| | In this edition: Families plead for return of African mercenaries in Russia, Nigeria’s new defense m͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Africa |  |

| |

|

- S. Africa’s growth run

- Wise gets approval

- Plea for African mercenaries

- New Nigeria defense minister

- Trump insults Somalis

- Afreximbank’s Samurai bond

Why Africa’s forests are turning from carbon sinks to carbon sources. |

|

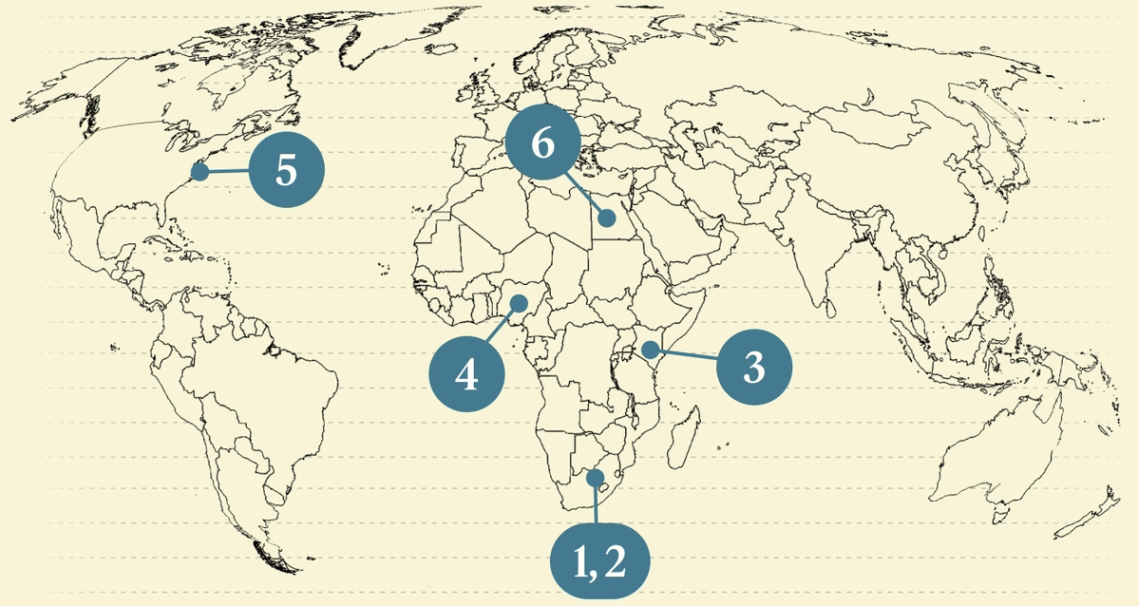

Months of US efforts to end a long-running humanitarian crisis in eastern DR Congo will come to a head on Thursday when the presidents of DR Congo and Rwanda meet here in Washington to sign a long-expected peace agreement. Those efforts are being presented as a feather in US President Donald Trump’s cap and his ostensible push to end wars around the world. But the most oft-repeated cliché we’ve heard this week has been: “The devil is in the details.” Despite multiple stages of agreements being signed by representatives of the two African governments in recent months, both sides remain quietly concerned about whether real peace will be achieved. The Congolese continue to see Rwanda as the aggressor because of Kigali’s alleged support for the M23 rebels who have controlled swaths of the troubled eastern region for most of the last decade with thousands of lives lost and millions displaced. Thursday’s anticipated agreement to end the fighting includes a US-brokered economic pact, so both sides can benefit from the valuable minerals funding the conflict. It would also create an opportunity for interested US businesses to invest. Any deal still leaves lots of room for uncertainty, however, once Trump’s photo ops with DR Congo’s President Félix Tshisekedi and Rwanda’s Paul Kagame are done. “The difficult work of resolving the underlying economic, mining, and human rights issues will need to be firmly addressed by the Congolese, Rwandans, and the M23 if peace is the ultimate goal,” cautioned Benjamin Mossberg of Field Focus, a Washington advisory firm. “It’s easier to bring people to Washington and sign a document in front of the cameras — peace will be much harder.” |

|

South Africa extends growth streak |

South Africa recorded stronger GDP growth in the third quarter than many analysts had expected. The 0.5% growth, compared with the previous three months, marked a fourth straight quarter of expansion, extending the economy’s longest growth streak since 2021, when the country was recovering from the COVID-19 pandemic. The 2.1% year-on-year growth — which follows fewer power cuts and improved efficiency by state logistics company Transnet — is “almost considered heroic for the country,” Razia Khan, Standard Chartered’s head of research for Africa, said in a note, adding that the outlook was “looking a little more positive for South Africa.” Goldman Sachs said it would revise up its full-year growth projections in light of the Q3 figures. The growth was driven by strength in the mining sector and domestic consumption but it comes only days after an influential survey showed sentiment among South African manufacturers dropped sharply in November amid weak export sales — a trend that was borne out in the latest economic data. — Alexis Akwagyiram |

|

Wise gets approval from South Africa |

British fintech giant Wise secured conditional approval from South Africa’s central bank to offer international money transfer services to personal customers in the country — its first such approval in Africa. The South African Reserve Bank’s approval paves the way for Wise, which specializes in low-cost international money transfers, to disrupt the market for cross-border payments in Africa’s most developed financial sector. South Africa’s international payments market has long been dominated by banks and global money transfer operators, but fees are often high and opaque. Cross-border flows are largely driven by trade and remittances sent by migrant workers from neighboring Lesotho, Malawi, Mozambique, and Zimbabwe. A report by the nonprofit FinMark Trust found the remittance market for payments from South Africa to countries in regional bloc SADC had “experienced substantial growth” in recent years, with formal outflows growing around $350 million in 2016 to more than $1 billion in 2024. The sharp rise was spurred by the COVID-19 pandemic, which shifted flows from informal to formal money transfer channels. — Alexis |

|

Families demand mercenaries return |

| |  | Vivianne Wandera |

| |

Shamil Zhumatov/Reuters Shamil Zhumatov/ReutersThe families of Kenyans fighting for Russia in its war against Ukraine are calling on their government to help bring them home, as the recruitment of Africans into Moscow’s armed forces becomes an increasingly fraught issue across the continent. More than 1,400 Africans from at least 36 countries — including Cameroon, Kenya, Nigeria, Senegal, and South Africa — are fighting alongside the Russian Armed Forces in Ukraine, Kyiv said last month. Nairobi said it estimated around 200 Kenyans were among their ranks. On Friday, the issue came to prominence in South Africa too, when Duduzile Zuma-Sambudla, the daughter of former South African President Jacob Zuma, resigned as an MP following allegations that she tricked 17 men to fight for Russia as mercenaries in Ukraine. Speaking to Semafor in Nairobi, Susan Kuloba said her 22-year-old son, David Kuloba Shitanda, traveled to Russia in August after failing to find a job at home. He had been in regular contact until early last month. “I just want my son to come back home. And if he is dead, then give me his body.” |

|

Nigeria nominates new defense minister |

Christopher Musa. Marvellous Durowaiye/Reuters. Christopher Musa. Marvellous Durowaiye/Reuters.Nigerian President Bola Tinubu nominated a former chief of the country’s defense staff as defense minister, against the backdrop of a security crisis that threatens bilateral ties with the US. Tinubu tapped Christopher Musa to replace outgoing Defense Minister Mohammed Badaru Abubakar, who cited personal health reasons for his resignation a day earlier. Musa is a recently retired Nigerian army general who Tinubu removed in October when he sacked service chiefs days over reports of an alleged coup plot. The 58-year-old Musa had been chief of defense staff since 2023. Nigeria’s security challenges, marked by a resurgent kidnapping crisis, have turned from a national to an international crisis for Tinubu’s government: The Trump administration has threatened Abuja with sanctions and military actions over the alleged mistreatment of Christian in the country. — Alexander Onukwue |

|

Trump calls Somalis ‘garbage’ |

Brian Snyder/Reuters Brian Snyder/ReutersUS President Donald Trump stepped up his rhetoric against Somalis as his administration blocked all migration from 19 countries that were earlier subjected to a partial travel ban. Following accusations that US government funds were misappropriated in part to support the Somalia-based militant group al-Shabab, Trump told a cabinet meeting Somalis were “garbage.” The administration has been cracking down on migration, and the topic is back in the headlines after two National Guard troopers were shot in Washington, allegedly by an Afghan immigrant, last week. All applications by people from Afghanistan and 10 African countries — including Congo Brazzaville, Equatorial Guinea, Eritrea, and Somalia — among other nations have been halted. Washington has also slashed the number of refugees the US will take in this year, and pressed several African countries to take in so-called third-country nationals deported from the US, or risk tariffs and visa bans. A version of this item first appeared in Flagship, Semafor’s daily global affairs briefing. Subscribe here. → |

|

|

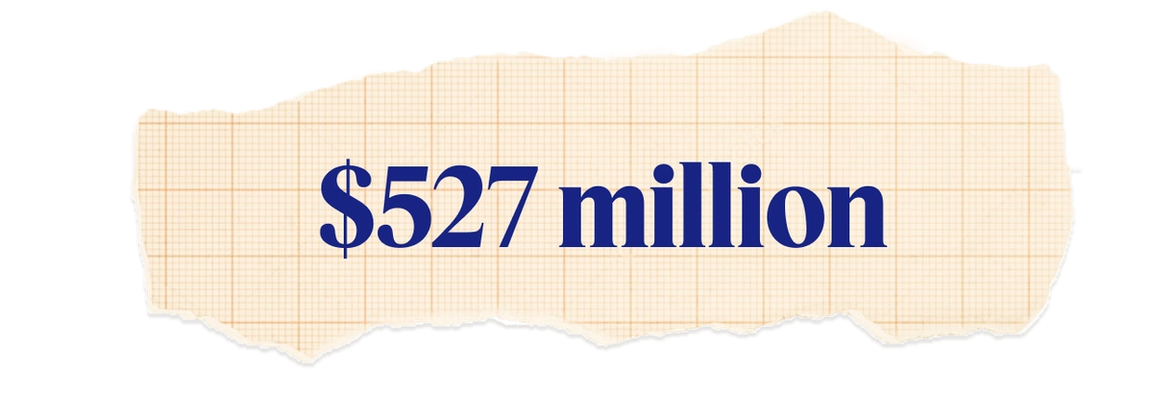

Afreximbank’s Samurai bond |

The amount raised by the African Export-Import Bank from a second “samurai bond” transaction, exceeding its debut $90 million samurai bond from a year ago. Non-Japanese companies can raise money from Japanese investors by issuing yen-denominated debt in Tokyo, known as samurai bonds. Afreximbank said participating at this year’s edition of TICAD, Japan’s flagship Africa conference where Tokyo committed more than $5.5 billion in loans to the continent, was key to engaging would-be investors in the bond. The Japan Credit Rating Agency retained a “stable” A- rating on Afreximbank’s bonds across two assessments in August and November, amid a flurry of downgrades by Western agencies this year. At the same time, it maintained its view that the bank had a “relatively high-risk asset profile” and its shareholder structure mainly consisted “of those with a low credit profile.” |

|

As one of the world’s foremost financial hubs, Abu Dhabi is emerging at the crossroads of innovation, investment, and inclusion — linking markets across the Middle East, Africa, and Asia. Held at Abu Dhabi Finance Week, Semafor will showcase insights from the upcoming Global Findex 2025 report and the Global Digital Connectivity Tracker, translating global research into practical, locally grounded conversations. With Abu Dhabi prioritizing sustainable finance, digital transformation, and cross-border collaboration, the city provides an ideal stage to explore how technology and capital can work together to expand access, inclusion, and economic opportunity. Dec. 11 | Abu Dhabi | Request Invitation |

|

Business & Macro

|

|

|