI summaries hit traffic to many of its brands.

An amazing figure: Google search accounted for 54% of the publisher’s traffic two years ago (when it was still called Dotdash Meredith) and that’s now down to 24%.

However premium advertising is up for categories like travel, technology and finance, while performance marketing and content licensing helped contribute to overall digital growth of 9%. With print revenue down 15%, however, total revenue was down 2% to $429.8m in the quarter.

Now, onto our exclusive interviews.

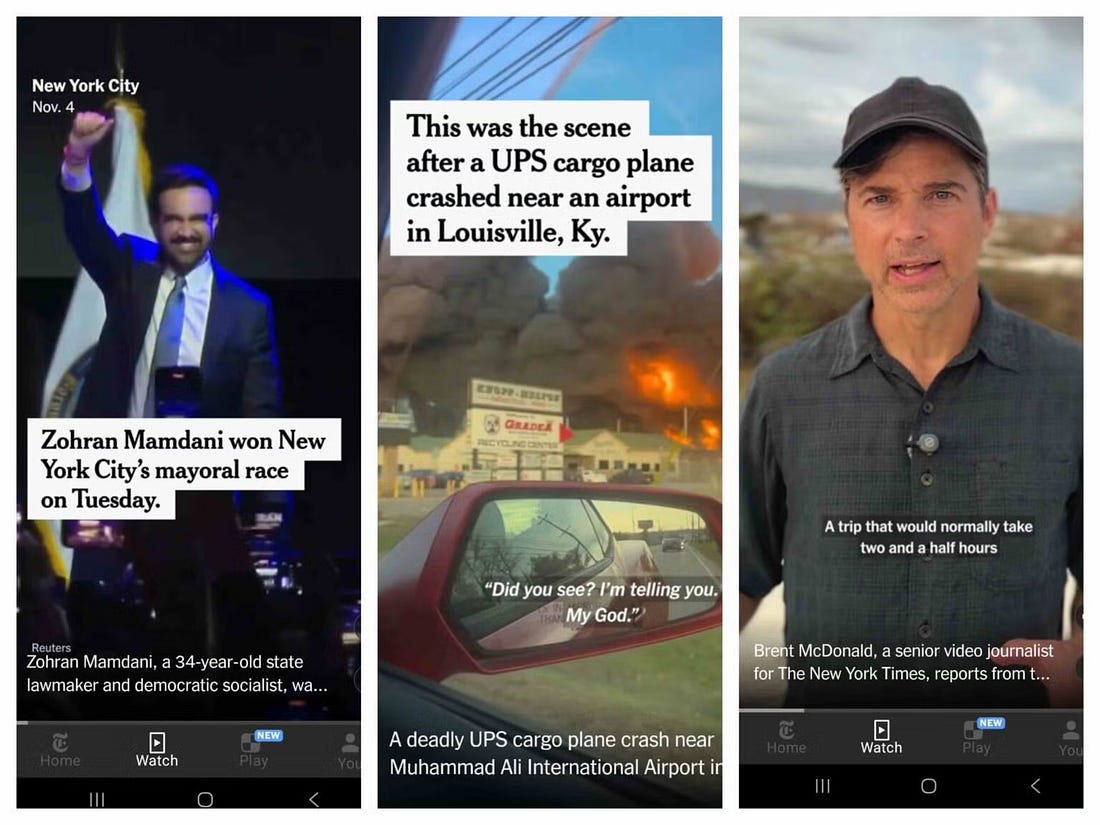

📼 The New York Times has joined the ranks of publishers emphasising short-form vertical video on their own platforms.

It’s launched a Watch tab in its app that lets you scroll through the news videos of the day.

It’s a bit like a mini Tiktok for news in the way you swipe and the visual language used.

But there are more ways it differs: it’s curated by editors and not personalised for users. And it’s actually finite and finishable, with around 20 videos per day.

🌎 Meanwhile I spoke to Newsweek editor-in-chief Jennifer H Cunningham about how she is making the magazine brand “more reflective of the modern era”.

They’ve just undergone a major redesign on both print and online and are clearly aiming for a more sophisticated feel.

Cunningham also emphasised the importance of the Newsmakers interview series as something that feels premium, works across all platforms, including video, and is more AI proof than a lot of current affairs content.

A final reminder from our editor-in-chief Dominic that Press Gazette is returning to New York next week with an open invitation for media industry leaders to join us at our Media Strategy Network USA event.

This free event is being held at the People Inc building on Thursday 13 November.

It offers a half-day masterclass on new ways to make journalism pay in the digital age covering everything from adtech to video and from paywalls to AI in the newsroom.

Our speakers include Bloomberg Media chief operating officer Julia Beizer, Arc XP chief technology officer Joe Croney, senior VP for development at BBC Studios Melissa Rubinson and People Inc chief innovation officer Jonathan Roberts.