| | In this edition, how the Justice Department’s antitrust efforts will change after Gail Slater’s firi͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Business |  |

| |

|

- M&A water is warm

- CFTC to states: Drop dead

- Utilities face AI mob

- Gulf wants 2-and-20, too

- Semafor goes to China

Warner Bros. wants Paramount’s best and final … Palantir takes its talents, and politics, to Miami … |

|

Hopes among progressives and right-wing populists for a crackdown on corporate monopoly power collapsed last week. Some cast the firing of Justice Department’s antitrust chief Gail Slater as a victory for corporate lobbyists over a devoted band of trustbusters, an explanation satisfying to Trump critics who see corruption everywhere. And that buddy-cop photo of Steve Bannon and Lina Khan launched a thousand horseshoe-theory-of-politics columns. The media “love strange bedfellows,” Semafor’s Ben Smith noted in a column over the weekend. But Trump’s commitment to antitrust was, in retrospect, never real. The president’s hostility to Big Tech was a culture war masquerading as economic policy, and as those fights waned — mostly solved by Mark Zuckerberg’s rightward shift and the resurgence of Elon Musk’s X as a free-for-all public square — so did the guise of traditional competition enforcement. The dominant force in tech moved from fights about online censorship, which sharpened questions about platforms’ size and reach, to AI urgency, where the industry and the White House are more aligned. Where the free-speech fight is still going, antitrust enforcement will continue to be a useful tool. (Keep an eye on the Federal Trade Commission’s investigation of Apple News downranking conservative outlets.) Where it isn’t, the message is clear: The nation’s chief dealmaker wants more deals. |

|

Companies and their advisers are waking up to a new Washington: You can do deals again. A year ago, deal lawyers were busy rewriting client memos to reflect the populism of the campaign trail, where Trump had railed against big tech, defense, and health care companies “stifling competition.” That rhetoric has been replaced by a basic long-leash Republicanism — a shift that may be unsurprising with a dealmaker in the Oval Office, but has disappointed progressives and hardcore populists, and sent legal sherpas scrambling to freshen their advice. Remedies are back on the table, offering companies the chance to cut a deal to get their mergers approved, sometimes with the help of an ascendant crop of MAGA lobbyists. “The advice to clients that have transactions likely to face scrutiny is to come ready with something to offer,” said Tim Cornell, an antitrust lawyer at Debevoise & Plimpton. |

|

CFTC’s Selig tells states: Drop dead |

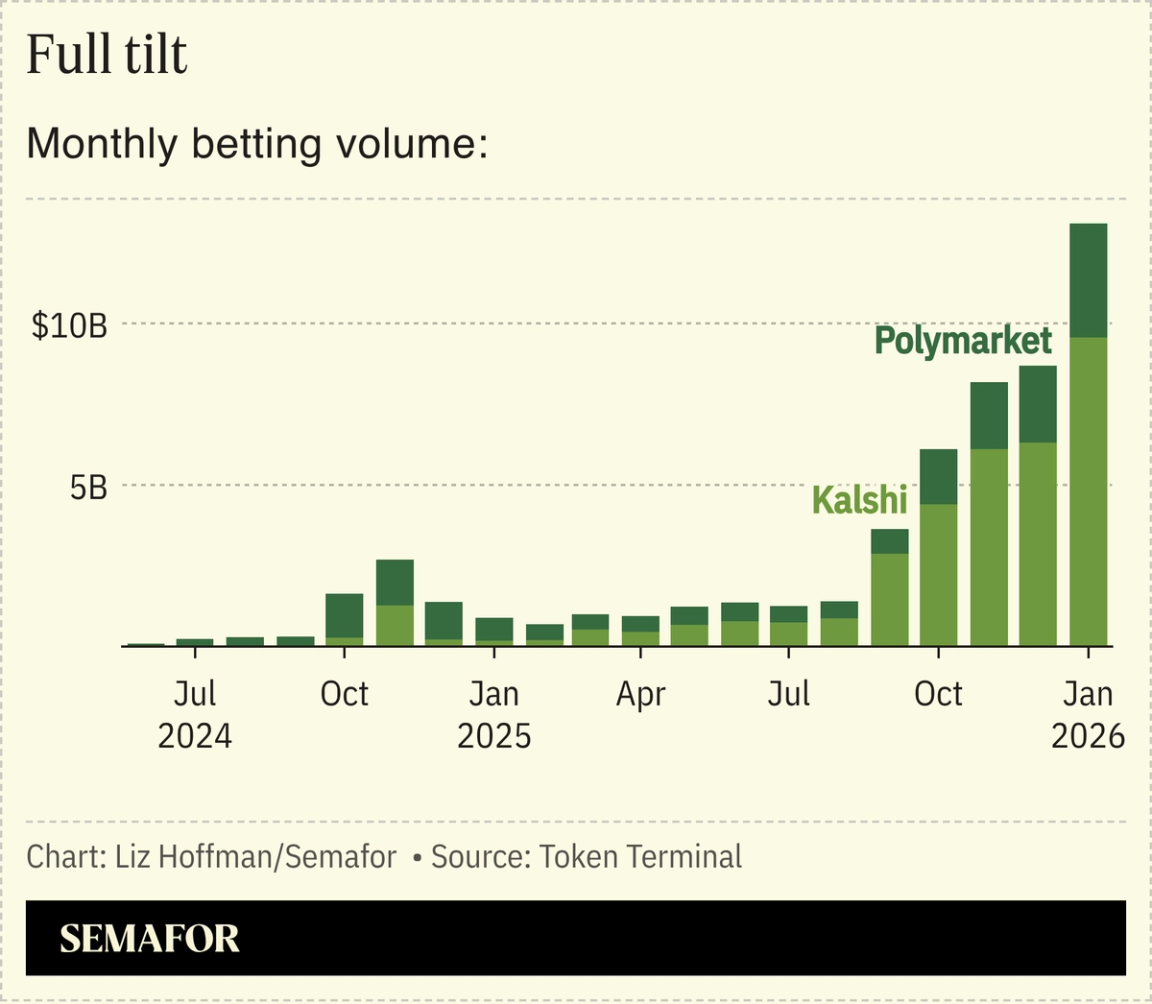

State officials have filed two dozen suits against prediction market operators, trying to protect traditional casino revenue and stop underage gambling. The Trump administration’s message to them: Drop dead. The Commodity Futures Trading Commission on Tuesday filed a legal brief in support of Crypto.com, which alongside Kalshi and Polymarket is being sued by Nevada for allegedly operating unlicensed sportsbooks. CFTC Chair Michael Selig said betting markets “provide useful functions for society,” allowing people to, for example, hedge their energy bills by betting on the weather, and are “an important check on our news media and information streams.” These startups’ vision — a world where anything can be a binary contract — could replace large swaths of investing with simple yes-no markets. Will Walmart’s profits beat analyst expectations? That bet is more cleanly placed on Polymarket than on its minority investor, NYSE. States are protecting tens of billions of dollars in casino revenues, but have also cast a public policy eye on the rise of teen gambling. Prediction-market companies “are neglecting age restrictions, protection programs, revenue, consumer protections,” Massachusetts’ gambling regulator told Semafor in an interview earlier this year. (A Kalshi-linked X account says 57% of online gamblers are female, an improbable figure that raises the question of how many kids are using mom’s ID.) — Rohan Goswami |

|

Exelon’s controversial energy play |

Leah Millis/File Photo/Reuters Leah Millis/File Photo/ReutersUtilities are on the front lines of the growing public backlash to AI data centers. One CEO has a new idea: Own the electrons. The chief executive of Exelon, the largest US utility by customers, told Semafor’s Tim McDonnell that the company is getting back into the business of generating its own electricity — something it hasn’t done since it spun off Constellation Energy and its fleet of nuclear power plants in 2022 — to tamp down spiraling power prices. “I’m trying to respond to a marketplace that’s not stepping up,” Calvin Butler said. The trouble with the strategy is that it hinges on bullish forecasts for AI. If demand turns out to be lighter, households could be left paying for infrastructure they don’t need, a point that KKR’s North American infrastructure head made in a recent interview. Of course, if AI demand turns out to be lighter, the economy has bigger problems. |

|

Not the world’s ATM anymore |

Sheikh Tahnoon bin Zayed. Rashed Al Mansoori/UAE Presidential Court/Handout via Reuters. Sheikh Tahnoon bin Zayed. Rashed Al Mansoori/UAE Presidential Court/Handout via Reuters.For years, the Middle East handed its money to Wall Street to manage. Then it started managing its own money. Now it wants to manage Wall Street’s money, Semafor’s Matthew Martin writes. The launch this week of yet another financial arm of the Emirati government shows the region’s ambitions to not just keep tighter control of its own wealth, but become a player in the global money-management world. It follows the launch of Mubadala’s inaugural co-investment fund, which will welcome foreign investors into its deals. When Abu Dhabi branded itself the “capital of capital” a few years ago, it was mostly a reference to the nearly $2 trillion pool of sovereign-linked wealth — a reminder that anyone raising serious money would need to make a trip. Increasingly, Abu Dhabi is looking to bring in capital, and not just send it out. |

|

China’s ascent is far more than a domestic story — over the past 50 years, it has transformed global markets, technology, and geopolitics, and is a huge player in the big global economic questions of today: Whose technology with the global AI stack be built on? How automated should our factories be? Is state capitalism, whether the Beijing or Washington variety, here to stay? So Semafor is launching its flagship China Briefing, our third global expansion following Semafor Africa and Semafor Gulf. Authored by Pulitzer Prize-winning journalist Andy Browne, Semafor China will deliver original reporting, expert analysis, and sharp insight into how China is reshaping the world around us. Subscribe for free here. |

|

➚ BUY: Shoes. Retailers are sounding the alarm after the fastest climb in footwear prices in more than three years, reports Women’s Wear Daily (though men’s sneakers were to blame). ➘ SELL: Socks. For one week last year, the world’s largest seller of socks was … McDonald’s. The fast food giant sold more than 50 million pairs during its latest holiday meal-moving promo. |

|

Companies & Deals- Late checkout: Thomas Pritzker is stepping down as chairman of hotel giant Hyatt after revelations of his Epstein ties. That the scion of a family-controlled company can be forced out raises the question of whether any executive touched by the Epstein oil slick can survive it.

- Feeling truly seen: BlackRock has long thought of itself as a tech company, pointing to its Aladdin software, which serves as a kind of operating system across the investment world. ValueAct agrees.

- Equal opportunity employer: Goldman Sachs will stop considering diversity criteria when choosing board directors, yet another sign of the DEI retreat since Trump’s reelection.

- Self-dealing: UnitedHealth’s CEO has quietly invested millions of dollars in health startups — including direct competitors or partners of the company he leads — without notifying shareholders, WSJ reports. The scoop begs the question of what the growing volumes of corporate disclosures are for, if not this. (This morning, SEC Chairman Paul Atkins suggested some trims.)

Watchdogs- Parental advisory: Global efforts to keep kids off social media are gathering momentum, with Germany and India the latest to weigh bans for users under 16. Platforms have rolled out teen accounts meant to be safer and more sanitized, but start-’em-young is good business: A 2024 Harvard study found that under-18 users generated $11 billion in ad revenue for Meta, TikTok, and others.

- Dublin down: Ireland’s data watchdog is investigating whether Grok, the chatbot from Elon Musk’s xAI, violated European rules by generating on-demand nudes. Ireland’s status as the bloc’s key data regulator and the legal home (for tax reasons) of most big tech companies gives it outsize influence.

|

|

|