| | In this edition, how the pandemic-era financial froth — SPACs, meme stocks, and crypto fever — has t͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Business |  |

| |

|

- Instagram TV, with Adam Mosseri

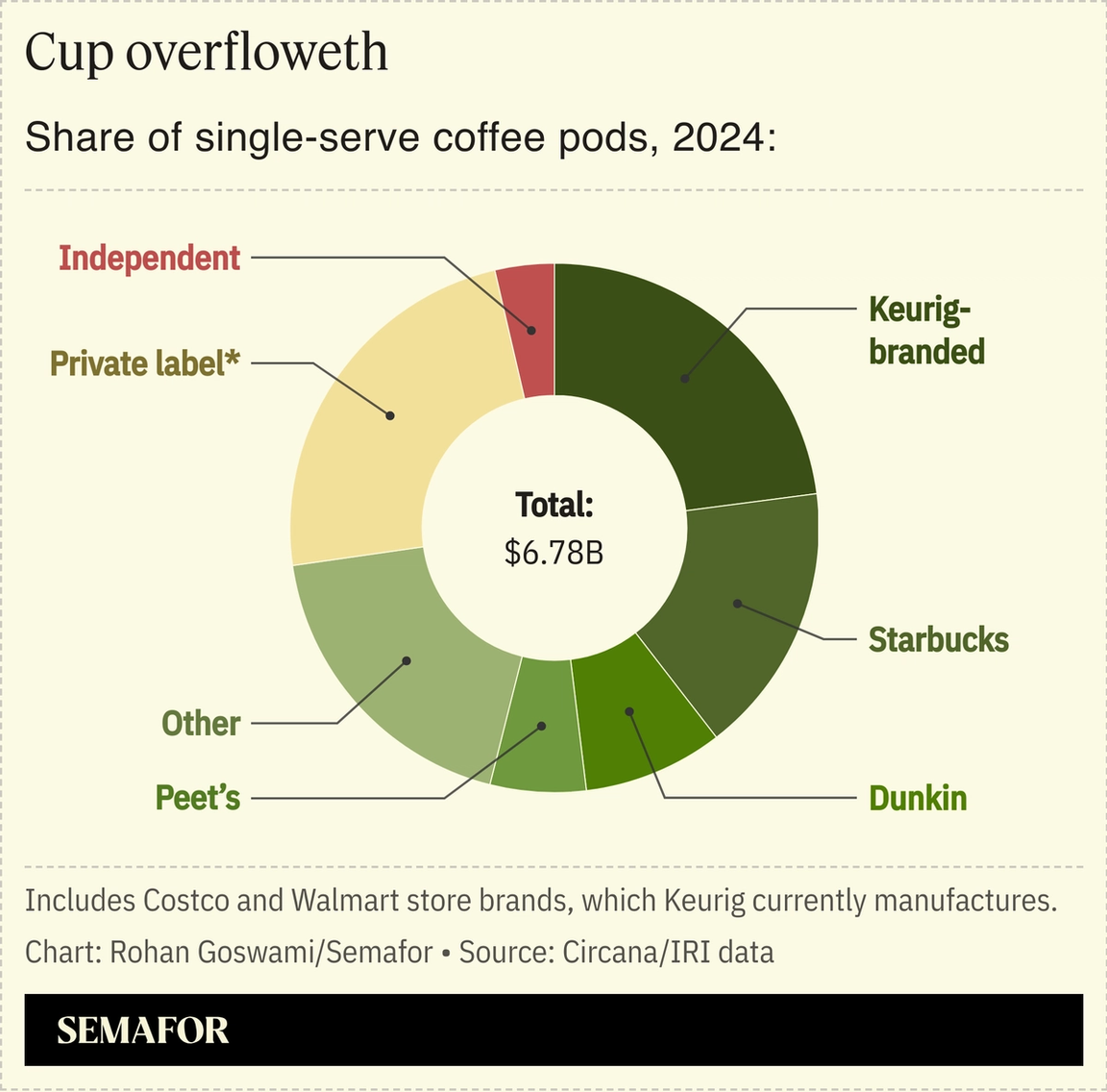

- Keurig’s domination

- Think of the white men

- Riyadh on the rocks

- The other media merger to watch

Danny DeVito’s Blackstone cameo … |

|

Is the US now the dumb money? Trump Media’s $6 billion merger with a nuclear energy company doesn’t even pretend to make business sense. TMTG is, to borrow Matt Taibbi’s defining phrase of another era, the vampire squid of this moment, haphazardly jamming its blood funnel into anything that smells like money. (It has been less successful than Goldman Sachs in that regard: TMTG shares are down 80% since early 2024, though Trump’s personal stake is still worth $1.2 billion.) Unlike Wall Street profit-seekers, it’s laying its own scent trail by following Trump’s favored policies — first into conservative social media, then to bitcoin, and now to nuclear energy. The pandemic-era financial froth — SPACs, meme stocks, and crypto fever — was supposed to die with rising interest rates. Now those things look almost charming. The inanity and nihilism is still there, but tinged with something darker and more permanent, a sense that the rules of capitalism changed. As my colleague Rachyl Jones reported this week, critical minerals and nuclear energy companies are embracing SPACs in the hopes of catching Trump’s eye and bagging a government investment. The nuclear startup, TAE, is merging with TMTG not because there’s an obvious tie between fusion and all-caps threads, but because of the Trump firm’s “access to significant capital.” American capitalism is losing its way even as other countries are moving away from suboptimal and clunky state-run economies. Gulf countries are professionalizing their investments and no longer want to be the world’s dumb money. Japan is forcing sleepy conglomerates, whose structures protected the elite, to slim down and compete. Meanwhile, the world’s leading democracy is starting to look like a family office with a meme hobby. |

|

Everything is TV now, even Instagram |

Semafor/YouTube Semafor/YouTubeTelevision’s reemergence has sent a decade of social-media apps scrambling to win that screen, too. “We’re late to the game,” Instagram’s Adam Mosseri tells Semafor’s Mixed Signals podcast, which will be available Friday. Instagram launched its first TV app this week, on Amazon’s Fire TV streaming device. “Historically, we’ve been fighting with some pretty fierce competition for people’s time on mobile phones,” Mosseri tells Semafor’s Ben Smith and Max Tani. “But obviously there’s an immense amount of time spent on TV, where some of our competition is showing up with force.” Chiefly, that’s YouTube, which is television for much of Gen Z. “When they’re turning on the TV, they’re turning on YouTube,” YouTube CEO Neal Mohan told Mixed Signals a few months ago. “They expect to see their favorite creator, their favorite podcaster, their favorite gaming livestream, an NFL game, a new music video dropped by their favorite artist, all in one place.” That’s a challenge for Instagram, which already played catch-up to TikTok in short videos consumed on phones and is now trying to claim space on TV screens, where long-form and premium content dominate. “A 20-minute video, which doesn’t even seem long, in the Instagram world is very long,” Mosseri said. Listen to Mixed Signals wherever you get your podcasts, or watch it on YouTube. |

|

Keurig keeps iron grip on coffee pods |

“Our favorite monopolists,” a senior executive at Peet’s Coffee moaned in a 2015 email to colleagues. He was referring to Keurig, which had pressured distributors, bricked its countertop machines to squeeze more life from an expiring patent, and boxed rivals out of the growing market for coffee pods.  Those efforts are the subject of an ongoing private antitrust lawsuit that the company’s pending $18 billion takeover of Peet’s has given new relevance. The deal would create a global coffee giant and bring one of Keurig’s biggest customers in-house — the type of vertical integration that competition experts have long warned against, and a deal whose consequences, critics warn, will be measured out with nickels, dimes, and coffee spoons in every grimy office kitchen in America. That deal is set to move forward: The deadline for the Federal Trade Commission to seek additional information from Keurig and Peet’s — a sign the agency might seek to block the deal — expired without any such requests, people familiar with the matter said. |

|

EEOC opens the door to white men |

@andrealucasEEOC/X @andrealucasEEOC/XCorporate America has barely extricated itself from the last culture war, beating a hasty retreat from progressive policies. Here comes the next one. “Are you a white male who has experienced discrimination at work based on your race or sex? You may have a claim to recover money under federal civil rights laws,” the head of Trump’s Equal Employment Opportunity Commission said on X yesterday. The EEOC, established in 1965 to enforce the Civil Rights Act in the workplace, is being employed in reverse, capturing a political wave led by the Trump administration and like-minded allies, concentrated in Silicon Valley, who believe corporate DEI initiatives didn’t so much balance the scales as re-skew them in the opposite direction. “For white male millennials, DEI wasn’t a gentle rebalancing — it was a profound shift in how power and prestige were distributed,” Jacob Savage wrote for Compact in an article getting heavy reading this week. Another data point: A money manager at investor Carl Icahn’s firm sued both his bosses and contact lens maker Bausch + Lomb, alleging the company’s preference for “diverse” board members cost him millions of dollars in pay. |

|

Saudi tipples beckon expats |

A pop-up non-alcoholic bar in Riyadh. Fayez Nureldine/AFP via Getty Images. A pop-up non-alcoholic bar in Riyadh. Fayez Nureldine/AFP via Getty Images.In the world of high finance, a job listing for a bartender in Riyadh might seem like a blip. But help-wanted ads from high-end hotel chains are the latest sign that the kingdom, which already loosened rules around private alcohol sales, is ready to go further in its bid to lure Western financiers whose talent and capital are crucial to its economic reinvention, Semafor’s Matthew Martin reports. The lack of alcohol has been an oddly significant hurdle for Wall Street and City bigwigs, who prefer the relative libertinism of nearby Dubai and Abu Dhabi. Allowing booze will help recast Riyadh as a viable home rather than a temporary hardship post and give Saudi Arabia a boost in its bid to win the “regional headquarters” race. |

|

Sinclair weighs all options to win Scripps |

Alex Wong/Pool via Reuters Alex Wong/Pool via ReutersAs the Warner Bros. Discovery saga deepens, another contentious media merger is worth a moment’s consideration. Scripps on Tuesday rejected a takeover offer from Sinclair that would combine two of the largest owners of TV stations under the control of conservative-leaning Sinclair. Scripps, which is still controlled by its founding family, has said little about its reasons — but notably did not dismiss the bid on price alone, saying only that it wasn’t in the “best interests” of shareholders. “There is obviously an ideological difference,” Dan Kurnos, a broadcast-industry analyst at Benchmark, told Semafor. Sinclair has offered to set up guardrails that would insulate Scripps’ stations from meddling by Sinclair’s right-leaning brass, according to a securities filing, though the history of those promises at media companies — whose owners like the megaphone they offer — is spotty at best. |

|

Each Saturday, Quartz Markets brings award-winning journalist Catherine Baab’s sharp review of the week in US markets, plus insights on risks and opportunities to help you navigate the coming week. Membership required. Subscribe now. |

|

➚ BUY: YouTube. Hollywood’s biggest night is heading to the small screen. The Oscars will stream exclusively on YouTube in 2029, the latest sign of tech’s expanding influence. ➘ SELL: U2. Oasis turned down an offer to play at Las Vegas Sphere after Bono, whose band opened the venue in 2023, warned him about high production costs. James Dolan’s venue is still operating at a loss. |

|

Companies & Deals- Rules of engagement: Defense-tech startup Anduril’s CEO tells Semafor’s Reed Albergotti that legacy contractors are “fighting dirty” by stoking stories about crashing drones, failing undersea vehicles, and testing mishaps.

- Lane discipline: More than a quarter of Tesla shareholders want Elon Musk to spend more time in Washington, an EV Intelligence survey found. That’s fewer than say his political activities which hurt the automaker, but more than we’d expect.

- Everything is fine: The future of a $10 billion Oracle data center in Michigan is in doubt after talks of funding from Blue Owl stalled.

- Beyond petroleum: Woodside Energy’s Meg O’Neill will become BP’s fourth CEO in six years, the first woman, and the first outsider. She replaces Murray Auchincloss after pressure from activist investor Elliott to scrap a renewables pivot and refocus on oil and gas.

- Juicing it: Chime is offering users $1 just for opening the app, something commentators saw as an effort to juice engagement numbers.

Watchdogs- Fine print: The FCC removed the word

|

|

|