|

Why Europe should resist the Second China Shock

Deindustrialization sounds peaceful and easy and pleasant, but it's not.

|

Europe has a lot on its plate these days. It’s facing a hostile Russia that has no intention of stopping with Ukraine. It’s dealing with tariffs and various other threats from an unpredictable and hostile Trump administration. And it’s struggling with internal unrest over migration from the Middle East and Central Asia. That would be enough to keep anyone occupied. But on top of all that, Europe is being buffeted by the Second China Shock.

The Second China Shock is another name for the flood of high-tech exports that China has been sending out around the world in the last few years. China’s economy is still suffering from the prolonged effects of the real estate bust that began in late 2021. In response, Xi Jinping’s government has unleashed the most expensive and wide-ranging industrial policy the world has ever seen, promoting high-tech manufacturing across a variety of sectors. Because the economy is in the doldrums, Chinese consumers themselves aren’t able to buy all the stuff that their government is paying Chinese companies to make — electric vehicles, ships, machinery, and so on. So the companies are selling that stuff overseas, anywhere they can, for cut-rate prices.

In Europe, that has manifested as a giant trade deficit with China:

|

This flood of Chinese exports to Europe is being boosted by several tailwinds. First, China’s currency has gotten cheaper — partly as a result of China’s weak domestic economy, and partly because the government has pushed down the exchange rate in order to pump up exports. Shanghai Macro Strategist writes:

This combination — falling relative prices in China and a weaker currency — has made Chinese goods and services extraordinarily cheap in global terms…A vivid example: a night at the Four Seasons Beijing costs roughly $250, compared with more than $1,160 in New York. The price gap is so extreme that it no longer reflects relative productivity or income levels; it reflects a currency that has become fundamentally undervalued…At these valuations, it is virtually impossible for most countries to compete with Chinese exporters. The current level of the yuan is simply too cheap to support a sustainable rebalancing of global trade.

Here’s a chart showing the yuan’s recent depreciation against the euro:

|

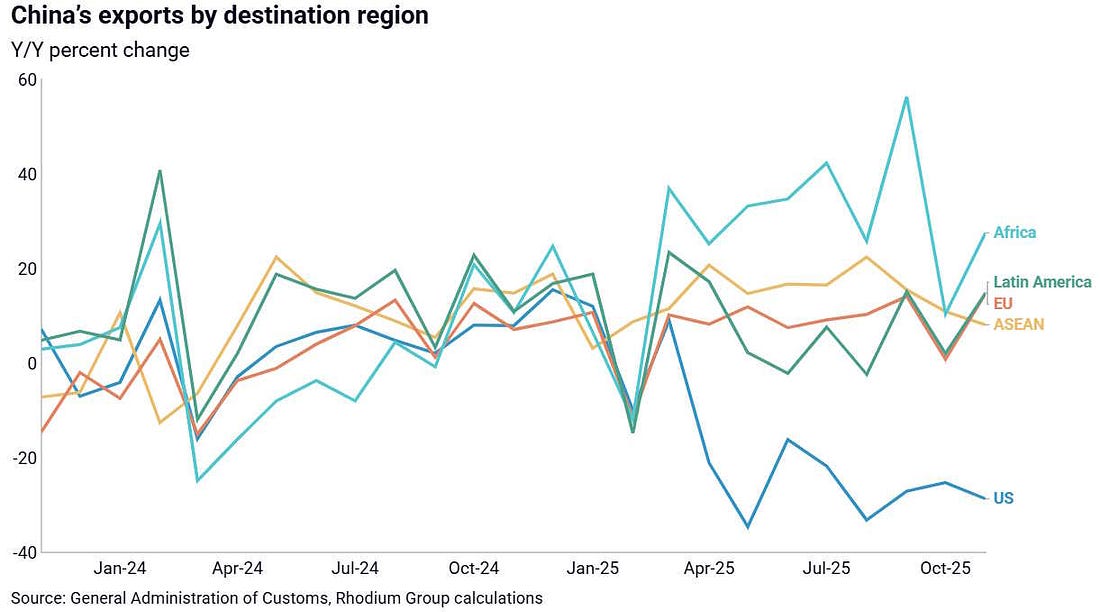

The second tailwind is Trump’s tariffs. Although Trump has backed off of most of his threats of tariffs on China, some important changes — like the end of the “de minimis” exemption for small packages — have gone into effect. And the threat of tariffs is probably prompting Chinese companies to seek other markets. As a result, Chinese exports to America are falling fast, while the country’s exports to other regions — Europe, Southeast Asia, and Latin America — are booming:

|

Some people claim that China’s surge of exports to these other countries is actually going indirectly to the U.S. Those people are wrong. As Gerard DiPippo has shown, “transshipment” to America is quite low. China simply found new customers to buy its products. Europe is the most important of those customers.

This means that although Trump’s boneheaded tariffs on allied countries have hurt U.S. manufacturing, his tariffs on China — and his threats of even higher tariffs on China — have partially insulated America from the Second China Shock. Europe as yet has no such insulation.

At this point you may ask: Who cares? China is selling a bounty of useful consumer goods to Europeans at cut-rate prices; why look that gift horse in the mouth? If a store in your neighborhood had a blowout sale, you’d enjoy it, wouldn’t you? And on top of all that, many of China’s fastest-growing exports to the EU — electric cars and such — are “green” technology that Europe has been trying to promote in order to fight climate change.

Given that Europe has so much else to worry about, why shouldn’t it just take the cheap Chin