|

A Youtube comment got me thinking about uncertainty.

Many investors are way too sure of themselves.

Today I want to share some thoughts on why that is a problem.

But first, I’ll share the comment with you.

It’s already been proven if you invest in high growth etf for 30 years your balance at retirement will be 3x higher vs investing in dividend stocks. Invest in growth and when you retire take all that money and invest in dividend growth.

Let’s start with really breaking down what’s being said here.

The Obvious Issues

There are a few obvious things that jump out right away.

The assertion that ‘it’s already been proven’

First, nothing in the market is "proven.”

Science has things that are proven.

The temperature at which water freezes.

That gravity makes things fall.

Bernoulli’s principle.

But markets are run by people and emotions.

In that world, there are no sure things.

That the outcome 30 years from now is known

If we knew what would happen in 30 years, we wouldn’t even need the ETF.

We’d just buy the one best stock. Bet it all on black and let it ride.

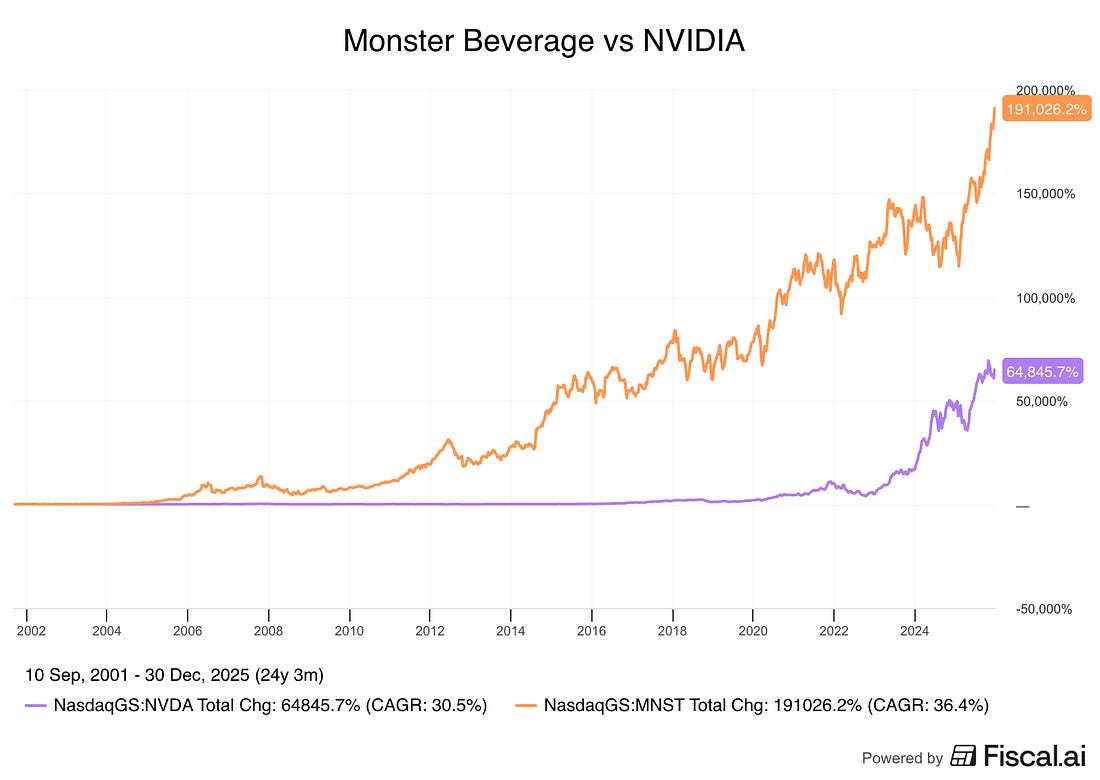

If, in 2001 you knew that Monster Beverage would be the best performing stock for the next 24 years, beating out even NVIDIA, would you buy anything else?

Of course not.

But nobody knows the future.

Those are the obvious issues. Let’s dive into some that aren’t so obvious.

No room for uncertainty.

I’m not talking about the ‘already been proven part’.

I’m talking about the underlying implication that just because growth did outperform in the past 30 years, that it had to.

One of my favorite aphorisms comes from Elroy Dimson, who said that “risk means more things can happen than will happen.”

This seemingly simple statement has massive implication here.

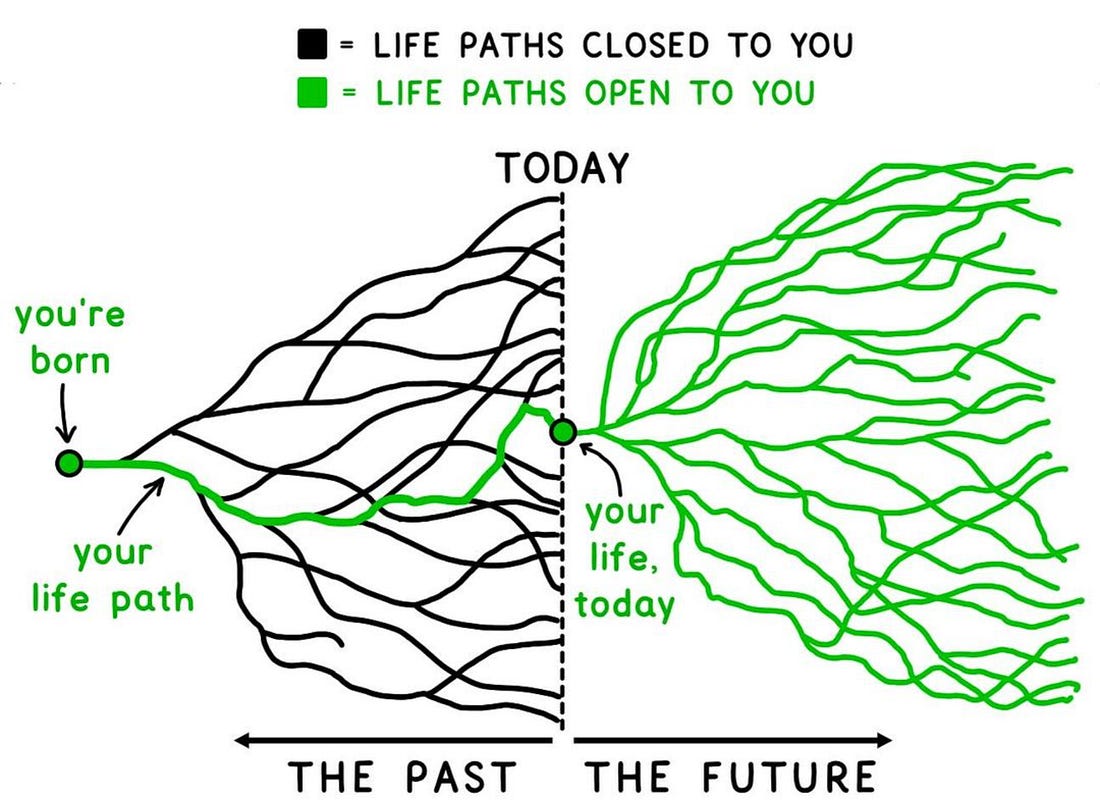

To show you why, I like to think of this picture from Tim Urban.

It’s about your life path and the choices you made, but I think it applies equally to stocks.

We know the green line in the past - what happened.

But we don’t know how many other black lines there could have been, and we don’t know the probabilities of each of them.

We also don’t know how many green lines there are for the future, or their probabilites.

Which means that not only can we not figure out a probability for what’s going to happen in the future, we can’t even figure one out for what’s already happened in the past.

Investing means operating under conditions of massive uncertainty.

Never forget that.

Good Outcomes Don’t Imply Good Decisions

This is closely related an idea from Annie Duke.