| | In this edition, the downstream and upstream of AI deals, and the SEC’s next deregulatory move. ͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Business |  |

| |

|

- Nvidia’s keiretsu

- The Ledger live

- ‘Boomer candy’

- Making stock markets great again

- To Russia, with trepidation

Mar-a-Lago no-fly zone rankles Palm Beachers … NYC miscounted its mayors … |

|

Who captures the value in AI? I increasingly think it’s unlikely to be the creators of the models themselves: Gemini and ChatGPT are currently trading the lead back and forth — Sam Altman, recently lapped, has declared a “code red” — but with enough time, power, and talent, they’ll mostly converge. It’s more likely to be those upstream (the “picks and shovels” purveyors producing GPUs) and downstream (application makers and corporate customers that can replace workers with AI) of those models. LLMs will be to the AI age what electrons were to the electricity age — critical but mostly fungible, and useless without sockets and things to plug into them. The value lives mostly on the outside of the socket; electric-utility CEOs are not, by and large, billionaires. In that light, OpenAI’s bizarro-world investment in Thrive — normally venture firms give money to startups, not the other way around — looks like a classic diversification play. OpenAI is worth $500 billion today. But if AI fortunes lie upstream and downstream of it, then it makes sense to put a few chips, so to speak, in those places. That’s the bearish-on-LLMs case, but the bull case gets you to the same place. If ChatGPT is eventually smarter than human venture capitalists, the VCs will ask ChatGPT what companies to invest in. And now the people who built ChatGPT can own a piece of every company it recommends. It’s a more circuitous monetization route than converting its 800 million weekly users into paying subscribers, but a fun one. Why not tack on an activist hedge fund? Programming note: Hope to see many of you tonight at the New York Stock Exchange for Semafor’s The Ledger, where I’ll be interviewing some of Wall Street’s heaviest hitters. (Sorry about the weather.) See below for the full lineup and what’s on my mind, and respond to this email with questions you want answered. |

|

A new holding company rises |

Evelyn Hockstein/File Photo/Reuters Evelyn Hockstein/File Photo/ReutersMasayoshi Son wept as he sold SoftBank’s $5 billion stake in Nvidia last month, but a bit of SoftBank seems to have rubbed off on the chip giant. With a $2 billion investment in one of its suppliers, Nvidia is adding to its string-of-pearls balance sheet, which also includes stakes in OpenAI, Mistral, CoreWeave, Intel, and, for some reason, British fintech Revolut. Nvidia’s circular investments, which fund customers pouring that same cash back into Nvidia GPUs, makes it the cornerstone of an AI complex that is already drawing Too Big To Fail comparisons. “We’re basically holding the planet together,” Nvidia CEO Jensen Huang said at a town hall last month. But they borrow from a (dying) tradition in Japan, from legacy trading houses with interlocking ownership to the holding company that Son built with stakes in Alibaba, Yahoo, and Sprint. SoftBank is unwinding its portfolio to fund its in-house AI ambitions, and the Tokyo Stock Exchange is dismantling the keiretsu model, which it partly blames for poor shareholder returns. |

|

Live tonight: Liz will be hosting The Ledger, Semafor’s annual financial summit. She’ll be joined onstage at the New York Stock Exchange by: - Jay Clayton, US Attorney for the Southern District of NY — Is Wall Street doing a good enough job policing itself?

- Michael Patterson, Senior Managing Director at BlackRock — to talk cockroaches, canaries, and pearl-clutching in private credit

- Gregg Lemkau, Co-CEO of BDT & MSD Partners — to talk sports, philanthropy, and media M&A

- Igor Tulchinsky, CEO of WorldQuant — to discuss how AI will change data-driven investing, and whether everything is just a giant prediction market right now

- Nick Robbins, Vice President of CoreWeave — on Wall Street’s AI skeptics, the GPU aftermarket, and how deep the moat goes

|

|

Goldman’s $2B bet on ‘boomer candy’ |

Andrew Kelly/File Photo/Reuters Andrew Kelly/File Photo/ReutersGoldman Sachs is buying a provider of a newfangled type of structured investment that has drawn concerns across Wall Street. It will pay $2 billion for Innovator Capital, forgoing the big M&A the financial world has been expecting in favor of a tuck-in approach to bolster its money management arm, which oversees $3.5 trillion. Innovator’s buffer funds track S&P indexes but use protection instruments to cap upside and limit downside. They’re the latest product of an investment-fund lab that has grown quickly in recent years; there are now more ETFs than stocks to go into them, and inverse, leveraged, and single-stock ETFs have warped the original plain-vanilla promise of cheap diversification. One analyst recently called buffer funds “boomer candy.” Cliff Asness, the co-founder of hedge fund AQR and a Goldman alum who’s been extremely squeamish about market froth, has offered a less charitable view — “comfort cloaked in complexity” — and said yesterday that he’s “disappointed in my old firm.” |

|

As the AI boom intensifies pressure on America’s energy systems and infrastructure, lawmakers across the aisle are pursuing permitting reform to unlock new opportunities and cut through the political and regulatory barriers standing in the way of viable solutions. On Tuesday, Dec. 9, join Gov. Josh Shapiro, D-Pa., and Gov. Kevin Stitt, R-Okla., for on-stage conversations examining what’s at stake and potential bipartisan solutions to the challenges emerging from this greater technological revolution. Dec. 9 | Washington, DC | Request Invitation |

|

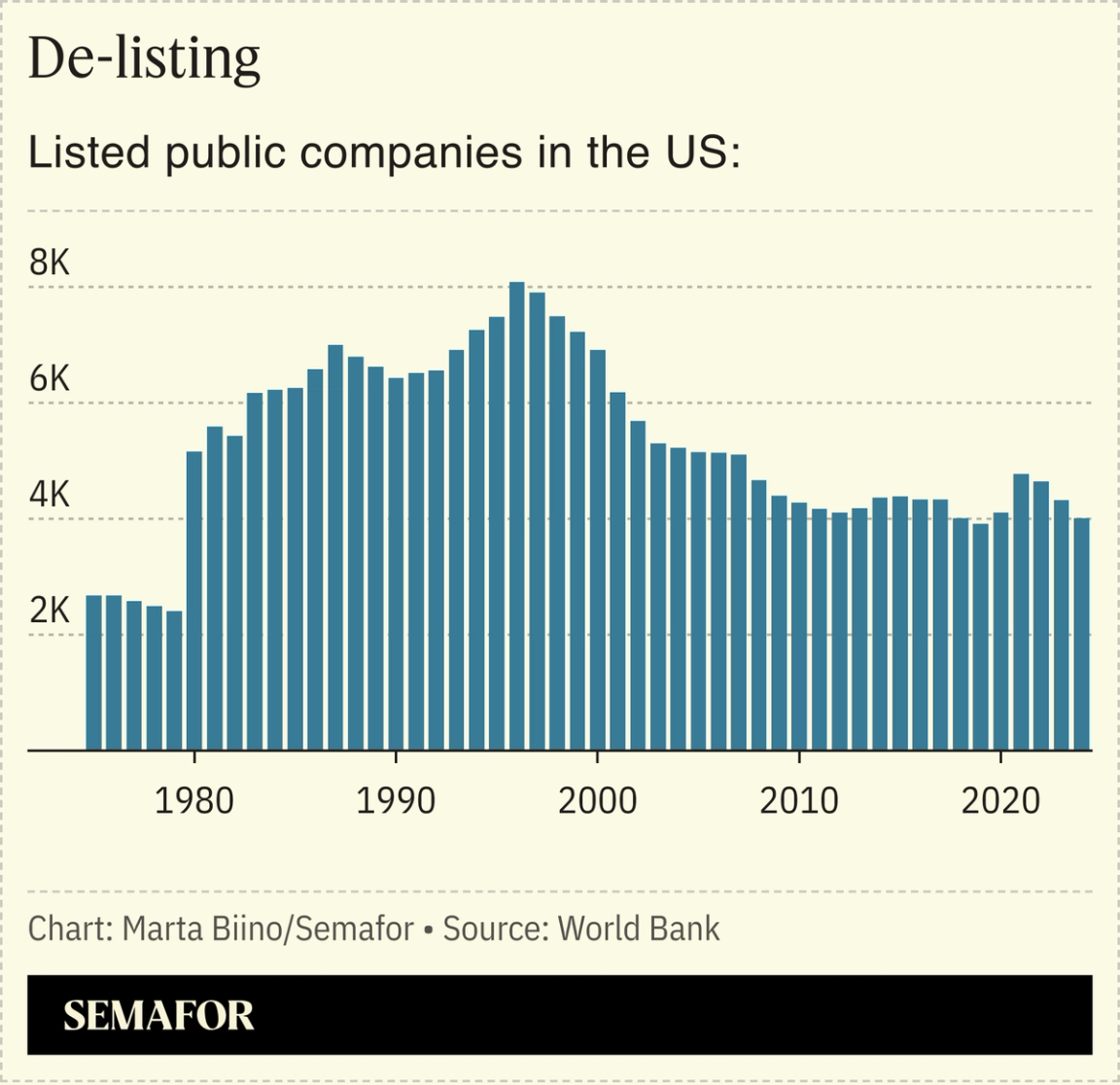

Public markets ‘worth reviving’: SEC Chair |

SEC Chair Paul Atkins has a 250th birthday gift for America’s CEOs: less paperwork. In a NYSE speech Tuesday, the regulator vowed to cut the “regulatory creep” of “voluminous disclosure requirements.” Atkins, noting in his speech that public-market listings have fallen 40% since the mid-1990s, has been beating this drum for a while. Earlier this year, he blessed the idea of companies moving to twice-yearly earnings reports, the standard in Europe. Overhauling reporting requirements burdens could make IPOs more appealing at a time when more companies are staying private for longer. The 2012 JOBS Act, which loosened reporting requirements for smaller companies, did coax some startups to list — one academic study found a 25% increase, controlling for other factors — but there’s more private capital available now than ever before. |

|

Kirill Dmitriev and Steve Witkoff. Sputnik/Vyacheslav Prokofyev/Pool via Reuters. Kirill Dmitriev and Steve Witkoff. Sputnik/Vyacheslav Prokofyev/Pool via Reuters.Russia is open for American businesses, but will there be any takers? The White House detailed its hopes that a deal can be struck to end the war and open up the country to Western capital. But US investors and operators — some of whom are still trying to disentangle themselves, nearly four years after the invasion of Ukraine and resulting sanctions — are unlikely to rush back in, Semafor’s Ben Smith writes. Any return would be a bet that a decadeslong project can survive Putin’s imperial ambitions and post-Trump shifts in American politics. It would also require forgetting that few Western firms ever made much money in the country, whose post-Soviet years mostly enriched local oligarchs. The CEO of Exxon, whose appetite for global risk was voracious enough that the definitive book about the company is Steve Coll’s excellent Private Empire, recently said the company has “no plans to reenter Russia” after taking a $4.6 billion writedown on assets seized by Moscow. Bill Browder, once the biggest foreign investor in Russia and now a bitter Putin critic, told Ben it’s “the stupidest thing ever to think the Russians will let Americans get a single penny out of this.” |

|

Join more than 2 million readers who trust The Hustle for their daily 5-minute read on business and tech stories that actually matter. Become part of this informed community that starts each day with essential insights delivered with a fun, engaging twist. Sign up today. |

|

➚ BUY: Top Gun. America’s servicemen and women are making — and losing — small fortunes playing the stock market, at rates far higher than the broader population, WSJ reports. ➘ SELL: Days of Thunder. NASCAR is going to trial in an antitrust suit brought by Michael Jordan. |

|

Companies & Deals- Money talks: Michael Dell and his wife will give $6.25 billion to millions of American kids, building on the savings started by “Trump Accounts.” (We’ll dig into the details tonight with Lemkau — the MSD stands for Michael S. Dell.)

- All that glitters: Mining giant Barrick, under pressure from Elliott, announced Tuesday it would explore an IPO of its North American gold business.

- Big game hunting: Apple is shaking up its AI division to try to catch up in the AI race. It poached Amar Subramanya, who worked at Google on Gemini and most recently was VP of AI at Microsoft. (We’d remind you that big tech companies were, in recent memory, accused by federal prosecutors of illegally conspiring not to compete for talent.)

- Someone think of the MBAs: McKinsey, Bain, and BCG have frozen

|

|

|