| | Donald Trump pledges ‘help’ to Iranian protesters, Japan’s prime minister plans to call a snap elect͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Flagship |  |

| |

|

The World Today |  - Trump backs Iran protesters

- More secondary tariff threats

- US inflation holds steady

- Questioning US’ Powell probe

- Venezuela’s oil reboot

- Microsoft’s energy cost vow

- Takaichi to call snap election

- Delivery apps face scrutiny

- China’s US poverty obsession

- Games Workshop expands

Old-school horror in a high-tech world. |

|

Trump pledges ‘help’ for Iran protesters |

Stringer/WANA via Reuters Stringer/WANA via ReutersDonald Trump told Iranians to “keep protesting” against the regime, promising that “help is on the way.” The US president didn’t offer specifics, though he has threatened military action to counter Iranian authorities’ deadly crackdown on anti-government demonstrations. Trump on Tuesday canceled meetings with Iranian officials, while Axios reported that a top White House envoy secretly met Iran’s exiled former crown prince — an opposition figure. Amid an internet blackout, some Iranians used landline phones to inform relatives of lethal force being used against protesters. The violence may tempt Trump to deal a “deathblow” to the regime, two experts wrote in Foreign Affairs, but a US strike could backfire by diverting citizens’ attention and giving Tehran a reprieve. |

|

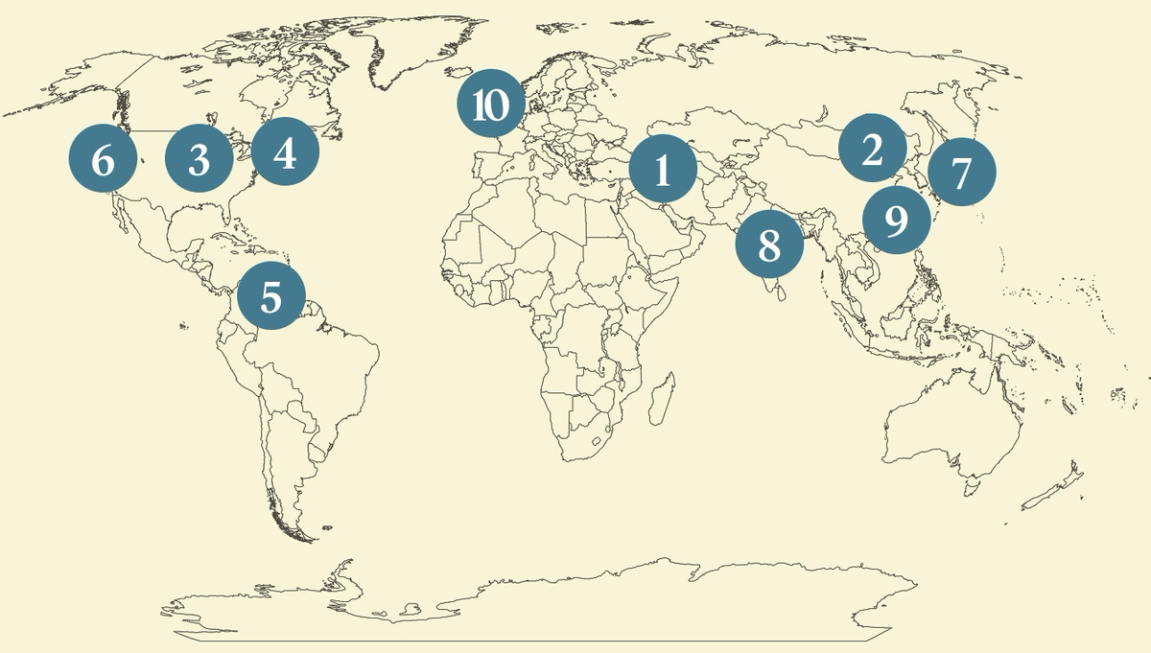

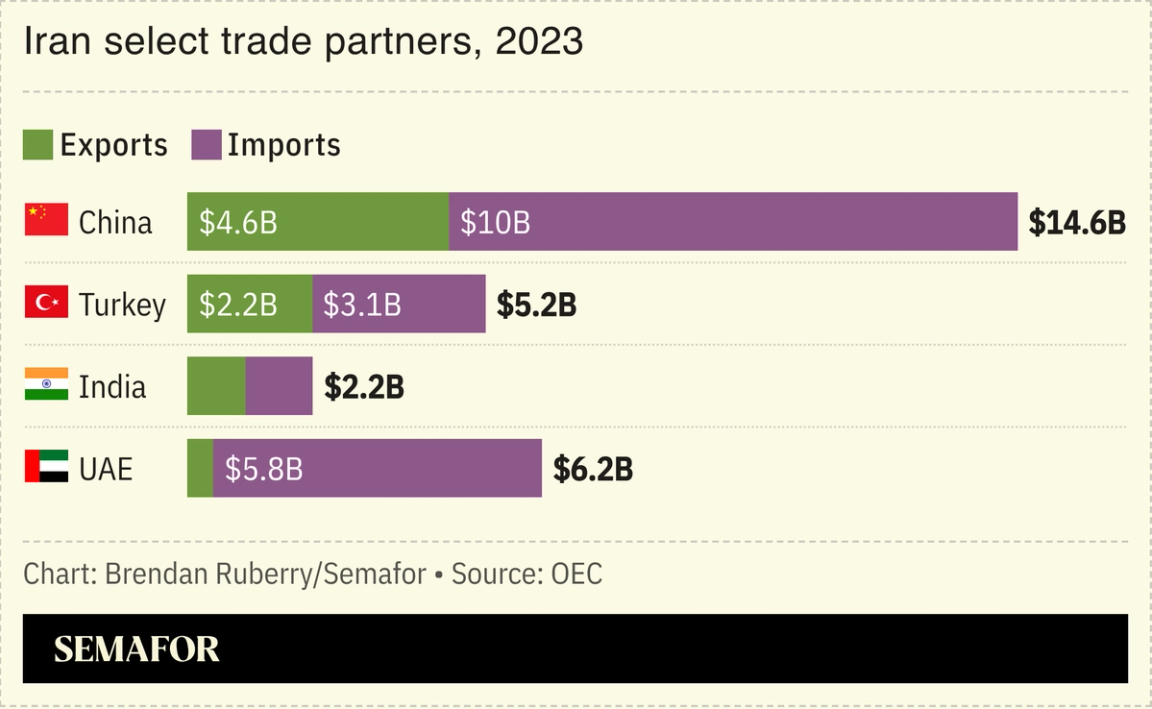

Trump’s secondary tariff playbook |

US President Donald Trump’s threat of 25% tariffs on Iran’s trading partners is already causing ripples in global commerce. Trump has embraced “secondary tariffs” as a trade cudgel in his first year back in office: He previously floated duties on any country that buys Russian goods or Venezuelan oil, and imposed 25% tariffs on India for buying Moscow’s oil. Trump’s latest threat has slowed India’s rice exports to Iran to a trickle; China and the United Arab Emirates are also in the crosshairs, given their multibillion-dollar annual trade with Tehran. Trump’s tactic risks reopening fraught geopolitical wounds with Beijing, following its bruising trade war with Washington that de-escalated late last year. |

|

US inflation steady in December |

Sarah Silbiger/Reuters Sarah Silbiger/ReutersUS inflation held steady in December, new data showed Tuesday, suggesting the country has largely avoided a runaway surge in consumer prices. Although inflation remains above the Federal Reserve’s 2% target, the new reading suggests the impact of tariffs on prices has abated since the fall. President Donald Trump used the report to urge the Fed to lower the cost of borrowing, though traders expect policymakers to hold interest rates steady this month. Trump promoted his economic strategy in a speech Tuesday as his administration ramps up its affordability messaging. It remains to be seen whether the cooler inflation reading will be enough to assuage Americans’ cost-of-living concerns: Prices for daily necessities like food were particularly elevated in December. |

|

Little financial upside to Fed probe |

Kevin Lamarque/Reuters Kevin Lamarque/ReutersJPMorgan Chase’s Jamie Dimon warned Tuesday that “anything that chips away” at the US Federal Reserves’s independence could fuel inflation, adding to a chorus of voices questioning the Trump administration’s criminal probe of the central bank chair. President Donald Trump wants the Fed to cut interest rates faster, which risks restarting price increases that are barely tamed. Lowering short-term rates wouldn’t necessarily bring down the mortgage rates that voters care about, Semafor’s Liz Hoffman noted, so “who is this for?” The probe appears to be politically defeating, too: Even some Republicans critical of Powell can’t endorse the investigation and have threatened to withhold support for Trump’s future Fed nominees. |

|

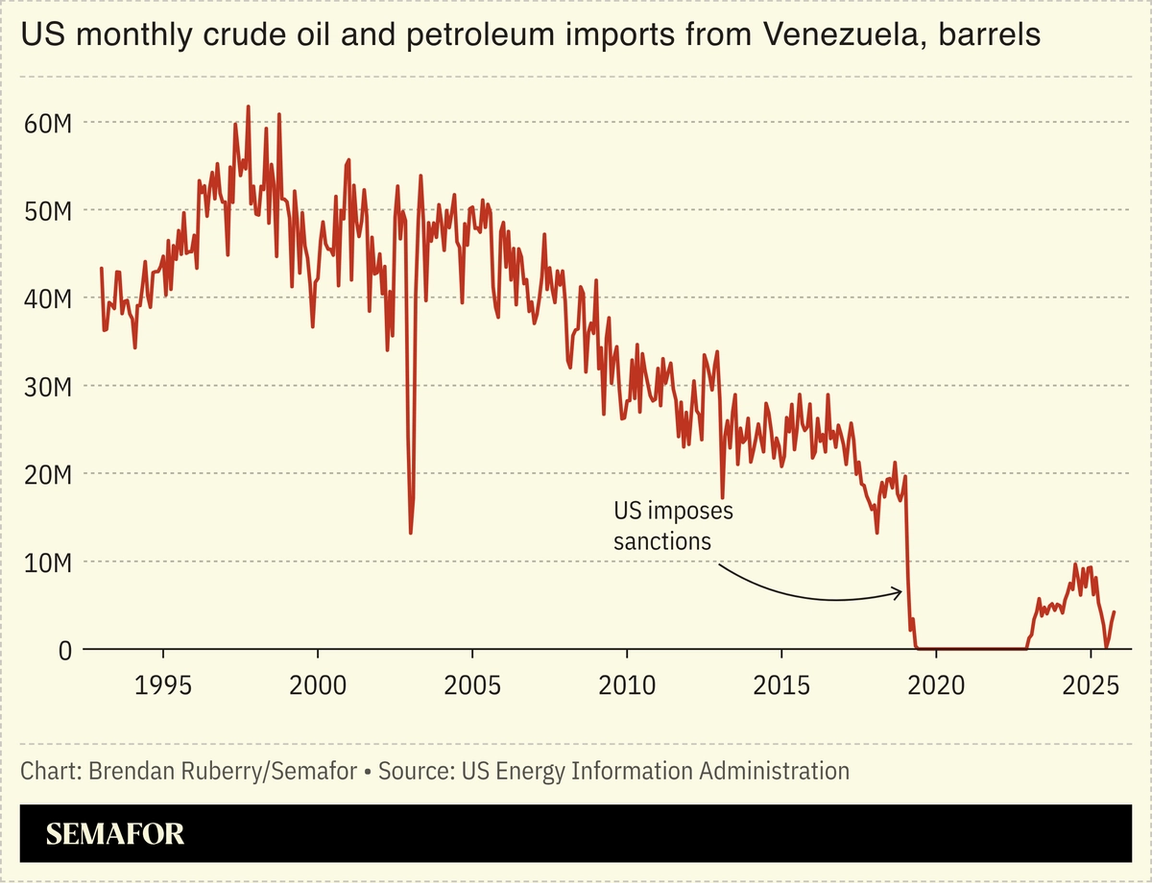

Venezuela oil reboot takes shape |

US President Donald Trump’s vision of a Venezuelan oil bonanza will take years to materialize, but the reboot favors the bold, analysts argued. Small, risk-tolerant Texan wildcatters and service companies like Halliburton are emerging as potential winners, edging out drilling giants still hurting over the big losses they suffered in the country, Semafor’s Tim McDonnell wrote. Oversupply of oil has kept prices low, meaning the investment required to tap Venezuela’s heavy crude would likely outweigh any gains, The Economist noted: “A heavy lift with an uncertain pay-off.” Consumers are winning, though. Goldman Sachs lowered its oil price forecast for the next two years, citing more drilling in Venezuela; the country reopened oil wells this week and resumed crude exports. |

|

Tech firms vow to cover energy costs |

Jonathan Ernst/Reuters Jonathan Ernst/ReutersUS tech giants, under pressure from politicians and communities, vowed to take more aggressive steps to keep their data centers from hiking electricity costs. Microsoft’s president said Tuesday that the company will pay utility rates that are high enough to cover their energy costs, replenish more water than the facilities use, and add to local tax bases where it has data centers. Google, which recently bought an energy developer, is pushing federal regulators to speed up approvals for data centers that supply their own power. US President Donald Trump is urging Big Tech companies to “pay their own way” to avoid raising electricity prices, as the AI boom pushes power-grid operators to the brink. |

|

‘Takaichi trade’ is back in Japan |

Eugene Hoshiko/Pool via REUTERS Eugene Hoshiko/Pool via REUTERSJapanese Prime Minister Sanae Takaichi’s plan to call a snap election jolted the country’s markets, as investors bet on her expansionary fiscal policy. A conservative who has enjoyed high approval ratings, Takaichi reportedly plans to tell allies on Wednesday that she is eyeing an election in February in a bid to tighten her grip on power. That reinvigorated the “Takaichi trade,” thanks to expectations that she will have a freer hand to push stimulative measures that could boost defense, AI, and energy sectors: Japanese stocks hit a record high Tuesday. A strong showing could also reduce Takaichi’s vulnerability to domestic pushback as she navigates a diplomatic spat with China, analysts said. |

|

India, China scrutinize delivery apps |

Francis Mascarenhas/Reuters Francis Mascarenhas/ReutersThe world’s two most populous countries are stepping up regulation of delivery platforms in a bid to curb damaging competitive practices. China’s antitrust regulator this week opened an investigation into the country’s e-commerce sector to target aggressive discounting that has pushed prices down and dampened margins. And Indian authorities convinced major delivery apps to stop promising 10-minute delivery times, following concerns about the impact on gig workers’ health and safety. Competition in the Indian market has driven a “quick commerce” sector boom, aided by strategically located warehouses and armies of drivers who could be penalized for late deliveries. Some 200,000 gig workers recently protested across the country to call for better wages and conditions. |

|

China state media focuses on US poverty |

Carlos Barria/Reuters Carlos Barria/ReutersChinese state media is drawing attention to US poverty, an attempt to declare superiority despite Beijing’s own economic challenges. Commentators used the gaming term “kill line” — the point at which a player is so weak they can be killed with one shot — to argue that millions of Americans, weakened by poverty, debt, or drugs, could be destroyed by a single misfortune. Official outlets also pushed spurious claims that the US poverty line stands at $137,000. The “kill line” idea overstates American fragility, The Economist argued, but reveals China’s own economic worries: Censors curtail criticism of China, but “one can talk freely under the guise of discussing America,” a Chinese writer said. |

|

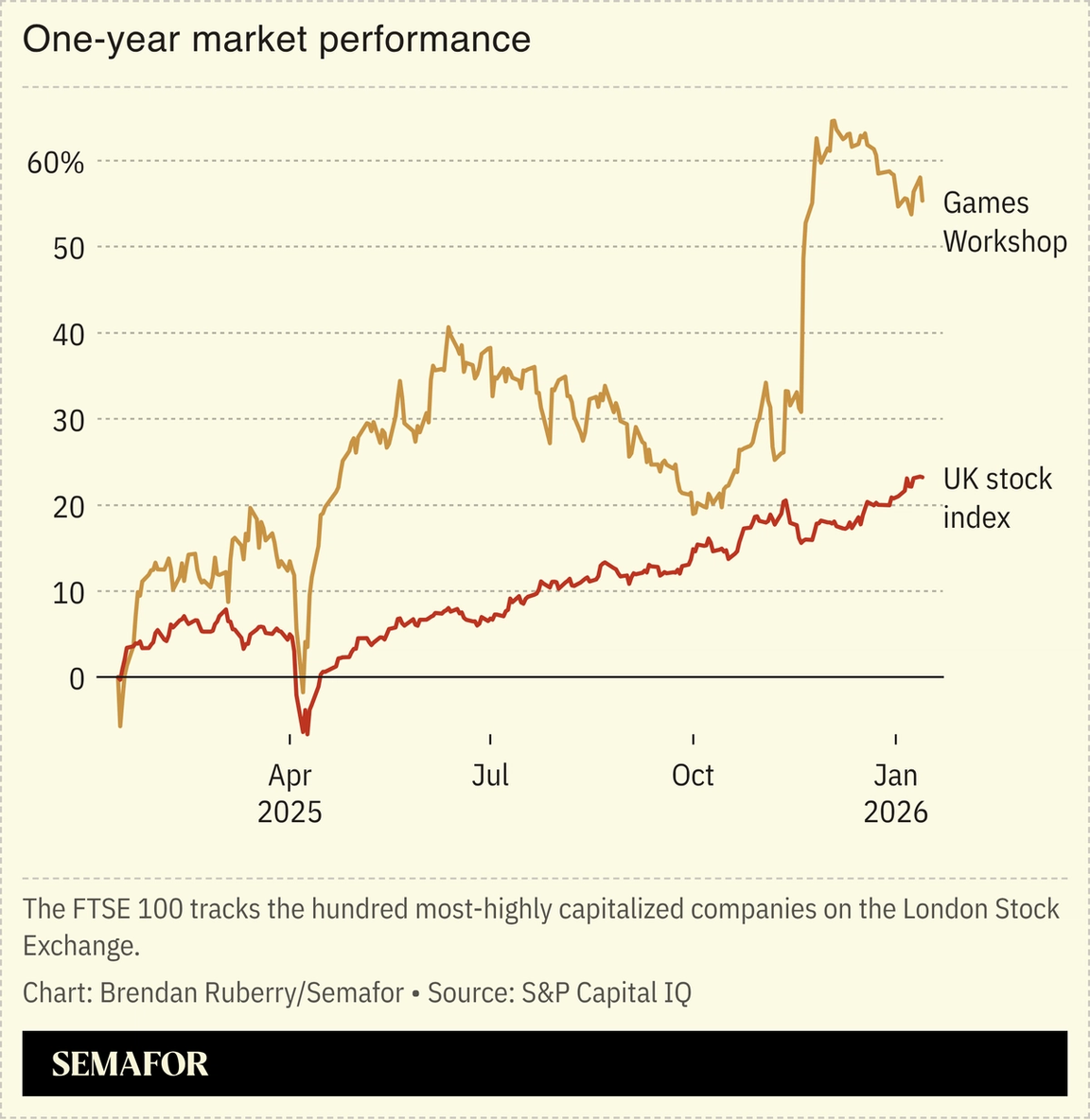

UK’s Games Workshop goes global |

Games Workshop will open a “Warhammer World” hub in the US next year, a sign of the British company’s global reach. The 50-year-old wargaming firm has become a giant, with its sci-fi/fantasy tabletop games and paint-your-own miniature figurines bolstered by successful video games, a growing universe of fiction, and an upcoming Amazon Prime TV series starring Henry Cavill, Dispatch noted. The company on Tuesday reported record half-year sales, and last month entered the |

|

|