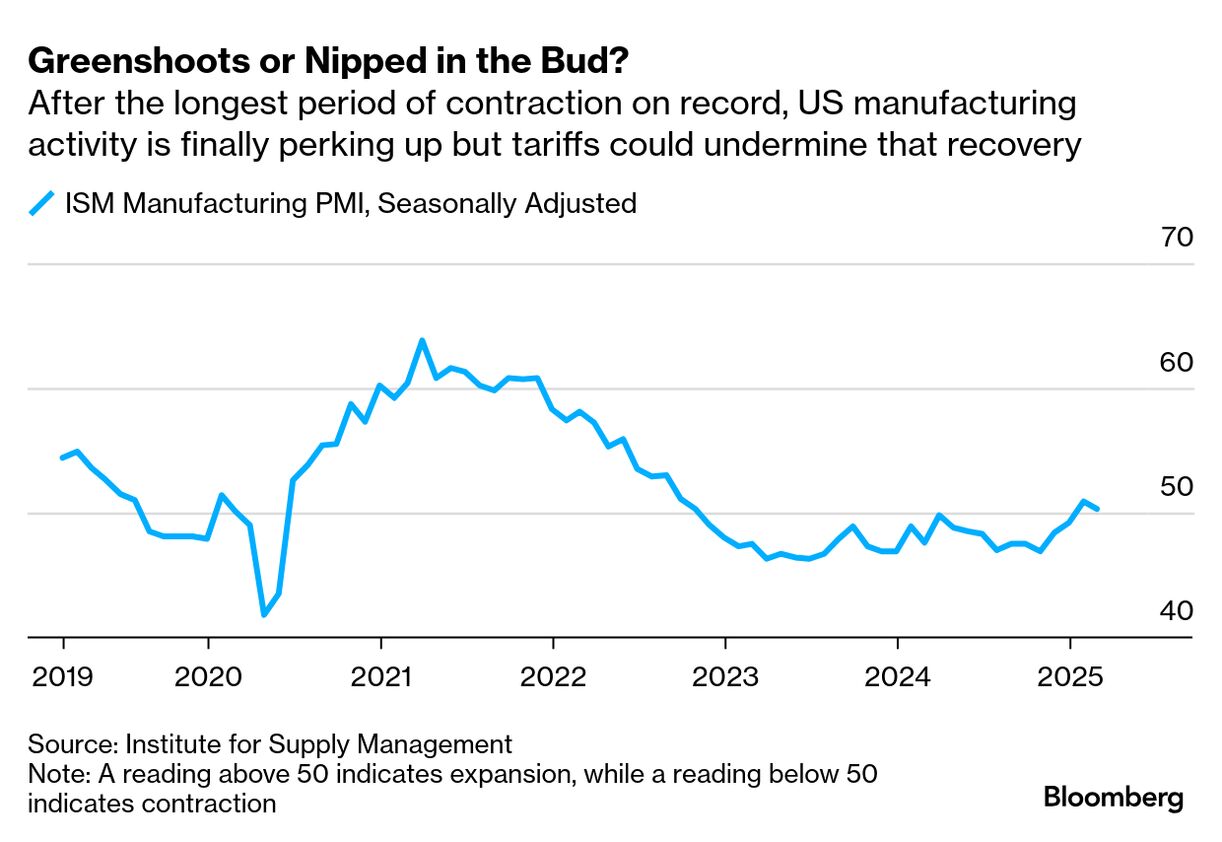

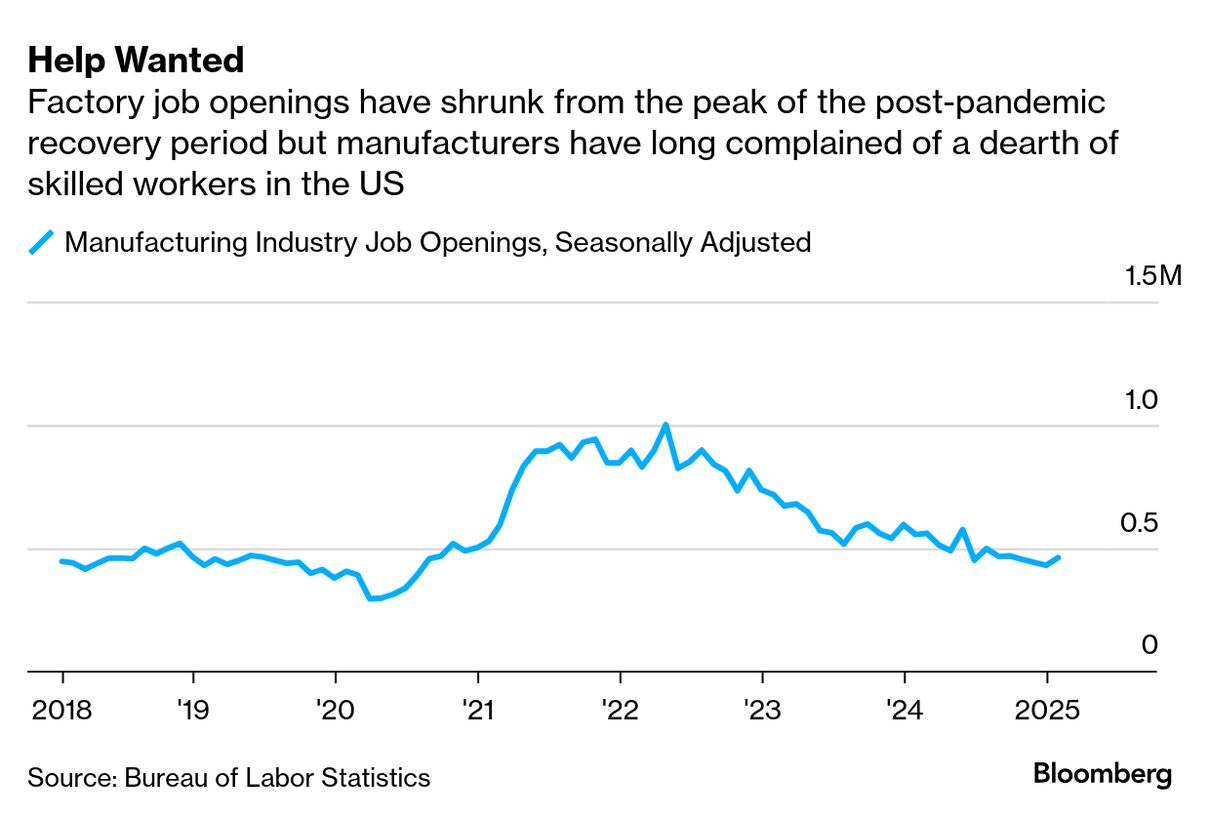

| Have thoughts or feedback? Anything I missed this week? Email me at bsutherland7@bloomberg.net. Also a programming note: There will be no Industrial Strength next week. Look for the next one on March 28. To get Industrial Strength delivered directly to your inbox, sign up here. The vibes are moving in the wrong direction in the manufacturing industry. The CEOs of some of the biggest industrial companies gathered this week in New York for JPMorgan Chase & Co.’s annual conference, and the mood was noticeably more cautious than it was just a few weeks prior when many of the same executives spoke at a pair of confabs hosted by Barclays Plc and Citigroup Inc. In February, CEOs were asked to give a detailed update of their exposure to geographies that the Trump administration planned to target with tariffs but they generally stuck to a sunny outlook and spoke to a rebound in industrial activity over the course of this year. Come this week, those outlooks were still mostly intact but companies were having to go to greater lengths to defend them, touting their ability to raise prices and cut costs to offset the impact of tariffs or to accelerate share buybacks if their stock prices remained in their current slump. Trump this week followed through on 25% tariffs that affect both steel and aluminum raw material imports as well as a wide range of goods that contain the metals. That’s spurred Canada and the European Union to respond with tariffs of their own on US goods. Trump threatened to double the duties to 50% for Canadian imports — in part because of that retaliation — before ultimately backing down.  “The administration has made the weekends interesting with the tariffs on, tariffs off. So whether that has been time well spent or not, we'll see,” said Richard Tobin, the chief executive officer of Dover Corp., which makes gas station fuel pumps and grocery store refrigerators. The company, which also makes technologies used to manufacture beer and soda cans, built positions last year in certain metals, including copper and stainless steel, on favorable terms. “No matter what happens with tariffs, at least right now we've got financial instruments that allow us to deal with that,” Tobin said at the JPMorgan conference this week. Customers are stretching out order timelines for 3M Co. products, asking that goods be delivered later than would be typical, CEO Bill Brown said at the conference. “I do believe it's just general caution across our consumer base in placing orders, given what might be happening in the macro,” he said. Read More: Factory Recovery Wobbles on Tariff Whiplash It was all very reminiscent of 2019: No industrial CEOs were outright predicting a recession back then, either, but they spent quite a lot of time talking about the possibility of one as tariffs from Trump’s first trade war squeezed their margins and eroded demand. What’s different this time is that the consumer economy, rather than the industrial one, is on the frontlines of this latest trade back and forth. The first Trump administration deliberately sought to protect consumers from the knock-on effects of tariffs by focusing levies on raw materials and $250 billion of mostly manufacturing-related Chinese imports. The latest barrage of tariff actions is much broader, threatening everything from baseball bats to toys, shoes, gas prices and grocery store staples. That’s a much riskier dynamic, with so much of the US economy dependent on consumer spending, teeing up the possibility that this weakness spreads much more quickly than it did last time around. The tariff uncertainty is already having an impact: Delta Air Lines Inc., American Airlines Group Inc. and Southwest Airlines Co. this week trimmed their outlooks for the current quarter, citing weaker-than-expected demand. This was all the more troubling because air travel had been a bright spot for spending even as consumers downgraded to cheaper alternatives elsewhere and pulled back on purchases of everything from cheeseburgers to tire changes and luxury handbags. A series of high-profile aviation safety incidents, including a deadly accident in January in Washington when an American Airlines plane collided with a military helicopter and a crash landing for a Delta regional jet in Toronto, have also weighed on people’s willingness to travel. “There's a whole generation of people traveling these days that didn't realize these things can happen,” Delta CEO Ed Bastian said at the JPMorgan conference this week. But “it became pretty quickly obvious to us there was more than just the consumer sentiment coming out of the incident,” he said. “There was something going on with economic sentiment, something going on with consumer confidence.” That’s manifesting most clearly in last-minute bookings as consumers feel less empowered to spend on pricier tickets and business travelers pull back amid widespread uncertainty. The stall in corporate travel is being driven by aerospace and defense, automotive, media and technology companies — industries that are under particular pressure from government spending scrutiny and tariffs, Bastian said in a separate conversation with CNBC. While United Airlines Holdings Inc. didn’t cut its guidance, CEO Scott Kirby said earnings would come in on the low end of the previously expected range. Government-related travel has been cut in half at United as Elon Musk’s cost-cutting efforts ramp up, while demand for flights from Canada into the US has also dropped materially amid backlash over the tariffs, Kirby said. United is speeding up the retirement of 21 jets, which will help cull unneeded capacity and save $100 million on maintenance costs. Delta is also planning to trim its flight schedule. “We had a bias to fly whatever we could as we headed into the summer. And I think on the margin, we've tempered that down to make it, ‘Fly what needs to be flown,’” Delta President Glen Hauenstein said. Southwest and JetBlue Airways Corp. have already been eliminating routes to try to bolster their profitability. “There has to be a reason for travel to step up again,” Melius Research analyst Conor Cunningham wrote in a note. “Likely what is needed is a bit of stability in the environment.” It’s unlikely that such predictability will be coming any time soon. Speaking this week at a gathering of major CEOs who serve on the Business Roundtable, Trump told them to brace for more tariffs, arguing that even higher levies will make it more likely that manufacturers move their operations to the US. It’s not that simple. Many companies are still in the process of rejiggering their supply chains after Trump’s last trade war. For the most part, they have favored Mexico over the US for their reshoring efforts — not just because of costs but because labor is more readily available south of the border. Read More: Automakers Need Years to Move Factories, Despite Tariff Relief “It's hard to find manufacturing labor in the places that we’re located in the United States. We're competing against the Amazons of the world and other companies who offer easier jobs at the same cost points,” John Stauch, the CEO of pool pump maker Pentair Plc, said at the JPMorgan conference. With the proposed Mexico tariffs, “it's really hard to say if these were to become permanent that we're going to pull back all of our manufacturing factories out of Mexico,” Stauch said. “Then by the time you're done with that, maybe a new administration comes in with a new particular view.”  The risk is that even if tariffs ultimately all get rescinded, the inflation damage has already been done. “You've got a lot of war rooms set up in a lot of places crunching numbers and talking to customers and getting ready” to make significant price increases, said Bill Sperry, chief financial officer of electric equipment manufacturer Hubbell Inc. Some of those price increases have already been implemented in response to the significant swings in commodity markets ahead of Trump’s metal tariffs, he said. Once price increases go into effect, it’s very difficult to undo them — even if the tariffs that made them necessary ultimately get walked back. Manufacturers rarely, if ever, cut prices and their instinct will be to protect their profit margins rather than try to stimulate demand with discounts. Read More: Tariff Playbook Calls for Price Increases Pentair, for example, primarily relies on distributors to sell its products so it would be reluctant to dial back price increases and leave those partners stuck with inventory writedowns, Stauch, the CEO, said. The company imports about $100 million of steel and aluminum products into the US annually and $125 million of goods from China, which are subject to broad 20% tariffs the Trump administration has put in place. That implies a roughly $50 million impact from those two categories of tariffs, while plans for reciprocal levies on countries that tax US goods would add $30 million of costs. Levies on Mexico would result in another $80 million squeeze. Pentair plans to offset those extra taxes with price increases. “That's a lot of price. I think at some point in time we would start to expect the consumer to pull back,” Stauch said. The cost-cutting playbook for the company would look different from the past if a recession were to occur, he said, considering pool construction demand is already hovering near the lows seen coming out of the financial crisis and expectations for a weak pace of housing starts this year. “This feels like a flat line bouncing along the bottom scenario,” he said. “I’ve been struck by how fearful people are and how unwilling they are to speak out. That has just not been true in the past. They don’t want to get on the wrong side of the president and his constituents.” — Bill George, a former CEO of medical-device maker Medtronic George made the comments to the Wall Street Journal in reference to the surprising lack of public pushback from CEOs to Trump’s policies. The silence hasn’t been uniform: Ford Motor Co. CEO Jim Farley has been particularly outspoken about the consequences of tariffs and an administration that thus far has introduced “a lot of cost, a lot of chaos.” But it’s a stark contrast to Trump’s last term when CEOs regularly spoke out on some of his more controversial policies — in part because of pressure from employees and social media — and resigned from White House advisory councils after he defended white nationalist protestors in Charlottesville, Virginia, in 2017. By contrast, there’s been no groundswell of public CEO criticism over Trump’s attempts to rewrite history on Russia’s invasion of Ukraine or his calls for mass deportation of undocumented immigrants. Even on tariffs, many CEOs are willing to be patient, expressing support for Trump’s underlying goals of reviving US manufacturing and correcting trade imbalances — even if they disagree with his methods and timelines and are feeling the weight of all the uncertainty he’s introduced. “The messaging is always messy,” Dover CEO Tobin said at the JPMorgan conference. “But I think fundamentally, what is being tried is — I would agree with it in total. And at the end, we would like to see real business activity GDP growth rather than, ‘Here's a bunch of cash floating in from the ether or from the Treasury into the economy,’ because that's not sustainable.” Stauch of Pentair said he saw the tariff back-and-forth with Mexico and Canada as a means of getting those countries to match US levies on the rest of the world, particularly Chinese goods, and that the companies who honor the existing trade agreements should continue to avoid taxes. “We don't get to avoid a China-based tariff by being a US company with a Mexican entity — we have to pay those tariffs,” he said. Likewise, foreign companies buying goods from China or Europe shouldn’t have a competitive advantage over US manufacturers, Stauch said. “So I think when you look at that framework, you start to get a little logic of maybe where the thought process is going, and it generally makes some sense,” he said. Deals, Activists and Corporate Governance | Eaton Corp. will pay $1.4 billion to buy Fibrebond Corp., which makes the specialized enclosures that store critical components for powering data centers, factories and utilities. These modular boxes are engineered to order with equipment installed and tested off site, which can help data center customers get up and running faster. The deal expands Eaton’s offerings for the multi-tenant data center market and marks a capstone of sorts for CEO Craig Arnold, who is set to retire in May after nearly a decade at the helm of the electrical equipment giant. He will be succeeded by Chief Operating Officer Paulo Ruiz. The purchase price on the Fibrebond deal works out to about 13 times the target’s expected earnings before interest, taxes, depreciation and amortization this year, a fairly reasonable multiple for a company that supplies the still fast-growing data center market.

nVent Electric Plc announced its own acquisition of a data center supplier, agreeing to purchase the enclosures and switchgear businesses of Avail Infrastructure Solutions for $975 million. The purchase price implies a multiple of 12.5 times the Avail business’ expected earnings this year, in line with what Eaton is paying for Fibrebond. nVent has been building up its electrical infrastructure offerings since spinning off from Pentair in 2018.

JetBlue Airways Corp. is the most likely target in any push for yet more consolidation in the airline industry, United CEO Scott Kirby said. “I think the ball is going to be in JetBlue's court,” he said. JetBlue benefits from its focus on customer loyalty but faces stiff competition from Delta in the key markets of Boston and New York, he said. Kirby said that he would like for United to have a bigger presence at New York’s John F. Kennedy airport to complement its hub at Newark airport in New Jersey. “But man, all the headache, all the brain damage of buying a whole airline to get there — that's a lot to do,” he said. United’s business is performing well and when that is happening, “the hurdle to go do a deal gets a whole lot higher,” Kirby said. |