| | The US crafts a peace plan for Ukraine in coordination with Russia, Nvidia reports earnings, and an ͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Flagship |  |

| |

|

The World Today |  - New US plan for Ukraine war

- Spate of US-Saudi tech deals

- Nvidia reports earnings

- Bitcoin price tumbles

- EU softens on Big Tech

- Beijing punishes Tokyo

- China’s self-driving expansion

- India turns to Chinese purifiers

- AI lit controversy in NZ

- Historic Klimt sale

The replica bones of “Hong Kong’s Whale” were installed after the original skeleton was destroyed in a super typhoon. |

|

New US-Russia peace plan for Ukraine |

Anatolii Stepanov/Reuters Anatolii Stepanov/ReutersThe Trump administration is pressing Kyiv to accept a new plan that was drafted in consultation with Russia to end the Ukraine war. Axios reported that the White House has been secretly working on the proposal with Russian officials, including Kirill Dmitriev, a close ally of Vladimir Putin, according to the Financial Times. The framework appears heavily tilted in Moscow’s favor, with one source telling the FT that accepting it would amount to Ukraine giving up its sovereignty; other potential concessions include rolling back US military assistance and adopting Russian as an official state language. Washington is “trying to will into existence Russia’s maximalist demands,” a Russia-focused journalist argued, by “seizing on Russian battlefield gains and Ukraine’s corruption crisis.” |

|

Slew of US-Saudi tech deals |

Evelyn Hockstein/Reuters Evelyn Hockstein/ReutersThe US and Saudi Arabia touted a slate of tech deals on Wednesday, though the specifics remain unclear. At a business summit in Washington, DC attended by Saudi’s crown prince, Elon Musk said he is working with the kingdom’s sovereign wealth fund-backed AI company on the first data center outside the US for his xAI startup. With billions being funneled into the AI race, each major American tech company appears to have “its own Middle Eastern champion,” The New York Times wrote. But this week’s deals are less about Saudi investments in the US than about the purchase of US goods and services that could help the kingdom build up a homegrown AI sector, Semafor reported from the summit. |

|

Nvidia revenue stronger than expected |

US chip giant Nvidia reported earnings that beat analysts’ expectations on Wednesday, likely reinvigorating the AI trade after several rocky days. As fears of an AI bubble grow, investors and policymakers are increasingly hungry for clarity on the AI industry’s future; the health of the world’s most valuable company — Nvidia reported a 62% annual increase in quarterly revenue — is critical to that equation by showing bumper demand for its powerful AI chips. The earnings come a day before September’s delayed US jobs report, another critical signal on the economy’s health that will provide clues into whether the Federal Reserve will cut interest rates next month. |

|

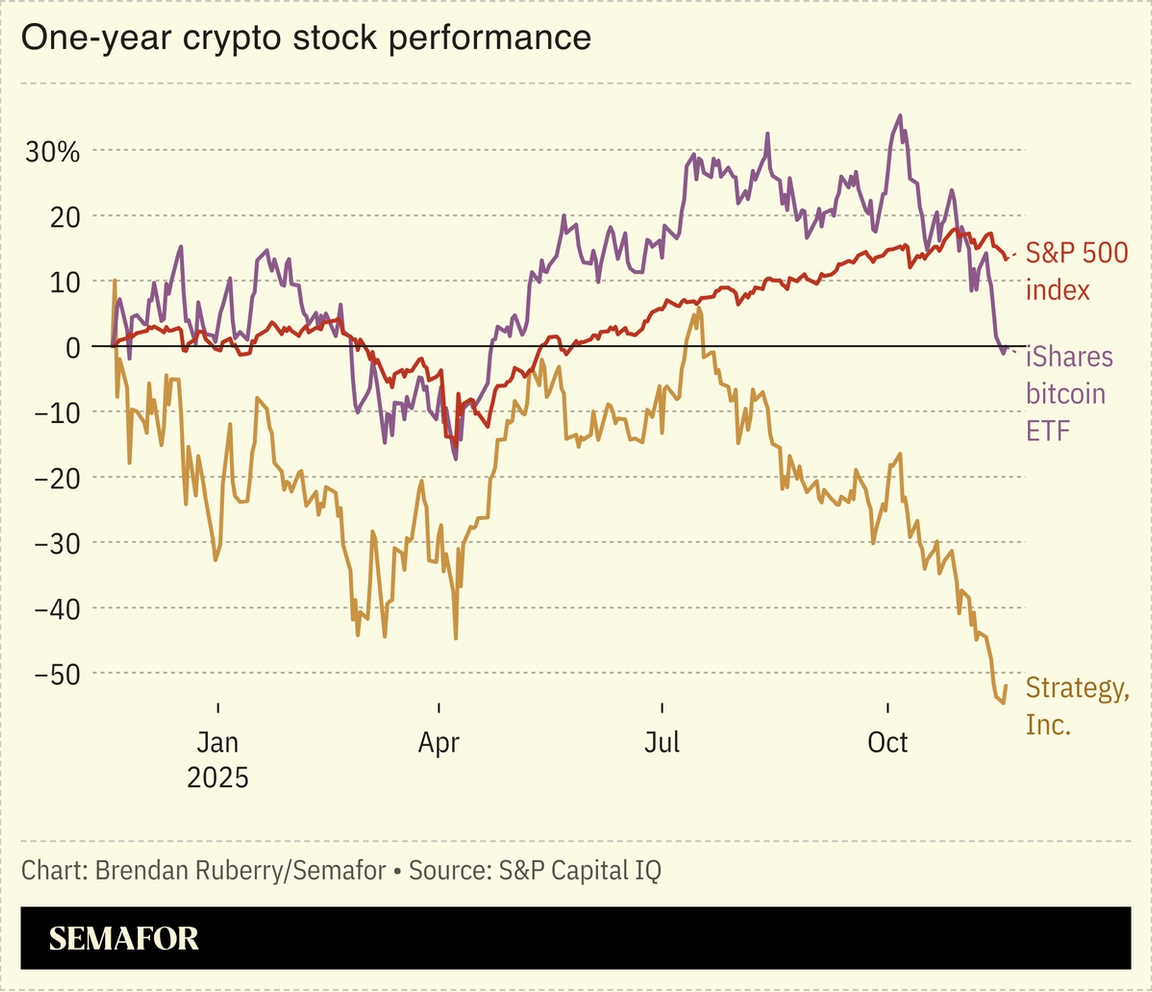

Bitcoin fall prompts ‘crypto winter’ fears |

The price of bitcoin fell below $90,000 on Wednesday, marking a 27% plunge from its October high and erasing the digital token’s gains for the year. Investors this week withdrew a record $523 million from BlackRock’s flagship bitcoin ETF, and the stock of pioneering digital asset firm Strategy tumbled further than bitcoin itself did over the same period, raising concerns of a “crypto winter.” The slide could imperil a slew of planned digital currency IPOs that aimed to capitalize on the higher valuations and favorable regulatory environment fostered by US President Donald Trump, The Information noted. “Investors have never had more ways to place complex wagers on crypto,” The Wall Street Journal wrote, and “the dangers of those bets are becoming apparent.” |

|

EU scales back Big Tech crackdown |

Yves Herman/Reuters Yves Herman/ReutersThe EU is scaling back its attack on Big Tech after years of aggressive regulation. The bloc’s leadership laid out a “digital package of simplification” on Wednesday, which will streamline rules on AI and privacy — and potentially, dare we hope, remove those “cookies?” pop-up boxes that clutter up the screen before you click them away. The EU has grown concerned that overzealous regulation is stifling growth, The New York Times reported: The European Central Bank’s former President Mario Draghi warned in an influential report last year that without sweeping changes, the bloc could become an economic backwater. The proposals have sparked backlash in Brussels, The Verge noted, with critics accusing lawmakers of “bowing to pressure from Big Tech.” |

|

China ramps up Japan retaliation |

Kim Kyung-Hoon/Reuters Kim Kyung-Hoon/ReutersChina is ramping up retaliation against Japan in a diplomatic row that is already impacting Tokyo’s fragile economy. Beijing said Wednesday it was halting Japanese seafood imports and movie releases, after advising citizens against traveling to Japan. Relations between the two countries soured after Japanese Prime Minister Sanae Takaichi’s comments about Taiwan; Beijing is now punishing Tokyo with aggressive rhetoric and economic pain. A blow to tourism is an “unwelcome drag” on Japan, a Moody’s analyst said, after the country reported its first quarterly GDP contraction in more than a year. But Japan’s public is “numb to Chinese rhetoric,” Bloomberg’s Japan-based columnist wrote, and Beijing’s conduct could help Takaichi advance her agenda by galvanizing public support. |

|

Chinese self-driving makes overseas push |

Tingshu Wang/Reuters Tingshu Wang/ReutersA new wave of Chinese cars heading overseas may have no one behind the wheel. The country’s autonomous auto sector, including companies that make self-driving buses and delivery vehicles, are accelerating expansion plans into markets including the Middle East and Southeast Asia, Caixin reported. It marks a test of whether the firms can navigate complex, foreign regulatory environments — a contrast from Beijing’s autonomous-friendly attitude — and follows the aggressive expansion of Chinese EV and food delivery companies into international markets. Chinese firms that make the tech that powers self-driving vehicles are also eyeing Europe as a growth market, Reuters reported. |

|

The Ledger is bringing together the leaders who are shaping the future of global finance. Semafor’s Liz Hoffman will be joined by Jay Clayton, US Attorney for the Southern District of NY, Michael Patterson of BlackRock, and Gregg Lemkau of BDT & MSD Partners for what is shaping up to be a sharp, timely set of conversations about where global finance is headed and which innovations will actually matter once the dust settles. |

|

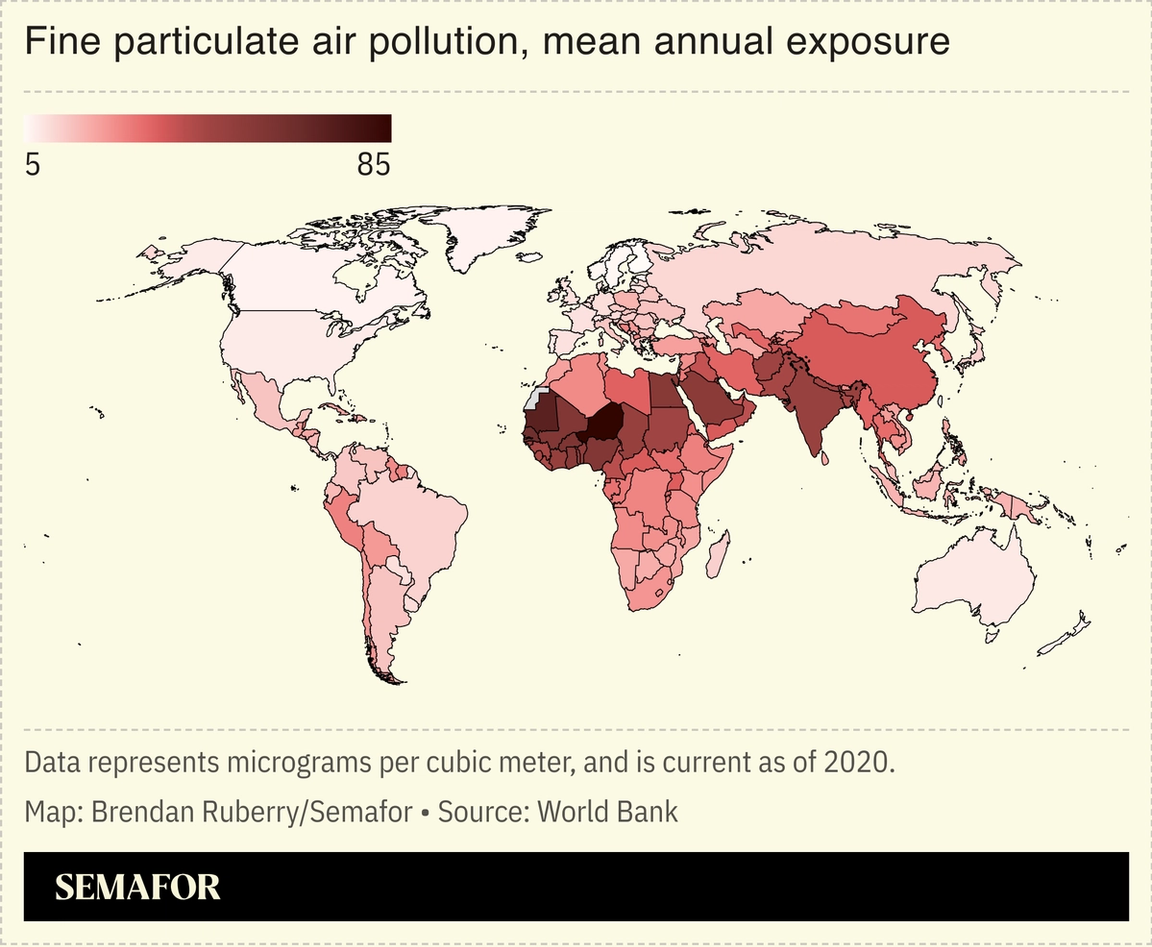

India looks to China for air purifiers |

Indians suffering from heavy air pollution are increasingly sourcing air purifiers from China. The capital of New Delhi in particular is seeing worsening air quality, making indoor air purifiers more commonplace, especially in upper- and middle-class households. Chinese brands offering cheaper models are increasingly popular among online shoppers on a budget, Nikkei wrote, exacerbating a class divide in India: Western brands still dominate high-value purifier sales. Some homegrown companies offer purification services but their prohibitive prices only attract elite customers. US tariffs make India a promising market for Chinese hardware and electronics; some Chinese smartphone manufacturers are also stepping up their presence in the country. |

|

Lit award drops two titles over AI use |

Quentin Wilson Publishing Quentin Wilson PublishingTwo New Zealand authors had their books pulled from the country’s most prestigious literature award because of the use of AI to design their covers. The publisher said it was “heartbreaking” that the authors’ works were rejected for reasons that had “absolutely nothing to do with their writing.” The use of AI in creative fields is controversial — artists are concerned about their work being used to train models without consent, and that the technology will put them out of work — but widespread nonetheless, because it boosts productivity. It could also enhance creativity, two British academics argued recently: “No human artist could ever gather a range of sources” like those available to AI, meaning it can widen the scope of artists’ inspiration. |

|

|