| | In today’s edition: US withdraws from Abu Dhabi-based International Renewable Energy Agency, and Eri͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Gulf |  |

| |

|

- US exits renewables group

- Saudi gets Trump mansions

- New Riyadh Four Seasons

- A minerals ‘super region’

- Qatar to join ‘Pax Silica’

- Iran: Heed Trump warning

Saudi wants to bring back wild lions. |

|

IRENA’s US-made budget gap |

Francesco La Camera, the Director-General of IRENA. Maxim Shemetov/Reuters. Francesco La Camera, the Director-General of IRENA. Maxim Shemetov/Reuters.The Trump administration has weakened the budget of the International Renewable Energy Agency (IRENA), according to a person familiar with the matter. The Abu Dhabi-based organization joins dozens of other agencies hobbled by the US’ broader retreat from global causes: IRENA is one of 66 international organizations, many of them linked to climate action, that the Trump administration said at the start of the year it would withdraw from. Even before that, the US had not paid $5 million in dues to the agency in 2025 and is not expected to make its annual contribution this year either, leaving IRENA to grapple with a 22% hole in its operating budget, according to the person, who spoke on condition of anonymity. An IRENA spokesperson said that membership withdrawal “takes effect at the end of the year in which it is expressed” and does not affect a member’s “contractual obligations or its financial obligations for the year in which it withdraws.” The US Embassy in Abu Dhabi did not immediately respond to a request for comment. IRENA is now looking to raise private funds following the US withdrawal, Director-General Francesco La Camera told reporters in Abu Dhabi on Sunday. An annual meeting of IRENA’s members this week marks the unofficial kickoff to Abu Dhabi Sustainability Week, where some 50,000 people, including energy executives, policymakers, investors, and entrepreneurs, will gather to discuss and cut deals related to the energy transition. — Kelsey Warner |

|

Saudi’s $24M Trump-branded mansions |

Eric Trump and Dar Global CEO Ziad El Chaar at the cornerstone laying event of Trump International Wadi Sfar. @erictrump/Instagram. Eric Trump and Dar Global CEO Ziad El Chaar at the cornerstone laying event of Trump International Wadi Sfar. @erictrump/Instagram.The Trump Organization is moving ahead with a second residential project in Jeddah after rapid early sales at its first development in the city, bringing the value of its real estate ambitions in the kingdom to more than $10 billion, Executive Vice President Eric Trump told Semafor. Alongside Jeddah, the company is branding a golf and residential community in Diriyah — a $63 billion Public Investment Fund–backed project on the outskirts of Riyadh that’s being developed into a cultural and tourist destination — in partnership with Dar Global, the international arm of a Saudi-based developer. Dar Global CEO Ziad El Chaar said the Diriyah project will include about 500 mansions, priced between $6.7 million and $24 million. The expansion coincides with tightening housing conditions in Riyadh, where a five-year rent freeze is in place, as well as a broader Saudi real estate push backed by more than $1.3 trillion in planned spending across the government’s gigaprojects. — Manal Albarakati |

|

Saudi developer’s rising prominence |

Planned Four Seasons hotel and residences at Diriyah. Courtesy of Midad Real Estate. Planned Four Seasons hotel and residences at Diriyah. Courtesy of Midad Real Estate.Saudi Arabia’s Midad Real Estate unveiled plans for a $827 million Four Seasons hotel and private residences in the Diriyah cultural district on the outskirts of Riyadh, in the latest sign of the developer’s increasing ambition. Diriyah is a $63 billion, Public Investment Fund-backed real estate development around a UNESCO heritage site that was the ancestral home of the Saudi ruling family. Midad — whose Chief Executive Abdulelah bin Mohammed Al Aiban is the brother of Saudi National Security Adviser Musaad Al Aiban — also has a $2 billion joint venture with PIF’s Jeddah Central Development Company to develop Atlantis and One&Only hotels in the west coast city. Its portfolio under development also includes a Four Seasons hotel and residences in Jeddah. Separately, Midad’s energy division is reportedly in talks to acquire the international assets of Russia’s Lukoil, after the US imposed sanctions on the Moscow-headquartered company. In October, Midad signed a contract with Algeria’s state-owned energy company Sonatrach for a $5.4 billion investment in oil and gas exploration and development. — Matthew Martin |

|

Gulf eyes Africa’s mining gap |

The decline in the value of mining deals in Africa over the past five years, compared with a more than tripling in Latin America over the same period, according to the McKinsey Global Institute. The divergence shows how risk perceptions continue to weigh on Africa, despite its vast reserves of copper, nickel, manganese, lithium, uranium, silver, and other minerals critical to the energy transition and technology supply chains. That has made miners wary of committing capital — though Saudi Arabia and other Gulf countries want to change that trend, through vehicles like the Public Investment Fund-backed Manara Minerals and Abu Dhabi’s International Resources Holding. The McKinsey analysis, released ahead of this week’s Future Minerals Forum in Riyadh, discusses the potential for greater cooperation in a “super region” spanning Africa, Western Asia, and Central Asia. The area holds more than half of the world’s critical mineral reserves, but has the lowest level of exploration spending of any region globally. |

|

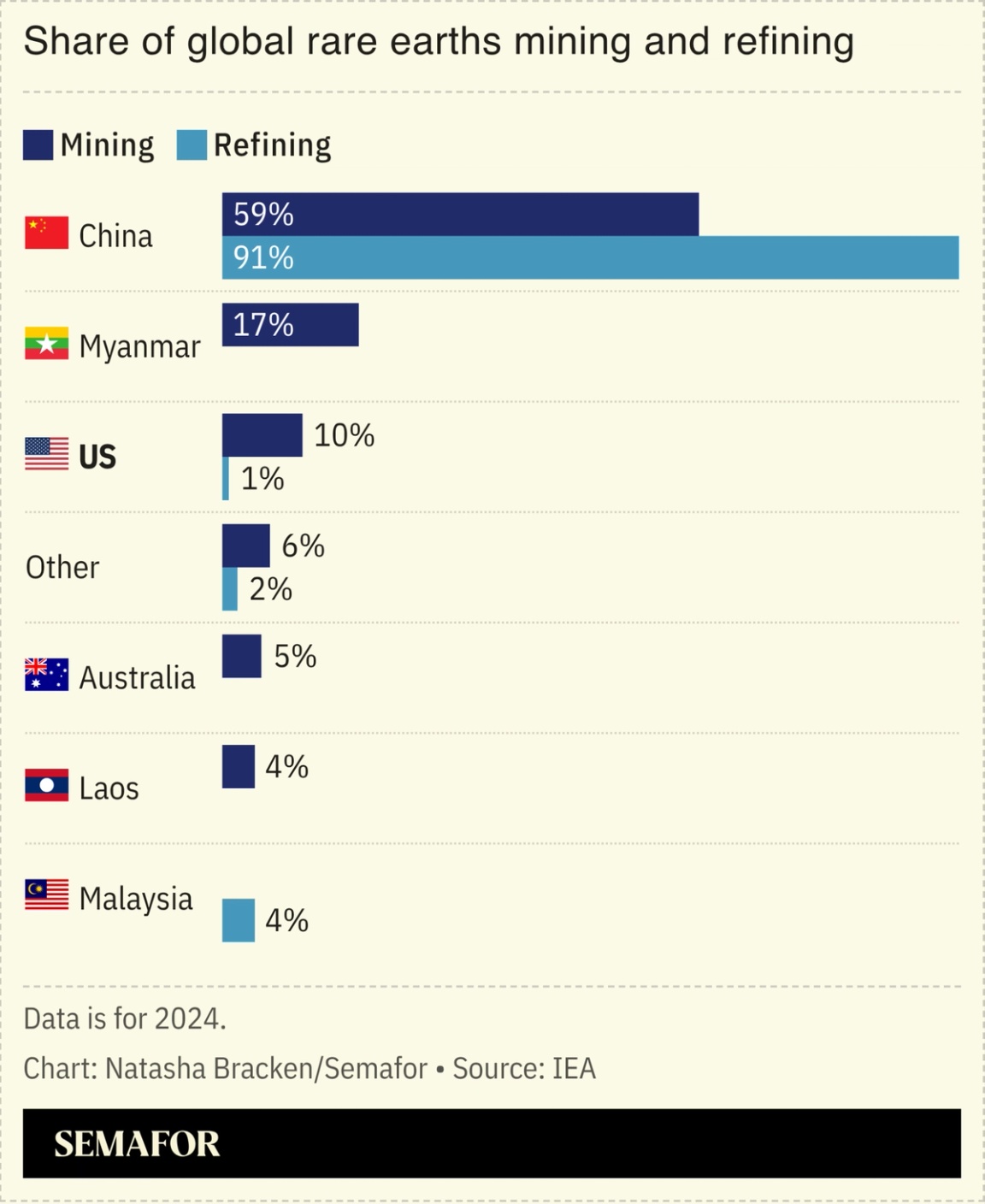

Qatar and UAE join Pax Silica |

Qatar and the UAE will join Pax Silica, a US-led initiative to secure artificial intelligence and semiconductor supply chains, including critical minerals, advanced manufacturing, and computing power, Reuters reported. The program is a crucial part of the Trump administration’s strategy to push allies to stop working with rival nations like China. The group includes Australia, Britain, Israel, Japan, Singapore, and South Korea. Qatar signed the declaration earlier today, and the UAE is expected to follow on Jan. 15. Pax Silica is a “coalition of capabilities,” with membership driven by the industrial strengths and companies of each country, Undersecretary of State for Economic Affairs Jacob Helberg told Reuters. The moves come as Riyadh hosts The Future Minerals Forum from Jan. 13‑15. |

|

View: Trump’s red lines aren’t theoretical |

Kamran/Middle East Images/AFP via Getty Kamran/Middle East Images/AFP via GettyIran would be making a serious miscalculation if it ignored US President Donald Trump’s warning against killing protesters, Jason D. Greenblatt, Trump’s former Middle East envoy, writes in a Semafor column. Trump does “not issue symbolic warnings or negotiate against himself,” Greenblatt wrote. “When a regime’s conduct threatens American interests, whether through narcotics trafficking, weapons proliferation, terrorism, or the export of instability beyond its borders, Trump will act.” |

|

Diplomacy- Türkiye is reportedly seeking to join the defense alliance between Pakistan and Saudi Arabia, which would create a regional bloc with nuclear weapons, wealth, and a substantial defense industry. — Bloomberg

- Qatar’s embassy in Ukraine was damaged during Russian shelling of Kyiv on the night of Jan. 8, although none of its diplomats or embassy staff were hurt. Moscow denied it had targeted the mission and suggested the damage was caused by a “malfunction” of Ukraine’s air defense system.

Energy- QatarEnergy, France’s TotalEnergies, and Italy’s Eni signed a gas exploration agreement with the Lebanese government for the offshore Block 8, on the country’s maritime border with Israel; the companies previously drilled unsuccessfully on the neighboring Block 9. — Reuters

- Abu Dhabi energy company ADNOC confirmed a final investment decision on the SARB offshore gas project, which will deliver 200 million-cubic-feet-a-day of gas by 2030, enough to power more than 300,000 homes.

Water- The Abu Dhabi Fund for Development allocated $1 billion to a program to provide safe water to 10 million people worldwide; it hopes to mobilize $2 billion with support from local and international partners.

|

|

Chester Zoo/Cover Images/Reuters Chester Zoo/Cover Images/ReutersIf Saudi Arabia gets its way, lions could soon prowl the desert again. The kingdom’s largest nature reserve, Prince Mohammed bin Salman Royal Reserve, is exploring the reintroduction of Asiatic lions, more than a century after they were hunted to extinction in the region. If it happens, it would make Saudi the only country outside India with a wild population of the big cats, AGBI reported. It is part of a broader rewilding push that has already seen the return of oryxes and Persian onagers (a member of the horse family) to the kingdom. Alongside flashy new theme parks and luxury resorts, Saudi is keen to showcase its natural landscape that is often dominated in the popular imagination by images and ideas of the Empty Quarter desert, but which also ranges from coral reefs in the Red Sea, to Hejaz mountain resorts, and historic sites in AlUla. A safari park would add to the mix and could both pull in foreign visitors and keep more Saudis vacationing at home. |

|

|