| Bloomberg Evening Briefing Americas |

| |

| Billed as so rock-solid safe they’re risk-free, US Treasury bonds have long been the first port of call for investors during times of panic. They rallied during the global financial crisis, on 9/11 and even when America’s own credit rating was cut. But this time may be different. As President Donald Trump unleashes an all-out assault on global trade, their status as the world’s safe haven is increasingly coming into question. They are trading, in other words, a little like a risky asset themselves. Or, as former Treasury Secretary Lawrence Summers says, like the debt of an emerging-market country. Yields, especially on longer-term debt, have surged in recent days while the dollar has plunged. Even more disconcerting for America is the pattern of recent market moves. Investors have often dumped 10- and 30-year Treasuries—pushing prices down and yields up—at the very same time they frantically sold stocks, crypto and other risky assets. The inverse is also true, with Treasuries rising in unison with them. This has many on Wall Street increasingly nervous.  President Donald Trump, left, Treasury Secretary Scott Bessent, center, and Commerce Secretary Howard Lutnick in the Oval Office. Photographer: Saul Loeb/AFP This volatility—and the risk of destabilizing the US financial system—is seen as likely to continue when markets open Monday. Trump, 78, has continued to up the ante in one of the biggest poker games in history, and his main opponent—China—keeps matching his raises. Just this morning, Beijing said it will boost tariffs on all US goods from 84% to 125%. Perhaps hoping to bluff his way to a win, Trump has said he’s waiting for Xi Jinping to call him. But the Chinese leader has shown an unwillingness to back down. China has in fact been publicly adamant, going so far as calling Trump’s tariffs a “joke.” At this point, the levies on both sides are so high that trade between the world’s two largest economies is effectively about to halt. Which means any further escalation would have to be in other areas. And China has signaled it may go there. —David E. Rovella

| |

What You Need to Know Today | |

| The Trump administration, which admitted to wrongly sending a man to a notorious prison in El Salvador (violating a court order in the process) and declined to try and get him back, on Friday went a step further. Lawyers for Trump, despite an order by the US Supreme Court, refused to tell a federal judge where the man was or what it’s doing to get him back. A federal judge, following the Supreme Court’s direction, set a deadline today for Trump’s lawyers to explain how the government planned to follow the high court’s ruling. Trump’s lawyers rejected the court’s order, saying it didn’t have enough time, and questioned her authority. The Supreme Court ruling against Trump was one of his first defeats tied to the administration’s attempt to broadly expand executive powers. It followed a series of recent procedural rulings that saw the Republican-appointee controlled court rule in his favor. But this latest refusal by Justice Department lawyers to fully comply with court orders, unlike previous cases tied to Trump policies, directly implicates a ruling from the highest court in the land, intensifying an ongoing and unprecedented constitutional crisis between the two branches of government. | |

|

| Stocks rallied on Friday, making up much of their recent losses with the S&P 500 landing where it was last August as the closing bell rang. But it’s bonds that have everyone’s attention, particularly when you pick a fight with a country that owns a lot of yours. This of course is what Trump did when it comes to China. After a week of wild swings in the US bond market, China’s holdings of Treasuries are increasingly under scrutiny from analysts. Some have gone as far as suggesting—without hard evidence—that sales by Beijing may have helped fuel the biggest surge in 30-year yields since the pandemic. Others debate whether China might turn to dumping US debt in the future as a response to the steepest American tariffs in a century. | |

| |

|

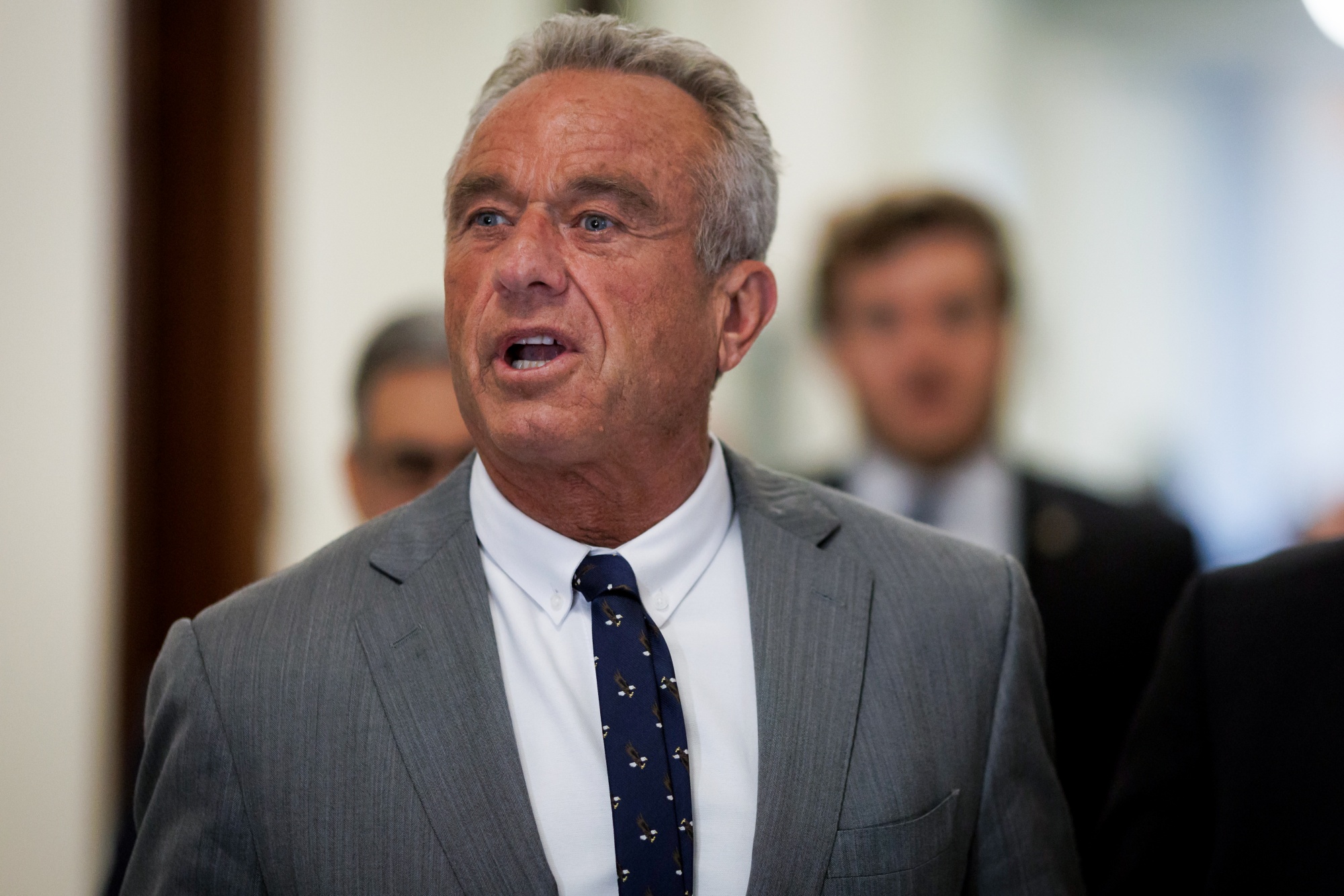

| The US now has 712 confirmed cases of measles, a 17% increase over last week in an outbreak that has left two unvaccinated children dead. The Centers for Disease Control and Prevention reported 105 new cases Friday. In West Texas alone, the Associated Press reported some 505 cases earlier this week. With trust in vaccines falling since the pandemic and the politicization of the proven science behind them, measles patients have now been confirmed in 24 states, with 97% of them people who were unvaccinated or had an unknown vaccination status. Trump’s head of Health & Human Services is Robert F. Kennedy Jr., a vaccine skeptic who has touted debunked treatments for various diseases and leveled a host of other controversial assertions. On Friday, Kennedy warned Food and Drug Administration staff at an all-hands meeting about the “deep state” while also making off-color comments about children with developmental disabilities.  Robert F. Kennedy Jr. Photographer: Ting Shen/Bloomberg | |

|

| The only good thing about some of Friday’s price action in the US Treasury market is that it happened on a Friday, Mohamed A. El-Erian writes in Bloomberg Opinion. The fact that the moves in government bond and currency markets continued to defy America’s traditional “safe haven” role confronts policymakers with difficult questions, he says. These become more pressing as the probability of a damaging market malfunction increases to an uncomfortable level. | |

| |

|

| When the Trump social media post hit and the S&P 500 vaulted 7% in eight minutes Wednesday, Ed Al-Hussainy stepped away from his desk in Manhattan. The algos had taken over and the buy orders were pouring in at such a furious clip that “there was nothing to do.” So he strolled over to the corner Walgreens, grabbed an 18-pack of Modelo and handed them out to his colleagues at Columbia Threadneedle to enjoy as they watched the frenzy. “For us,” Al-Hussainy said, “it was really a moment of calm.” But it didn’t last long. By Thursday morning, he was staring once again at screens showing that stocks were sinking and, more importantly, Treasury yields were soaring. The bond market was buckling, and might not stop until the Treasury or Federal Reserve stepped in. “I’m actually not worried about a recession,” Al-Hussainy said. “What I do worry about is a financial crisis.” It was a moment of fear all across Wall Street. | |

|

| Beyond the mountain of lawsuits challenging the legality or constitutionality of the myriad steps Trump has taken to deport a wide array of people in part for exercising free speech, hollow out federal agencies, fire tens of thousands of employees and various other executive orders, there’s a big question about his signature policy. His tariffs have hammered financial markets, prompted an outcry from world leaders and raised the specter of a US recession or worse. Trump has proclaimed an emergency and has insisted he’s calling the shots, but there’s a problem with that: the US Constitution gave Congress the last word in setting import duties. So is Trump’s trade war even legal? | |

|

| |

What You’ll Need to Know Tomorrow | |

| |