| | In this edition, why Big Tech will need to go long, and the Justice Department is at war with itself͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Business |  |

| |

|

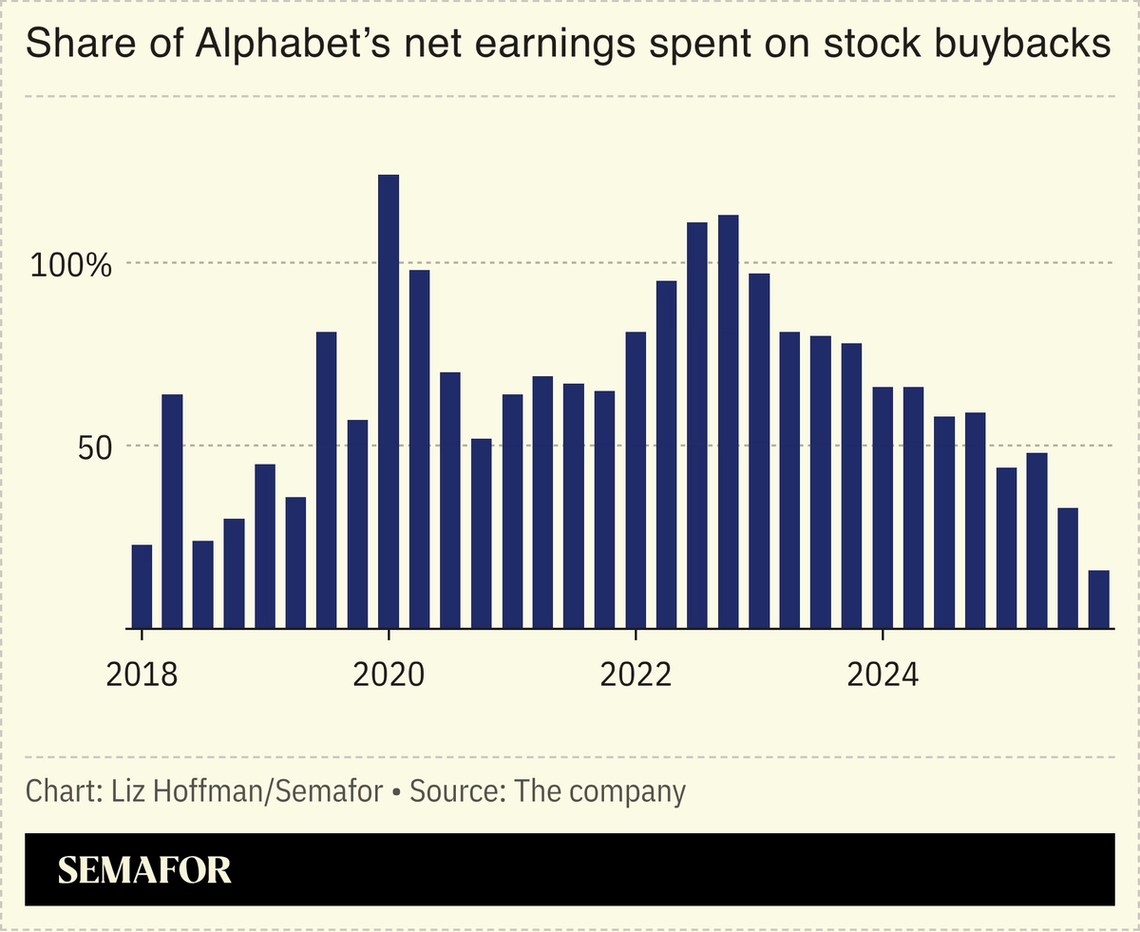

A big complaint about modern financial markets is that they have the foresight of a goldfish. This critique, popularized by such proletariat rabble-rousers as Larry Fink, says CEOs can’t focus on the future because they’re sweating the next 90 days and obsessing over their stock prices. So they buy back shares while their factories rot and their products slide into obsolescence. But look at the engine of the global economy, Silicon Valley, and you’ll see something that looks suspiciously like the long-term stewardship Fink begged for back in 2015. Elon Musk’s deepest desire is to fling enough data centers into space so that humanity can live there forever. Jeff Bezos is building a clock inside a mountain designed to tick once a year for the next 10,000. Alphabet is hawking the tech industry’s first century bond since the late 1990s — after a quarter in which it spent the smallest percentage of its profits buying back its own stock, just 16%, in eight years.  And the tech companies are plowing shareholders’ money into AI investments that will take years to pay off, if they ever do, because they believe that it’s the right bet. (Their personal obsession with human longevity may be a factor here: If you plan to live for 150 years, and your net worth is tied up in a company you control, you care less about the stock price tomorrow than you do about the stock price in 150 years.) Of course, tech CEOs until now have been able to make these millennial bets without sacrificing short-term riches. The wilder the moonshot, the higher their stocks went on the backs of FOMO-seized investors. But that immunity is already fading, as Oracle has learned over the past few months. The tradeoff that Fink lamented is likely to hit stronger players as the cost of the AI race grows. Even moonshots come with bills to pay. Congrats, Larry, you got your long-termism. It comes with AI porn generated in space, but you got it. Plus: We just announced our first slate of speakers for the 2026 Semafor World Economy, April 13-17 in Washington. We’ll be interviewing ARM Holdings CEO Rene Haas, Meta President Dina Powell McCormick, OpenAI Chairman Bret Taylor, Citadel founder Ken Griffin, Verizon CEO Dan Schulman, and dozens of other newsmakers. You can see the first lineup of speakers here. |

|

Live Nation settlement divides Trump’s DOJ |

Mike Blake/Reuters Mike Blake/ReutersThe Trump administration’s antitrust regime is at war — with itself. Settlement talks between Live Nation and the Justice Department are deepening fractures between let’s-make-a-deal Trump brass and line trustbusters led by DOJ antitrust chief Gail Slater, who wants to take the government’s monopoly case against the ticketing giant to trial next month, Semafor scooped. Slater was bigfooted last week by Attorney General Pam Bondi on a personnel decision, and her top deputy just resigned. Lobbying isn’t unique to Trump’s Washington, but criticisms of undue influence peddling by connected MAGA lawyers has dimmed hopes among both progressives and right-wing populists for a tough approach to corporate power. The administration’s most prominent corporate skeptic, Vice President JD Vance, has abandoned the cause, leaving Slater fighting a lonely battle she appears to be losing. |

|

Calls for Lutnick’s resignation grow |

Elizabeth Frantz/Reuters Elizabeth Frantz/ReutersMore US lawmakers are calling on Commerce Secretary Howard Lutnick to resign after the release of emails showing that his ties to Jeffrey Epstein were more extensive and longer-running than he’d previously disclosed. Lutnick’s ability to not only survive but thrive in Trump’s cutthroat cabinet has been one of the biggest surprises of the president’s first year, and he is now poised to control what could be more than $1 trillion in federal investment dollars, Semafor reported. But as Semafor’s Ben Smith wrote Monday, “the truth of the Epstein files is that, like an oil slick, once you’ve got it on you, there’s no washing it off.” Another curious aspect of the Epstein scandal, Ben writes, is its drip-drip nature. Even Trump is having trouble counter-programming as reporters dig through a vast trove of documents that reveal embarrassingly, if not criminally, bad judgment by a widening circle of elites. |

|

Google goes long with 100-year bond |

Alphabet’s $11.5 billion bond sale is notable for two things: Its debt is really cheap, and a chunk of it will outlive anyone who bought it. Alphabet is paying less on the £1 billion, 100-year debt slug than the average American consumer is paying for a 30-year mortgage (compared to yields on government bonds.) The company’s century bond was set to be issued Tuesday at 1.2 percentage points above UK gilts, according to a person familiar with the matter. Corporate century bonds are rare; the last one was in 2021 from French utility EDF, and the last one from a tech company was Motorola’s in 1997. They are more common from governments, which have forecastable 100-year expenses like pensions and defense. But as Liz noted in her column today, companies making centuries-long bets on AI now have centuries-long bills to pay. One other note on Google’s cash grab: The roughly 3 billion Swiss franc portion appears to be the largest by a non-Swiss company, and could make that market more enticing to issuers — especially as global investors edge away from the US dollar. |

|

Paramount dangles more money — just not right now |

Mike Blake/File Photo/Reuters Mike Blake/File Photo/ReutersThe Ellisons have spent the last few weeks weighing whether to raise their bid for Warner Bros. Discovery or walk away. Instead, they chose door number three, Semafor’s Rohan Goswami writes. Paramount on Tuesday added a sweetener to its $108 billion offer for the owner of CNN and HBO, which it is trying to wrestle away from Netflix. A “ticking fee” will add 25 cents a share — worth about $650 million — for every quarter the Netflix transaction doesn’t close, starting next year. It’s a workaround to Paramount’s problem: The sharp decline in Oracle’s stock price, the source of much of Ellison’s wealth, and previous questions over its plans to tap Gulf money have for now limited its ability to raise its bid. And Paramount doesn’t want to bump only to have regulators nix the Netflix takeover anyway, as political backlash builds in Washington to a deal that would combine the world’s No. 1 and No. 4 streamers. |

|

Can a YouTuber fix Americans’ nest eggs? |

Hamad I Mohammed/Reuters Hamad I Mohammed/ReutersWe now have two competing visions to fix to Americans’ retirement problem: the federal government, and the world’s biggest YouTube star. MrBeast, the influencer who brought us real-life Squid Game and monetized the seven days he spent buried alive, is buying teen-focused finance app Step “to give millions of young people the financial foundation I never had.” With money from YOLO king Chamath Palihapitiya and Bitmine, a major crypto holder chaired by perma-bull Tom Lee, Beast Industries is betting that Americans want to be financially savvier and healthier than they are, despite years of evidence to the contrary. Another (better) idea comes from Australia by way of Washington, which is rolling out retirement accounts for kids, seeded with $1,000 from the federal government and matching funds from some employers. The reality is that mandatory nest eggs, whether through bygone corporate pensions or nationalized retirement schemes, have a long track record of actually working. Gamified behavioral nudges don’t. |

|

Target faces more than a CEO shift |

Target’s latest turnaround effort comes the same month Walmart soared past $1 trillion in market value, stoking investor fears that the retail chain’s efforts are too little and too late. Shares fell 2% Tuesday after the company cut 500 management jobs and promoted two longtime insiders to new roles, including its chief merchant. The moves come a week into the tenure of CEO Michael Fiddelke, who joined the company in 2003 as an intern — and whose promotion has been met with skepticism by investors who were hoping for some outside blood and, with it, fresh ideas. Even Target’s decision to use money saved by white-collar job cuts to boost pay for store workers is copied from Walmart, which pivoted faster to digital sales and boosted wages under the protection of its billionaire family, the Waltons. Playing catch-up has left Target vulnerable to activist investors: TOMS Capital Investment Management still has a big stake in the company and has discussed its — still publicly vague — concerns with management, people familiar with the matter said. A Target spokesperson declined to comment. |

|

Semafor is proud to announce its first slate of speakers for the 2026 Annual Convening of Semafor World Economy, taking place April 13-17 in Washington, DC. This global cohort of senior leaders from every major sector across the G20 are just some of the 400 top CEOs joining Semafor World Economy for five days of on-stage conversations and in-depth interviews on growth, geopolitics, and technology. See the first lineup of speakers here. |

|

➚ BUY: Sunday. YouTube TV is set to offer sports fans a skinny bundle at a lower cost and isn’t ruling out bidding on the next round of NFL rights. ➘ SELL: Monday. The AI revolution comes for software companies. Shares of Monday.com tanked on weak guidance amid fears that agents and vibe-coding will kill enterprise software. |

|

|