| | A look at Kevin Warsh’s view on climate change and monetary policy, the Gulf ups its Africa climate ͏ ͏ ͏ ͏ ͏ ͏ |

| |   Riyadh Riyadh |   Wellington Wellington |   New Delhi New Delhi |

| Energy |  |

| |

|

- Warsh’s Fed climate plans

- Gulf ups Africa financing

- Venezuela’s crude surge

- US renewables growing

- Carbon market shift

China proposes a record number of new coal-fired power plants, despite its breakneck green growth. |

|

Warsh’s Fed climate plans |

Kevin Warsh at Semafor’s World Economy Summit. Tasos Katopodis/Getty Images for Semafor Kevin Warsh at Semafor’s World Economy Summit. Tasos Katopodis/Getty Images for SemaforUS President Donald Trump’s nomination for the next chair of the Federal Reserve has already had an impact on the markets, but his criticism of the central bank’s work on climate change has gone largely unremarked upon. Kevin Warsh faces a tricky path to actually taking up the Fed leadership but were he to take charge, he may lead a major shift in how the Fed views climate: In a speech last year, he said the bank should avoid addressing the “politically charged” issue of climate change. (The Fed, Warsh noted at the time, joined and then withdrew from a group of central banks that share expertise on responding to climate change.) The Fed has so far published some research analyzing changing temperatures’ impact on the economy and financial stability, though has not pursued the issue as aggressively as regulators on the other side of the Atlantic: The European Central Bank in November issued its first-ever fine for failing to identify climate risks; the Bank of England this year is rolling out tougher rules for lenders on the subject. Recent research from the London School of Economics, meanwhile, found that China’s central bank goes further still, making it easier for financial institutions to borrow in order to fund the energy transition. |

|

Gulf ups Africa financing |

Temilade Adelaja/Reuters Temilade Adelaja/ReutersClean-power investment from the Gulf — and particularly from Saudi Arabia and the UAE — into Africa is surging, but could have even greater impact were it targeted more towards power infrastructure, a new report argued. The two Gulf powers (and, increasingly, rivals) have in recent years driven money overwhelmingly into intermittent-renewable energy generation and hydrogen projects, according to Clean Air Task Force research shared first with Semafor. Riyadh and Abu Dhabi unveiled some $175 billion of funding pledges between 2010 and 2024, largely as investments rather than loans, which CATF noted was a friendlier form of financial relationship. But, CATF’s Director of Climate Policy Innovation David Yellen said, the two countries could have greater impact — environmentally, economically, and geopolitically — if they shifted the focus of their state-linked funds to financing grid improvements and transmission infrastructure: “Our hope is that the sources of capital that can be more patient… go into projects that enable knock-on investment,” he said. — Prashant Rao |

|

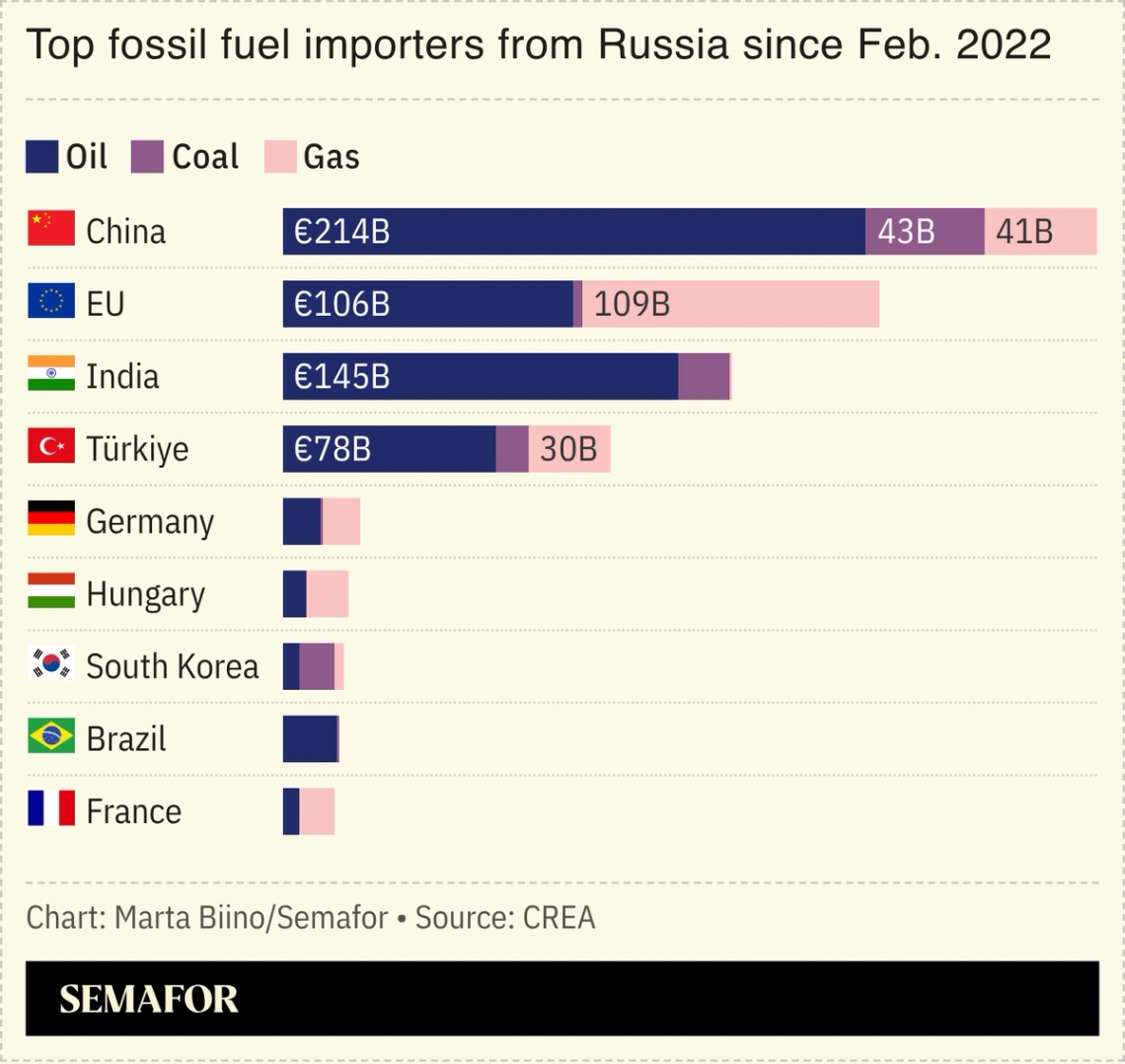

Venezuelan interim President Delcy Rodríguez meeting the US envoy Laura Dogu. Miraflores Palace/Handout via Reuters Venezuelan interim President Delcy Rodríguez meeting the US envoy Laura Dogu. Miraflores Palace/Handout via ReutersVenezuela’s crude sales have surged since Washington ousted the country’s leader and eased restrictions on the nation’s oil industry. Shipping data showed January’s exports were more than 50% higher than those of the previous month, though total output remains far below its peak of almost 3.5 million barrels a day in 2001. The increase, however, has had significant impacts downstream: As part of a trade deal with the US, Washington said India had agreed to substitute its imports of Russian oil with Venezuelan crude, a detail not confirmed by New Delhi. Oil companies are so far still being cautious about the prospects for reviving Venezuela’s fossil-fuel sector — they largely prefer the far-lower production costs Libya offers, energy expert Amena Bakr wrote in a recent Semafor column — but the potential for huge amounts of additional output is likely to weigh on a market that is already seen as heavily oversupplied. (Relatedly, Exxon Mobil and Chevron posted their smallest annual profits since 2021.) |

|

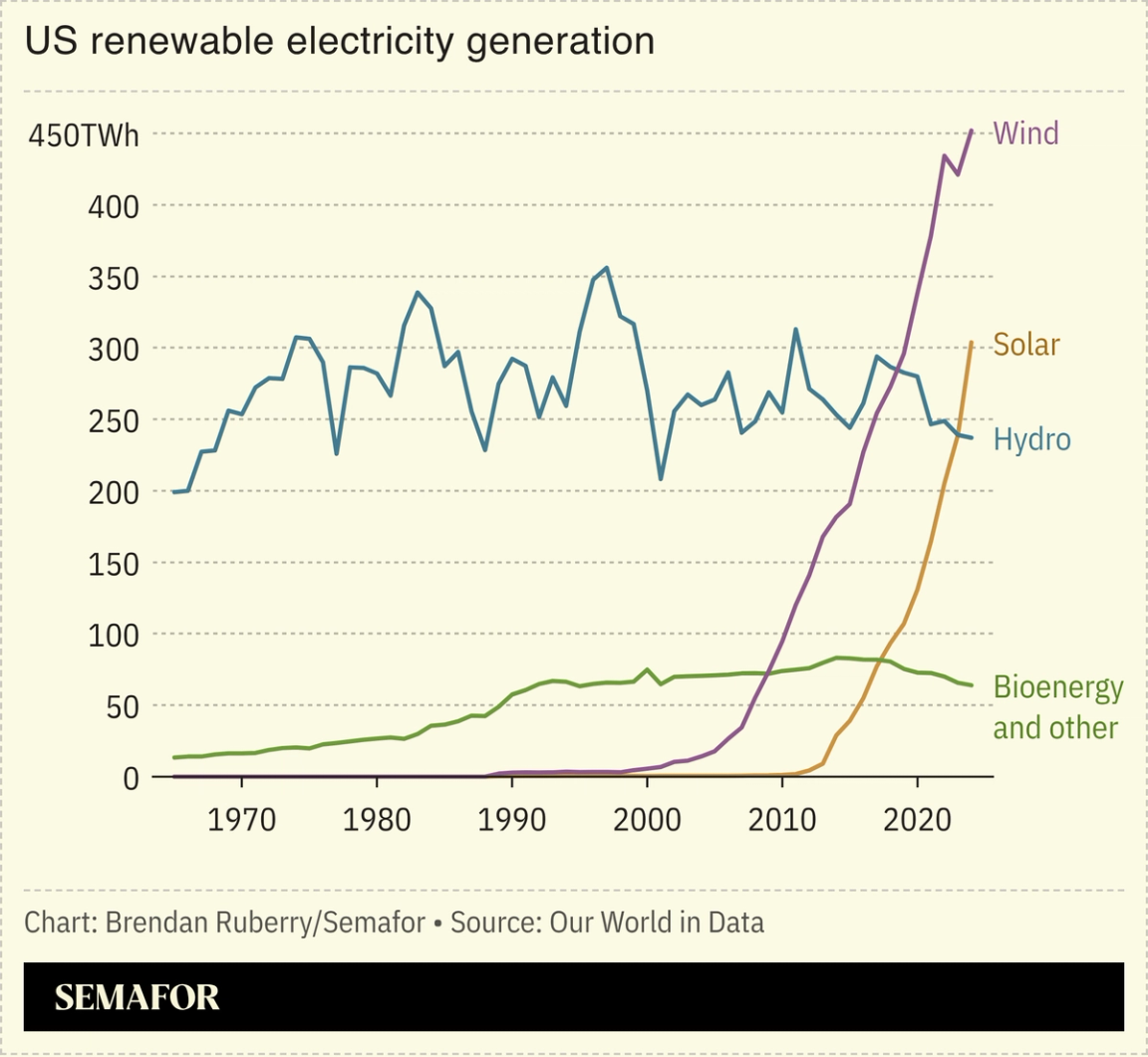

More than 99% of new electrical generation projected to come online this year in the US will be from renewable sources, a report found, despite President Donald Trump’s attacks on the sector. Solar, wind, and battery capacity is already booming: Utility-scale solar generation in the US increased by 22 gigawatts, enough to power about 20 million homes, in the first 11 months of 2025 — up 33.9% since Nov. 2024, while battery storage grew 49% over the same period. Wind power in particular is soaring even as Trump disparages it. His effort to halt new projects was dealt a fifth judicial defeat Monday after a judge ruled that construction could resume on a wind farm off the country’s northeast coast. |

|

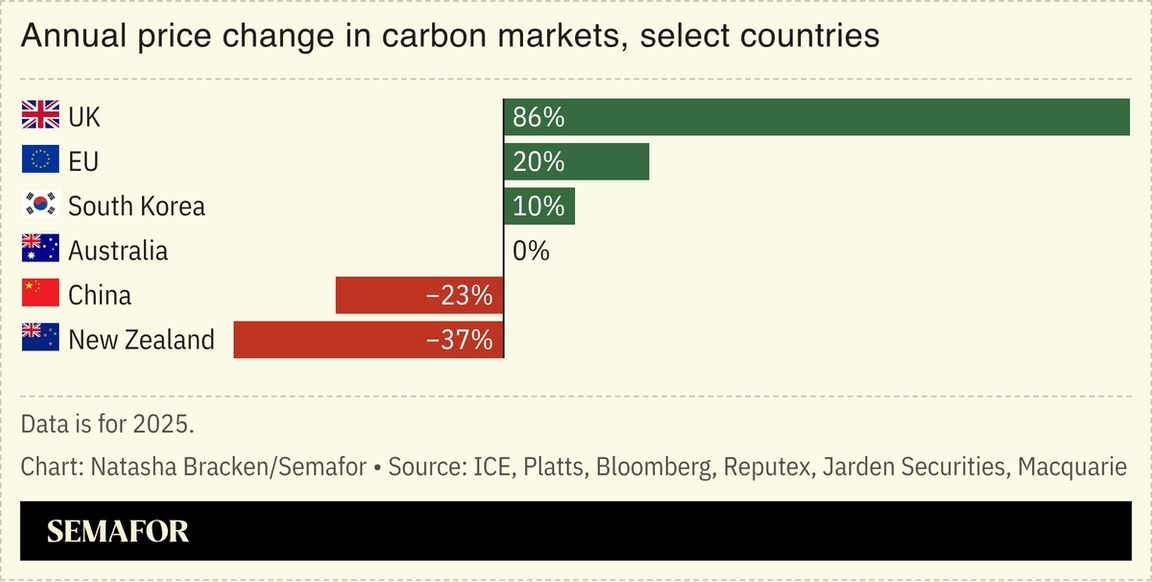

Carbon markets are increasingly reflecting regional policy decisions rather than global changes in emissions, new research showed. In Europe, for example, that shift translated into higher prices: EU carbon prices rose by around 20% over the course of 2025, driven by forecasts of tighter permit supply and slower-than-expected decarbonization, according to investment bank Macquarie. The UK’s carbon market was also a strong performer, with traders anticipating a future link to the EU system that would allow permits to trade interchangeably across both markets. Policies in New Zealand, by contrast, pushed carbon prices way down after the government moved to de-link its system from international climate commitments, reducing confidence that carbon permits there would become scarcer over time. Australia’s market showed a similar outcome through different mechanics, with the market there weighed down by strong issuance of carbon credits. — Natasha Bracken |

|

New Energy- A US federal judge ruled that the fifth and final offshore wind project the Trump administration had blocked could continue construction.

Fossil Fuels- US President Donald Trump, who had hit New Delhi with steep tariffs over its economic ties to Moscow, said Monday that India would stop buying Russian oil in exchange for a tariff reduction, and would replace it with US and Venezuelan oil.

Politics & PolicyMinerals & MiningEVs |

|

| |