|

✂️ Cut your QA cycles down to minutes with QA Wolf (Sponsored)

If slow QA processes bottleneck you or your software engineering team and you’re releasing slower because of it — you need to check out QA Wolf.

QA Wolf’s AI-native service supports web and mobile apps, delivering 80% automated test coverage in weeks and helping teams ship 5x faster by reducing QA cycles to minutes.

QA Wolf takes testing off your plate. They can get you:

Unlimited parallel test runs for mobile and web apps

24-hour maintenance and on-demand test creation

Human-verified bug reports sent directly to your team

Zero flakes guarantee

The benefit? No more manual E2E testing. No more slow QA cycles. No more bugs reaching production.

With QA Wolf, Drata’s team of 80+ engineers achieved 4x more test cases and 86% faster QA cycles.

When Stripe first launched, they became known for integrating payment processing into any business with just seven lines of code.

This was a really big achievement. Taking something as complex as credit card processing and reducing it to a simple code snippet felt revolutionary. In essence, a developer could open a terminal, run a basic curl command, and immediately see a successful credit card payment.

However, building and maintaining a payment API that works across dozens of countries, each with different payment methods, banking systems, and regulatory requirements, is one of the most difficult problems. Most of the time, companies either lock themselves into supporting just one or two payment methods or force developers to write different integration code for each market.

Stripe had to evolve the API multiple times over the next 10 years to handle credit cards, bank transfers, Bitcoin wallets, and cash payments through a unified integration.

But getting there wasn’t easy. In this article, we look at how Stripe’s payment APIs evolved over the years, the technical challenges they faced, and the engineering decisions that shaped modern payment processing.

Disclaimer: This post is based on publicly shared details from the Stripe Engineering Team. Please comment if you notice any inaccuracies.

The Beginning: Supporting Card Payments in the US (2011-2015)

When Stripe launched in 2011, credit cards dominated the US payment landscape. The initial API design reflected this reality.

Stripe introduced two fundamental concepts that would become the foundation of their platform.

The Token was the first concept. When a customer entered their card details in a web browser, those details were sent directly to Stripe’s servers using a JavaScript library called Stripe.js.

This was crucial for security. By never allowing card data to touch the merchant’s servers, Stripe helped businesses avoid complex PCI compliance requirements. PCI compliance refers to security standards that businesses must follow when handling credit card information. These requirements are expensive and technically demanding to implement correctly.

In exchange for the card details, Stripe returned a Token. Think of a Token as a safe reference to the card information. The actual card number lived in Stripe’s secure systems. The Token was just a pointer to that data.

The Charge was the second concept. After receiving a Token from the client, the merchant’s server could create a Charge using that Token and a secret API key.

A Charge represented the actual payment request. When you created a Charge, the payment either succeeded or failed immediately. This immediate response is called synchronous processing, meaning the result comes back right away.

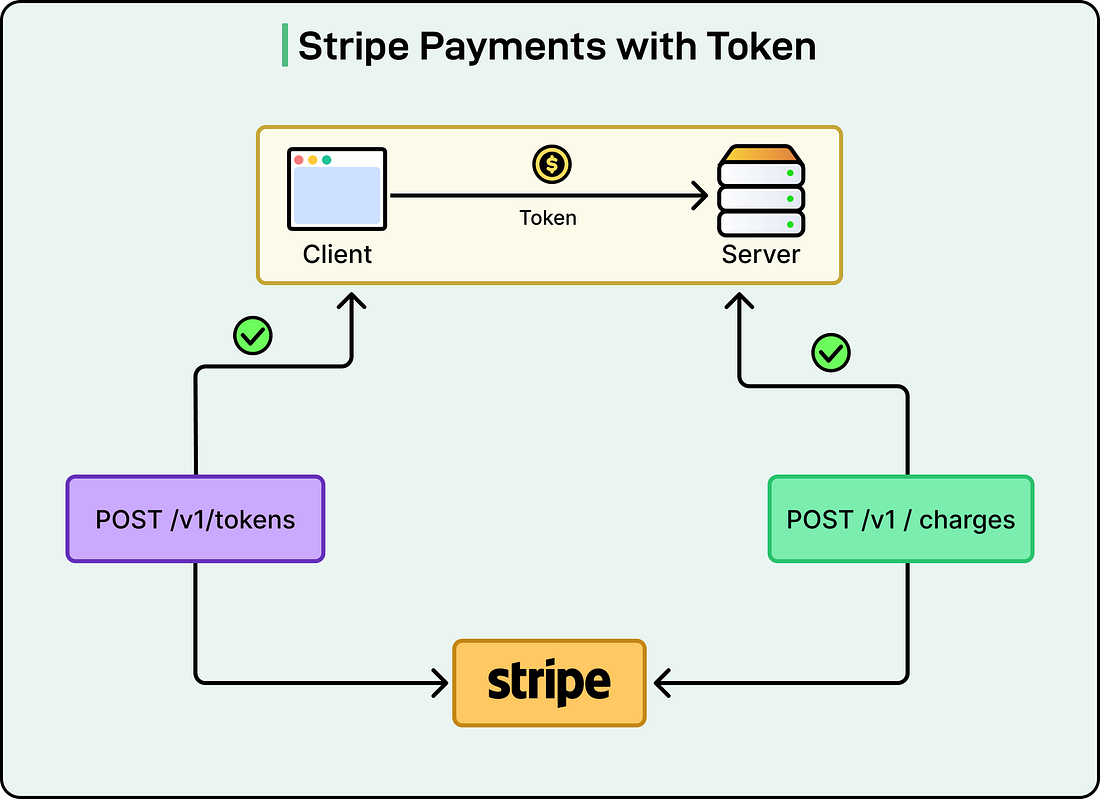

See the diagram below that shows this approach:

The payment flow followed a pattern common in traditional web applications:

JavaScript client creates a Token using a publishable API key

The browser sends the Token to the merchant’s server

The server creates a Charge using the Token and a secret API key

Payment succeeds or fails immediately

The server can fulfill the order based on the result

The First Challenge: ACH and Bitcoin (2015)

As Stripe expanded, they needed to support payment methods beyond credit cards. In 2015, they added ACH debit and Bitcoin. These payment methods introduced fundamental differences that challenged the existing API design.

Understanding Payment Method Characteristics

Payment methods differ along two important dimensions.

First, when is the payment finalized? Finalized means you have confidence that the funds are guaranteed and you can ship goods to the customer. Credit card payments are finalized immediately. However, Bitcoin payments can take about an hour, whereas ACH debit payments may take days to finalize.

Second, who initiates the payment? With credit cards and ACH debit, the merchant initiates the payment by charging the customer. With Bitcoin, the customer creates a transaction and sends it to the merchant. This