| | In this edition, the race to go back to tradition thanks to “Trump accounts,” and BlackRock normaliz͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Business |  |

| |

|

- Private credit’s real enemy: ZIRP

- Wall St.’s top cop stays busy

- Saudi debt binge

- Don’t say ‘climate change’

Meta’s metaverse reverse … PIMCO’s ‘Buy America’ bet pays off … |

|

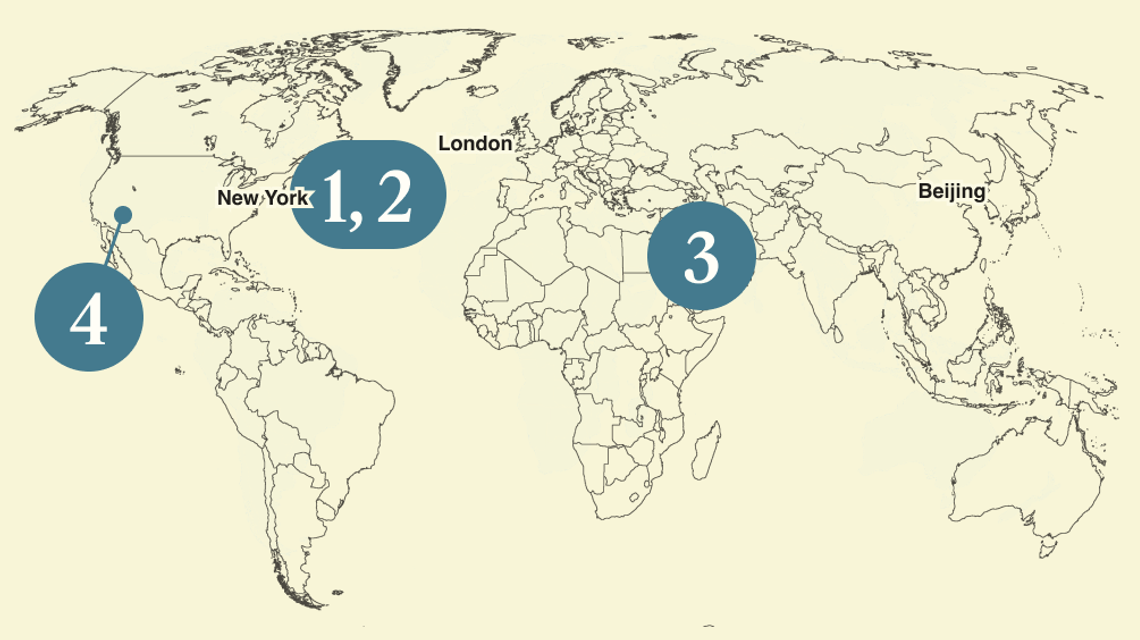

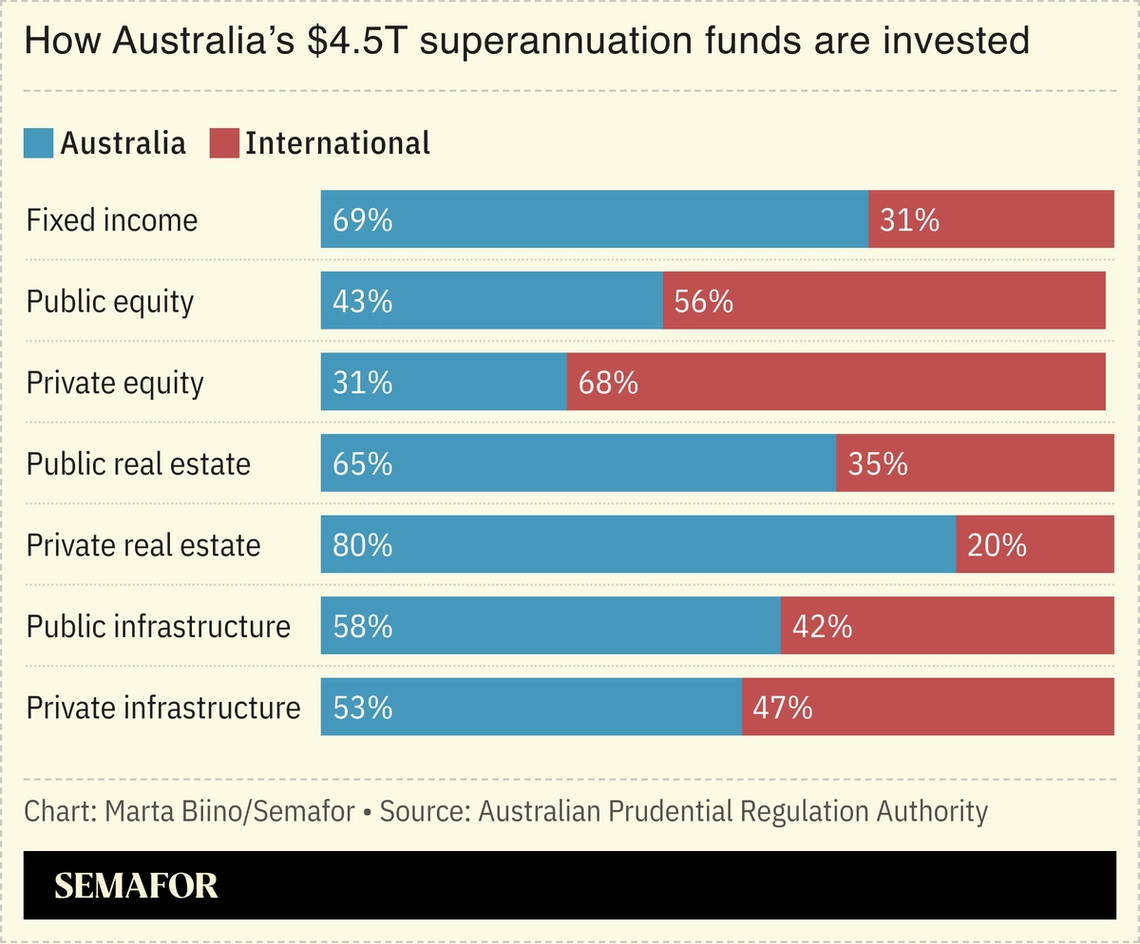

During the 2010s ride-share wars, the joke was that the brightest minds in Silicon Valley had reinvented the public bus. Now, the brightest minds on Wall Street, in tackling the retirement crisis left by the decline of traditional pension plans, have reinvented… the traditional pension plan. That begins with “Trump accounts,” which would seed every US newborn with $1,000 in an investment account. Michael Dell’s $6.25 billion gift this week will supplement that for slightly older kids who missed the cutoff. The government is rewriting rules to allow that money to be invested not just in stocks and bonds but in private equity, private credit, real estate, and infrastructure, and Wall Street is — obviously — salivating at the chance to manage it all. The model, former SEC chairman and current SDNY Chief Jay Clayton suggested to me at our The Ledger live event this week, is “a well-run pension fund… invested across American industry as much as possible” — like, he said, Australia. There, a national system of mandatory wage-garnishment has created a $4.5 trillion complex of “superannuation” funds — an astounding $300,000 per worker — that’s invested mostly in Australian stocks and property, with enough left over for the country to punch well above its weight as an international investor. The US Social Security trust fund has about $15,000 per employed person today, and it’s clipping Treasury coupons.  This may sound like a justification for a Wall Street money grab. But the best case for it is psychological. The gap between how the economy is doing (mostly good) and how people feel about it (mostly bad) has been the defining political factor for two successive White Houses now. As BlackRock CEO Larry Fink told me earlier this year: “You’re detached from the economy, and you don’t feel like you’re winning.” Programming note: I’ll be in the Middle East next week for Abu Dhabi Finance Week — drop me a note if you’re on the ground. |

|

Loan defaults are coming, but that’s OK |

Kevin Dale/Semafor Kevin Dale/SemaforLoan defaults in the fast-growing world of private credit are coming, but are just a healthy rebalancing after a decade of easy money and few consequences, said a BlackRock senior executive. “Coming from an incredibly benign period in the credit markets, the existence of defaults feels like a signal that there’s a problem. And that’s what I reject,” Michael Patterson said at The Ledger event Tuesday. “There will be people that do this job better and people that do this job worse.” The collapses this fall of several highly indebted companies, some of which involve alleged fraud, has unnerved investors and drawn told-you-so wagging from private credit firms’ bank rivals. The trailing 12-month default rate for private loans — a roughly $2 trillion market — hit 1.3% this summer, up from less than 0.5% three years earlier but well short of the 15% in 2009, according to S&P Global. The era of free money did a lot of suboptimal things to the economy — negative interest-rate bonds, underfunded pensions, vans with robot pizza chefs — but one we still haven’t shaken is the sense that loans shouldn’t go bad. Interest rates were so low for so long that bad businesses were able to borrow and refinance instead of admitting they were never going to be able to repay. Patterson is right that the market lost its tolerance for occasional failure. Read Liz’s view on why private credit’s real enemy remains the ZIRP legacy. → |

|

|

Think of the defense lawyers |

Kevin Dale/Semafor Kevin Dale/Semafor“The defense bar shouldn’t worry about the breadline,” was Manhattan US Attorney Jay Clayton’s response when Semafor channeled concerns bubbling among New York’s white-collar lawyers that federal prosecutors would be too distracted by President Donald Trump’s immigration and drug agenda to focus on financial fraud. “We’re going to increase the size of our white-collar group… let those folks know they can still pay for college,” Clayton said at The Ledger event Tuesday. The Southern District of New York has operated somewhat apart from the Justice Department’s headquarters, with a long leash to tackle crimes in its own backyard. Clayton has balanced that bread-and-butter, including an indictment of 777 Partners executives this fall in a story we’ve been tracking for a while, with White House priorities like fentanyl and the sticky responsibility for overseeing the release of files related to Jeffrey Epstein. Clayton also responded to another delicate aspect of the job under Trump: the president’s free use of pardons for politically connected felons. He declined to comment on specific cases but said “our constitutional system is pretty remarkable in that in almost all cases, whatever branch of government is acting, there’s a check.” He cited former Supreme Court Justice Robert Jackson on the high court’s role in that system: “We’re not final because we’re infallible. We’re infallible because we’re final. They have the final word. And in the pardon, the president has the final word.” |

|

Saudi’s borrowing binge rolls on |

Riyadh’s skyline. Bernd von Jutrczenka/picture alliance via Getty. Riyadh’s skyline. Bernd von Jutrczenka/picture alliance via Getty.Saudi Arabia will keep borrowing to fund its economic transformation as oil prices stay low, Semafor’s Matthew Martin writes. Oil exports’ contribution to the kingdom’s economy since 2017 has been “stagnant,” while the non-oil sector has grown more than 5% a year on average over the same period, Saudi Arabia’s finance minister said. Expect much of that borrowing to come from foreign funders: Banks there are increasingly squeezed after funding domestic projects. Riyadh still has ample room to borrow — its debt-to-GDP ratio is among the lowest in the world’s top 20 economies — and the government is increasingly turning to private debt placements in order to avoid crowding out other state-controlled borrowers like Public Investment Fund, its sovereign wealth vehicle, and Saudi Aramco, which are also tapping the bond market. |

|

Dems try new tactic: Don’t say ‘climate change’ |

Ruben Gallego. Jon Cherry/Reuters. Ruben Gallego. Jon Cherry/Reuters.Democrats’ new energy strategy bows to the political moment, with no explicit mention of “climate change” and only vague nods to emissions reductions as a side benefit of policies aimed at making energy cheaper, more reliable, and more globally competitive. “I think we may alienate” ardent environmentalists hell-bent on a rapid fossil fuel phaseout, Sen. Ruben Gallego, a moderate Arizona Democrat and rumored presidential contender, told Semafor’s Tim McDonnell. But “we can’t force the [clean energy] transition on the individual consumer, because that really affects people’s bottom line.” Still, the route to cheaper energy leads back to many of the same policies climate activists want to see. Gallego said Republicans have made it easy for Democrats to seize command of the energy affordability issue by railing against renewables. Most Americans don’t care about where their energy comes from, Tim writes: “they care how much stuff costs.” |

|

“What the hell happened to free enterprise?”

— California Gov. Gavin Newsom |

|

➚ BUY: Rosaries. Count the pope among a growing number of AI skeptics, warning that the youth risk stunting their skill sets. ➘ SELL: Groceries. Kroger cut its guidance for the year, saying the company was facing stiff competition for consumers’ wallets. |

|

Companies & Deals- A sporting chance: Saudi Arabia’s PIF will own 93% of Electronic Arts following its takeover, according to fresh filings. It’s a big overseas bite for an oil-rich nation that’s trying to take less of them.

- Lead left: Anthropic has hired lawyers from Wilson Sonsini to explore an IPO, no doubt setting bankers scurrying. (Have you already been hired? Call us!)

Watchdogs- The art of saying something: French President Emmanuel Macron made a blunt case for multilateralism at a meeting with Chinese President Xi Jinping, warning that the world was facing a “disintegration of the international order.”

- Fighting chance: Kevin Hassett, the frontrunner to be the next Federal Reserve chair, is unlikely to get the bipartisan support he’ll need, Semafor’s Eleanor Mueller writes. Those in Washington and beyond — including bond investors — are questioning whether Hassett can stand up to a president trying to bend the central bank to his will.

Markets- Continental CVS receipt: The perfect metaphor for Europe’s economic woes: The eight-inch tag hanging off a stuffed elephant toy.

|

|

|