| | Elon Musk announces a mega-merger, analysts debate the US-India trade deal, and France finally passe͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Flagship |  |

| |

|

The World Today |  - Musk’s SpaceX buys xAI

- S. Korea’s AI bet pays off

- US-India deal questions

- Venezuela oil exports up

- UK, EU boost ties

- France approves budget

- China pushes plane sales

- Trump’s Nigeria moves

- Mexico cartels sell vapes

- Lead exposure down

The complete works of an Italian piano virtuoso. |

|

Musk launches space data center venture |

Evelyn Hockstein/File Photo/Reuters Evelyn Hockstein/File Photo/ReutersElon Musk’s SpaceX bought Elon Musk’s xAI, and filed plans to launch a million “orbital data center” satellites. The $1.25 trillion merger represents two major bets, Ars Technica’s space editor wrote: That AI is not going anywhere, and space-based computing power will be cost-competitive — Musk himself told employees it would be “within two or three years.” Yet according to The Information’s co-executive editor, the decision also shows that Musk faces “the same financial realities the leaders of other AI startups face: It’s very difficult to compete in AI development with deep-pocketed tech giants.” Indeed, cloud-computing giant Oracle borrowed $25 billion in order to provide compute for OpenAI, with analysts warning that its huge debt was weighing on its stock. |

|

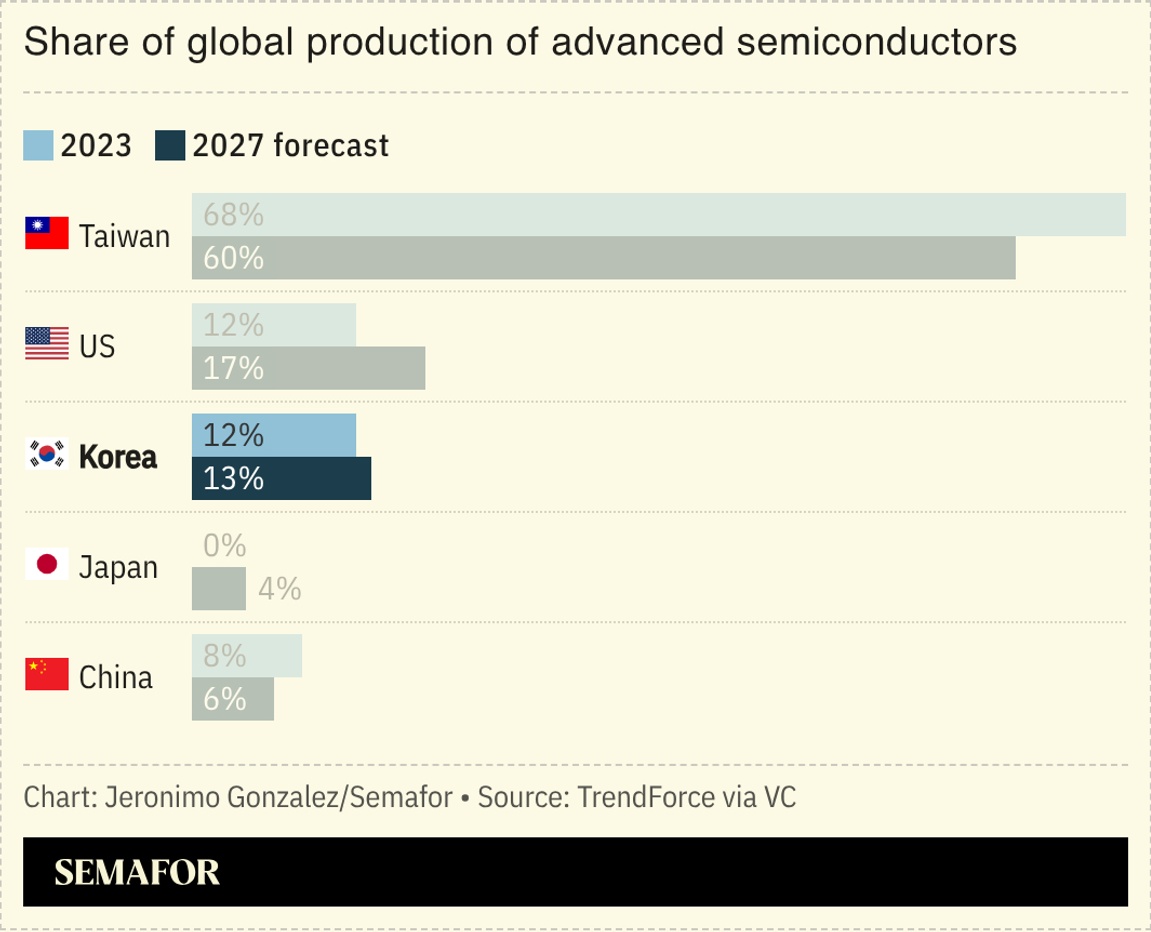

S. Korea’s AI chip bet pays off |

Chipmakers Samsung and SK Hynix secured a huge wave of investment, a sign of the AI boom rewarding firms building the infrastructure powering the technology more than those at the forefront of developing it. The combined valuation of South Korea’s two biggest companies by market capitalization reached $11.1 trillion, surpassing the total for China’s two largest tech companies, Alibaba and Tencent. The symbolic change showcased how Korea’s picks-and-shovels approach — becoming vital to a specific part of the tech supply chain — aligns with an approach favored by big-name investors: A top BlackRock executive argued recently that companies that mine for copper, generate power, or build semiconductors were more lucrative bets than the hyperscalers that garner headlines. |

|

Questions over US-India trade deal |

Kevin Lamarque/Reuters Kevin Lamarque/ReutersIndian analysts were cautiously optimistic over the country’s trade deal with the US, but warned that, because details of the agreement were scarce, much remained in doubt. The US will cut its tariffs on Indian goods to 18% from 50%, though New Delhi has not confirmed US President Donald Trump’s assertion that it will end its purchases of Russian oil. One leading Indian economics journalist, meanwhile, noted that Trump’s announcement that India would spend $500 billion on US goods would amount to about 85% of the annual Indian federal budget, with other experts also voicing skepticism over the “colossal sum.” As The Indian Express’ business editor put it, “With Trump, it’s always the art of the squeeze.” |

|

Venezuela’s oil exports soar |

Venezuelan interim President Delcy Rodríguez meeting the US envoy Laura Dogu. Miraflores Palace/Handout via Reuters Venezuelan interim President Delcy Rodríguez meeting the US envoy Laura Dogu. Miraflores Palace/Handout via ReutersVenezuela’s crude sales have surged since Washington ousted the country’s leader and eased restrictions on the nation’s oil industry. Shipping data showed January’s exports were more than 50% higher than those of the previous month, though total output remains far below its peak of almost 3.5 million barrels a day in 2001. The increase, however, has had significant impacts downstream: As part of a trade deal with the US, Washington said India had agreed to substitute its imports of Russian oil with Venezuelan crude — a detail not confirmed by New Delhi. Though Venezuelans are increasingly bullish on their country’s economic prospects, they remain bearish on hopes of greater freedom, despite Washington’s envoy pushing the country’s interim leader for political liberalization. |

|

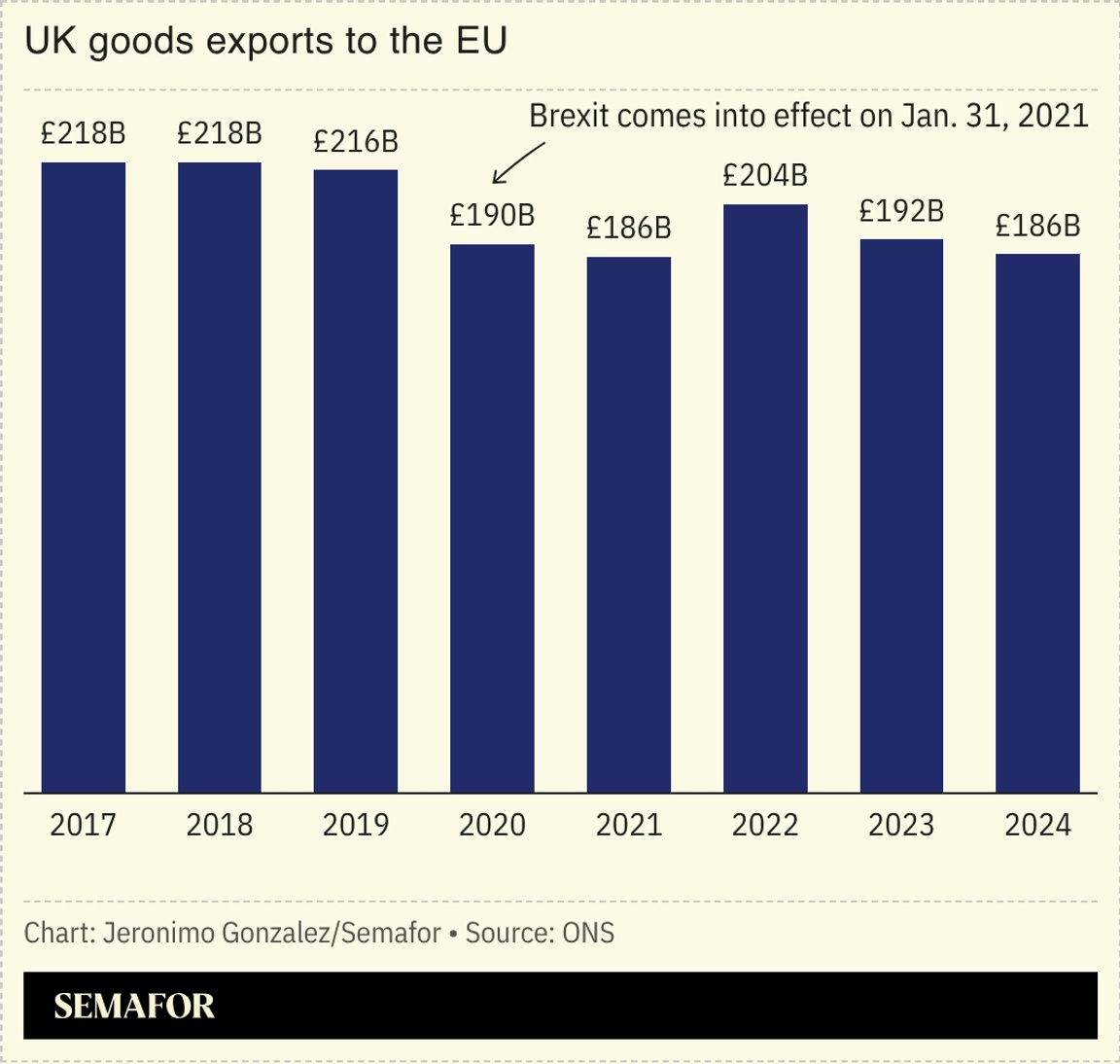

The UK and the EU solidified their rapprochement, holding talks to deepen Britain’s economic integration with the bloc. The UK’s finance minister and the EU’s economy commissioner spoke of shared values and the changing global order, in a veiled reference to US President Donald Trump’s unpredictable impact on geopolitics and trade, while the British prime minister said London should consider resuming talks on tighter defense ties with Europe. Closer alignment faces obstacles: EU diplomats suggested that Britain may have to pay heavily for access to the single market, while anti-EU British politicians, including Nigel Farage, leader of the surging populist Reform UK party, backed a campaign for a “proper Brexit”. |

|

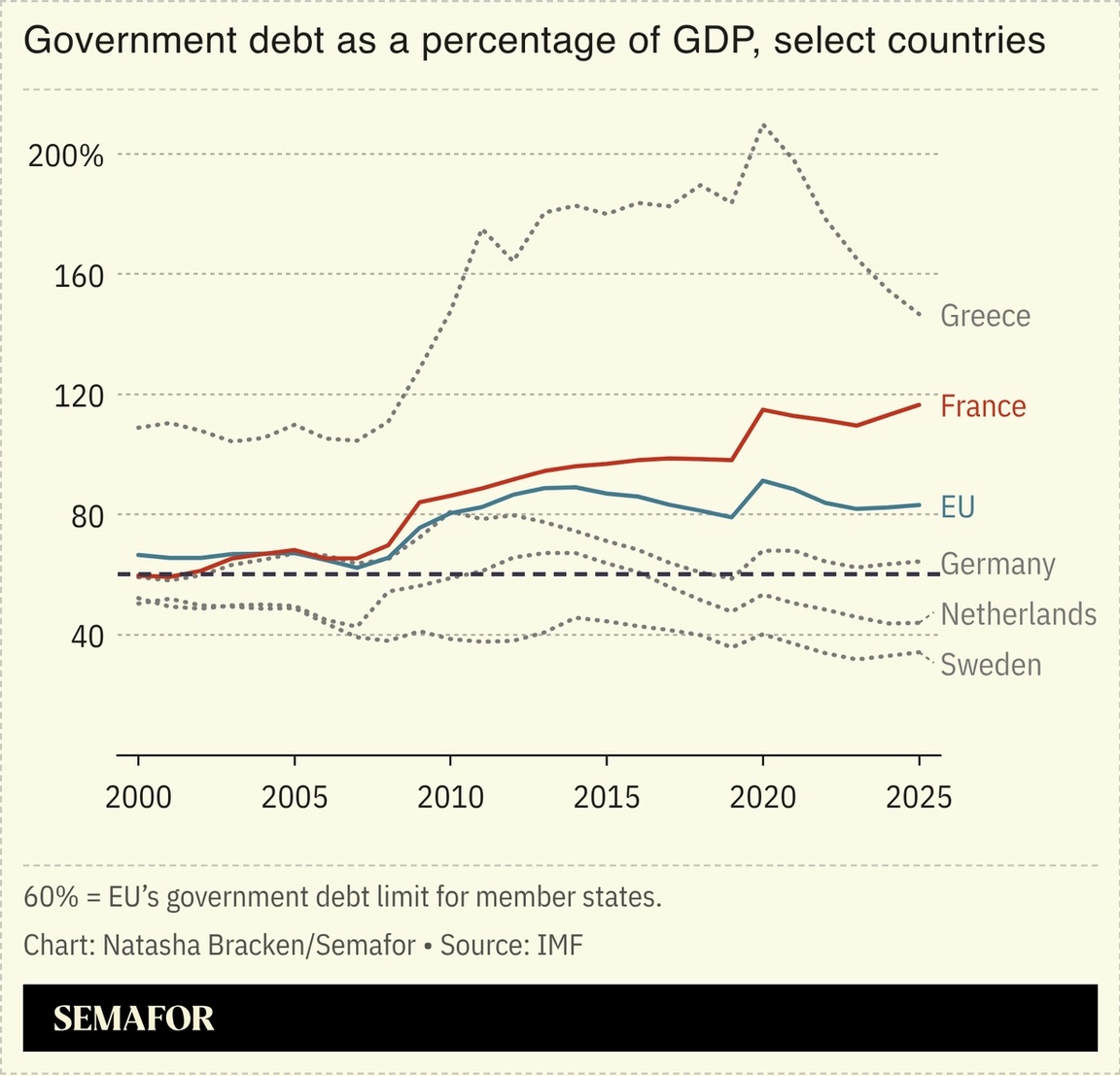

France finally passes budget |

France passed an annual budget, ending a long-running debacle that felled prime ministers, amplified support for the far right, and raised doubts over the country’s long-term finances. The spending plan falls short of the government’s stated deficit target — it offered several concessions to head off multiple no-confidence motions — but nevertheless pares back outlays and increases taxes in an effort to bridge a yawning fiscal gap. The dealmaking ensured Prime Minister Sébastien Lecornu did not suffer the same fate as his two predecessors, who were ousted after proposing austerity measures; with President Emmanuel Macron due to leave office next year, the budget success “elevates Lecornu as a potential contender for the 2027 presidential election,” Euractiv noted. |

|

China pushes aircraft sales |

Caroline Chia/Reuters Caroline Chia/ReutersChina’s biggest commercial plane manufacturer is hoping its showcase at the Singapore Airshow this week will finally lift international appetite for its jets. Though COMAC’s C909 and C919 narrowbody planes have been a considerable success domestically — the company has sold more than 200 to Chinese carriers, which have used them to ferry 36 million passengers — it has struggled to find buyers abroad, with just a few regional airlines picking them up. The global trade war and its toll on production has further dampened the company’s global ambitions, with the US and Europe moving to protect their champions. In response, the Shanghai-based firm slashed its original sales forecast for 2025 by 80%, Bloomberg reported in December. |

|

The Hustle brings you business as unusual: Daring moonshots, oddball startups, and trends from the fringes that traditional outlets miss. No recycled headlines, no ads, just fresh ideas in a fun, quick read. Ready for something different? Subscribe today. |

|

US lobbyists’ Nigeria push |

Marvellous Durowaiye/Reuters Marvellous Durowaiye/ReutersA yearslong push by Christian activists and Republican lawmakers drove US President Donald Trump to combat what he called a “Christian genocide” in Nigeria, The New York Times reported. Thousands are killed annually in Nigeria: The violence is multifaceted — as well as sectarian tensions, there are kidnappings for ransom and battles over land — but a Washington lobbying campaign centered the targeting of Christians, in part leading to the US launching a series of cruise missile strikes against Islamist targets in the northwest on Christmas Day. The move, like the Trump administration’s pressure on South Africa over its purported discrimination against white people, has upended domestic politics and foreign policy in Africa’s two largest economies. |

|

Mexican cartels take over vape sales |

Edgard Garrido/Reuters Edgard Garrido/ReutersMexico’s decision to ban vapes has pushed the $1.5 billion industry into the hands of the country’s powerful cartels. Though experts argue that vapes provide cigarette smokers with a far safer alternative — Japan has used the devices to slash tobacco use — Mexico categorized the devices in the same group as fentanyl, meaning sellers face lengthy prison sentences. The move has caused legal sales to plummet, with cartels stepping in to meet the huge demand. Experts fear the cartels’ control over the vape market could fuel sales of stronger, more harmful drugs. “Those selling cocaine, fentanyl, marijuana are selling you vapes,” and they don’t care if the buyer is a minor, a Mexican lawyer told the Associated Press. |

|

|