| | A leading provider of carbon trading data is branching out into a wider set of green commodities, it͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Energy |  |

| |

|

- Endangerment in danger

- Carbon commodities

- India’s oil dilemma

- Power demand surges

- Nigeria’s oil renaissance

BP ends share buybacks, and Russia targets Ukraine’s nuclear power plants. |

|

Kent Nishimura/File Photo/Reuters Kent Nishimura/File Photo/ReutersThe Trump administration is expected this week to rescind the longstanding federal policy on which all US greenhouse gas regulation is based, in what would amount to the most wide-reaching rollback of climate policy of President Donald Trump’s two terms. The “endangerment finding” — a 2009 scientific conclusion by the Environmental Protection Agency which finds that greenhouse gases are worsening droughts, storms, and other environmental disasters, and therefore pose an urgent risk to public health — provides the legal basis for the EPA to regulate those gases. Withdrawing it has long been a top priority for lawyers in Trump’s orbit, and would clear the way for EPA to scrap emissions limits for vehicles, power plants, and other sources. The change could also prompt state governments to roll out a patchwork of their own regulations, adding a new layer of compliance headaches for automakers, utilities, and other companies. Environmental attorneys also warn that the inevitable legal battle over the finding could result in a Supreme Court decision that effectively prevents future administrations from reinstating it. Still, one lesson from the Biden administration’s Inflation Reduction Act is that government incentives to reduce the cost of low-carbon alternatives — rather than regulations to penalize high-carbon sectors — could be a more effective way to drive decarbonization in any case. |

|

| |  | Tim McDonnell |

| |

Diego Vara/File Photo/Reuters Diego Vara/File Photo/ReutersA leading provider of carbon trading data is branching out into a wider set of green commodities as companies come under increasing scrutiny from regulators in Europe and elsewhere, its CEO told Semafor. Sylvera makes money by aggregating and analyzing data about the market for carbon credits, which buyers and sellers pay to access. It’s a service in high demand; the company said it doubled its number of paid users in 2025 and boosted its revenue by 50%. Now, CEO Allister Furey said, the company will offer similar insights about carbon-intensive commodities — including fossil fuels, hydrogen, ammonia, steel, and cement — that are increasingly exposed to global carbon taxes and tariffs, and therefore priced differently based on their carbon content. The idea is to give buyers of these products more insight into which specific producers are more or less exposed to carbon pricing — and, by the same token, give producers more insight into where their products can be most competitive. “The net is closing,” Furey said, “and carbon pricing is becoming wildly more difficult to escape from.” |

|

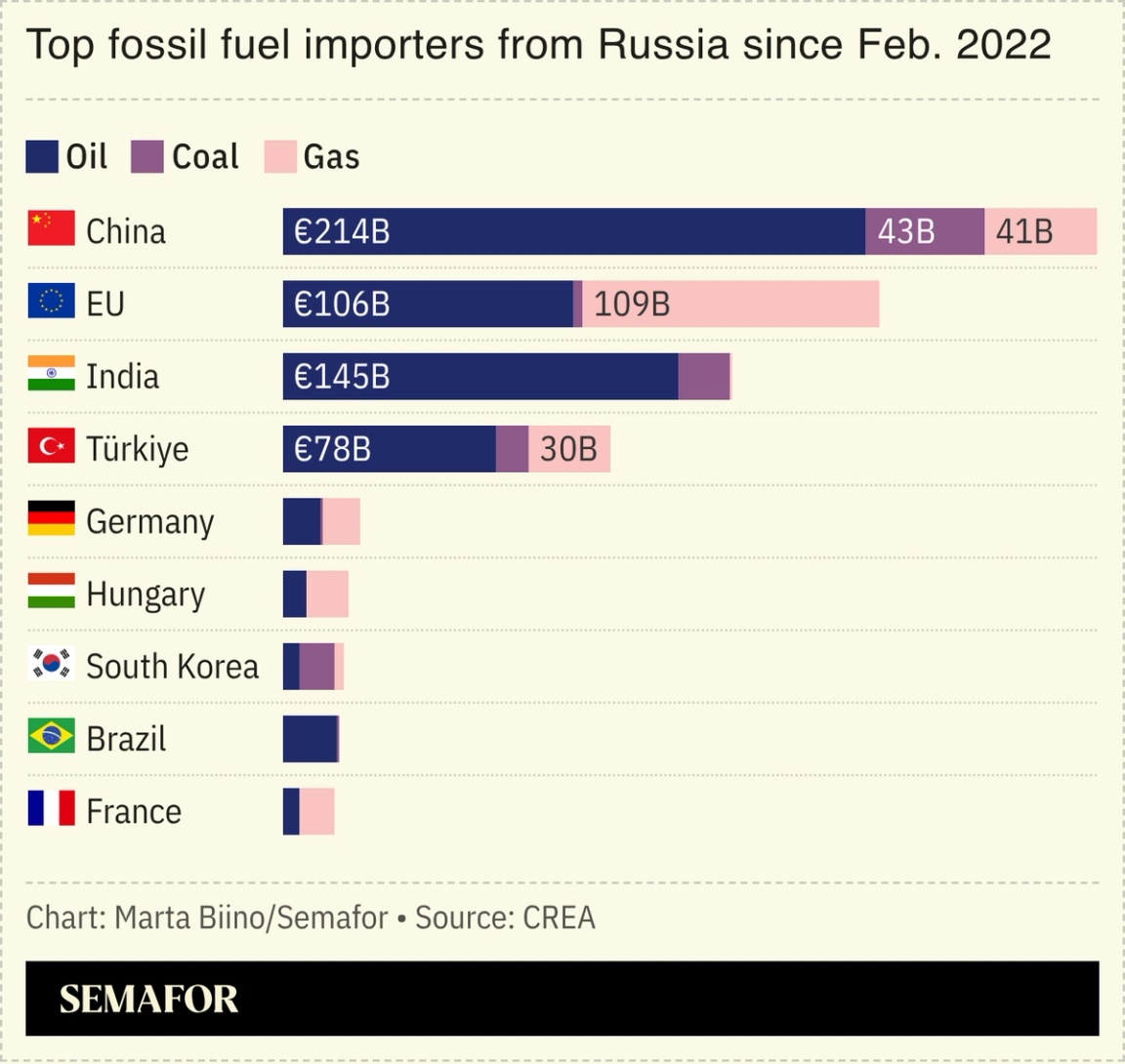

Oil prices dipped on Tuesday on signs that talks between the US and Iran are alleviating the risk of supply disruptions through the Strait of Hormuz, even as the US continues to ramp up pressure on Russia’s oil exports. On Monday, US forces intercepted another tanker allegedly part of Russia’s sanctions-dodging “shadow fleet,” days after US President Donald Trump said that India had agreed to stop buying Russian oil as part of a trade deal. That commitment wasn’t reflected in the deal itself, however, and hasn’t been confirmed by Delhi. “A full halt of Russian oil imports remains unlikely given India’s desire to preserve strategic autonomy,” Rystad Energy chief economist Claudio Galimberti wrote in a note. Still, Indian imports are declining gradually, which means that “Russia is at risk of losing a key seaborne outlet and being pushed into deeper China dependence, with weaker realized pricing as discounts widen to keep barrels moving.” Moscow’s oil and gas revenue in January was down to about one-third of its level this time last year. |

|

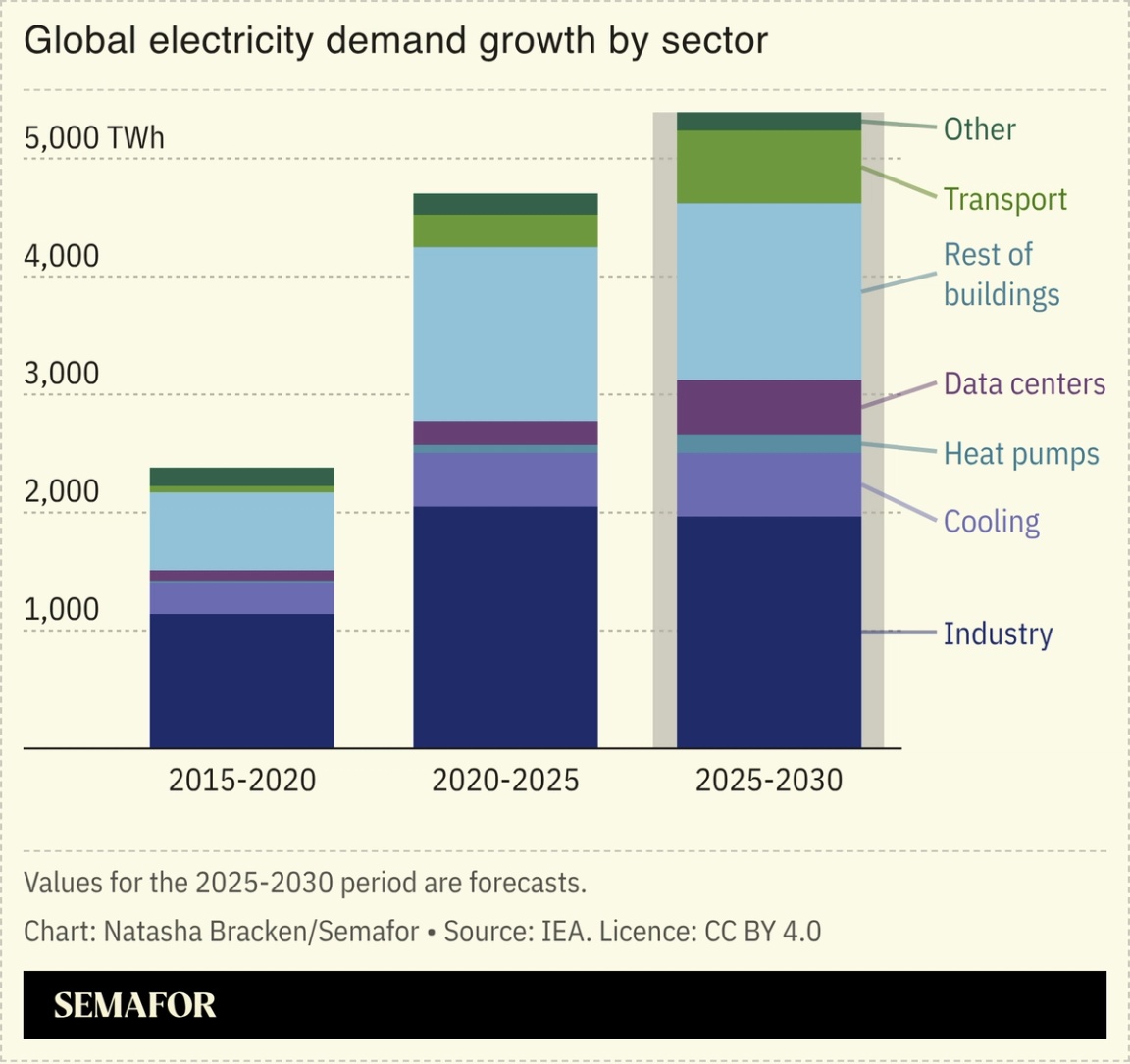

Global electricity demand is projected to surge 3.6% annually through the decade, driven by industry, EVs, air conditioning, and data centers, a new report found. Yet despite this boom in the “age of electricity,” emissions should remain relatively flat thanks to renewable progress, according to the International Energy Agency. Green electricity generation, led by record solar deployment, is overtaking coal-fired power globally after the two reached near parity in 2025. Nuclear output also hit a new record, and together with renewables, these sources are expected to supply half of global electricity by 2030. On the fossil fuel side, while coal use declined in India and China, it ticked up in the US due to higher natural gas prices and the Trump administration’s push to delay coal plant retirements to meet surging data center demand — expected to drive about half of US power demand growth this decade. Still, if planned closures proceed, US coal use should resume its decline. One of the biggest challenges facing most economies, however, is grid connectivity. Record-high connection queues from congested grids threaten to stymie electricity output even when demand and generation capacity exist. — Natasha Bracken |

|

China’s ascent is far more than a domestic story — over the past 50 years, it has steadily transformed global markets, technology, and international affairs. In today’s world economy, China is woven into every industry and influences trade and policy decisions across the globe. To provide clear context on China’s sweeping impact on deals, policies, and the emerging global order, Semafor is launching its flagship China Briefing. Authored by Pulitzer Prize-winning journalist Andy Browne, Semafor China will deliver original reporting, expert analysis, and sharp insight into how China is reshaping the world around us. Subscribe for free here. |

|

Nigeria’s oil renaissance |

| |  | Alexander Onukwue |

| |

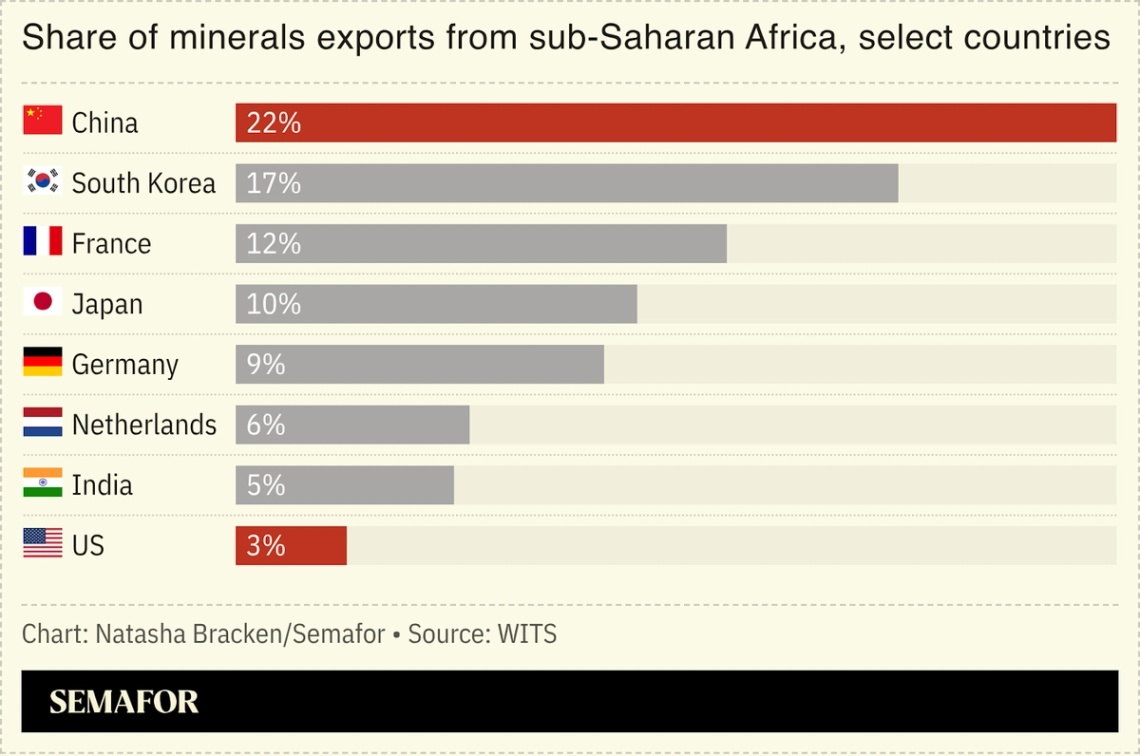

Temilade Adelaja/File Photo/Reuters Temilade Adelaja/File Photo/ReutersNigeria’s energy companies have ramped up oil production over the past year as the government intensifies its efforts to restart dormant refineries and monetize untapped gas reserves. Domestic companies now control assets that produce more than half of Nigeria’s oil production, according to operators and government officials. Renaissance Africa Energy, a consortium of mostly local firms that took over the operation of onshore oil assets from Shell a year ago, has doubled output from its facilities from a base of about 100,000 barrels per day, Nigeria’s junior oil minister told an industry gathering last week in Abuja. Reviving the energy sector has been a top priority of Nigerian President Bola Tinubu’s administration as it tries to rapidly grow an economy rocked by two recessions in the last decade. |

|

New EnergyFossil FuelsPolitics & PolicyMinerals & Mining EVs- Carmakers have registered around $55 billion in write-downs over the past year after the industry overestimated the pace of the energy transition, faced a reluctant US administration, and saw some companies struggle to keep up with new entrants from China.

|

|

| |  | | | You’re receiving this email because you signed up for briefings from Semafor. |

|