| | CEOs who successfully take advantage of the sustainability boom have a few things in common.͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Energy |  |

| |

|

- Green economy tops $5T

- Falling fuel standards

- Dubious oil deals

- Weaponized minerals

- Unworried about oil demand

LNG exports, and plastic waste, hit record highs. |

|

It’s time for Democrats to kiss and make up with fossil fuels. That’s the subtext of a new energy strategy produced on Wednesday by Sen. Ruben Gallego, D-Ariz., a moderate in a state that voted for Trump in 2024, and a rumored presidential contender for 2028. The plan doesn’t mention the words “climate change,” and only nods to emissions reductions as a side benefit of policies that are principally aimed at making energy cheaper, more reliable, and more globally competitive. And while it repeatedly emphasizes the cost and reliability benefits of renewables, it also calls for new steps to “ensure reliable oil and gas supplies.” “I think we may alienate some people,” Gallego told me, referring to Green New Deal-style environmentalists hell-bent on a rapid fossil fuel phaseout. But if Democrats want to win elections, he said, they need to refocus on affordability: “We can’t force the [clean energy] transition on the individual consumer, because that really affects peoples’ bottom line.” That may mean countenancing a slower rollout of EVs, for example, or swallowing some new fossil fuel infrastructure. Still, the route to cheaper energy leads back to many of the same policies climate activists want to see. Republicans have made it easy for Democrats to seize command of the energy affordability issue, Gallego said, by railing against things like vehicle fuel standards and tax credits for renewables and energy efficiency, which may fit into their anti-green culture war but take perfectly sensible cost-saving options off the table. The basic problem with typical energy messaging across the political spectrum is that most Americans simply don’t care about where their energy comes from and aren’t motivated by crusades for or against any particular technologies. They mainly care how much stuff costs. To that end, the Gallego plan “reflects voters’ priorities, rather than the green activists’ agenda,” said Josh Freed, senior vice president for climate and energy at the think tank Third Way. “It’s the most genuinely ‘all-of-the-above’ plan we’ve had since Obama.” |

|

Green economy tops $5 trillion |

| |  | Tim McDonnell |

| |

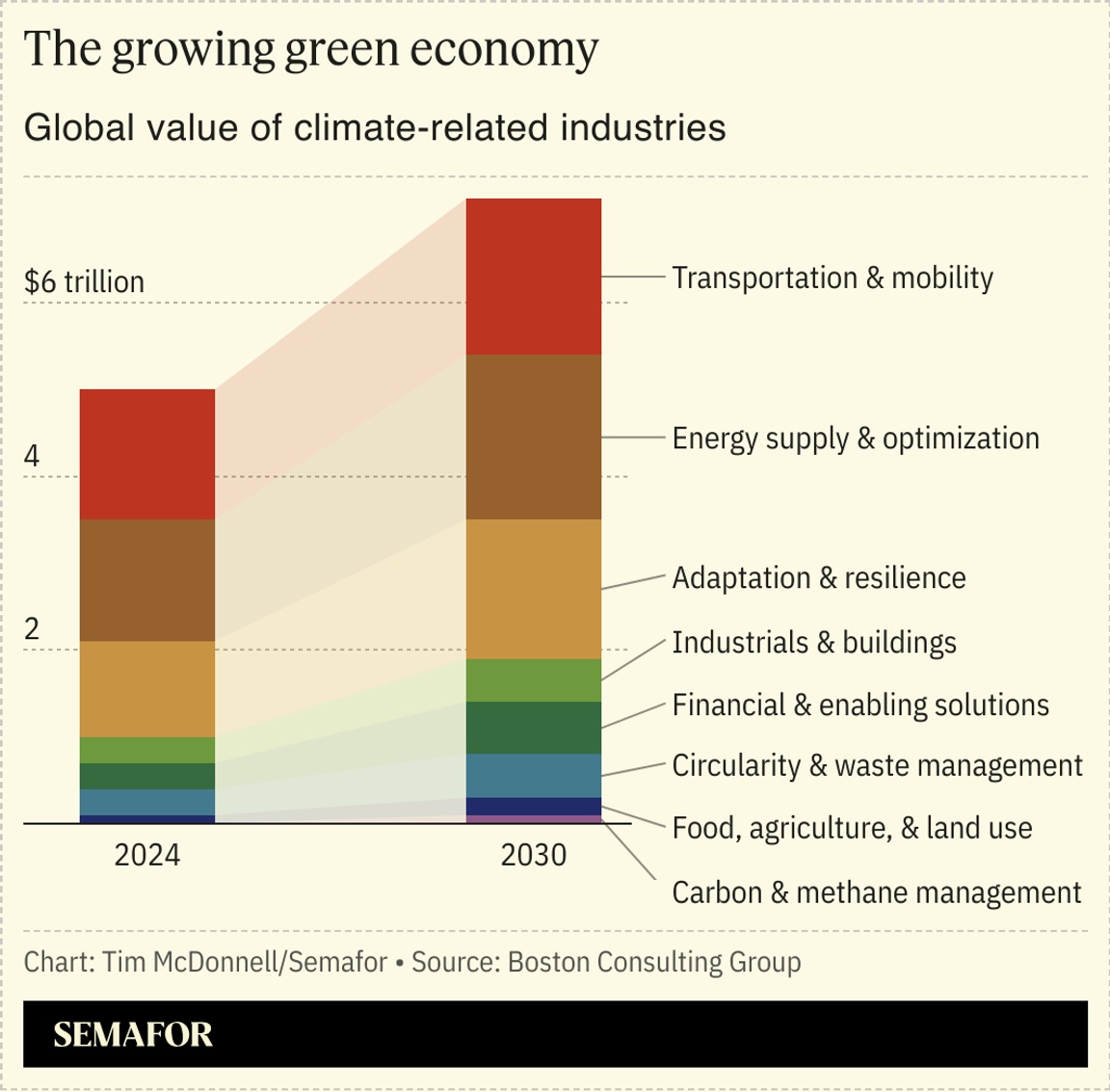

Businesses aimed at reducing emissions and adapting to climate change impacts are the second-fastest growing sector of the global economy after tech, and are on track to be valued at more than $7 trillion by 2030, a Boston Consulting Group study found. Steeply falling costs for renewables, electric mobility, and other key technologies have made sustainability-related investments increasingly insulated from shifting political winds; more than half of global emissions can now be addressed using technologies that are already cost-competitive, the study found. And as climate impacts worsen, the potential costs companies face through inaction are mounting. Whereas in the past many CEOs of large companies argued that sustainability-related investments were mainly a PR exercise, there’s a rapidly growing sense that “this is not about sacrificing the business, it’s about taking advantage of a growing part of the world economy,” Rich Lesser, BCG’s global chairman, told Semafor. The sustainability economy can be compared to AI, Lesser said: People might quibble about the pace at which it will progress, but “there’s no sense this trend will reverse. This is a long-term trend that is reasonable to bet on and probably risky to bet against.” |

|

Hannah McKay/Reuters Hannah McKay/ReutersThe Trump administration moved to significantly roll back vehicle fuel efficiency standards, a setback for climate activists that will also likely raise costs for drivers. Low-emission vehicles have been a target of the administration and Congressional Republicans for months, including through the unwinding of tailpipe emissions regulations and the elimination of tax credits for electric vehicles. Now, the Transportation Department plans to slash rules adopted by the Biden administration that required automakers to make their cars 2% more fuel efficient every year, which the White House argued “effectively resulted in an EV mandate.” That requirement will now fall to 0.5%. The change will make new cars less expensive, the administration said. But that could be offset by higher fuel costs; a Biden administration study found improved fuel efficiency standards would save most drivers $600 on fuel over the course of a car’s lifetime. Auto executives, who generally supported the latest change, pledged to keep developing EVs anyway — but the lower standards will make it easier to keep selling SUVs and pickups, which have a higher profit margin. |

|

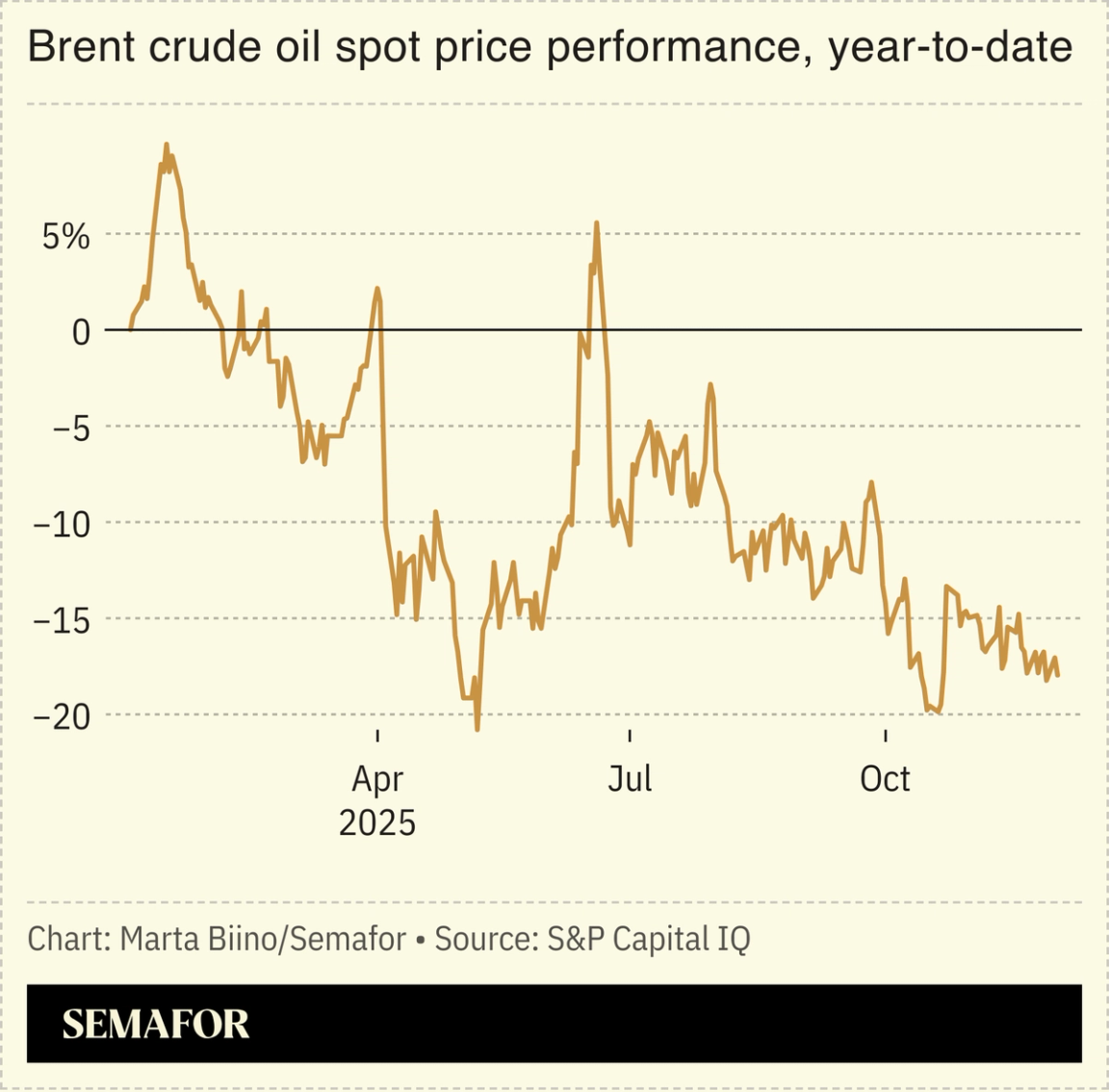

Stringer/Reuters Stringer/ReutersOil prices rose on Thursday after Ukraine carried out another strike on Russian oil infrastructure, and as US-brokered peace talks in Moscow yielded scarce progress. Kyiv’s military campaign against Russian oil refineries “has shifted into a more sustained and strategically coordinated phase,” the consulting firm Kpler reported, which will likely bring more pain for Russian drivers. But so far it’s clearly not enough to change the Kremlin’s calculus. For now, Moscow appears to be betting that it can use the prospect of new fossil fuel and mineral deals to entice the Trump administration — specifically the real estate developers-turned-lead negotiators Jared Kushner and Steve Witkoff — to ramp up pressure on Kyiv to accept major concessions. But as Semafor’s Ben Smith noted, there’s little reason to believe that a new era of US-Russia business deals would pan out any better than they have in the last three decades, especially after European leaders agreed this week to accelerate their timeline for ending all Russian gas imports. “It’s the stupidest thing ever,” Bill Browder, once the biggest foreign investor in Russia and now a bitter Putin critic, told Smith, “to think the Russians will let Americans get a single penny out of this.” |

|

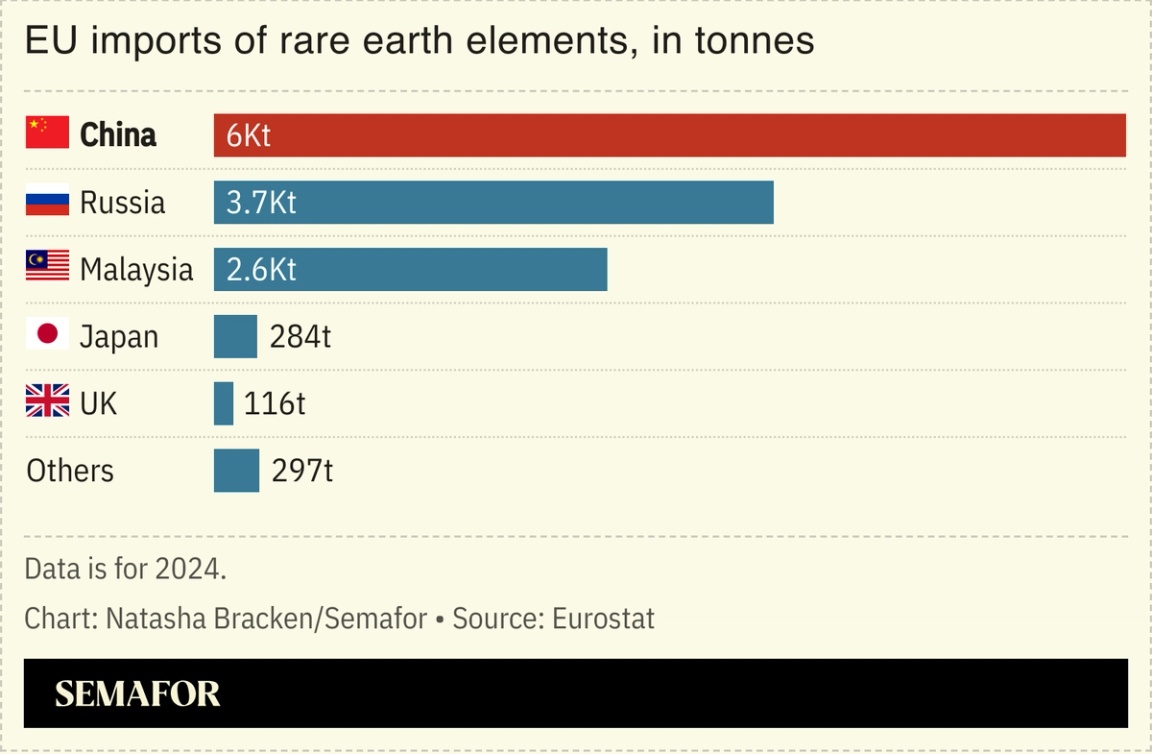

The European Union announced a new plan on Wednesday to secure critical mineral supplies as countries grow increasingly concerned over China’s market stranglehold and its willingness to weaponize it. Both the EU and US have found themselves vulnerable to Beijing’s leverage over critical minerals, essential for some semiconductors, batteries, and weapons, and while that risk pushed Washington to sign a string of bilateral deals with mineral-rich nations, Brussels has lagged behind. The bloc’s new €3 billion strategy aims to counter that by bankrolling mining, refining, and recycling projects of the vital minerals and metals inside Europe and abroad, and create a European Critical Raw Materials Center to oversee it all. — Natasha Bracken |

|

Unworried about oil demand |

Saudi Arabia has no worries about future oil demand and continues to invest in boosting its crude export capacity, Finance Minister Mohammed Al-Jadaan said in a briefing to reporters. “The worry we have is not oil demand” but output, he said. Spare production capacity globally is “under pressure” and “not as big as it’s perceived to be,” leaving the oil market more prone to price shocks, Al-Jadaan said. The kingdom has “defeated” forecasters who predicted that oil demand was no longer growing, he added, with some organizations forced to “adjust their projections on a continuous basis.” The International Energy Agency recently revised its prediction that oil demand could peak this year, saying demand could now keep growing to 2050. Saudi Arabia is continuing to invest in gas production and renewable energy for domestic power generation, which could free up 1 million barrels a day of crude for export, Al-Jadaan said. — Matthew Martin |

|

New Energy- The Trump administration is pushing to block the New England 1 wind farm off Massachusetts, asking a federal judge to return a project permit for additional review.

- South Korea and the US will establish a joint venture to help Washington secure enriched uranium for its nuclear power plants.

- UK regulator Ofgem approved £28 billion in grid funding through a price-control framework aimed at reducing volatility in energy bills.

Fossil Fuels Hamad I Mohammed/Reuters Hamad I Mohammed/ReutersFinance- Tom Steyer’s asset management firm is targeting venture debt, a private credit niche that’s recovering after Silicon Valley Bank’s 2023 failure caused lending to drop by a fifth.

- Floods in South and Southeast Asia have killed more than 1300 people and caused at least $20 billion in damage since late last month.

Politics & Policy- Global plastic pollution will reach 280 million metric tons annually by 2040, a new report found.

- The EU climate commissioner dismissed opposition to the bloc’s carbon border tax from China, India and Saudi Arabia, calling it “not very credible” and arguing the measure would create fair competition for European companies.

Minerals & Mining- Copper demand is boosted by the construction of grid infrastructure for green energy and AI data centers, which require 27 to 33 tonnes of copper per megawatt – more than double what conventional data centers need, the FT reported.

EVs- Ford’s EV sales continued to decline in November, as the company considers dropping its electric F-150 truck.

|

|

|