|

4x More Wealth (With Less Risk)

Why the Second Quintile is the Goldilocks zone of dividend investing.

👋 Howdy Partner,

In theory, investing is simple, but it’s not easy.

Buy great companies at fair prices, ignore the market, and wait.

But having patience isn’t easy, and Mr. Market can be hard to ignore.

It’s easy to get pulled into chasing the next big thing.

Especially when people seem to be making fast returns on gold, meme coins, or AI companies.

But we’re in this for steady income and to build true, generational wealth.

That means we need durability.

Markets crash. Bubbles burst. But quality dividends keep coming.

The High Yield Trap

When investors look for income, they usually make one mistake.

They sort a list of stocks by yield and buy the ones at the very top.

This is a trap.

If you blindly buy the highest yields, you’re often buying a group filled with companies in trouble.

The business model might be failing, the payout might be unsustainable, or a dividend cut might be on the way.

A Better Strategy

Savita Subramanian, Head of U.S. Equity Strategy at Bank of America, has a better way.

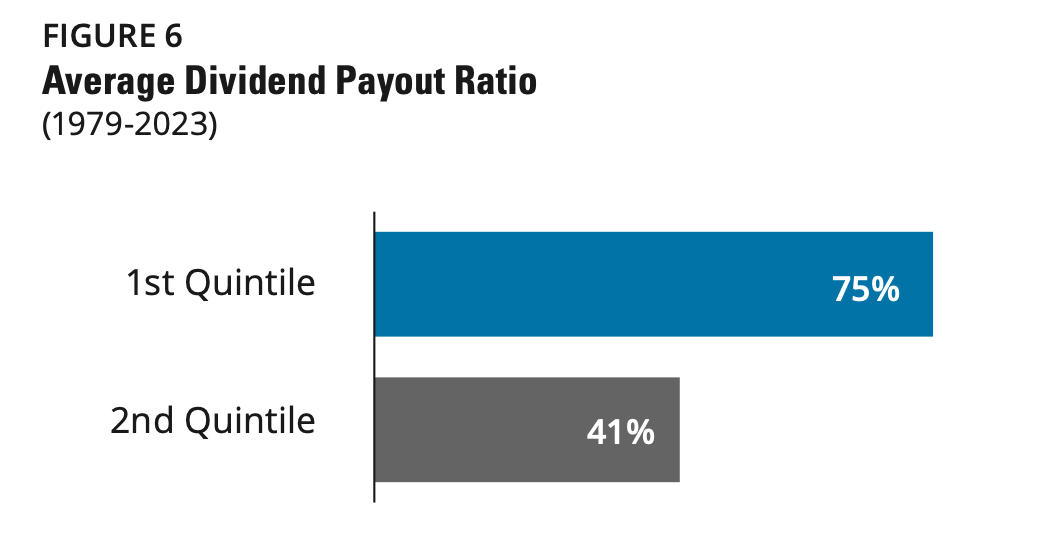

She divides the market into five groups (quintiles) based on their dividend yield.

1st Quintile: the 20% of the market with the highest yields

2nd Quintile: the 20% with the next highest yields

3rd - 5th Quintiles: lower yielders and non-payers

The secret to outperforming the market isn’t buying the first group.

It’s buying the second.

This one tends to hold solid businesses with healthy payout ratios.

How Does It Perform?

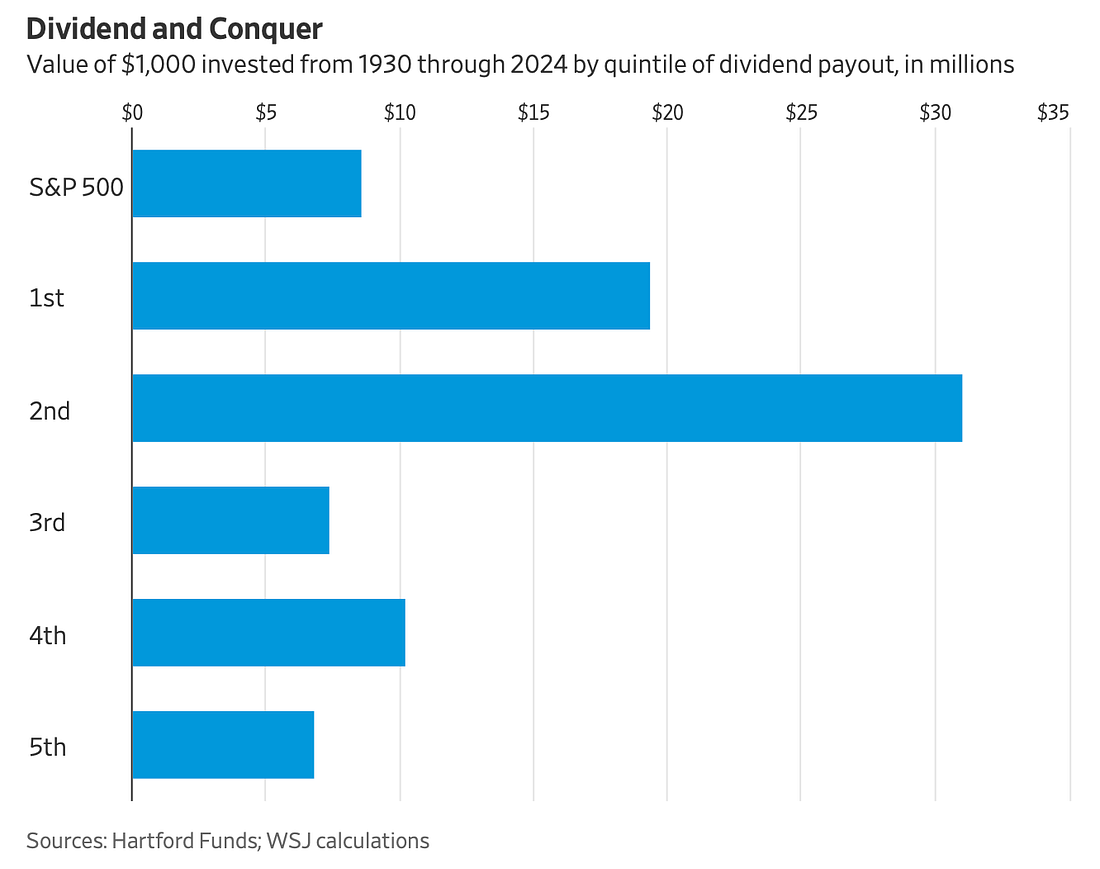

Hartford Funds looked at the performance of these groups from 1930 to 2023.

If you had invested $1,000 in the S&P 500, it would have grown to $8.6 million.

If you had invested that same $1,000 in the Second Quintile of dividend stocks, it would have grown to $31.2 million.

That is nearly 4x more wealth.