| | In this edition: South Africa hosts contentious naval exercises, a Nigerian drone firm secures US fu͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Africa |  |

| |

|

- Contentious naval exercises

- Ramaphosa’s ambitions

- Nigerian drone firm soars

- Senegal ups oil output

- Gulf eyes Africa mining gap

- Uganda’s ‘forever president’

A virtual museum in Khartoum. |

|

Africa’s long-running argument with the world’s credit rating agencies is becoming harder to ignore. Rising geopolitical fragmentation and shrinking development budgets mean African governments are increasingly reliant on market borrowing — and therefore on the judgments of New York firms Fitch, Moody’s and S&P. Their verdicts shape borrowing costs and, in some cases, whether countries can raise capital for education, health, and infrastructure. This is why 2026 has kicked off with a renewed push — led by the UNDP, the African Union, and a network of local credit rating agencies — to correct what many African policymakers see as a persistent mispricing of African risk. Local and regional African credit rating agencies argue that their global counterparts overweight hard currency constraints and external shocks while underestimating domestic resilience and informal economic activity. The result, they say, is a pattern of swift downgrades during crises but slow upgrades during recovery. These African agencies place greater emphasis on local-currency creditworthiness, subnational finances, and structural reforms to fill those blind spots. But even for regional agencies, data gaps remain acute, forcing reliance on third-party proxies that flatten economic complexity. This fuels the risk of a “single story,” said Aloysius Uche Ordu, a senior fellow at Washington think tank Brookings Institution, channeling the words of author Chimamanda Ngozi Adichie. “We have to tell our own story,” said Ordu. African rating agencies are unlikely to replace global ones anytime soon, nor do they need to. Instead, the continent needs both: stronger local-currency ratings, better data, deeper capital markets, and structured engagement between African and global rating agencies. In a world where cheap money is all but gone, correcting how African risk is understood — and priced — is no longer a theoretical debate. It is a financing imperative. |

|

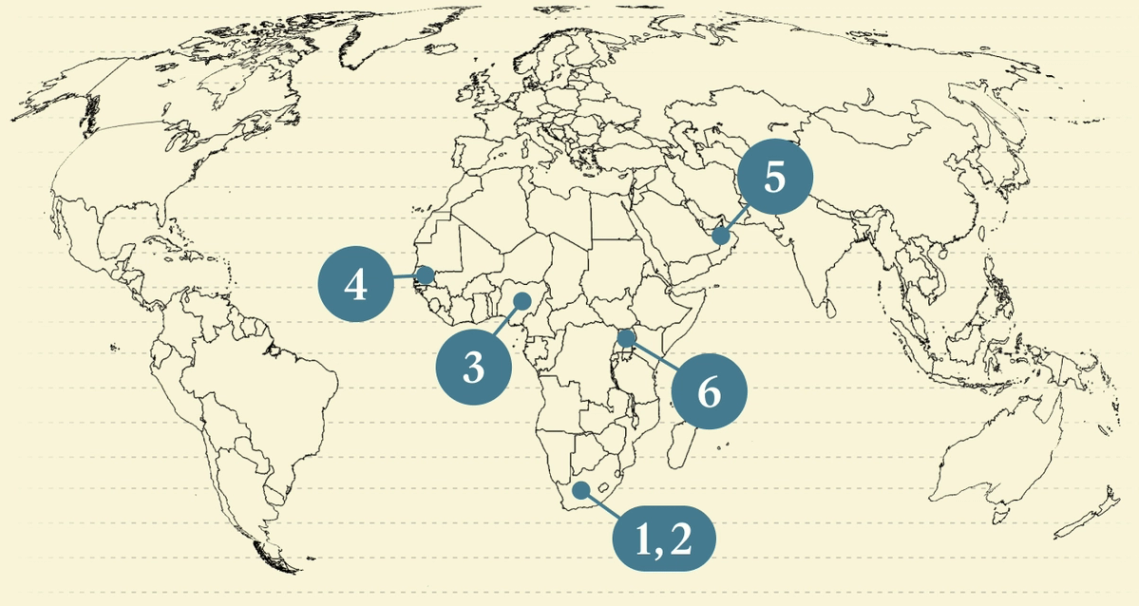

South Africa’s controversial drills |

South Africa is hosting naval drills involving China, Iran, and Russia, a move widely expected to further strain ties with the US. The exercises, which began off the coast of Cape Town on Saturday and will continue until Jan. 16, are aimed at showcasing a joint commitment to maritime security. But the Democratic Alliance, the second-largest party in South Africa’s ruling coalition government, criticized the move, saying the operations “contradict our stated neutrality.” Tensions between Washington and Pretoria have escalated under the Trump administration over matters including trade, tariffs, and South Africa’s genocide case against Israel at the International Court of Justice. Pretoria’s commitment to multilateralism and the interests of the Global South have clashed with US President Donald Trump’s America First approach. |

|

South African President Cyril Ramaphosa. Oupa Nkosi/Reuters. South African President Cyril Ramaphosa. Oupa Nkosi/Reuters.South Africa’s President Cyril Ramaphosa told his African National Congress that it must improve its poor record on delivering services ahead of crucial municipal elections this year, polls which could see it lose control of key cities. The ANC’s grip on power in Africa’s largest economy loosened in 2024 when it was forced into a coalition at a national level after losing its parliamentary majority for the first time since the end of apartheid. Though issues such as power provision appear to be improving, complaints of sanitation problems and crumbling roads have become increasingly commonplace ahead of the local elections, which must be held before November. A survey by Ipsos found nearly six in 10 respondents were dissatisfied with their municipality’s performance, with the polling company’s report saying local election results “could reshape South African politics at the grassroots level.” Councils most at risk are in the Gauteng economic powerhouse — Johannesburg and Tshwane — and eThekwini, in KwaZulu‑Natal. The loss of important cities could accelerate the ANC’s declining influence and increase the number of unstable coalitions — such as the one in Johannesburg — that control urban centers vital for economic growth. — Alexis Akwagyiram |

|

US investors back Nigerian drone maker |

Paco Freire/SOPA Images/LightRocket via Getty Images Paco Freire/SOPA Images/LightRocket via Getty ImagesNigerian drone maker Terra Industries raised new funding to expand output at its factory in Abuja and open a second in East Africa this quarter, its CEO Nathan Nwachuku told Semafor. Terra Industries, which supplies defense equipment to governments and companies across Africa, raised $11.75 million from more than half a dozen backers including 8VC, a venture capital firm run by the co-founder of data analytics company Palantir, and SpaceX investor Valor Equity Partners. Founded in 2024, Terra’s clients include oil, mining, and power companies in Nigeria, Ghana, and Kenya, though the majority of the revenue comes from governments, Nwachuku said. Drone use is increasing in Africa across various sectors, including by the military for surveillance and warfare like in Sudan, but also for social services. American drone company Zipline secured $150 million in November from the US government to grow its health care product delivery operation that started in Rwanda a decade ago and has since expanded to Côte d’Ivoire, Ghana, Kenya, and Nigeria. — Alexander Onukwue |

|

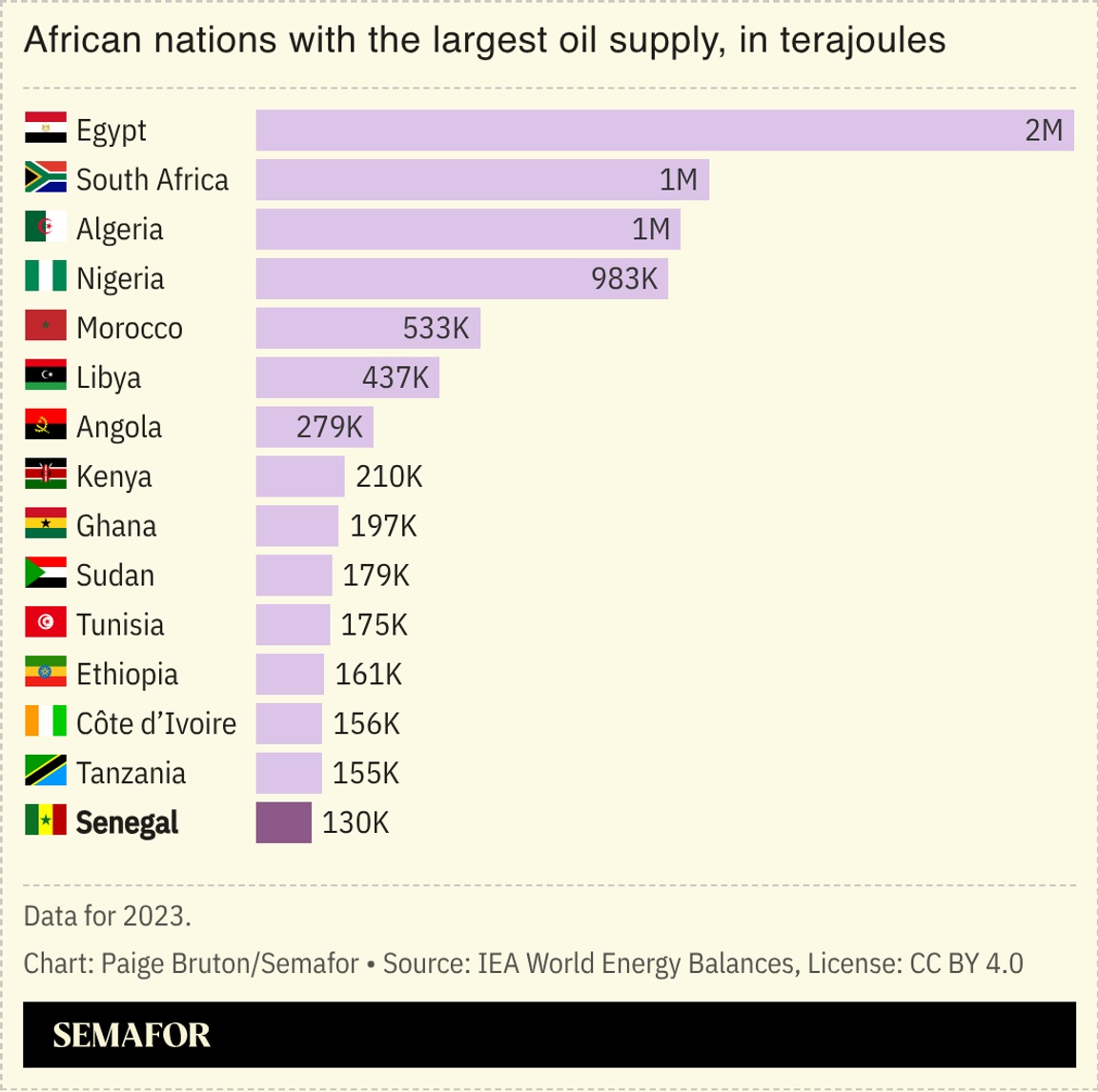

Senegal’s improved oil outlook |

Senegal produced 36.1 million barrels of oil in 2025, outstripping previous projections, its energy ministry said. Senegal’s oil output — which Dakar sees as playing an increasingly important role in economic development — comes from the offshore Sangomar oil and gas field, which began production in 2024. Bassirou Diomaye Faye’s government has vowed to ensure the country’s hydrocarbon industry is “well managed,” with a proportion of revenues being placed in funds to protect against price volatility, as well as in health and education. The government also wants oil receipts to help reduce Senegal’s reliance on loans, as it grapples with debts that the IMF said hit 132% of GDP at the end of 2024. Last week its prime minister insisted that the country would not need to implement a restructuring plan, despite facing a tough repayment schedule. |

|

Gulf eyes Africa’s mining gap |

The decline in the value of mining deals in Africa over the past five years, compared with a more than tripling in Latin America over the same period, according to the McKinsey Global Institute. The divergence shows how risk perceptions continue to weigh on Africa, despite its vast reserves of copper, nickel, manganese, lithium, uranium, silver, and other minerals critical to the energy transition and technology supply chains. That has made miners wary of committing capital — though Saudi Arabia and other Gulf countries want to change that trend, through vehicles like the Public Investment Fund-backed Manara Minerals and Abu Dhabi’s International Resources Holding. The McKinsey analysis, released ahead of this week’s Future Minerals Forum in Riyadh, discusses the potential for greater cooperation in a “super region” spanning Africa, Western Asia, and Central Asia. The area holds more than half of the world’s critical mineral reserves, but has the lowest level of exploration spending of any region globally. — Mohammed Sergie |

|

View: Uganda’s ‘forever president’ |

Uganda’s President Yoweri Museveni. Abubaker Lubowa/Reuters. Uganda’s President Yoweri Museveni. Abubaker Lubowa/Reuters.A “familiar weight of inevitability” hangs in the air in Kampala ahead of the country’s presidential election on Thursday, a veteran Ugandan journalist wrote in a column for Semafor. Should President Yoweri Museveni win again, he will embark on his ninth term since he came to power in 1986. “Ugandan elections follow a mystical arithmetic,” Charles Onyango-Obbo said, pointing to contests ending “with impossible numbers” and, ultimately, in court. “To cripple rivals, the state has perfected a containment tactic,” he explained, with military cordons thrown around the homes of opposition challengers. More than 550 opposition supporters have been arrested or disappeared in the run up to the vote. Museveni can point to a track record on the economy, wrote Onyango-Obbo. But his main rival, 43-year-old former pop star Robert Kyagulanyi, better known as Bobi Wine, “grasps this young country better,” says the journalist, unlikely as he is to “claim the crown.” |

|

- Jan. 12: Amazigh or Berber people across North Africa celebrate Yennayer, considered the official date of the new year, according to the traditional agricultural calendar.

- Jan. 15: Uganda holds its presidential and parliamentary elections.

- Jan. 15-16: The Game Time Africa Summit kicks off in Morocco, with major sports business leaders due to attend.

- Jan. 18: The Africa Cup of Nations final is scheduled to take place in Rabat.

|

|

Business & Macro |

|

|