| |

| |

| Markets Snapshot | | | | Market data as of 06:39 am EST. | View or Create your Watchlist | | | Market data may be delayed depending on provider agreements. | | |

Five things you need to know | |

| |

Stocks sink into a correction | |

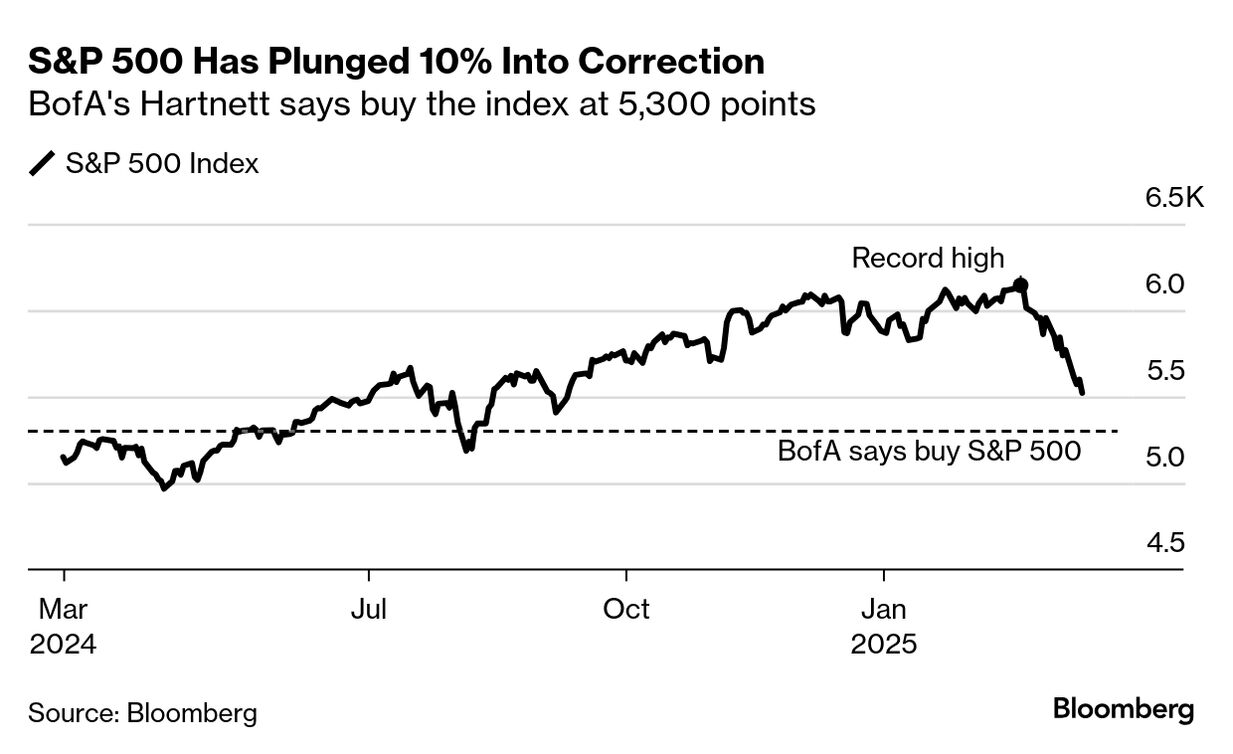

| US stocks tumbled into a correction yesterday, with the S&P 500 capping a 10% plunge from a peak in mid-February. It’s another milestone in what’s been a grim year for American investors. Here’s a roundup of the latest Bloomberg analysis on the selloff: - This marks the seventh-fastest correction in records going back to 1929, data compiled by Bloomberg show. It took 16 sessions for the S&P 500 to sink 10%. Three of the seven fastest drawdowns happened under President Donald Trump - in 2018, 2020 and now.

- Chart watchers say the S&P 500 needs to recapture its 200-day moving average, which is currently near 5,738. Some technical charts also show the S&P 500 is already at oversold levels. The index’s 14-day relative strength index is hovering around 30.

- Bank of America strategist Michael Hartnett says this is a technical correction, not the beginning of a bear market. “Since equity bear threatens recession, fresh declines in stock prices will provoke flip in trade and monetary policy,” he wrote.

- The AAII survey is registering extreme pessimism — a bullish signal in some circles because it indicates a mass surrender among individual traders and means that everyone who wanted to sell has done so. The index was at similar levels in 2022 and 2009, and prior instances have coincided with stretches of bear-market bottoms.

- But Dow Theory is signaling more pain ahead. Believers of the metric point to the fact that the Dow transports index has fallen about twice as much as the Dow industrial average from their peaks — a worrisome trend for key pillars of the US economy.

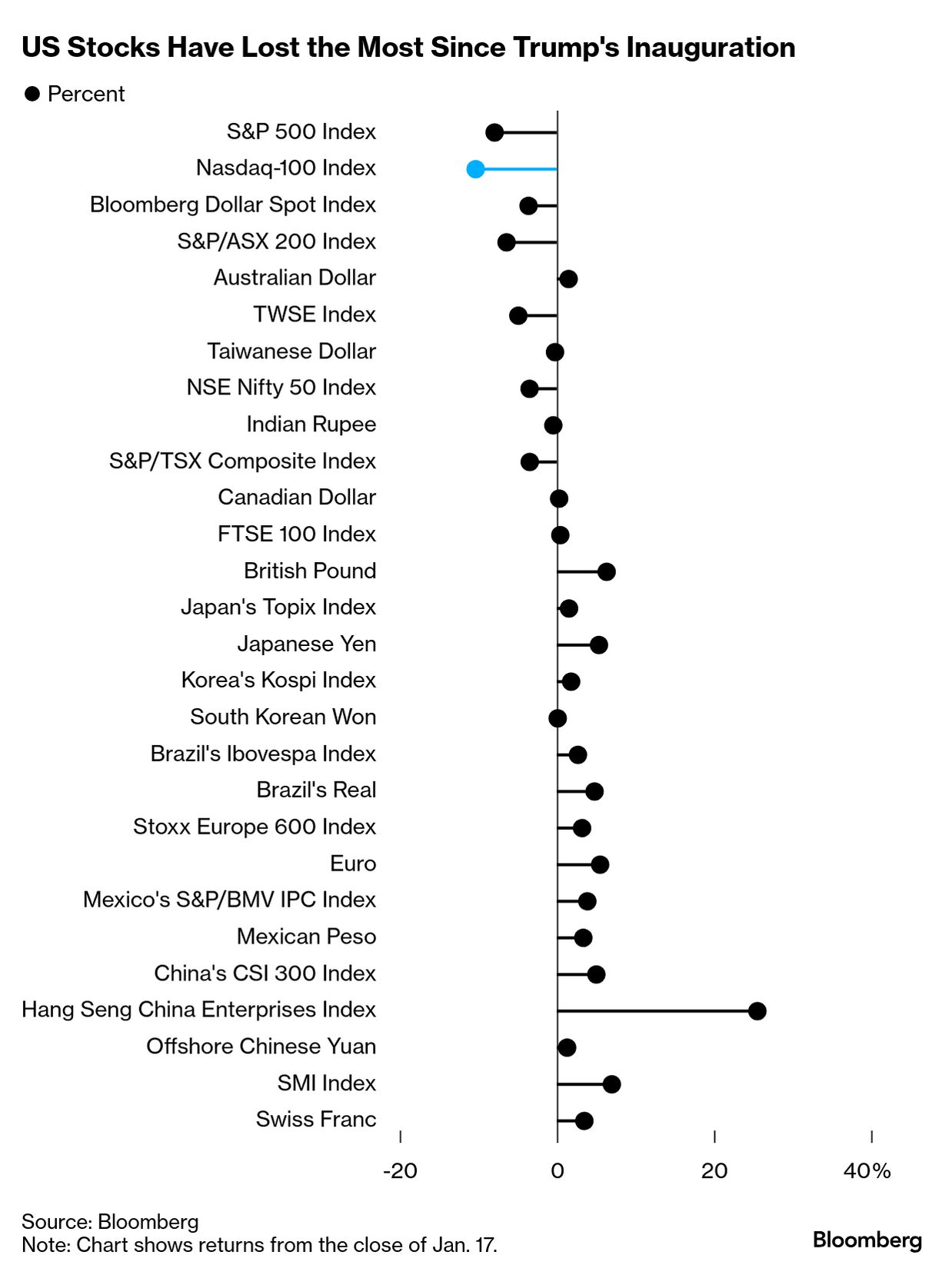

- US equities have fared the worst among the major asset classes since Trump took office on Jan. 20, with the S&P 500 dropping about 8% and the Nasdaq 100 Index sliding more than 10%.

- It’s still early days for the selloff. “Most corrections take about two months to play out,” said John Kolovos, chief technical strategist at Macro Risk Advisors. While stocks appear oversold, “we aren’t there yet in terms of time, as it took us about two weeks to get to these levels,” he said. — Natalia Kniazhevich, Abhishek Vishnoi, Sagarika Jaisinghani

| |

| | This is just a slice of our global markets coverage. To unlock every story and stay on top of the stocks you care about with unlimited watchlists, become a Bloomberg.com subscriber. | | | | | | |

| |

- Kering sinks 11% in Paris. The French fashion house appointed Balenciaga designer Demna Gvasalia to oversee a makeover of its struggling Gucci fashion label, disappointing investors who had expected a high-profile external hire.

- Brunello Cucinelli rises 3.7% in Milan. The Italian luxury brand reported broadly in-line earnings, demonstrating resilience a tough backdrop.

- DocuSign jumps 9.4% on results beating expectations. —Subrat Patnaik

| |

| |

| Credit markets are now beginning to confirm the growth angst that’s fueled a more than $5 trillion equity wipeout since late February. The cost to protect high-grade debt against default has hit the highest intraday level since August. Hedging across popular high-yield ETFs jumped, while at least six companies opted to postpone bond sales. It’s more evidence that the intensifying trade spat is threatening America’s investment and consumption cycle. “If credit spreads continue to widen much more from here, I think it tells you that the market is starting to price in a high chance of a recession,” said Priya Misra, portfolio manager at JP Morgan Asset Management, who has decreased credit risk exposure recently. —Denitsa Tsekova, Isabelle Lee and Caleb Mutua | |

| |

Word from Wall Street | | “It is finally settling in that there is no ‘Trump Put’ and there is no way the economy can manage so many shocks effectively - DOGE, firings, tariffs.” | | Peter Tchir Head of macro strategy at Academy Securities | | For more on why he's growing anxious about markets, read the full story here. | | |

| |

| |

| |

Enjoying Markets Daily? You might also like: | | |